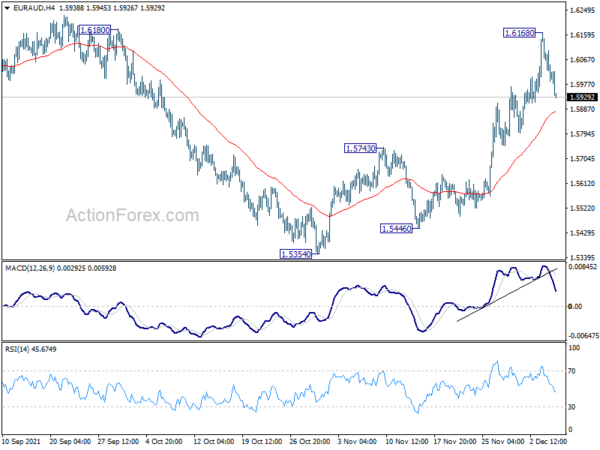

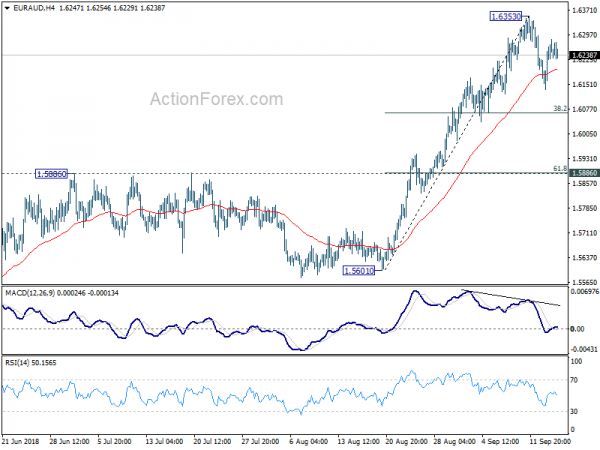

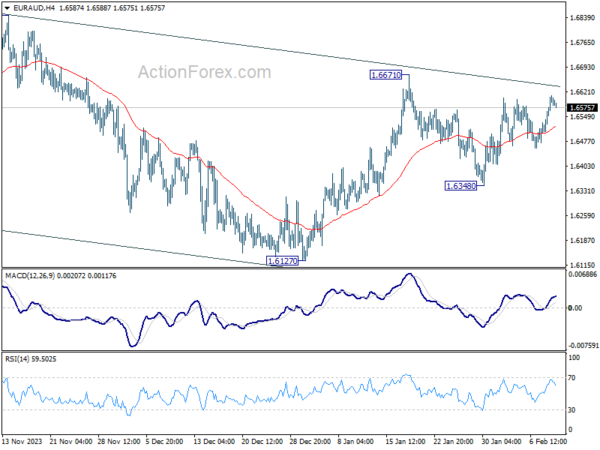

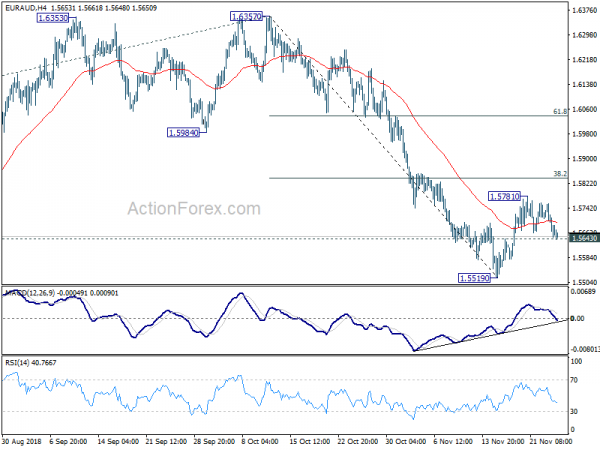

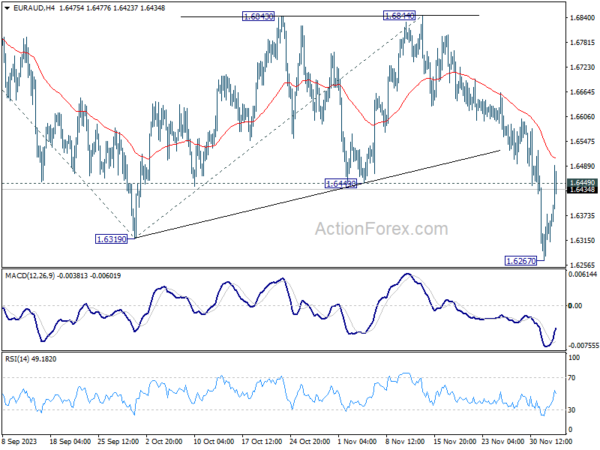

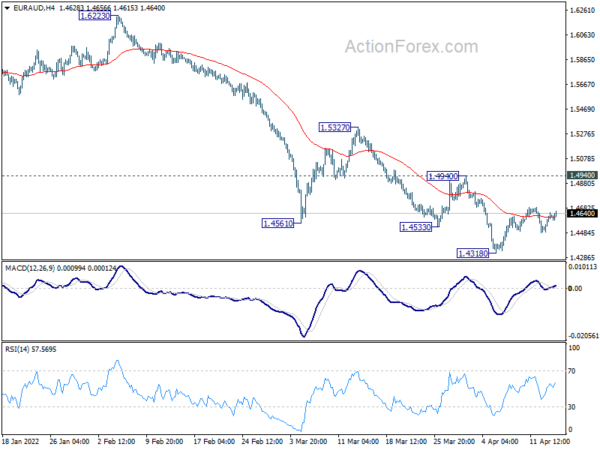

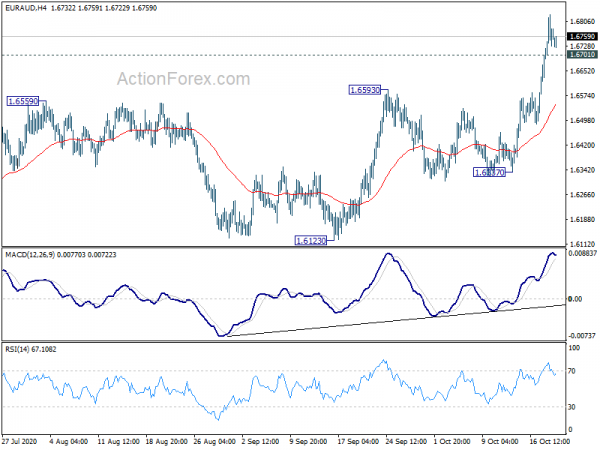

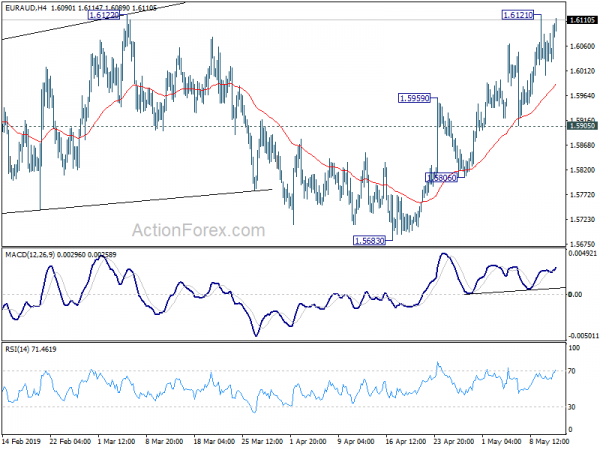

Daily Pivots: (S1) 1.5943; (P) 1.6052; (R1) 1.6112; More…

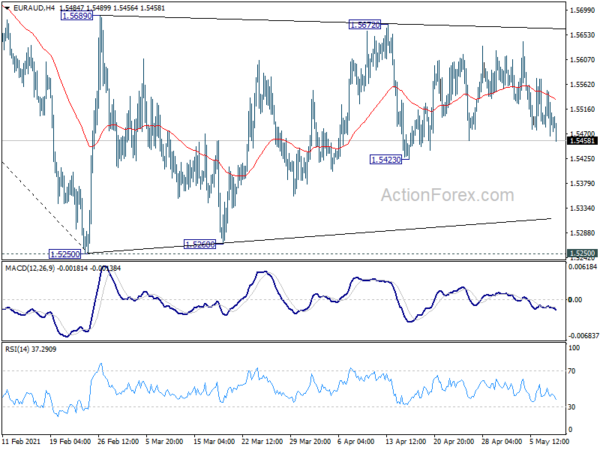

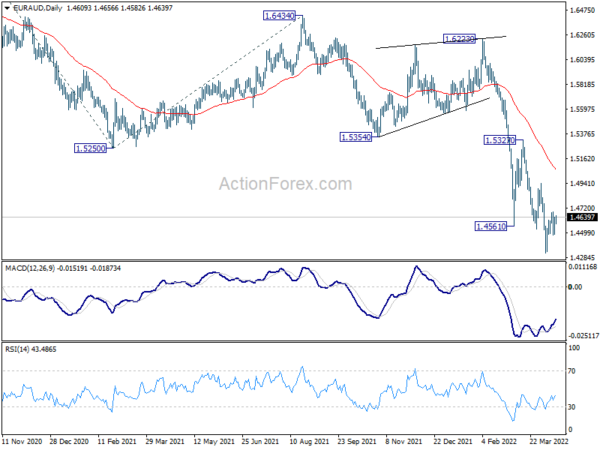

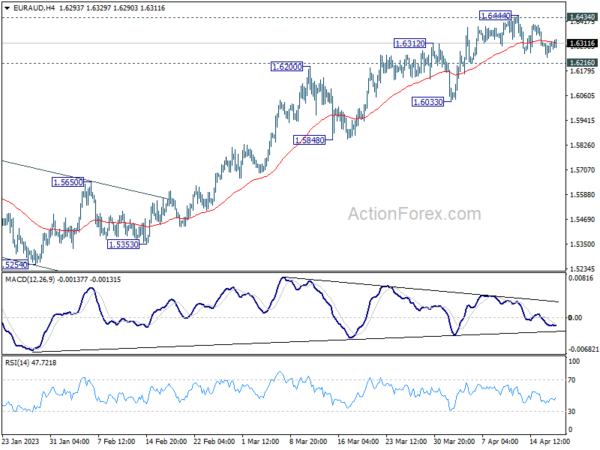

Intraday bias in EUR/AUD is turned neutral will current retreat. Another rise would be mildly in favor as long as 1.5743 resistance turned support holds. Break of 1.6168 will resume the rise from 1.5354 to 1.6434 high. However, firm break of 1.5743 will indicate that such rebound is over and bring deeper fall back to 1.5250/5354 support zone.

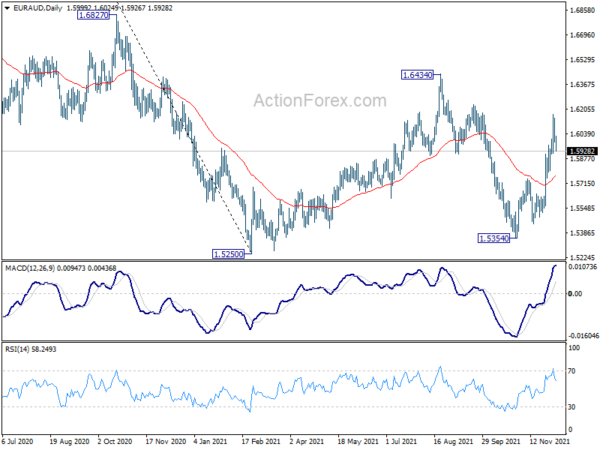

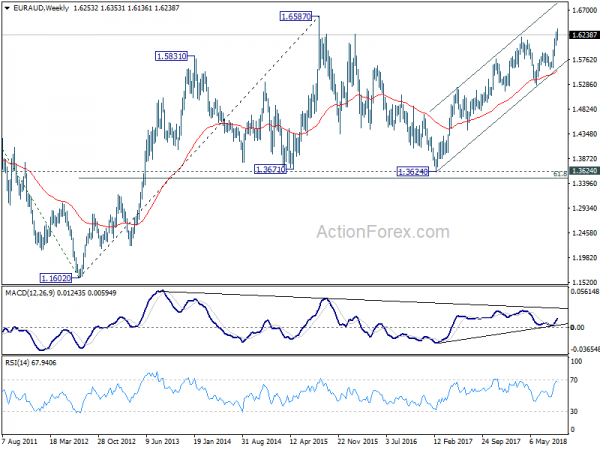

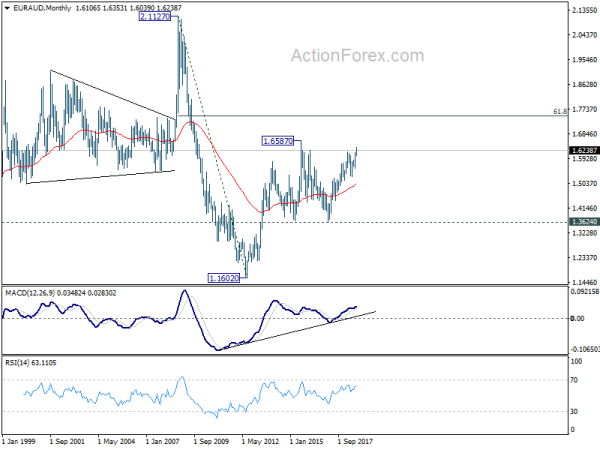

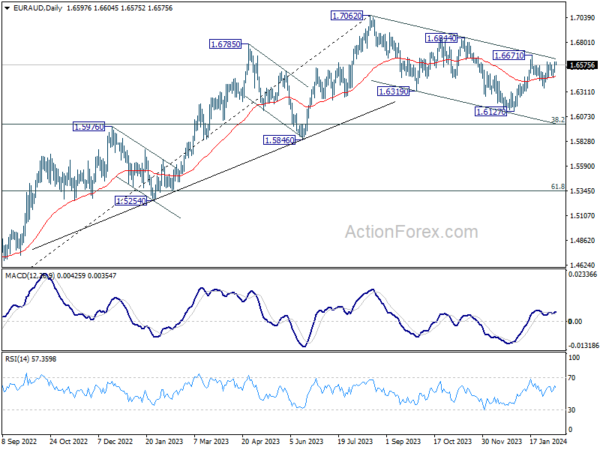

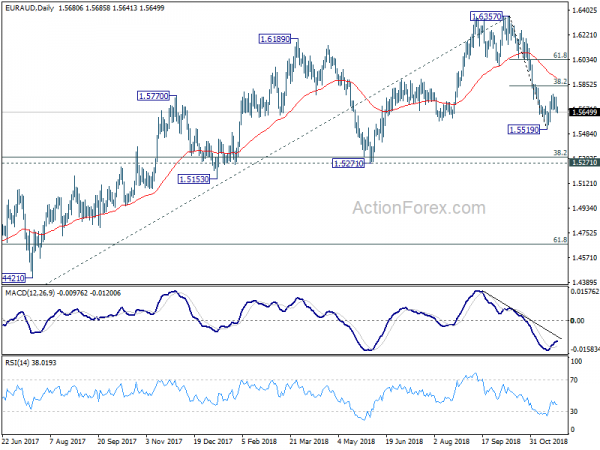

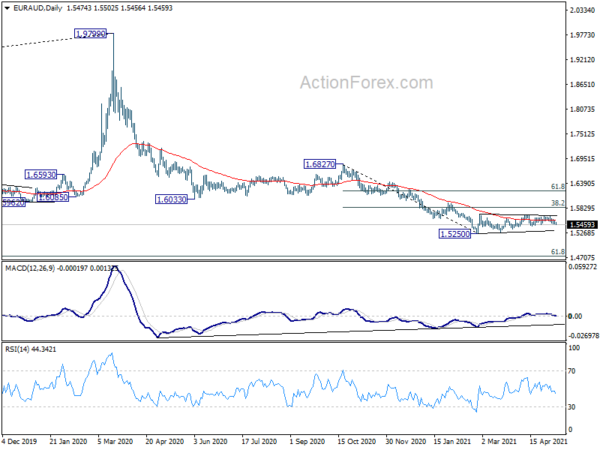

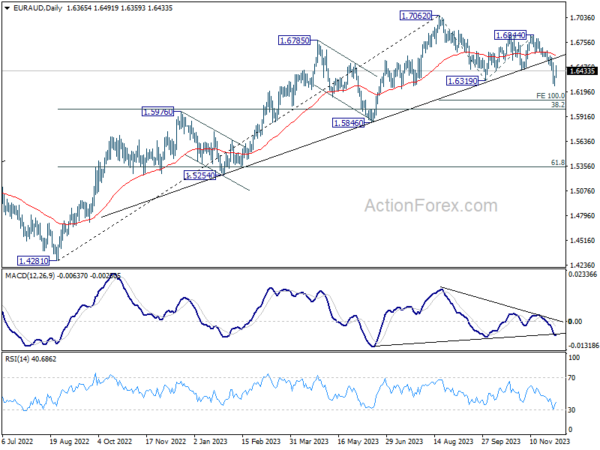

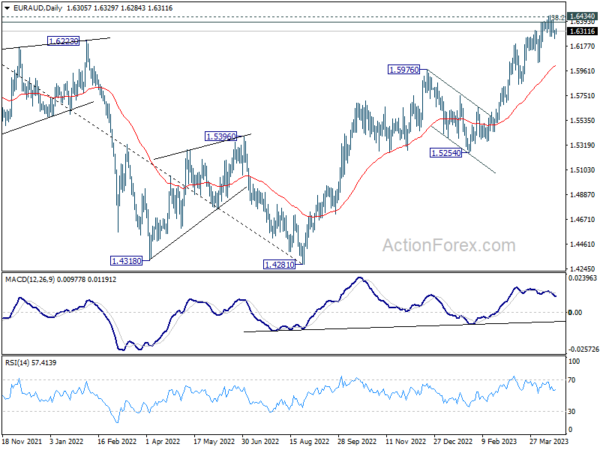

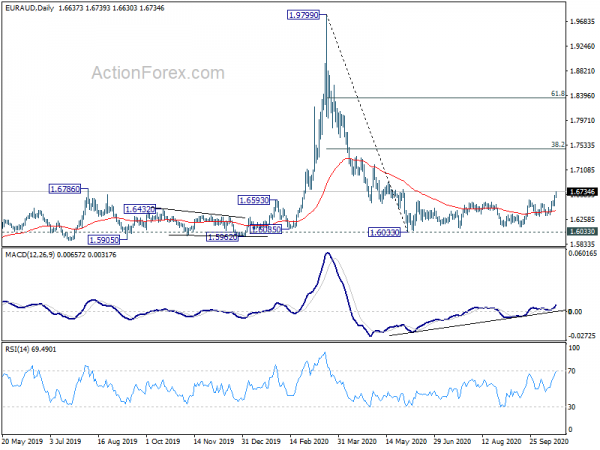

In the bigger picture, medium term outlook is neutral for the moment. Rise from 1.5354 is seen as the third leg of the corrective pattern from 1.5250 low first. Further rise could be seen through 1.6434 towards 38.2% retracement of 1.9799 to 1.5250 at 1.6988. On the downside, however, sustained trading below 55 day EMA (now at 1.5759) will turn focus back to 1.5250 low instead.