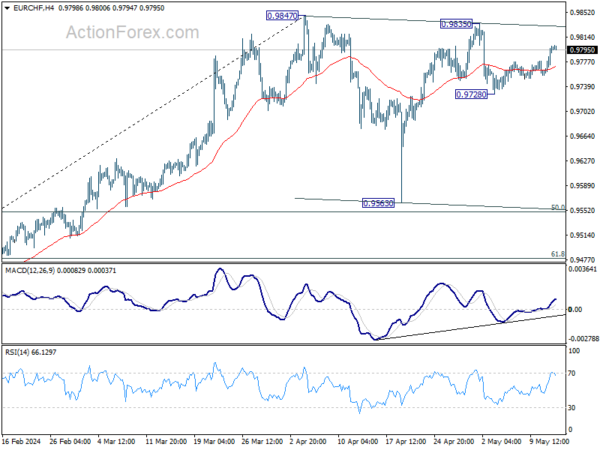

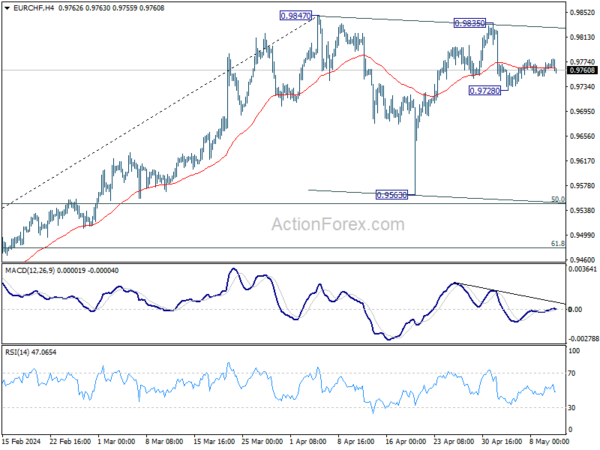

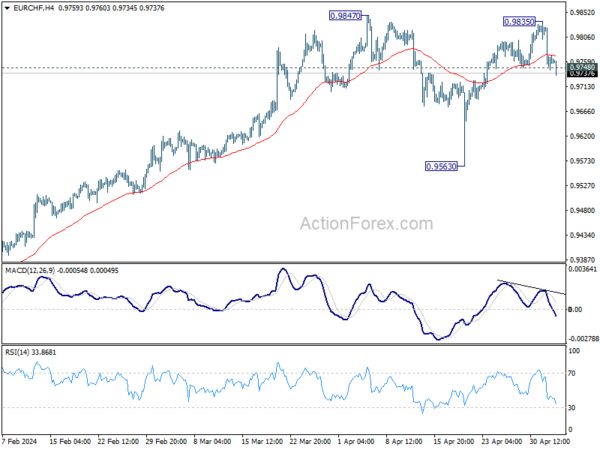

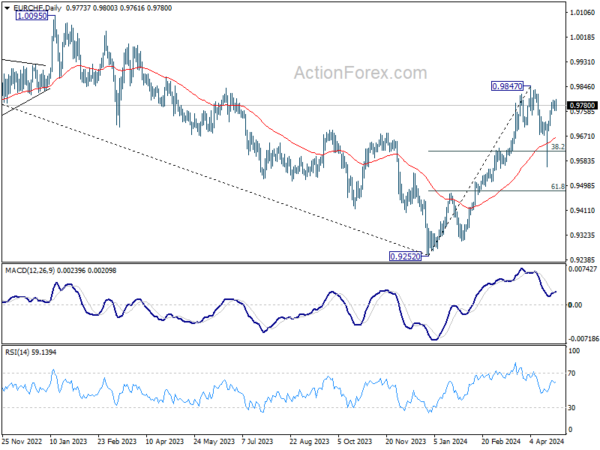

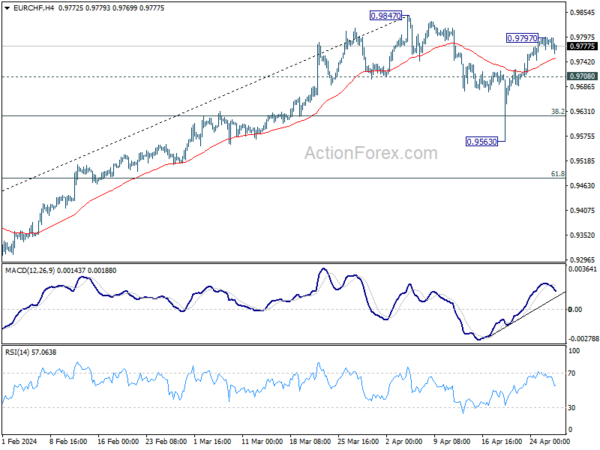

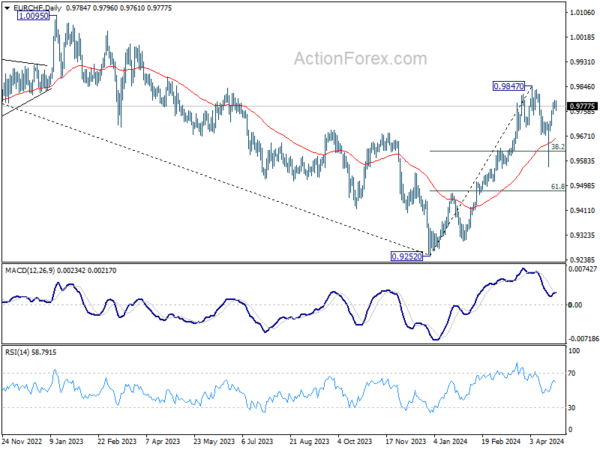

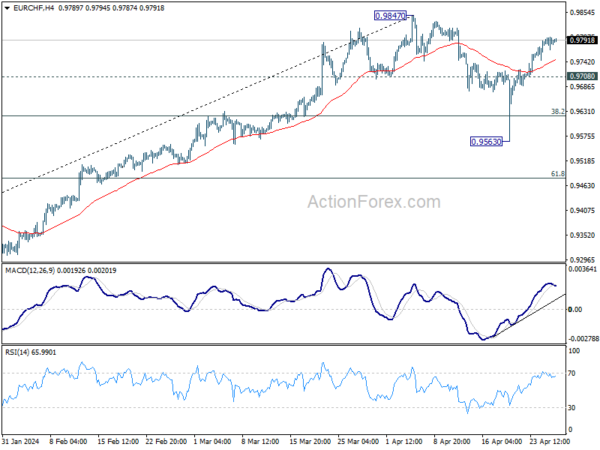

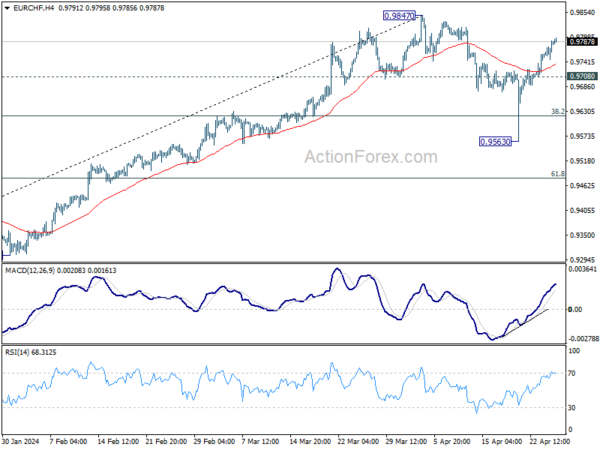

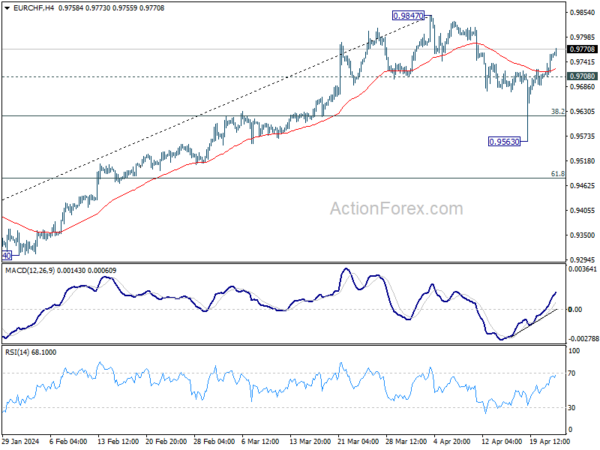

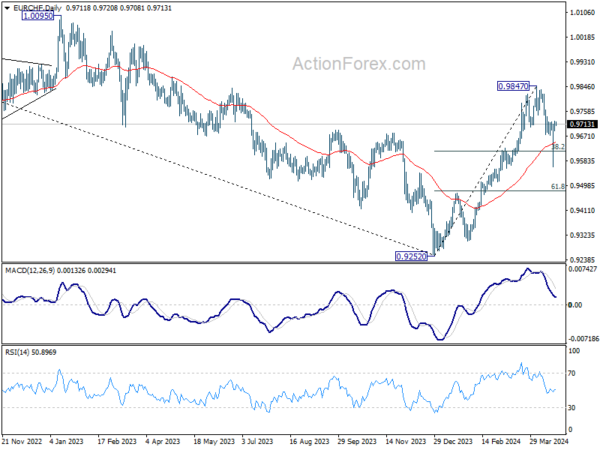

Daily Pivots: (S1) 0.9792; (P) 0.9803; (R1) 0.9819; More…

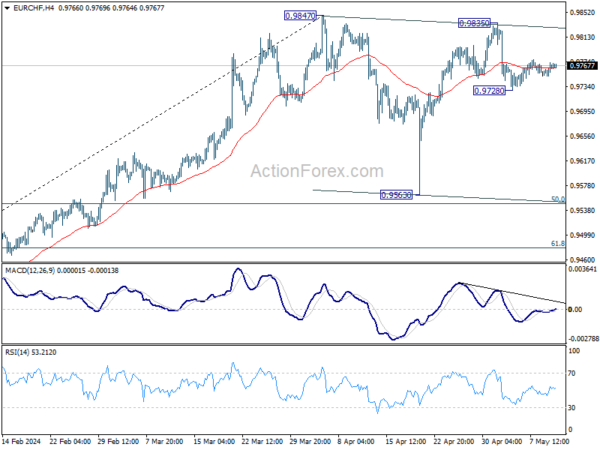

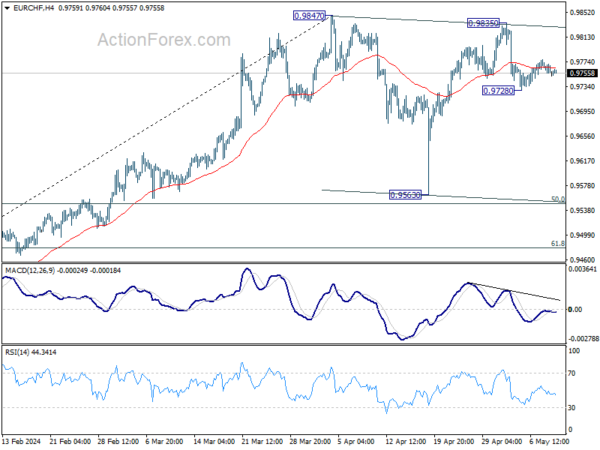

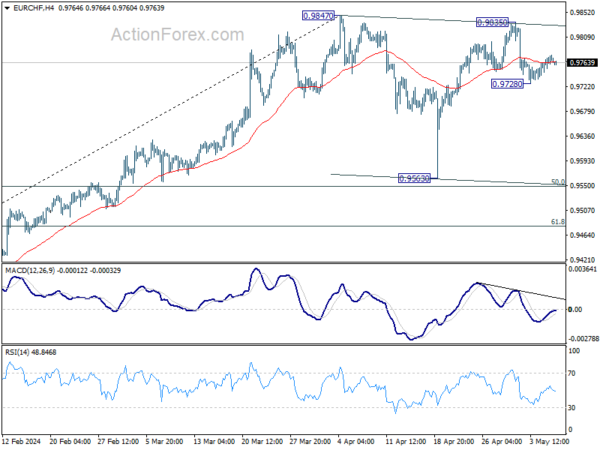

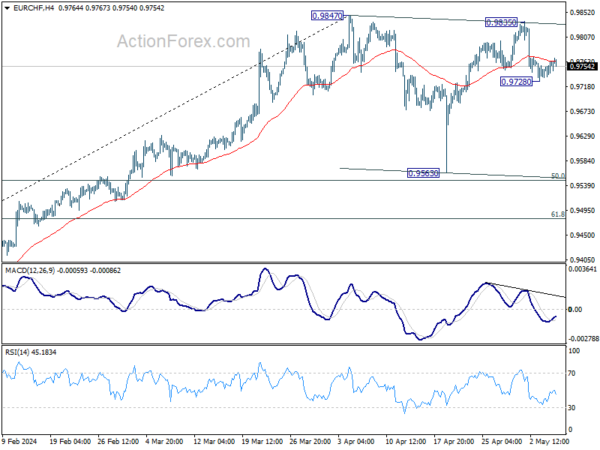

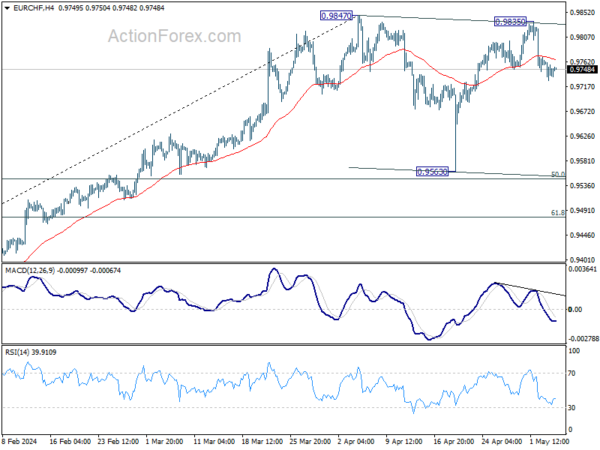

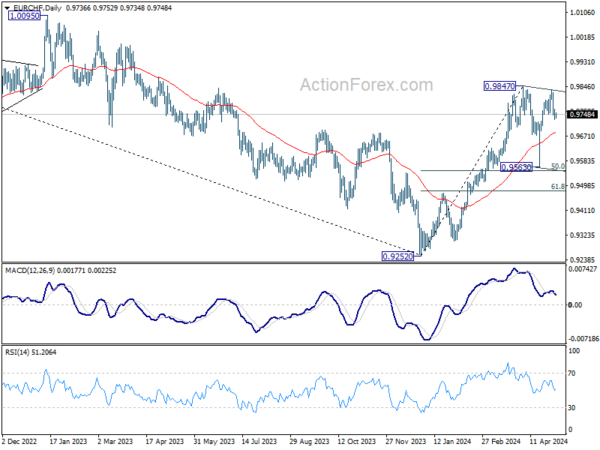

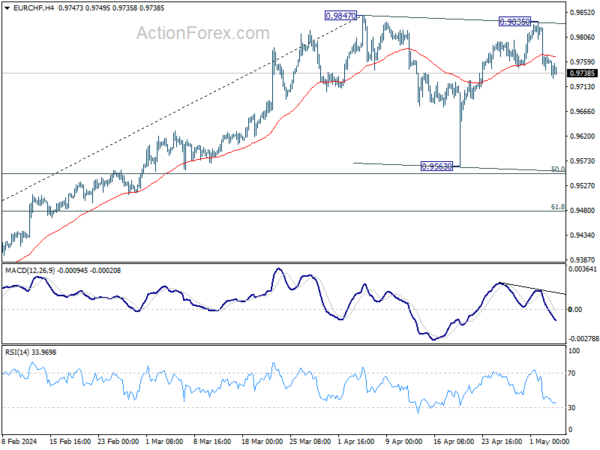

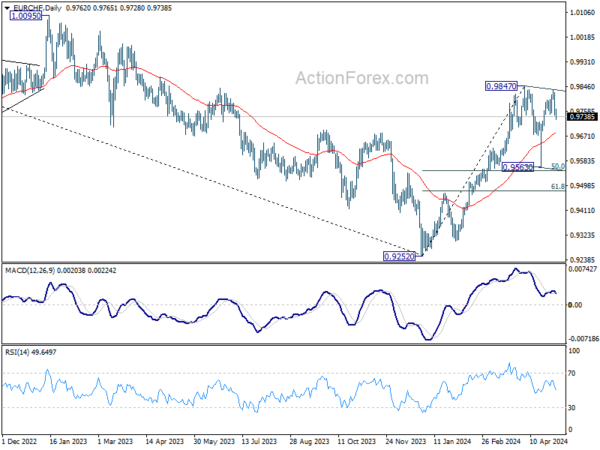

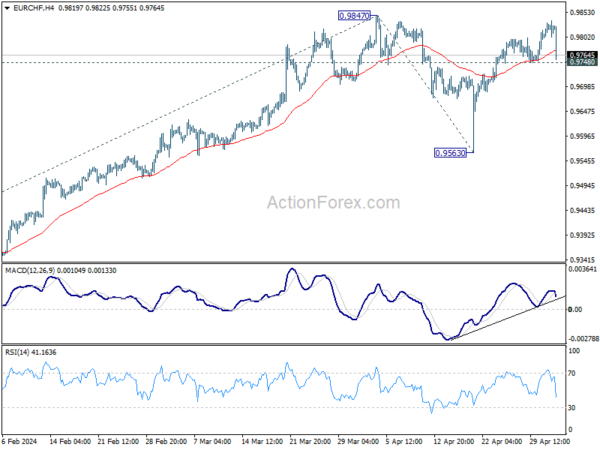

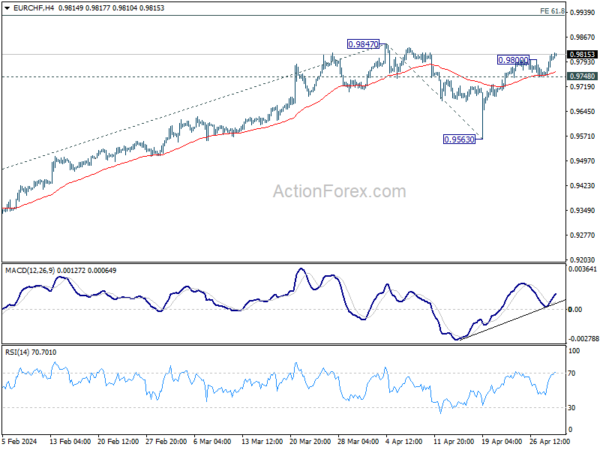

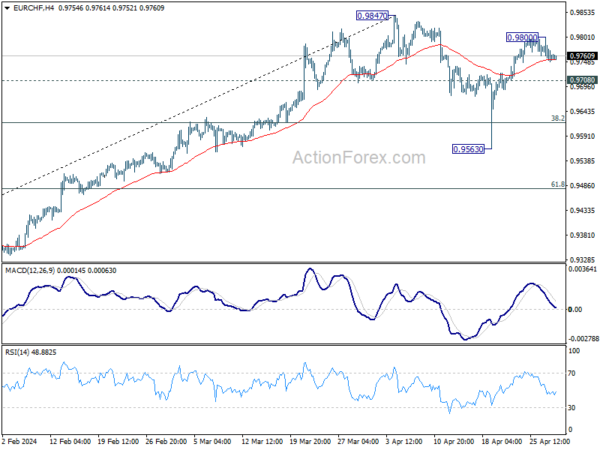

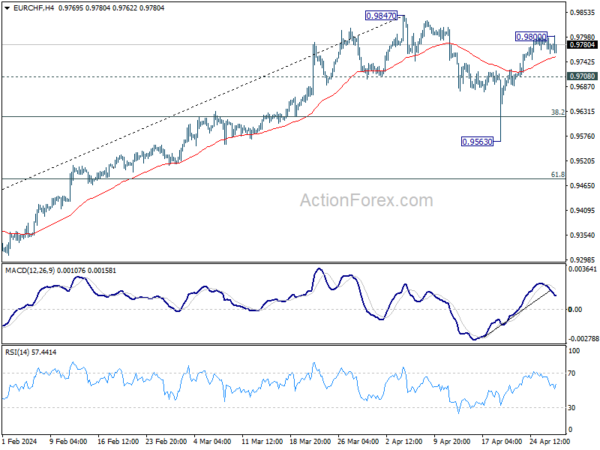

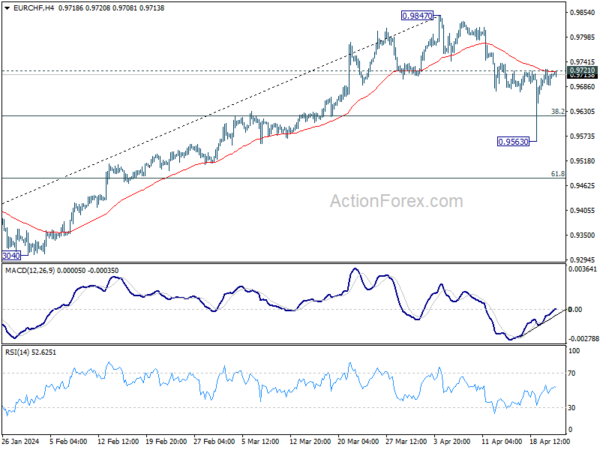

Intraday bias in EUR/CHF remains neutral for the moment. On the upside, decisive break of 0.9835/47 resistance will resume larger rally from 0.9252. On the downside, however, break of 0.9728 will extend the corrective pattern from 0.9847 with another fall, back to 0.9563 support.

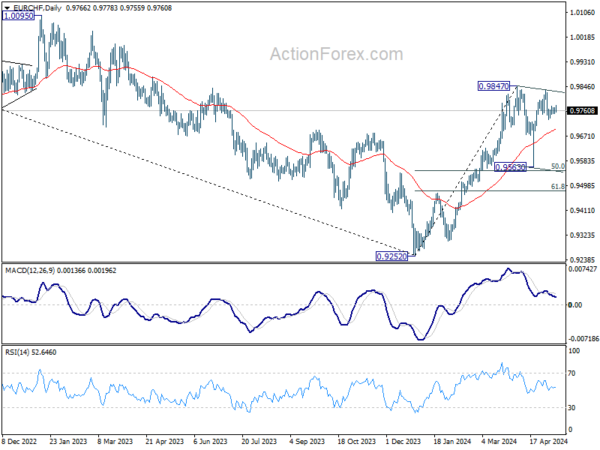

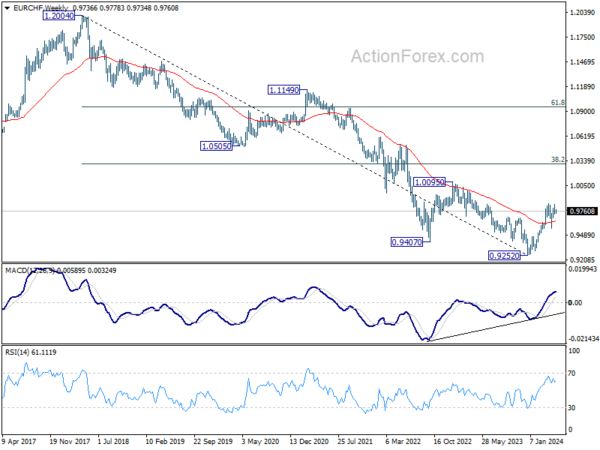

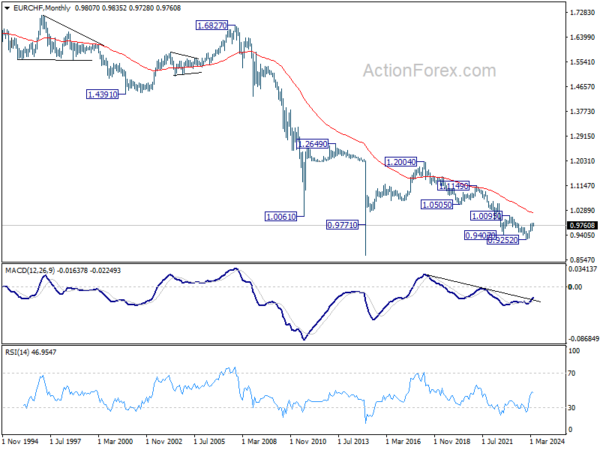

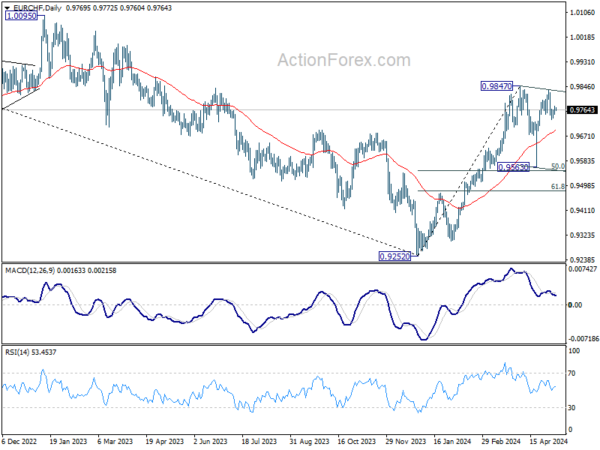

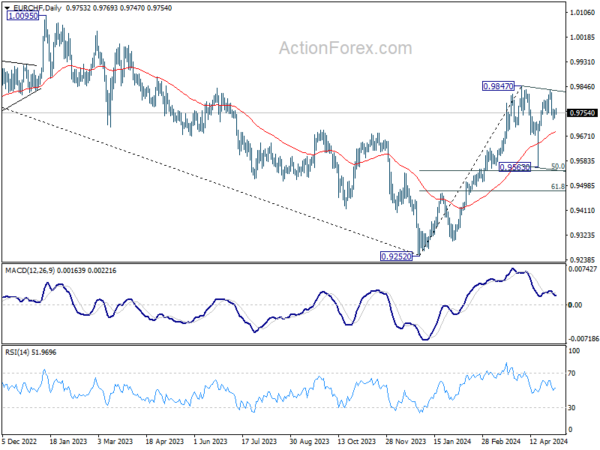

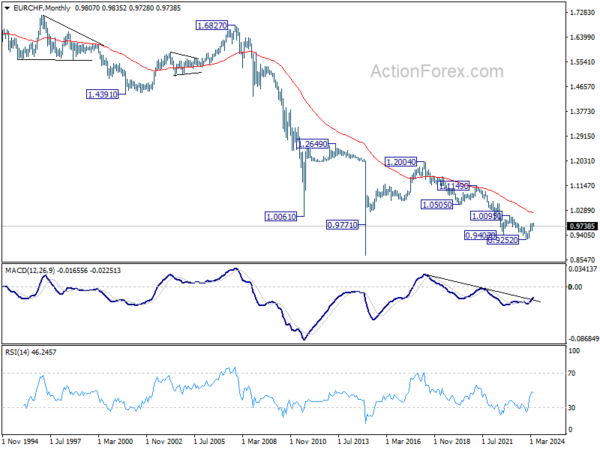

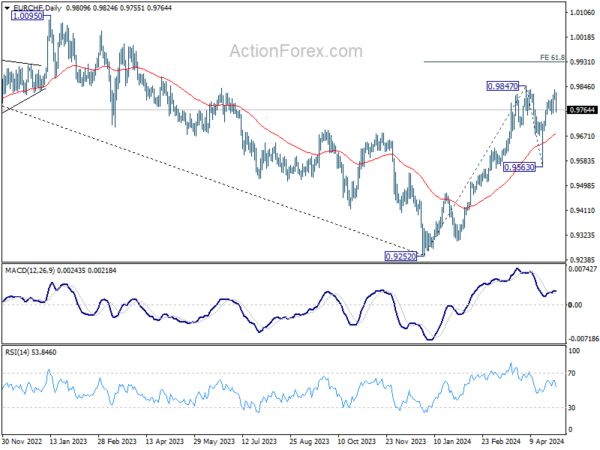

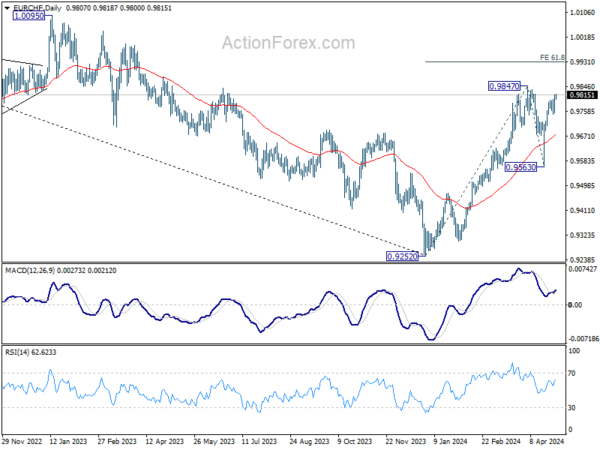

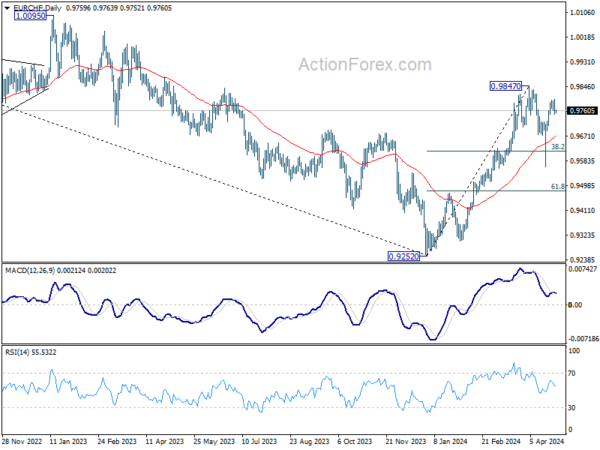

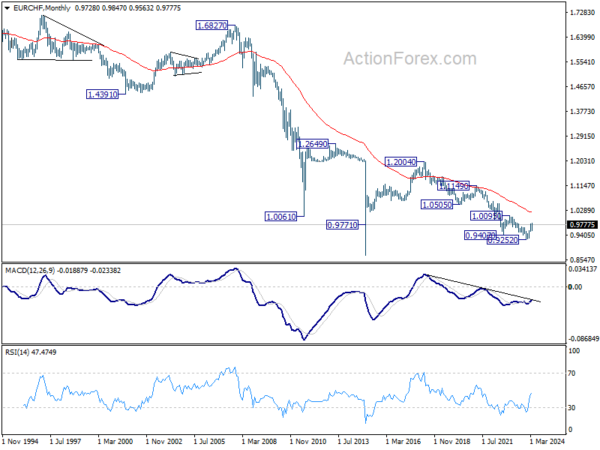

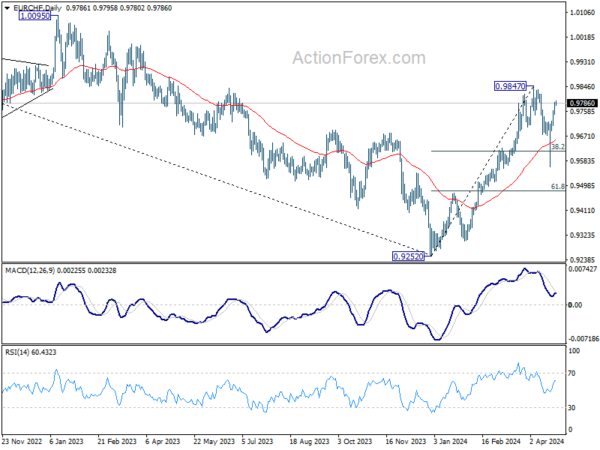

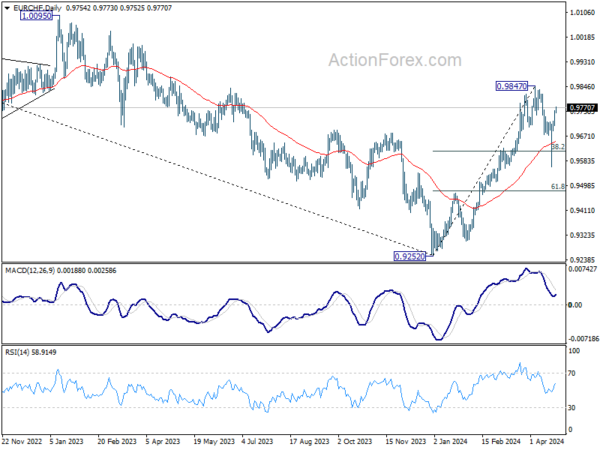

In the bigger picture, as long as 0.9563 support holds, rise from 0.9252 medium term bottom is still in favor to continue. Break of 0.9847 resistance will target 38.2% retracement of 1.2004 (2018 high) to 0.9252 (2023 low) at 1.0303, even as a correction to the down trend from 1.2004.