Daily Pivots: (S1) 1.6487; (P) 1.6533; (R1) 1.6588; More…

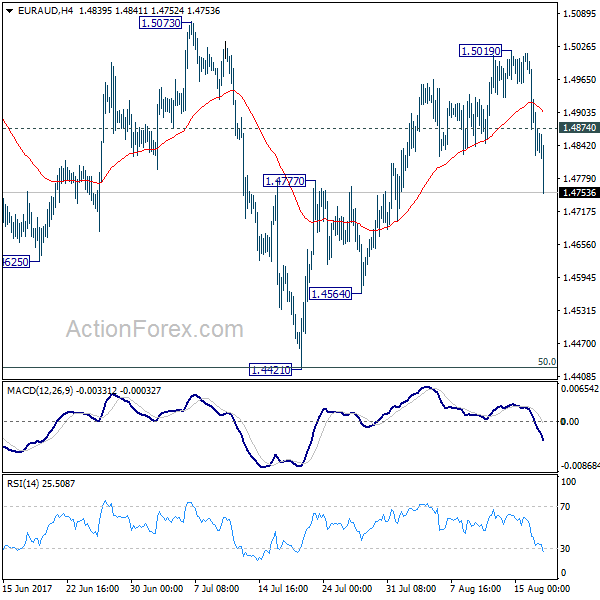

Intraday bias in EUR/AUD remains neutral first with focus on 1.6586 key resistance. Sustained break there will suggest that it’s at least in correction to the fall from 1.9799 to 1.6033. Further rise should then be seen to 38.2% retracement of 1.9799 to 1.6033 at 1.7472. However, rejection by 1.6586 will maintain near term bearishness for another fall through 1.6033 later.

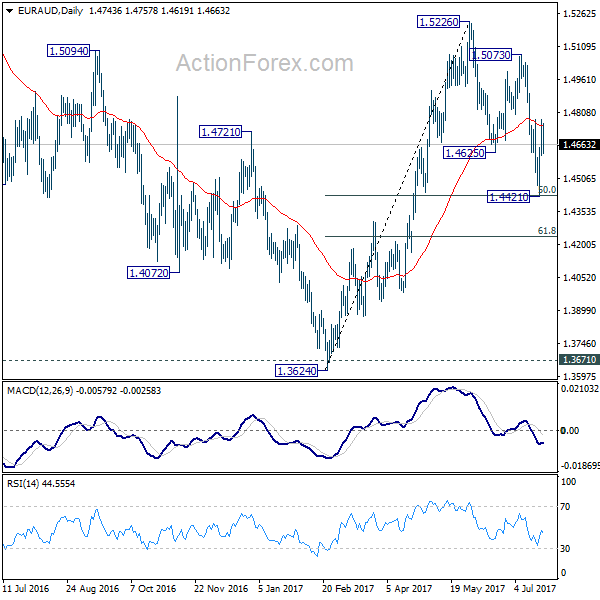

In the bigger picture, whole up trend from 1.1602 (2012 low) might have completed at 1.9799. Deeper fall might be seen to 55 month EMA (now at 1.5803). Sustained break there will pave the way to 61.8% retracement of 1.1602 to 1.9799 at 1.4733. However, strong support from 55 week EMA (now at 1.6458) would neutralize the long term bearishness and argues that price actions from 1.9799 are developing into a sideway range pattern instead.