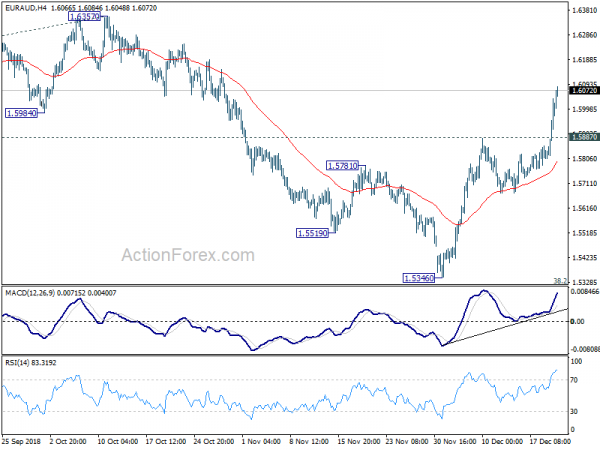

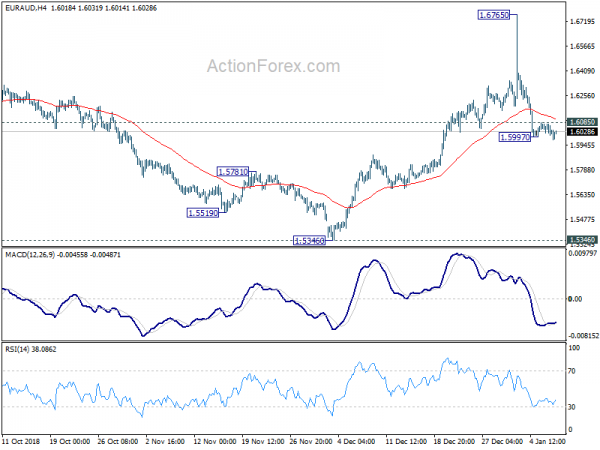

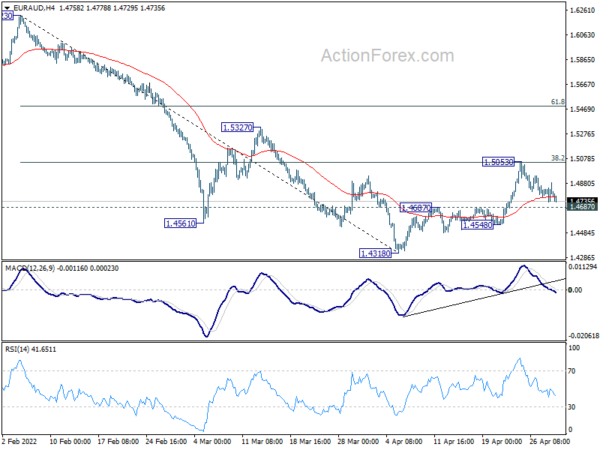

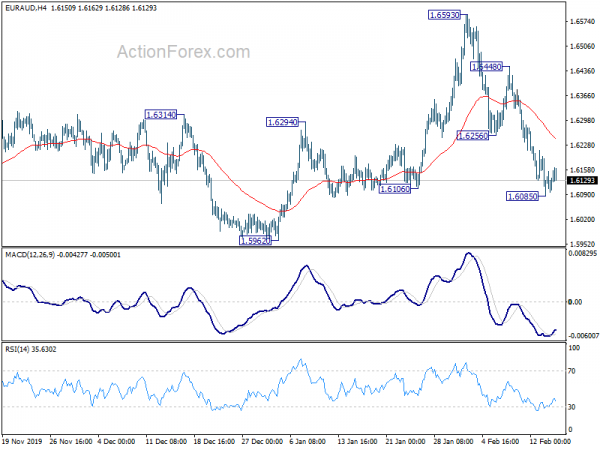

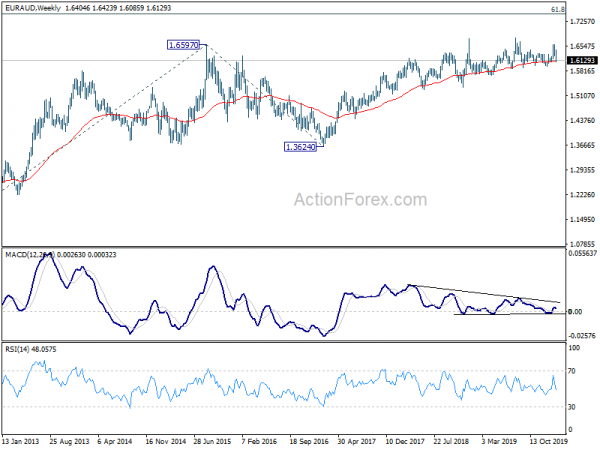

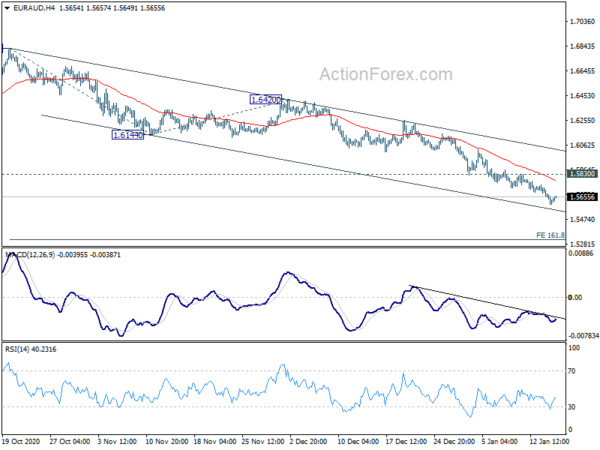

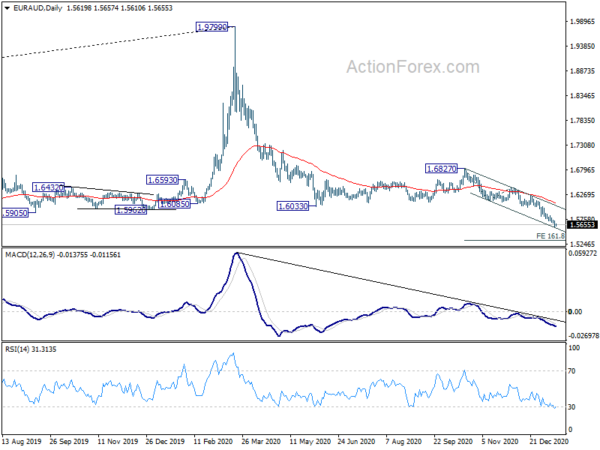

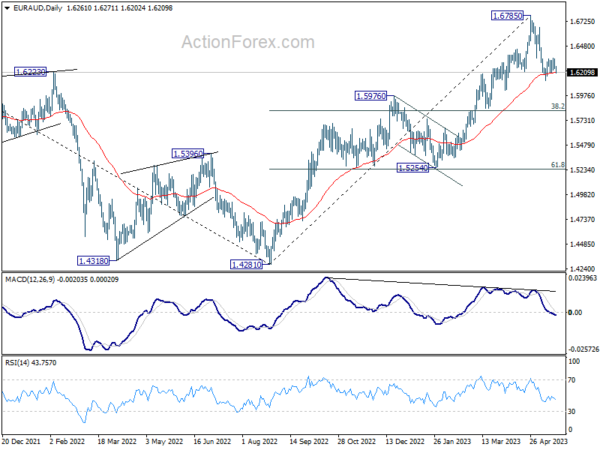

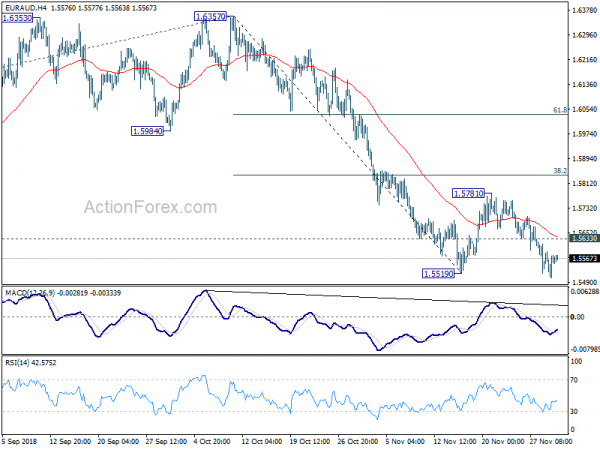

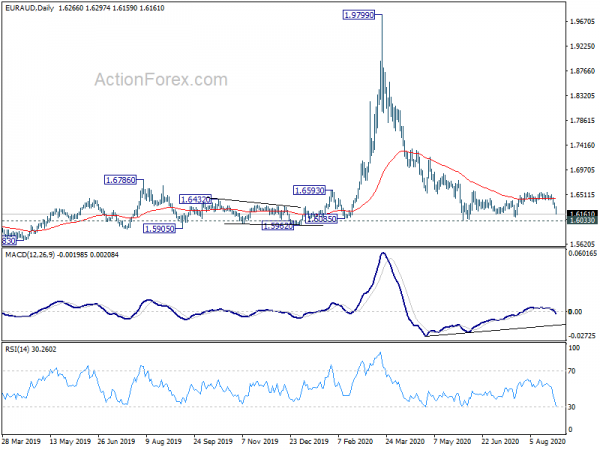

EUR/AUD’s pull back from 1.5226 extended lower last week and broke 38.2% retracement of 1.3980 to 1.5226 at 1.4750. It’s pressing 1.4669 support. At this point, we’re expecting strong support around 1.4669, near term 55 days EMA at 1.4685, to contain downside and bring rebound. Break of 1.4897 minor resistance will turn bias back to the upside for retesting 1.5226 high first. However, sustained break of 1.4669 will argue that rise from 1.3642 is completed and bring deeper pull back to 1.4309 resistance turned support.

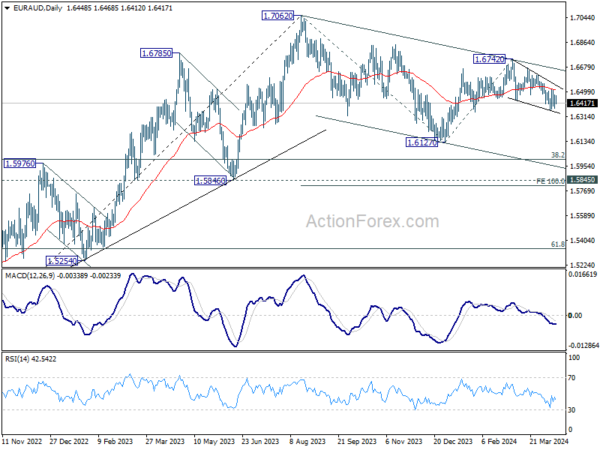

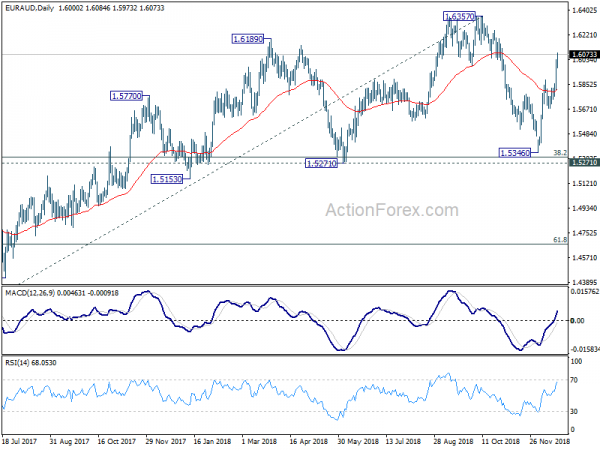

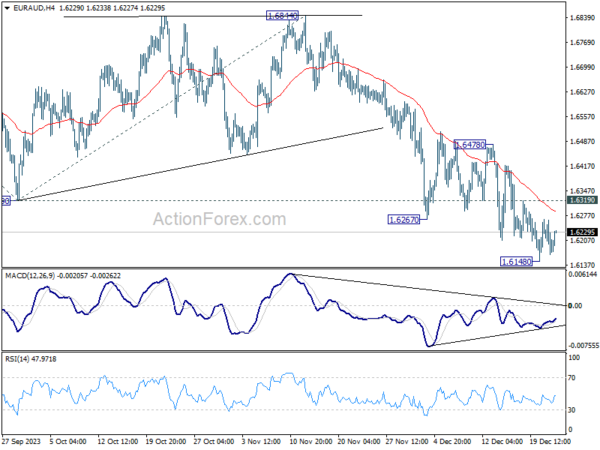

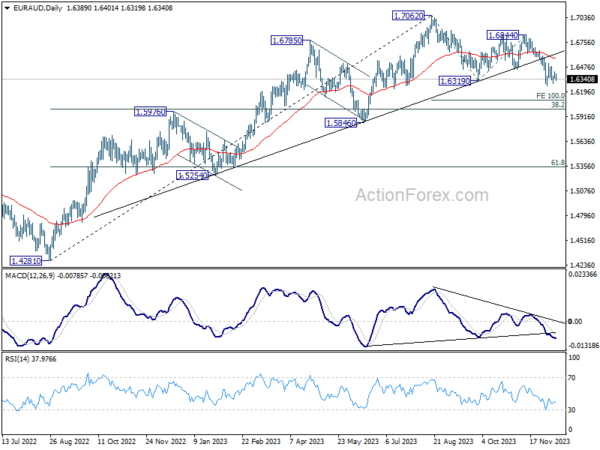

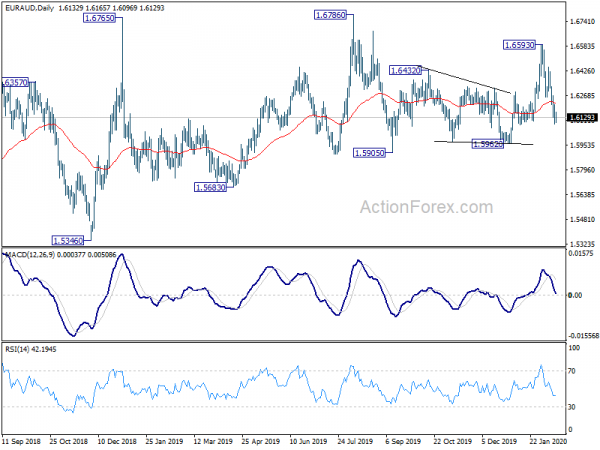

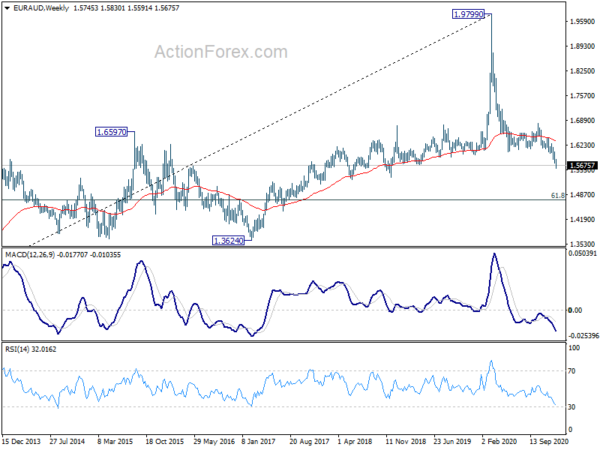

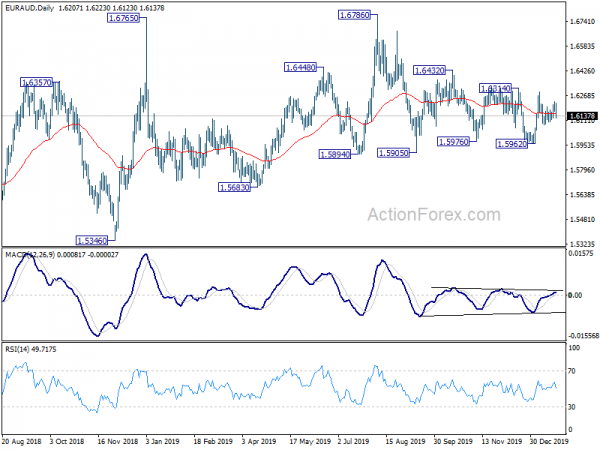

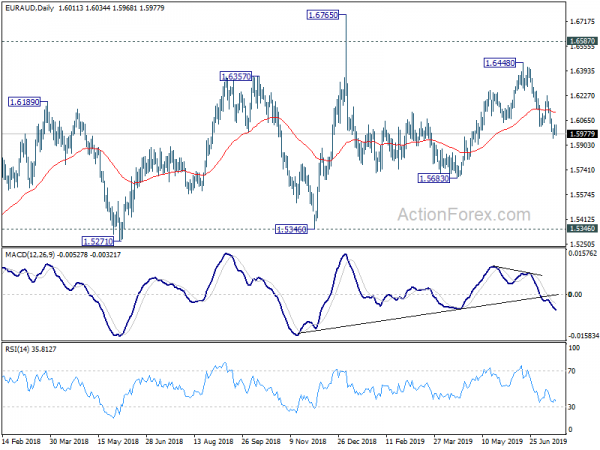

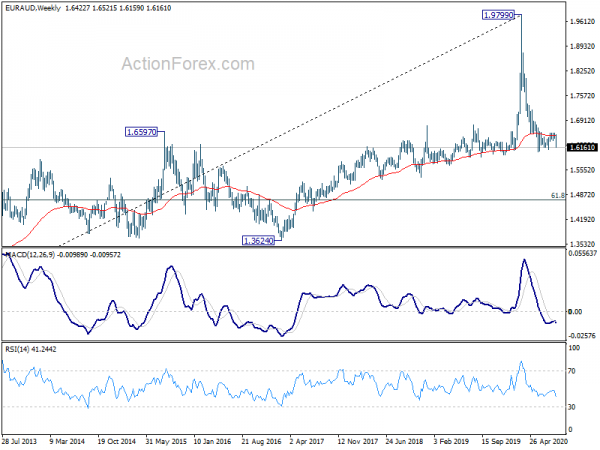

In the bigger picture, price actions from 1.6587 medium term top are viewed as a corrective pattern. Such correction should be completed at 1.3624 after defending 1.3671 key support. Rise from 1.3642 would extend to 61.8% retracement of 1.6587 to 1.3624 at 1.5455. Sustained break there will pave the way to retest 1.6587. However, sustained break of 1.4669 support will dampen this bullish view. We’ll assess the outlook later after looking at the structure and depth of the pull back.

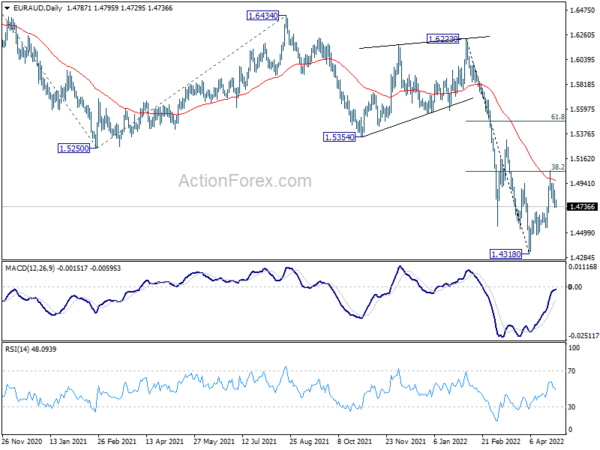

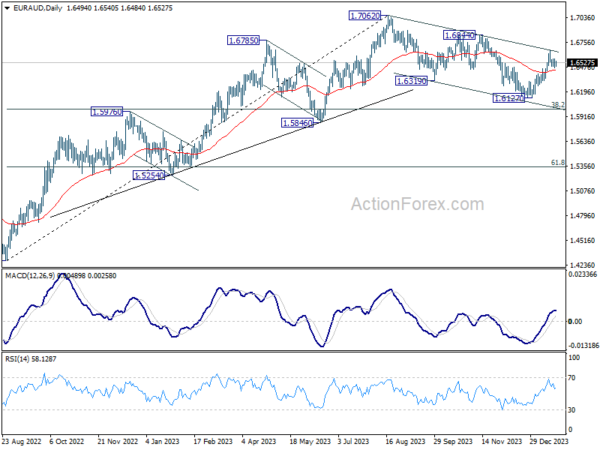

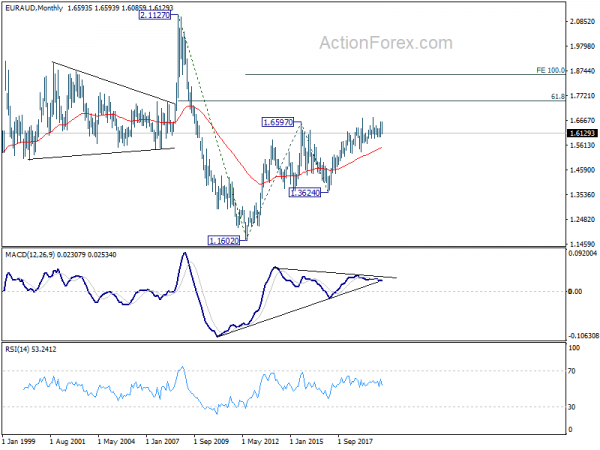

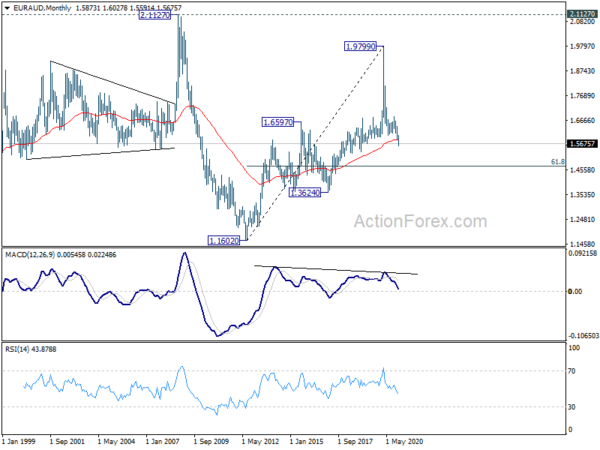

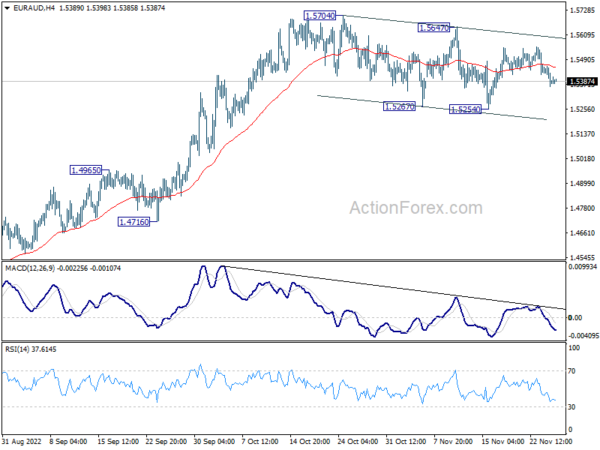

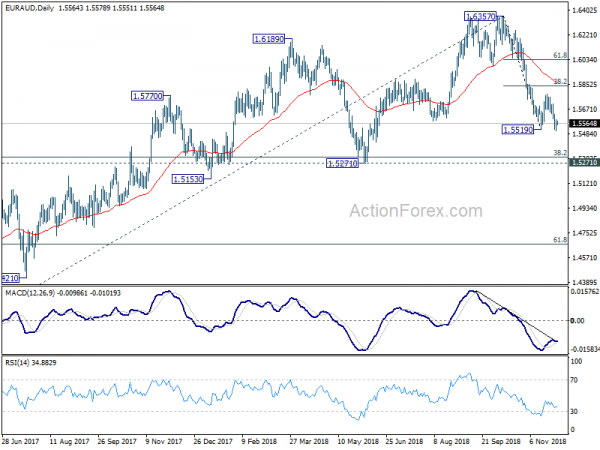

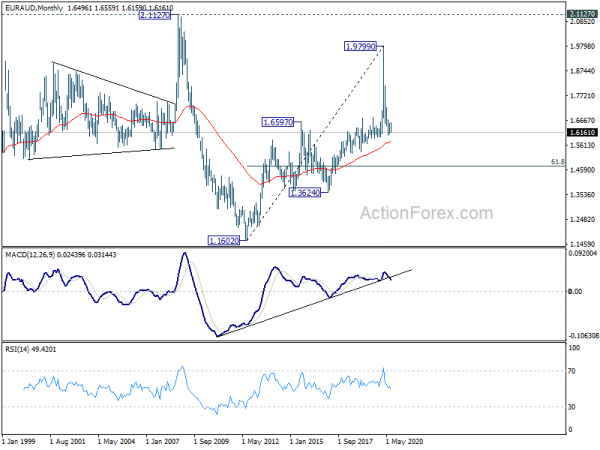

In the longer term picture, the rise from 1.1602 long term bottom isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3671 should confirm trend reversal and target 1.1602 long term bottom again.