Daily Pivots: (S1) 1.6108; (P) 1.6153; (R1) 1.6179; More…

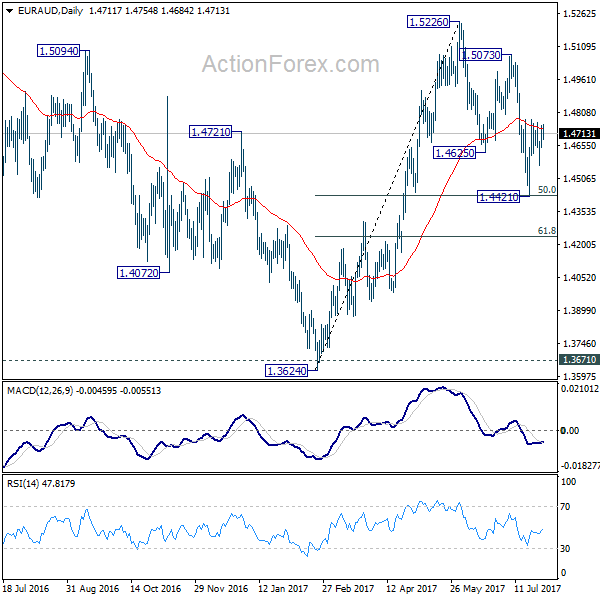

EUR/AUD is losing some upside momentum as seen in 4 hour MACD. Still, with 1.6086 minor support intact, intraday bias in EUR/AUD remains on the upside. Current rise from 1.5683 should extend to retest 1.6765 high. On the downside, below 1.6086 minor support will turn intraday bias neutral and bring consolidation first, before staging another rally.

In the bigger picture, as long as 1.5346 support holds, outlook will still remain bullish. Up trend from 1.1602 (2012 low) is expected to resume sooner or later. Break of 1.6765 will target 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488 next. However, firm break of 1.5346 key support will indicate trend reversal, with bearish divergence condition in weekly MACD, and turn outlook bearish.