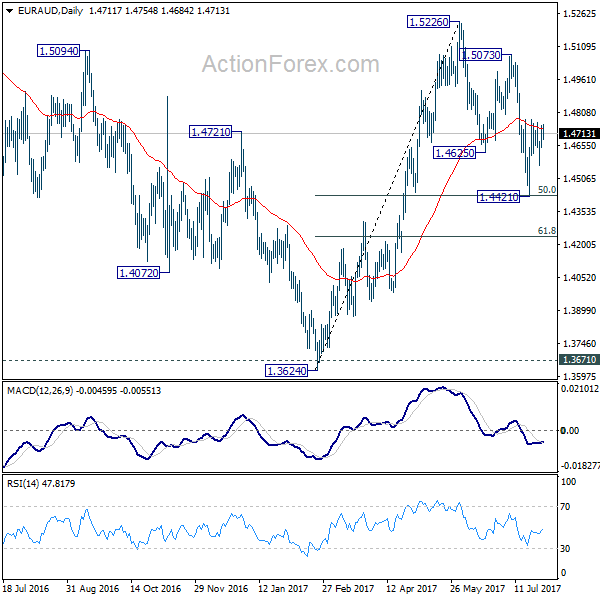

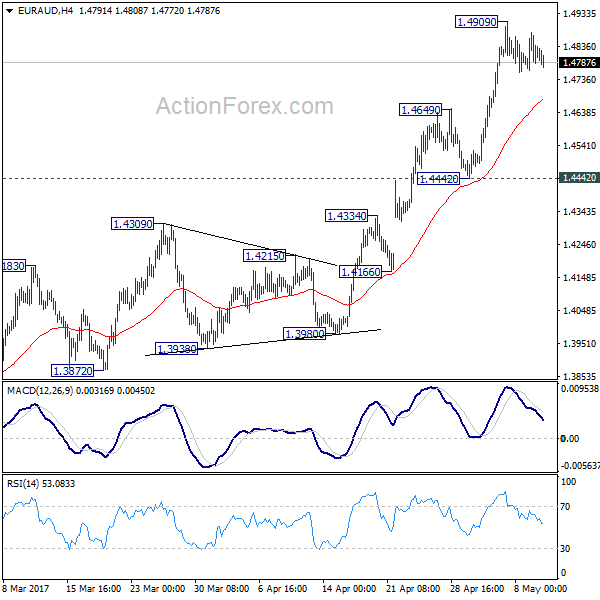

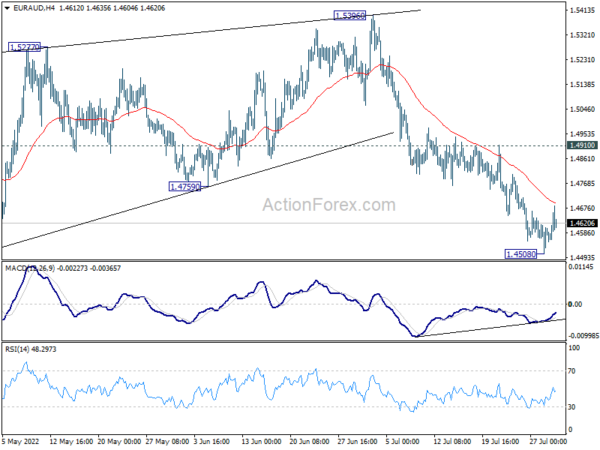

Daily Pivots: (S1) 1.4653; (P) 1.4701; (R1) 1.4754; More…

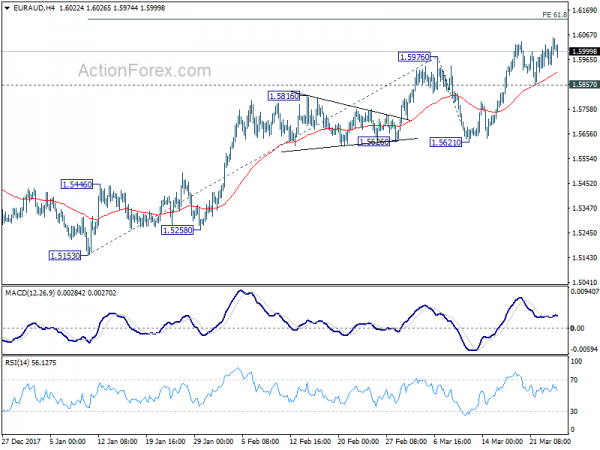

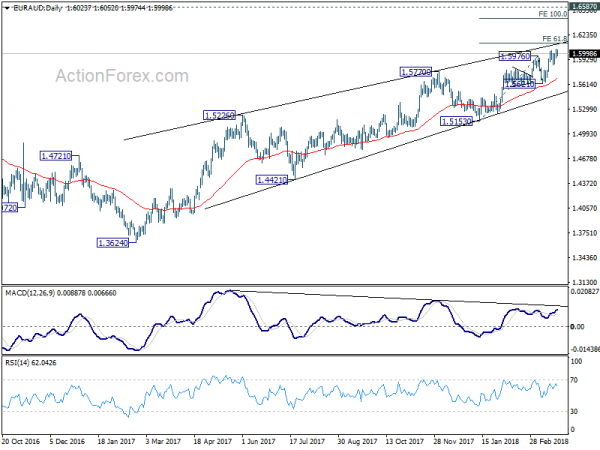

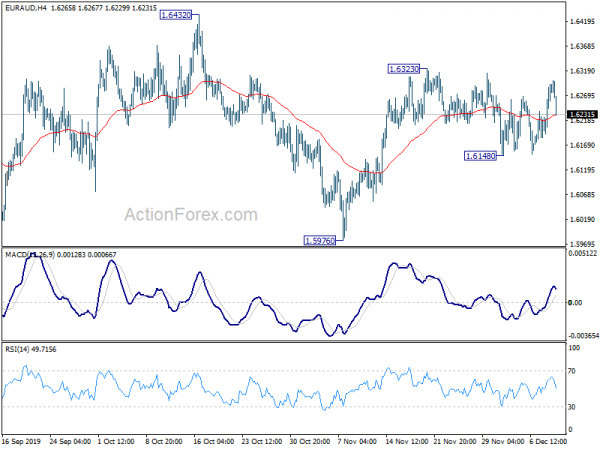

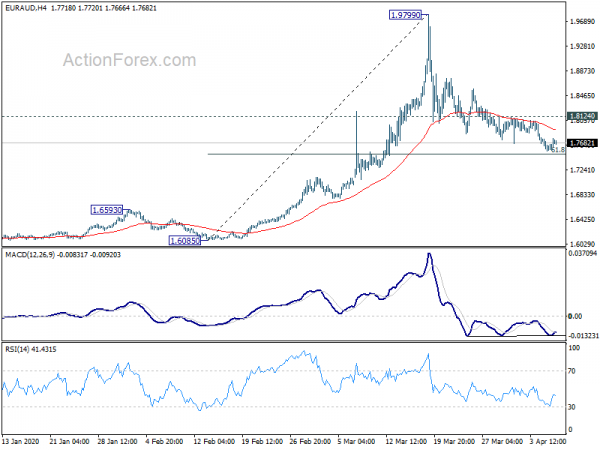

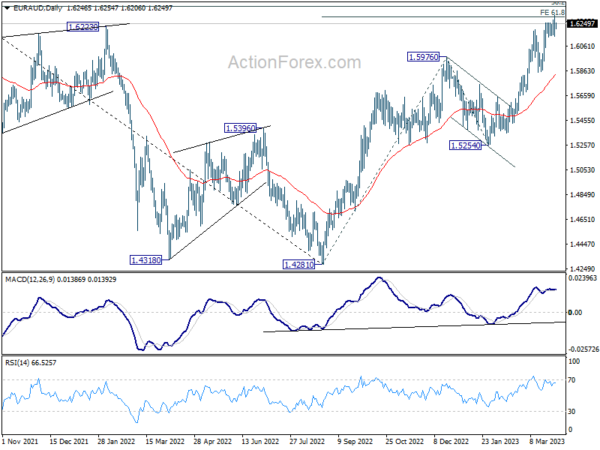

Intraday bias in EUR/AUD remains neutral for the moment. At this point, we’re still favoring the case that correction from 1.5226 has completed with three waves down to 1.4421 already. Hence, another rally is expected. Break of 1.4777 will turn bias to the upside for 1.5073 resistance first. Break there will indicate resumption of whole rise from 1.3624. However, break of 1.4221 will invalidate our view and extend the decline from 1.5226 to 61.8% retracement of 1.3624 to 1.5226 at 1.4236.

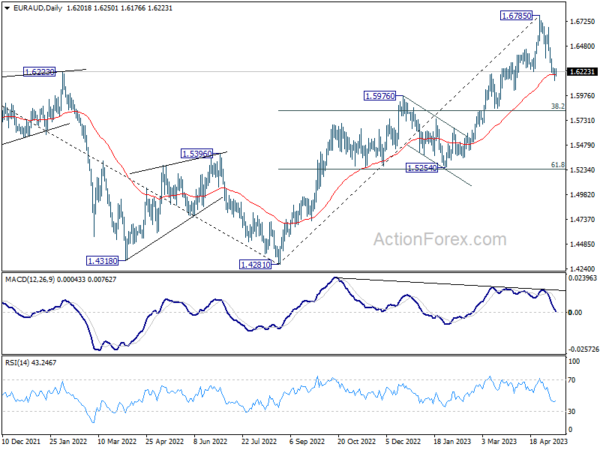

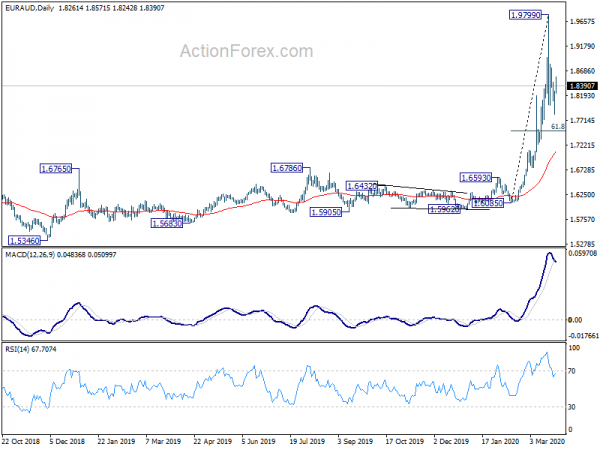

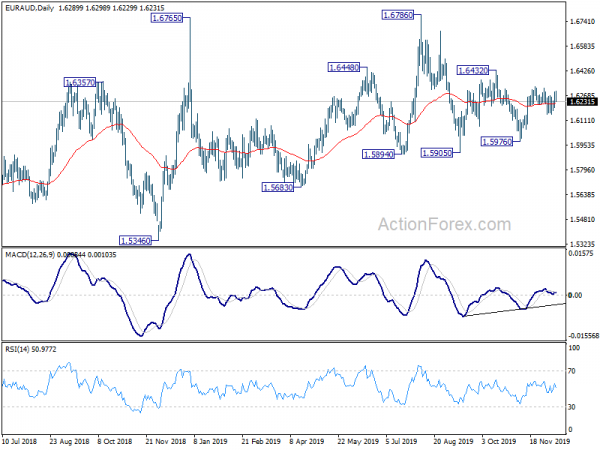

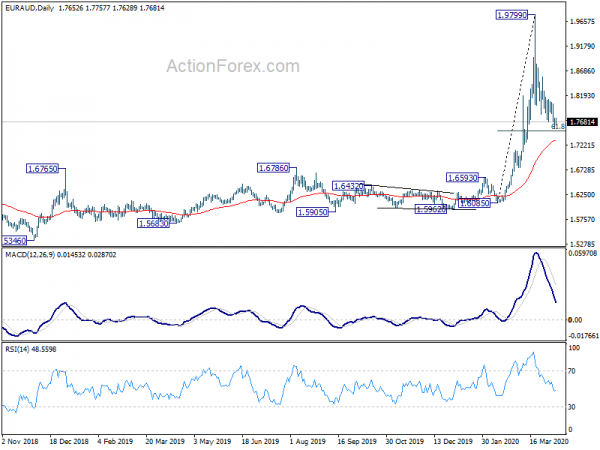

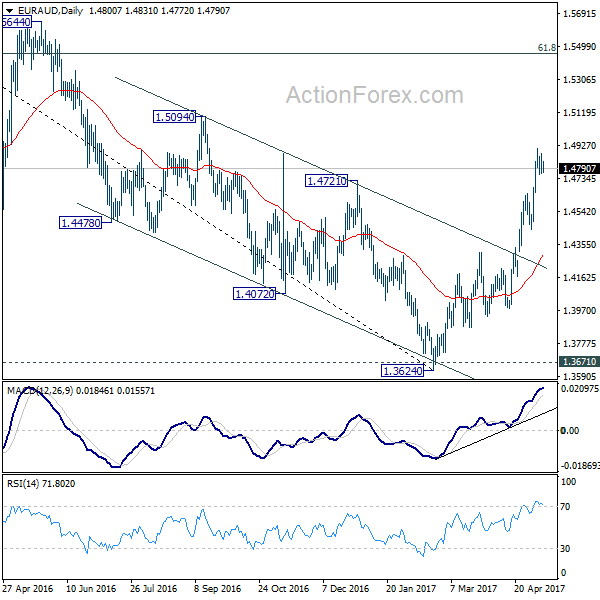

In the bigger picture, we’re holding on to the view that corrective decline from 1.6587 medium term has completed at 1.3624. Rise from 1.3624 is expected to resume to retest 1.6587. The corrective structure of the fall from 1.5226 is affirming this view. Above 1.5226 will target a test on 1.6587 key resistance. However, another decline will dampen our view and would drag EUR/AUD lower to retest key support zone around 1.3624.