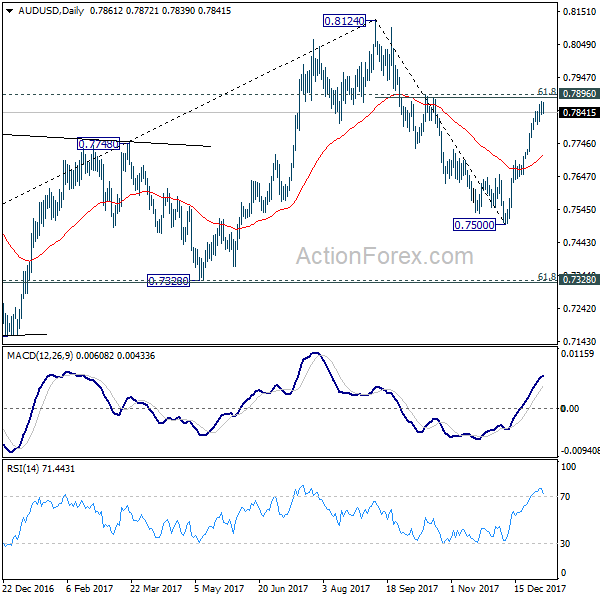

Daily Pivots: (S1) 0.6853; (P) 0.6890; (R1) 0.6938; More…

Further decline is expected in AUD/USD as long as 0.7008 minor resistance holds. . As noted before, corrective rebound from 0.6680 could have completed with three waves up to 0.7135. Retest of 0.6680 should be seen next. Firm break there will resume larger down trend. However, break of 0.7008 will turn bias back to the upside for 0.7135 resistance instead.

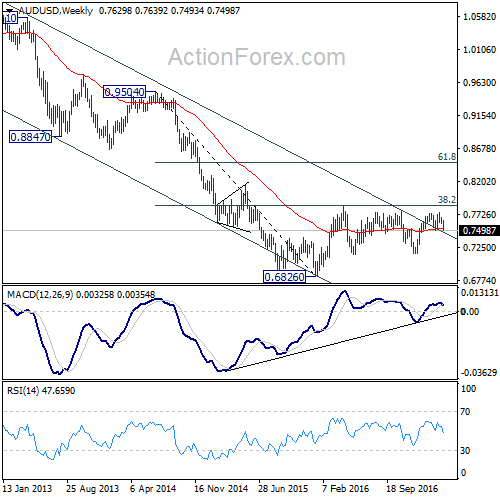

In the bigger picture, price actions from 0.8006 (2021 high) is seen more as a corrective pattern to rise from 0.5506 (2020 low). Or it could also be a bearish impulsive move. In either case, outlook will remain bearish as long as 0.7282 resistance holds. Next target is 61.8% retracement of 0.5506 to 0.8006 at 0.6461.