Daily Pivots: (S1) 1.6105; (P) 1.6147; (R1) 1.6216; More…

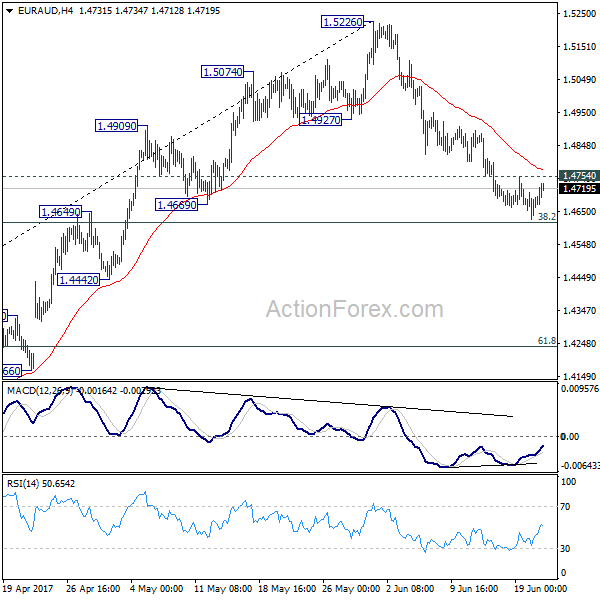

EUR/AUD’s recovery from 1.6025 is still in progress and focus is back on 1.6259 minor resistance. Break will confirm that corrective pull back from 1.6448 has completed. And further rise should be seen back to retest 1.6448 high. On the downside, break of 1.6025 will extend the fall from 1.648 to 1.5683 support and below.

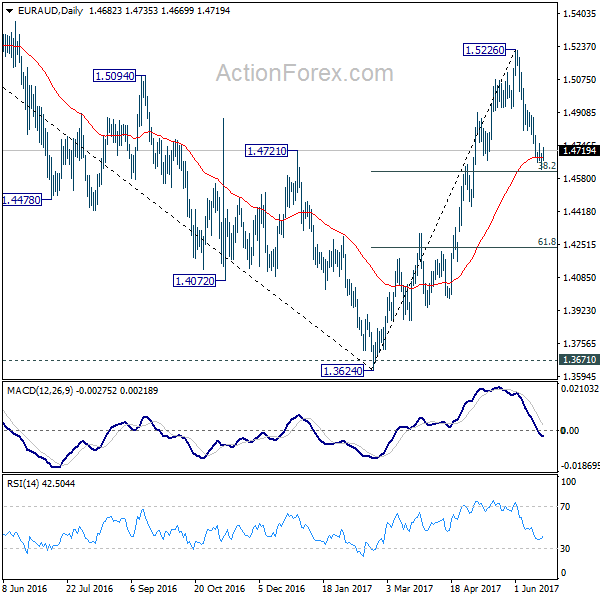

In the bigger picture, as long as 1.5346 support holds, outlook will still remain bullish. Up trend from 1.1602 (2012 low) is expected to resume sooner or later. Break of 1.6765 will target 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488 next. However, firm break of 1.5346 key support will indicate trend reversal and turn outlook bearish.