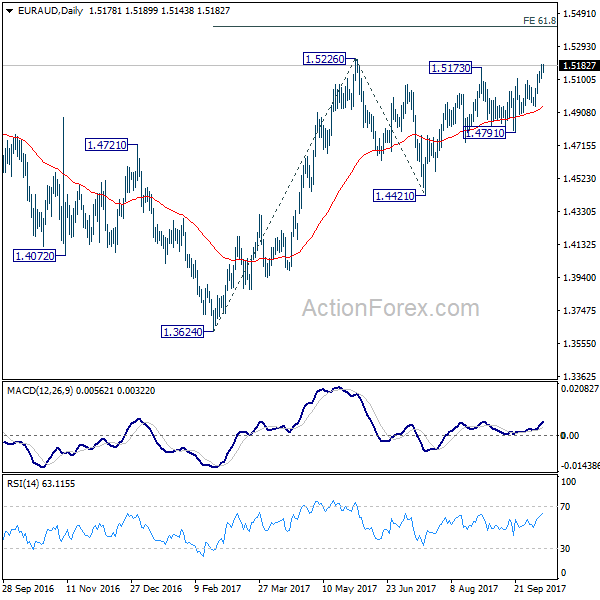

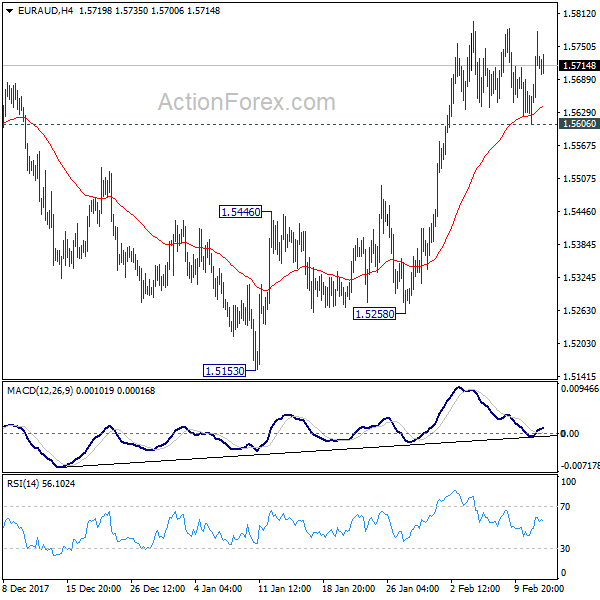

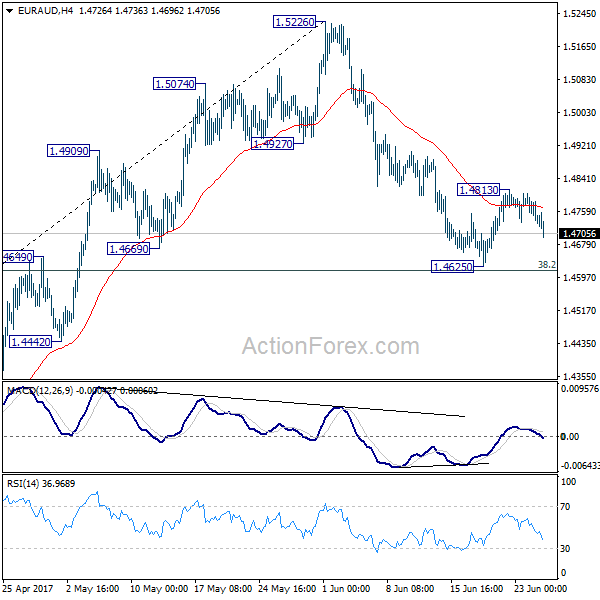

Daily Pivots: (S1) 1.5067; (P) 1.5118; (R1) 1.5149; More….

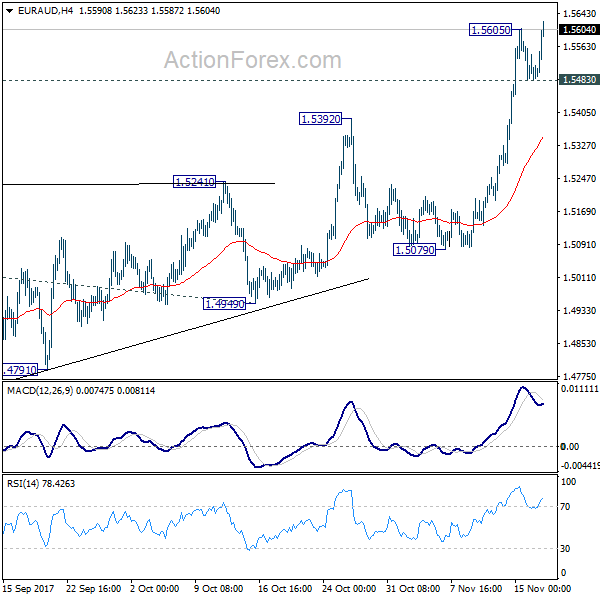

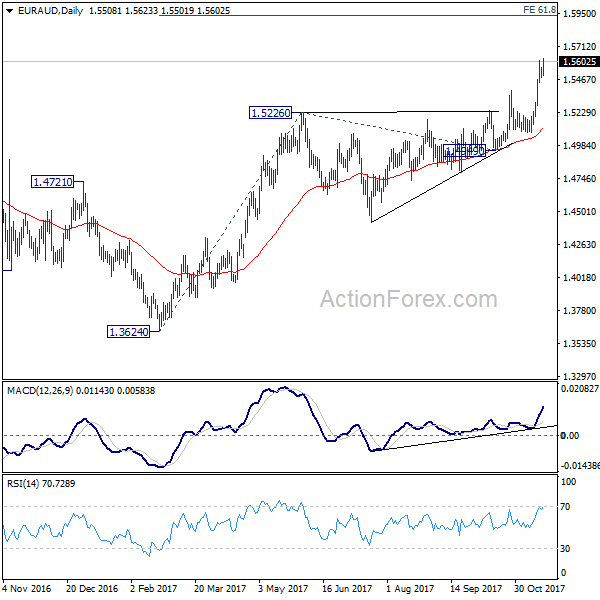

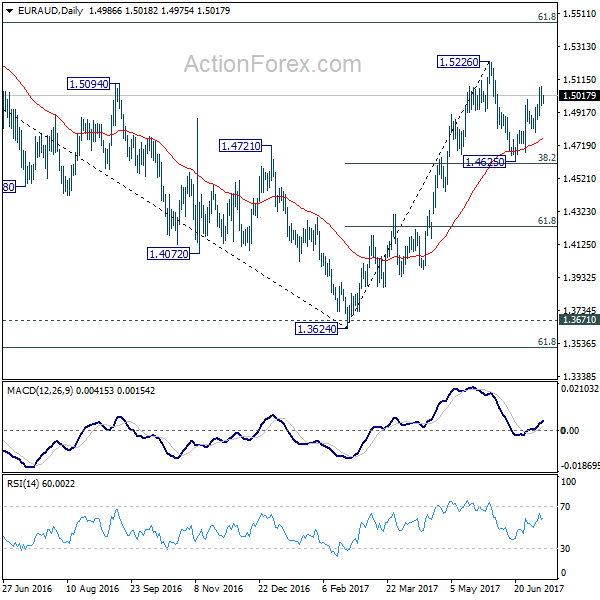

No change in EUR/AUD’s outlook as consolidation from 1.5392 extends. With 1.4949 support intact, outlook remains bullish and further rally is expected. On the upside, break of 1.5392 will resume medium term rise from 1.3624 and target 61.8% projection of 1.3624 to 1.5226 from 1.4949 at 1.5939 first. However, decisive break of 1.4949 will carry larger bearish implication and turn bias to the downside.

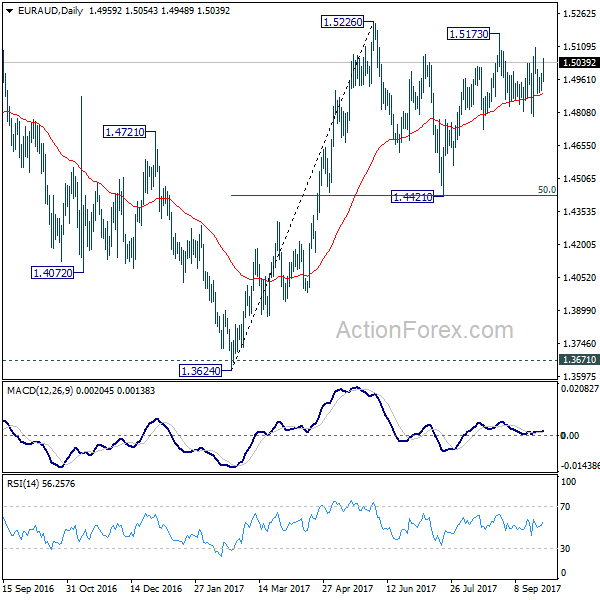

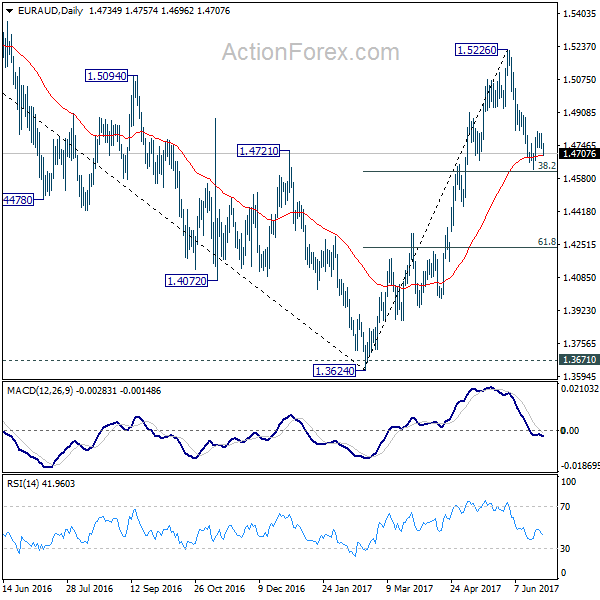

In the bigger picture, we’re holding on to the view that corrective decline from 1.6587 medium term top has completed at 1.3624. Rise from 1.3624 is expected to extend to retest 1.6587. However, break of 1.4949 support will dampen our view and argue that rise from 1.3624 has completed. In that case, EUR/AUD would turn southward for retesting 1.3624 low.