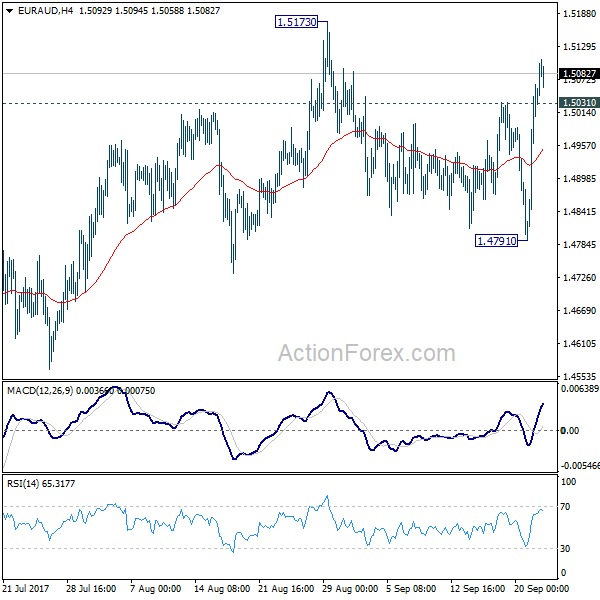

Daily Pivots: (S1) 1.5401; (P) 1.5466; (R1) 1.5499; More…

Intraday bias in EUR/AUD is mildly on the downside for retesting 1.5250 low. Break there will resume the larger down trend from 1.9799. Next target is 1.4733 long term fibonacci level. On the upside, above 1.5606 will extend the consolidation from 1.5250 with another rise, to 38.2% retracement of 1.6827 to 1.5250 at 1.5852.

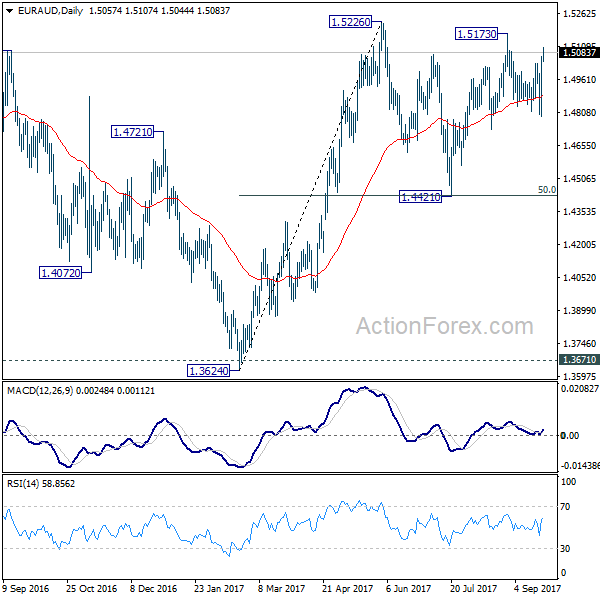

In the bigger picture, price actions from 1.9799 are developing into a deep correction, to long term up trend from 1.1602 (2012 low). Deeper fall would be seen to 61.8% retracement of 1.1602 to 1.9799 at 1.4733. Medium term outlook will remain bearish as long as 1.6033 support turned resistance holds, even in case of strong rebound.