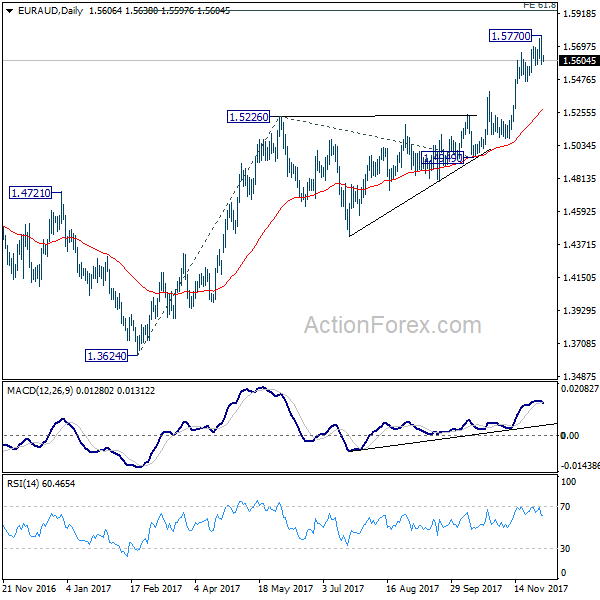

Daily Pivots: (S1) 1.6483; (P) 1.6564; (R1) 1.6688; More…

Intraday bias in EUR/AUD remains neutral first. On the upside, firm break of 1.6650 resistance will argue that pull back from 1.7062 has completed, after drawing support from medium term rising trend line. Further rally would be seen back to retest 1.7062. Nevertheless, break of 1.6319 will resume the fall to 1.6000 fibonacci level.

In the bigger picture, fall from 1.7062 is probably correcting whole up trend from 1.4281 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.4281 to 1.7062 at 1.6000. Strong support could be seen there to bring rebound, at least on first attempt. This will remain the favored case as long as 1.6650 resistance holds.