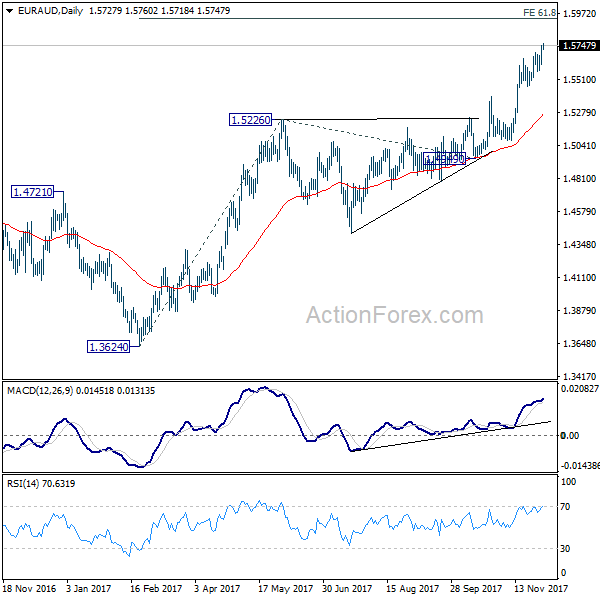

EUR/AUD’s down trend resumed last week but recovered after hitting 1.4318. Initial bias is neutral this week for some consolidations. But outlook will remain bearish as long as 1.4940 resistance holds. On the downside, break of 1.4318 will resume larger down trend to 1.3624 long term support next. On the upside, however, firm break of 1.4940 will indicate short term bottoming and turn bias back to the upside for 1.5327 resistance instead.

In the bigger picture, fall from 1.9799 is seen as a long term impulsive move. Next target is 61.8% projection of 1.9799 to 1.5250 from 1.6434 at 1.3623, which is close to 1.3624 long term support (2017 low). Some support could be seen there to bring interim rebound. But overall, break of 1.5354 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the longer term picture, fall from 1.9799 (2020 high) is seen as the third leg of the pattern from 2.1127 (2008 high). Deeper fall should be seen to 1.3624 support. Decisive break there would pave the way back to 1.1602 (2012 low).