EURAUD Outlook

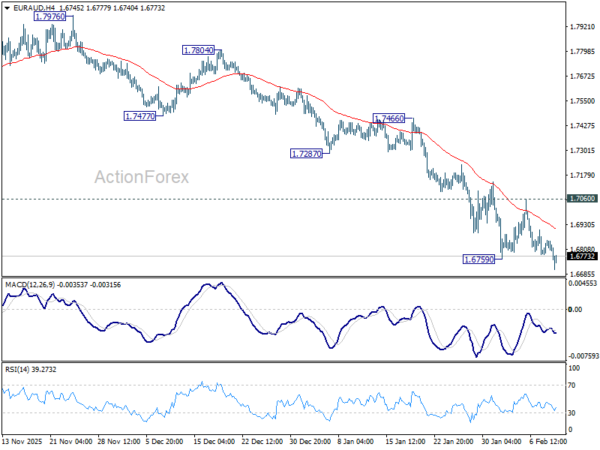

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6658; (P) 1.6708; (R1) 1.6793; More...

Intraday bias in EUR/AUD is turned neutral with current recovery, and some consolidations would be seen above 1.6620. But outlook will stay bearish as long as 1.7060 resistance holds. Break of 1.6620 will extend the whole down trend from 1.8554, and target 138.2% projection of 1.8554 to 1.7245 from 1.8160 at 1.6351 next.

In the bigger picture, fall from 1.8554 medium term top is seen as reversing the whole up trend from 1.4281 (2022 low). Deeper decline should be seen to 61.8% retracement of 1.4281 to 1.8554 at 1.5913, which is slightly below 1.5963 structural support. For now, risk will stay on the downside as long as 1.7245 support turned resistance holds even in case of strong rebound.

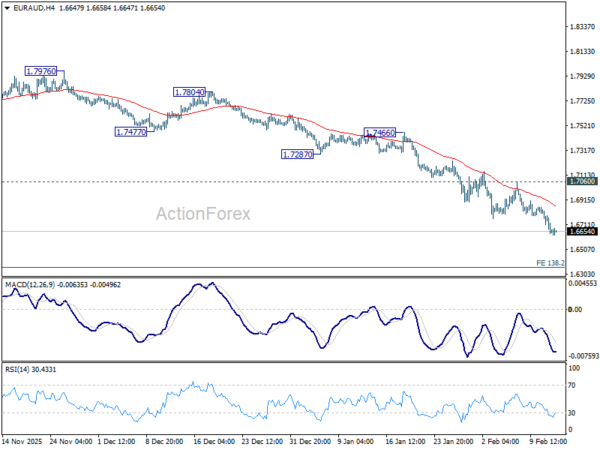

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6584; (P) 1.6708; (R1) 1.6782; More...

Intraday bias in EUR/AUD remains on the downside for the moment. Current fall is part of the whole down trend from 1.8554 and should target 138.2% projection of 1.8554 to 1.7245 from 1.8160 at 1.6351 next. For now, outlook will stay bearish as long as 1.7060 resistance holds, in case of recovery.

In the bigger picture, fall from 1.8554 medium term top is seen as reversing the whole up trend from 1.4281 (2022 low). Deeper decline should be seen to 61.8% retracement of 1.4281 to 1.8554 at 1.5913, which is slightly below 1.5963 structural support. For now, risk will stay on the downside as long as 1.7245 support turned resistance holds even in case of strong rebound.

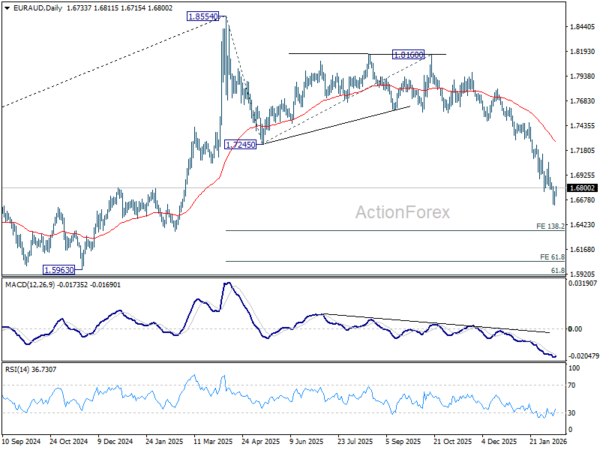

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6782; (P) 1.6818; (R1) 1.6848; More...

EUR/AUD's fall is resuming by breaking 1.6759 support. Intraday bias is back on the downside. Next target is 138.2% projection of 1.8554 to 1.7245 from 1.8160 at 1.6351. On the upside, however, break of 1.7060 resistance will indicate short term bottoming, and turn bias back to the upside for stronger rebound.

In the bigger picture, fall from 1.8554 medium term top is still in progress. Sustained break of 38.2% retracement of 1.4281 to 1.8554 at 1.6922 will argue that it's already reversing whole up trend from 1.4281 (2022 low). Deeper fall would be seen to 61.8% retracement at 1.5913. For now, risk will stay on the downside as long as 55 D EMA (now at 1.7303) holds even in case of strong rebound.