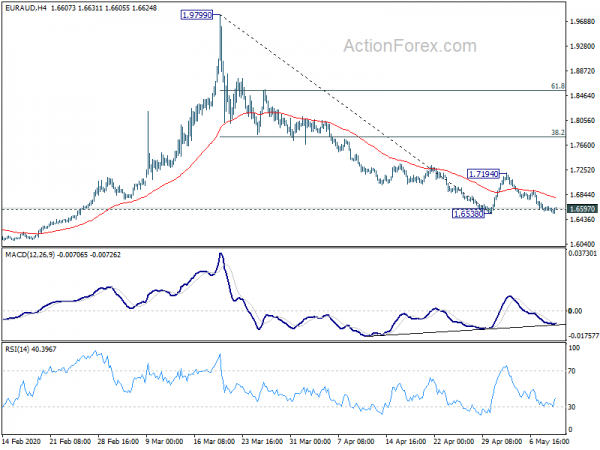

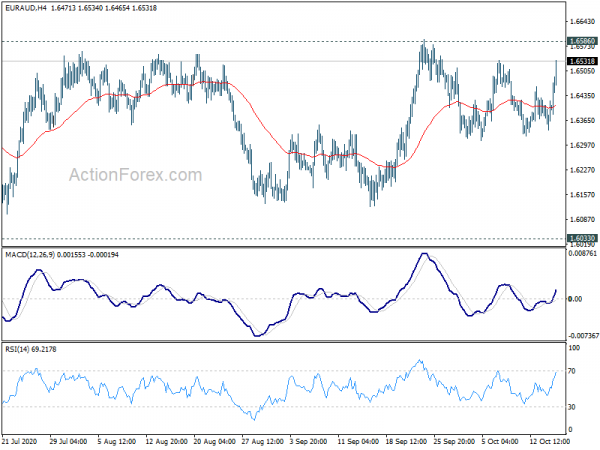

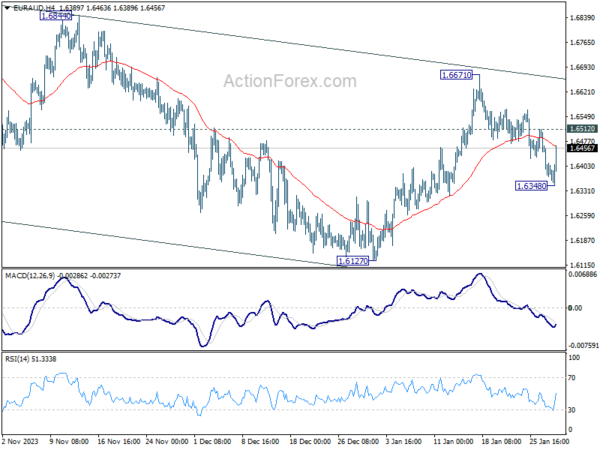

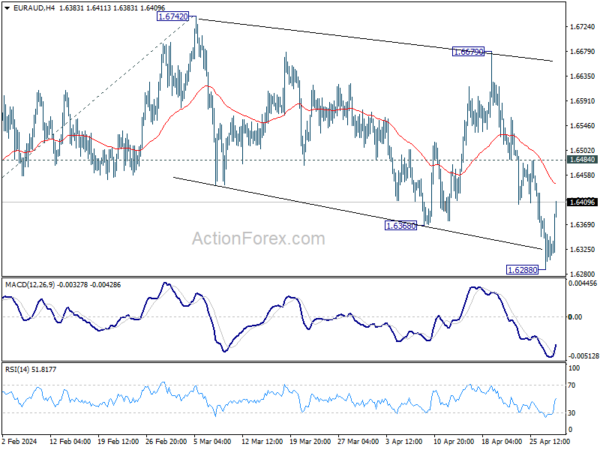

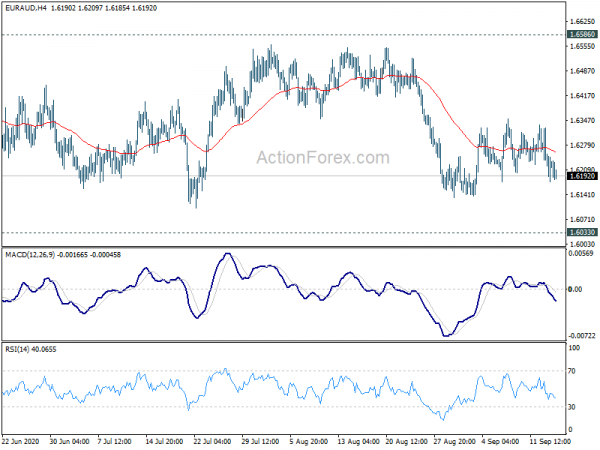

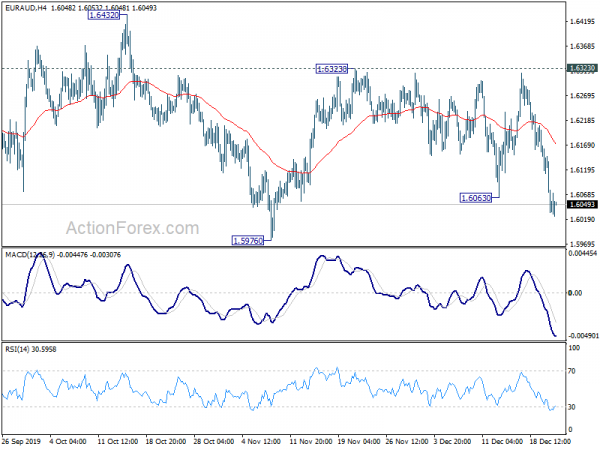

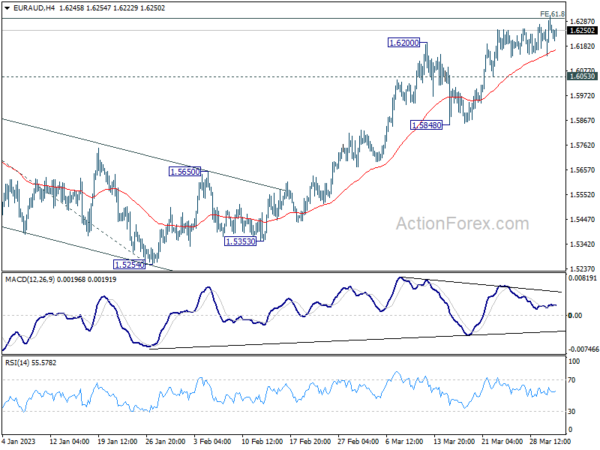

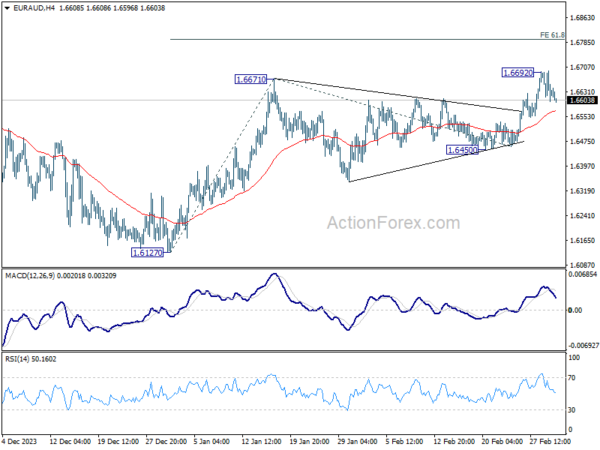

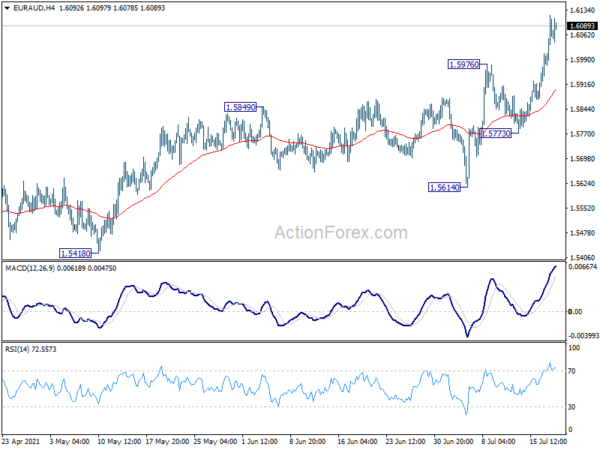

Daily Pivots: (S1) 1.6553; (P) 1.6621; (R1) 1.6668; More…

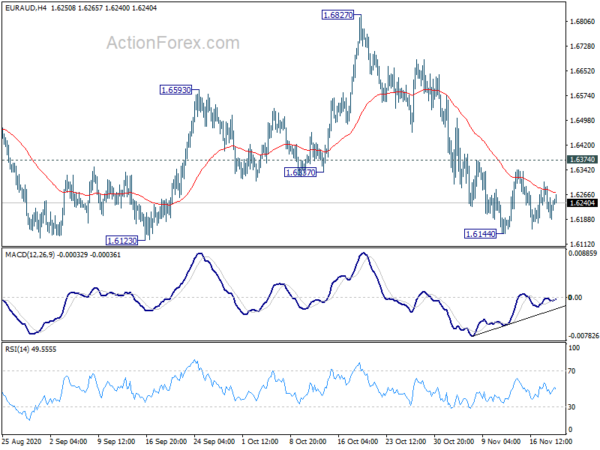

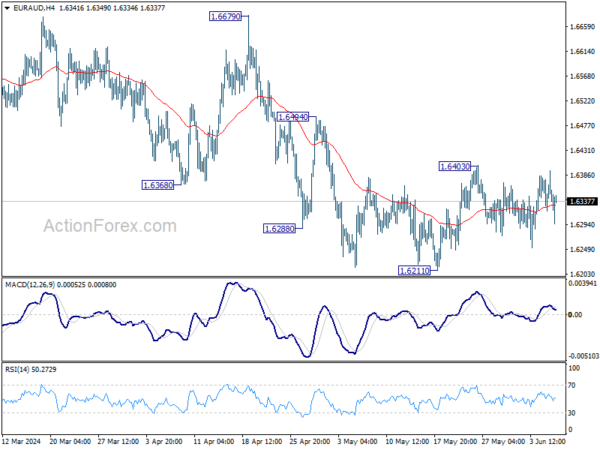

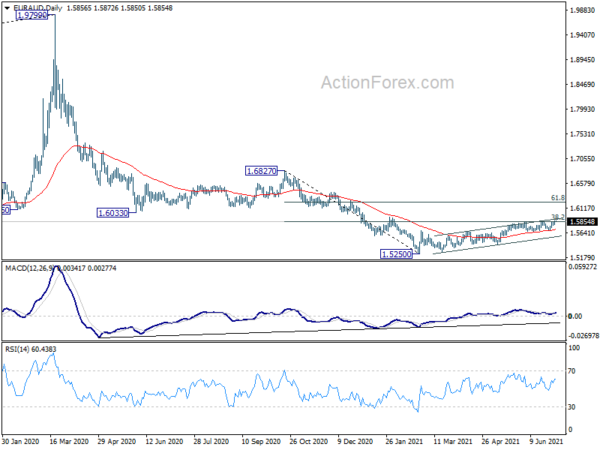

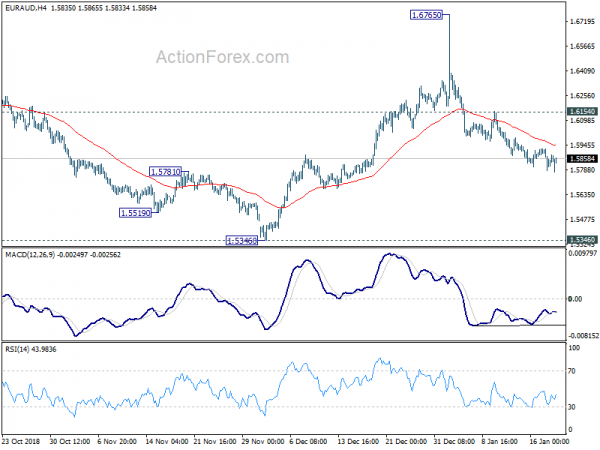

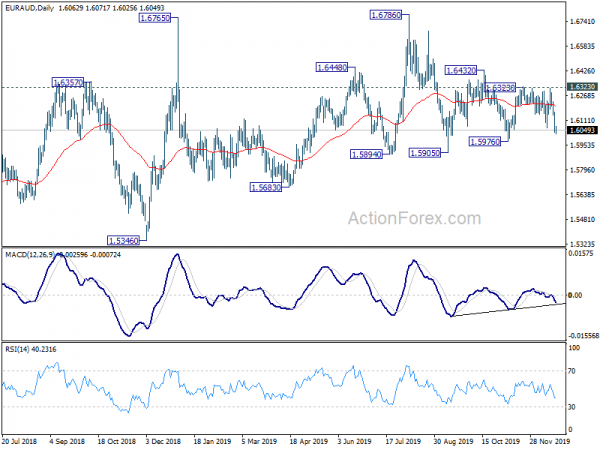

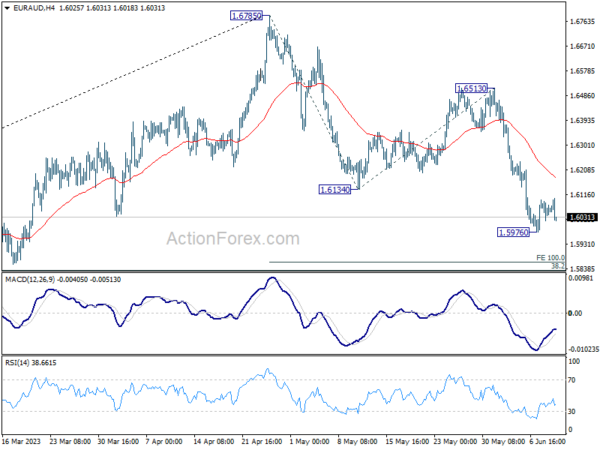

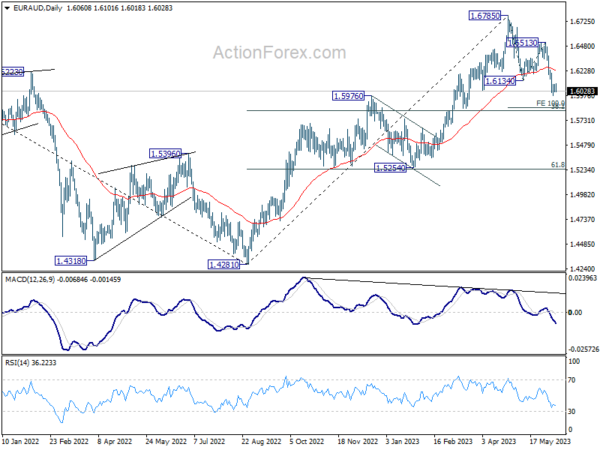

Focus remains on 1.6538 support in EUR/AUD. Break will resume whole decline form 1.9799. Also, sustained trading below 1.6597 key support will carry larger bearish implication and target 1.5962 support next. On the upside, break of 1.7194 resistance should confirm short term bottoming and turn near term outlook bullish.

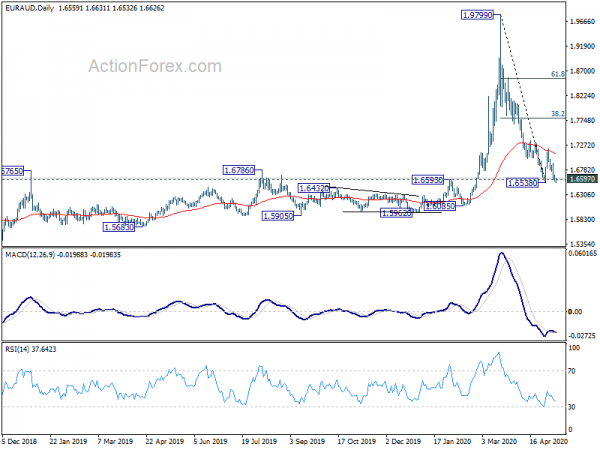

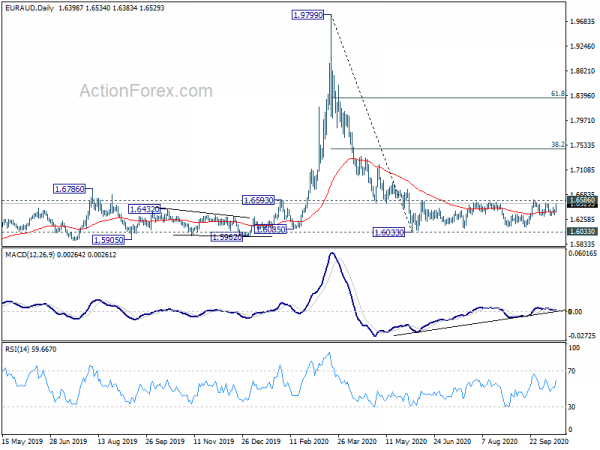

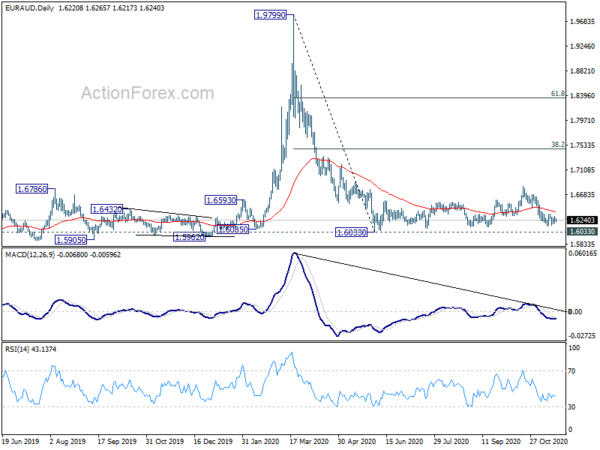

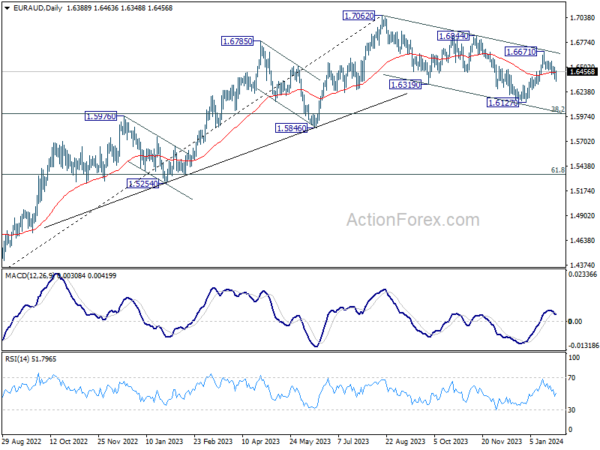

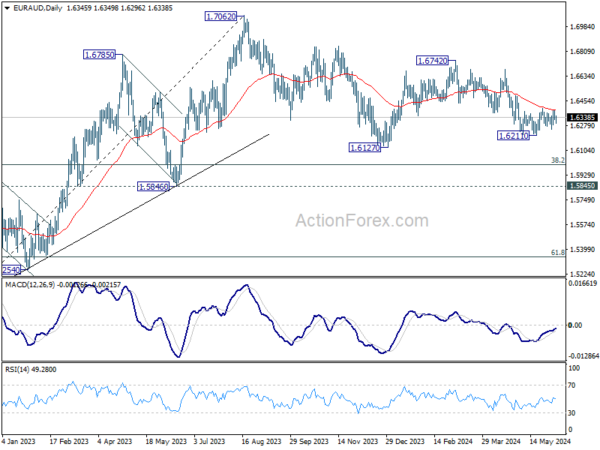

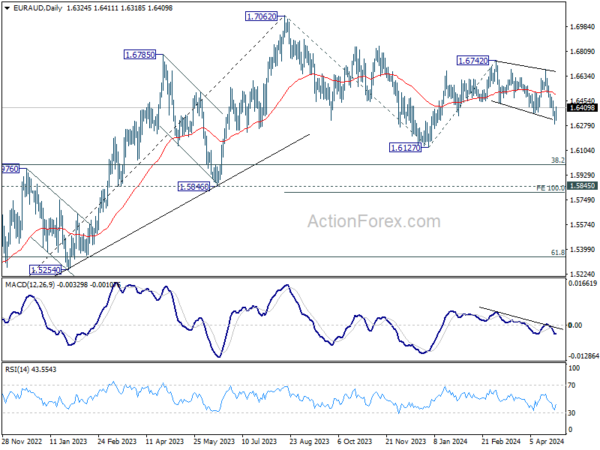

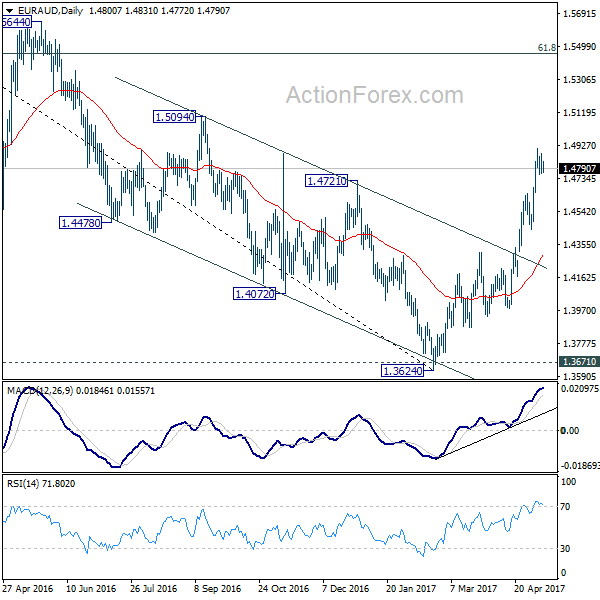

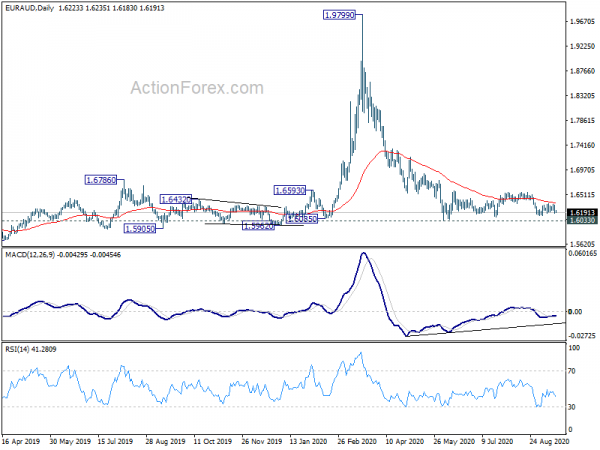

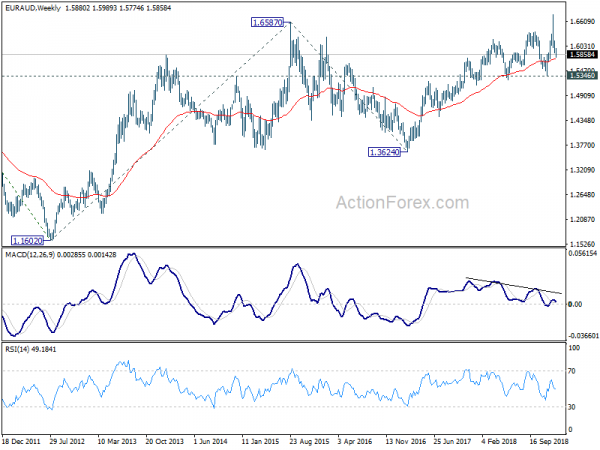

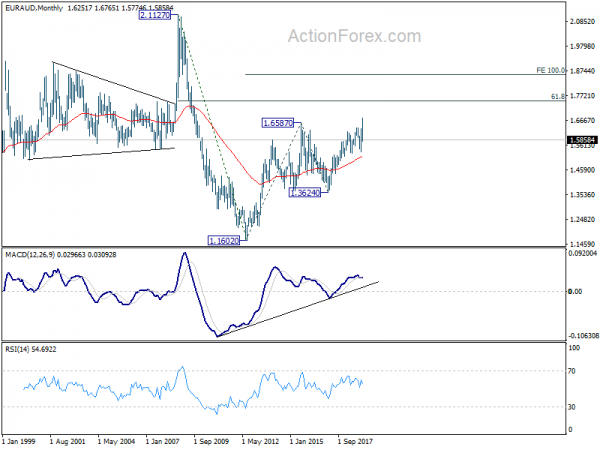

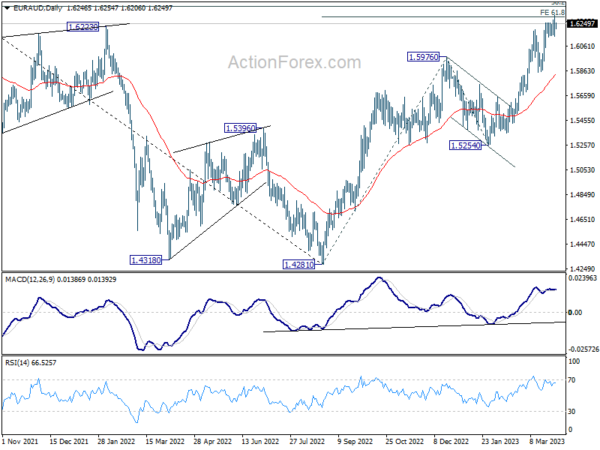

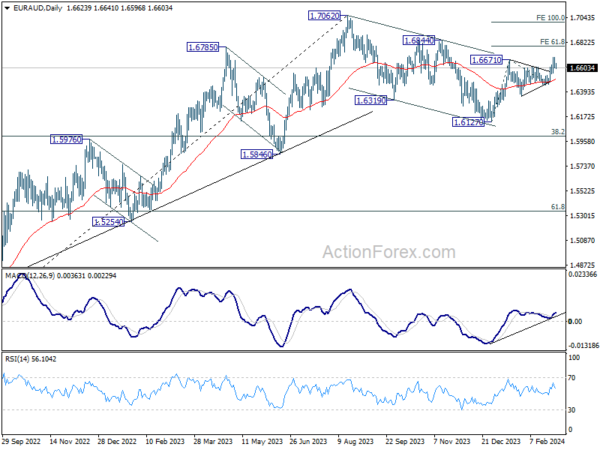

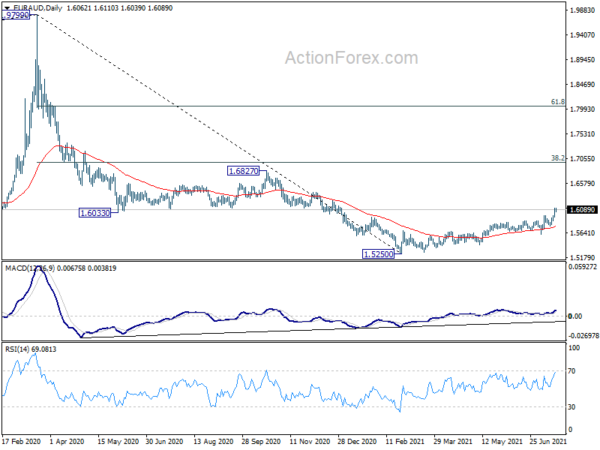

In the bigger picture, focus stays on 1.6597 key cluster support, (2015 high and 38.2% retracement of 1.1602 to 1.9799 at 1.6668, 55 week EMA (now at 1.6532). Strong rebound from current level will retain medium term bullishness. Larger up trend from 1.1602 (2012 low) would extend through 1.9799 high. However, sustained break of 1.6597 will suggest bearish reversal and target 61.8% retracement at 1.4733.