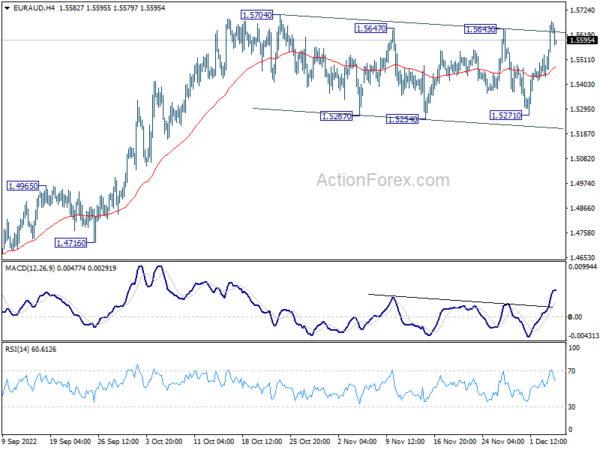

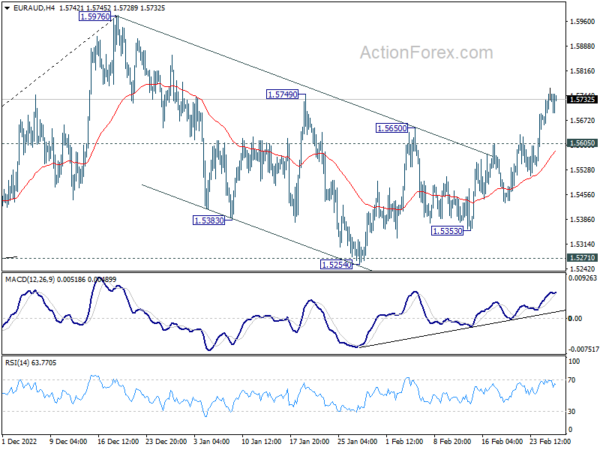

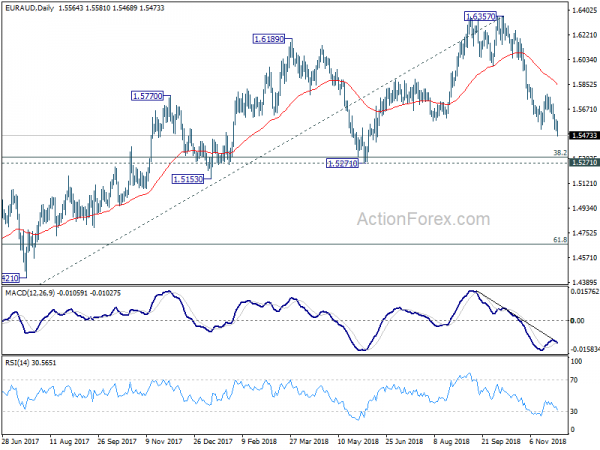

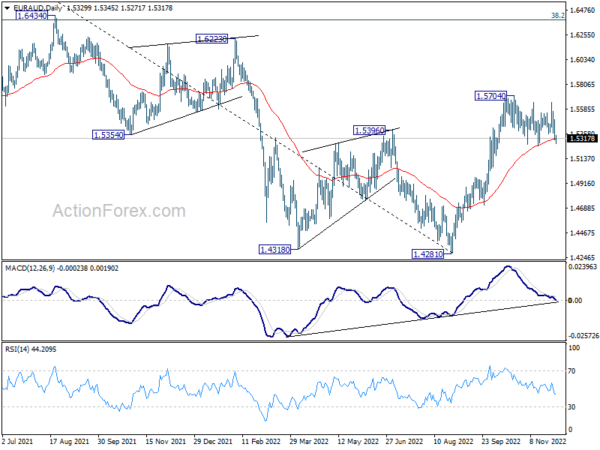

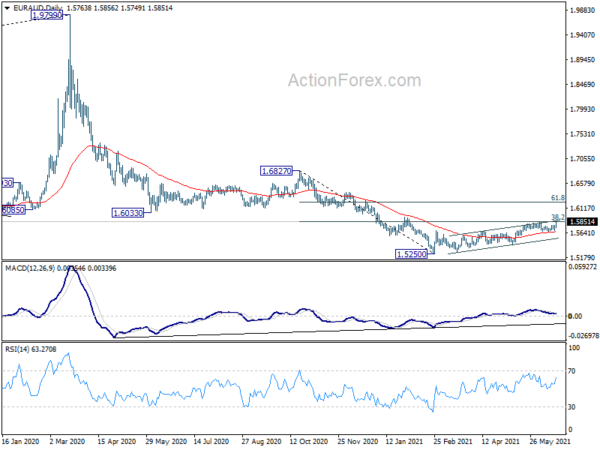

Daily Pivots: (S1) 1.5511; (P) 1.5595; (R1) 1.5751; More…

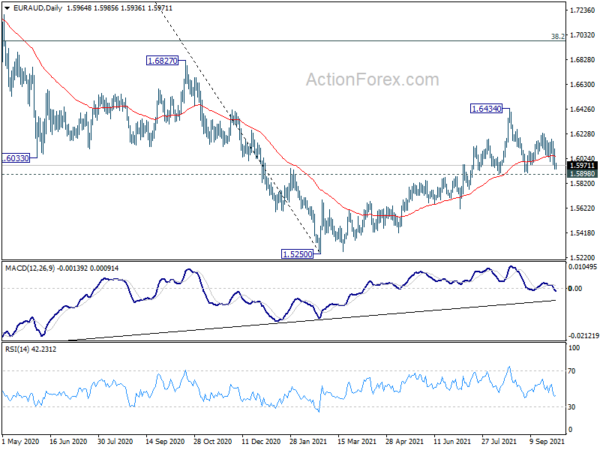

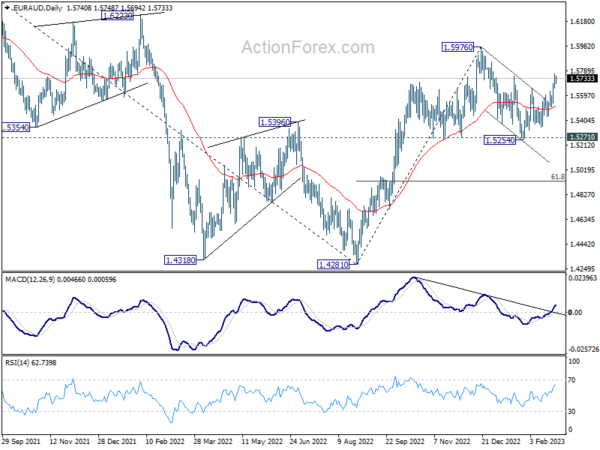

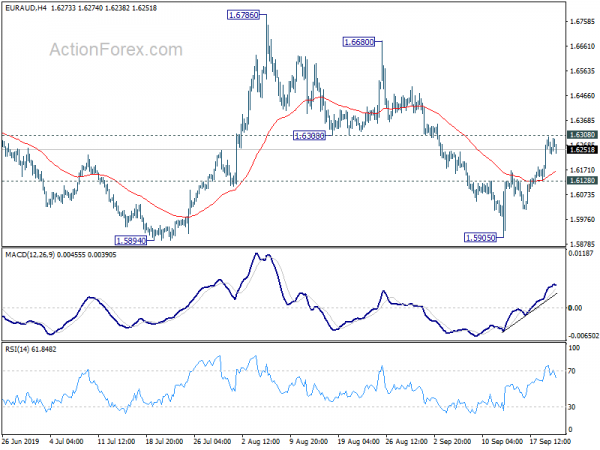

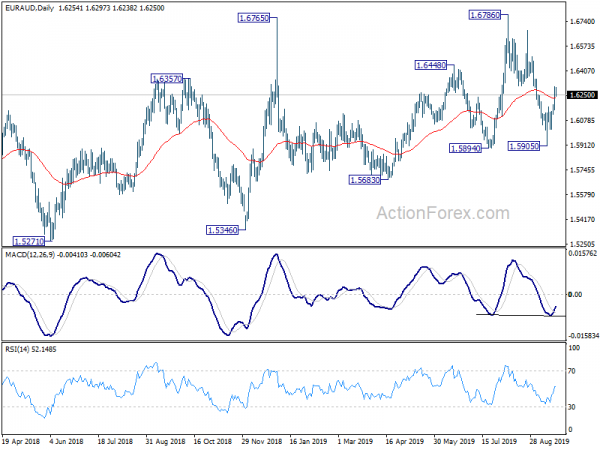

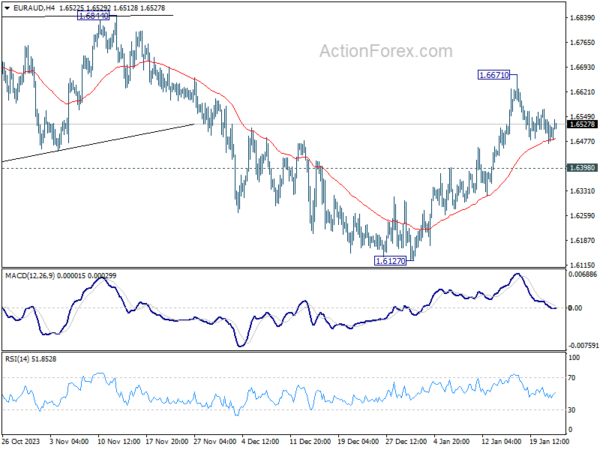

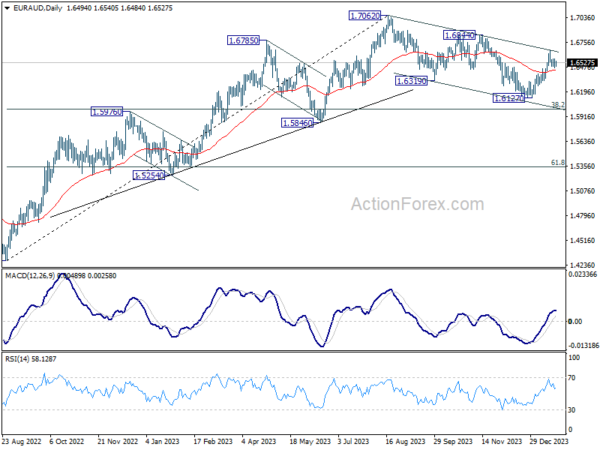

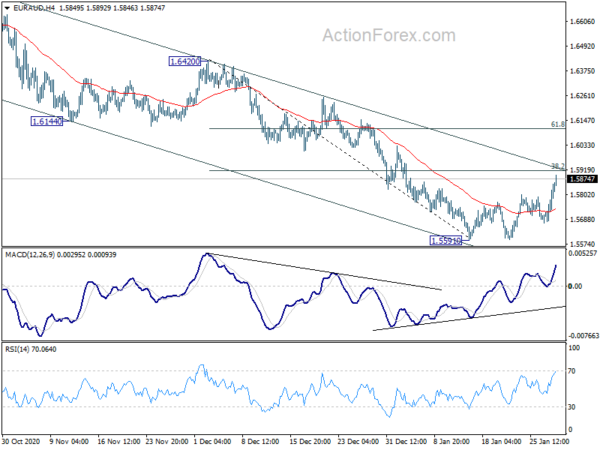

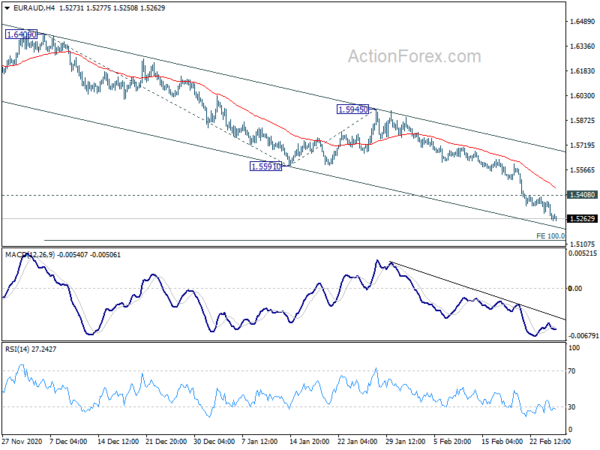

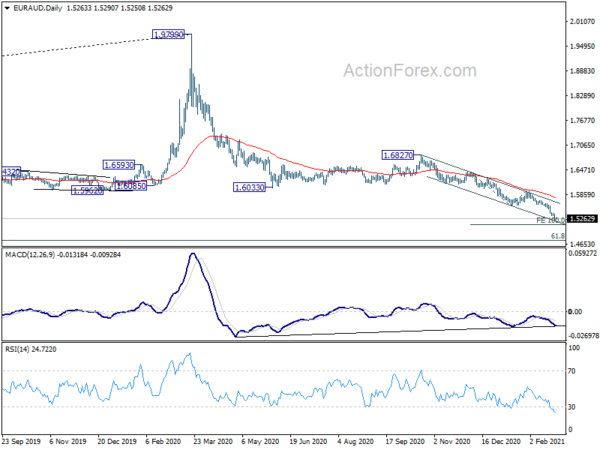

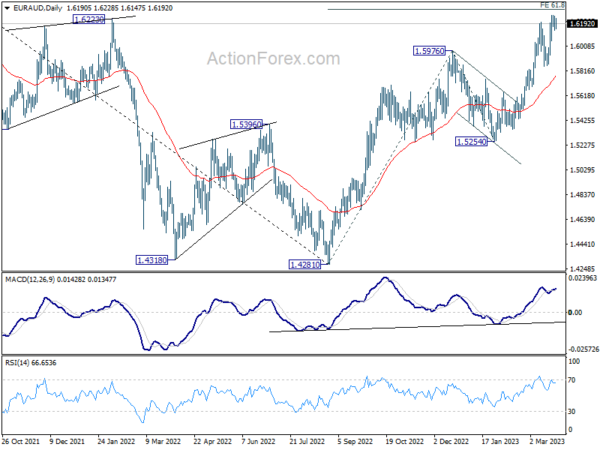

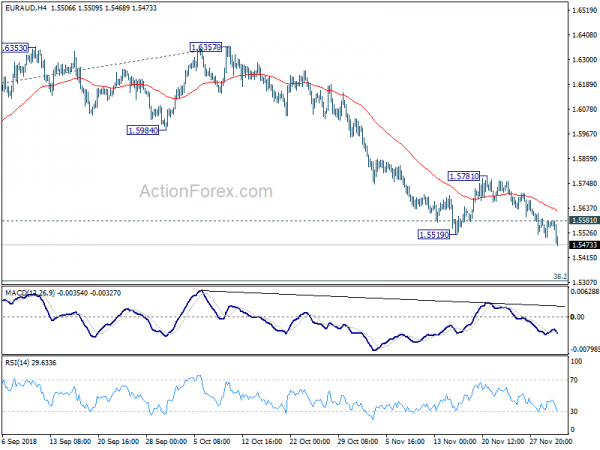

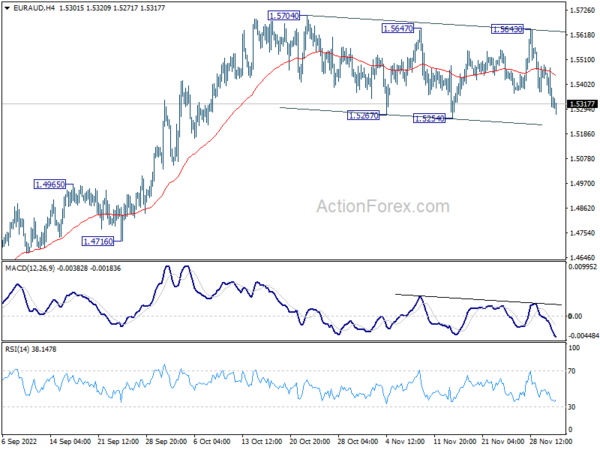

No change in EUR/AUD’s outlook as it’s still bounded in sideway consolidation from 1.5704 and intraday bias remains neutral. In case of another fall, downside should be contained by 55 day EMA (now at 1.5332) to bring rebound. On the upside, decisive break of 1.5704 will resume larger rise from 1.4281. However, sustained trading below 55 day EMA will bring deeper correction towards 1.4965 resistance turned support.

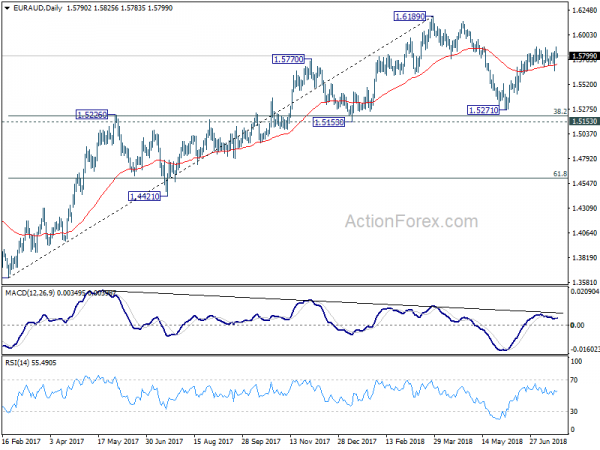

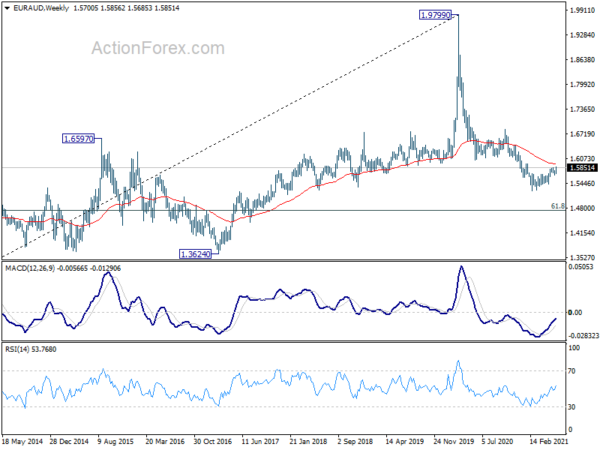

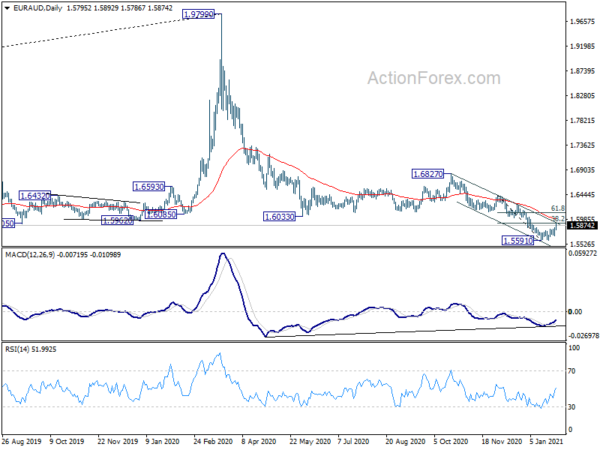

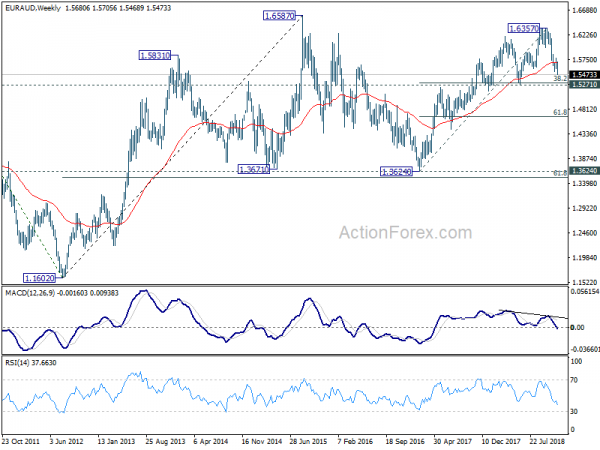

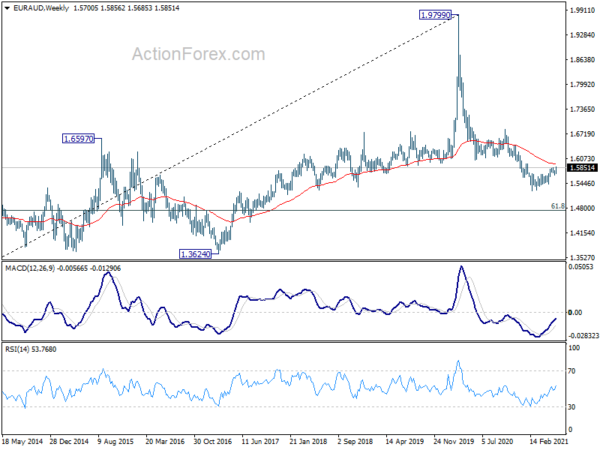

In the bigger picture, a medium term bottom should be in place at 1.4281, on bullish convergence condition in daily MACD. Further rise would be seen back to 1.6434 key resistance next. Break of 1.4965 resistance turned support is needed to indicate reversal. Otherwise, further rally will remain in favor.