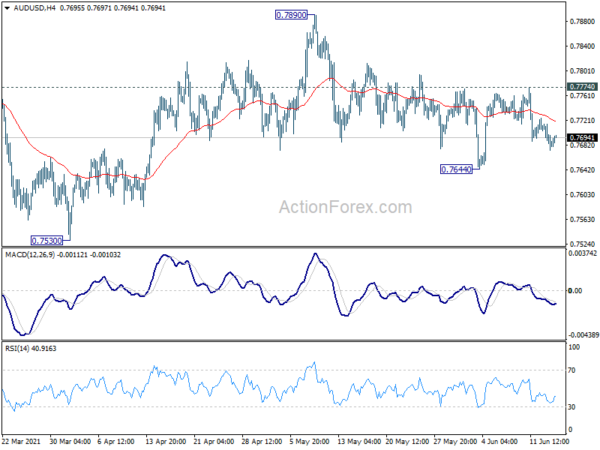

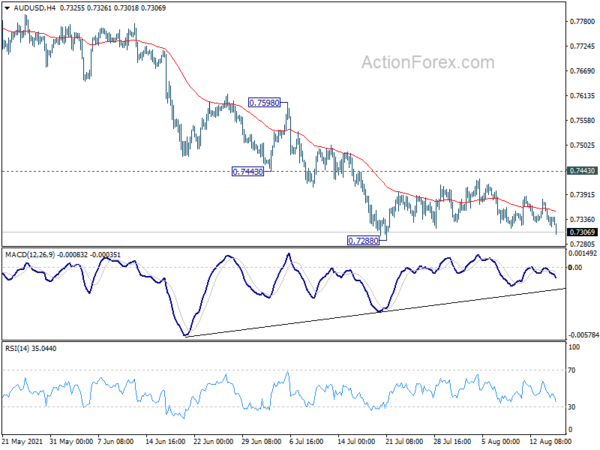

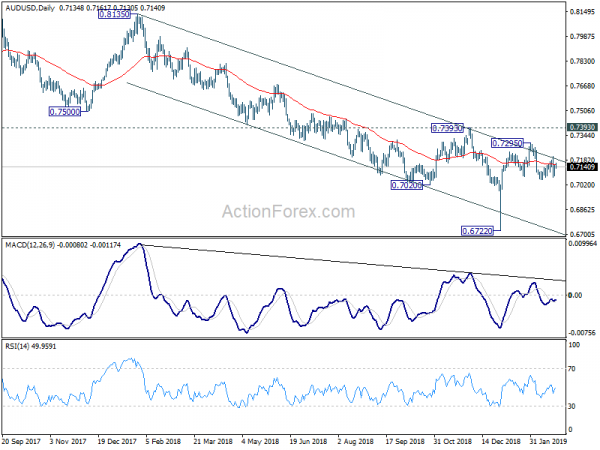

Daily Pivots: (S1) 0.7506; (P) 0.7531; (R1) 0.7564; More…

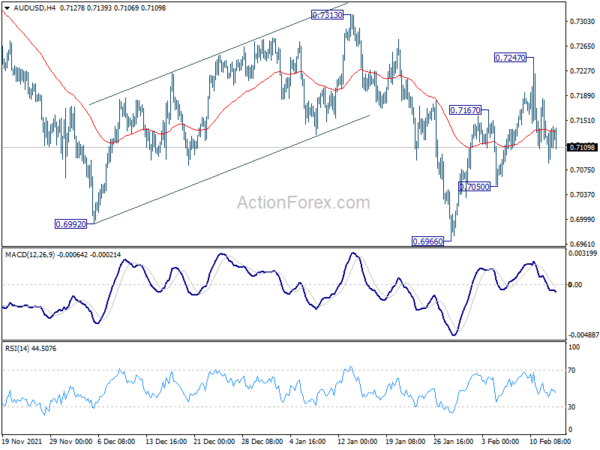

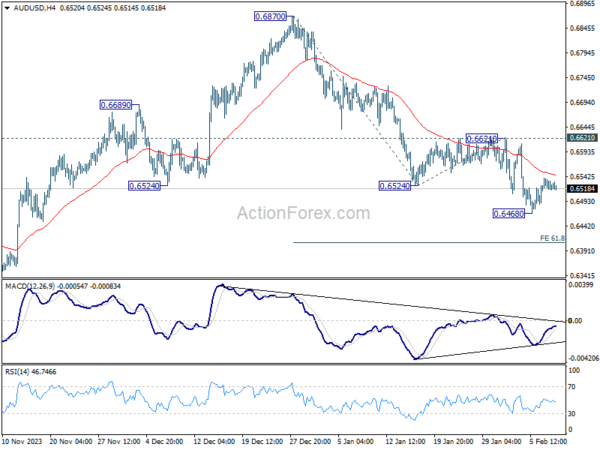

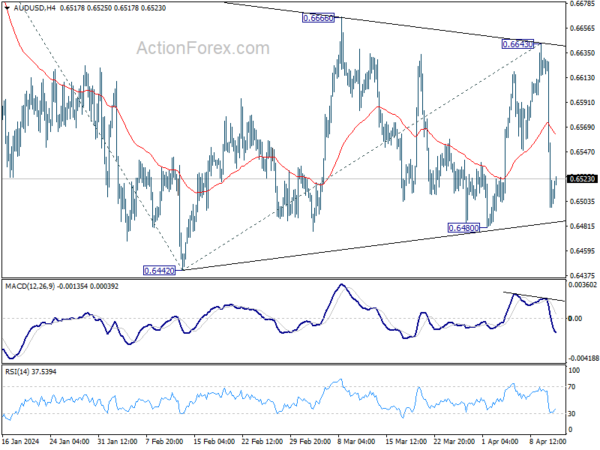

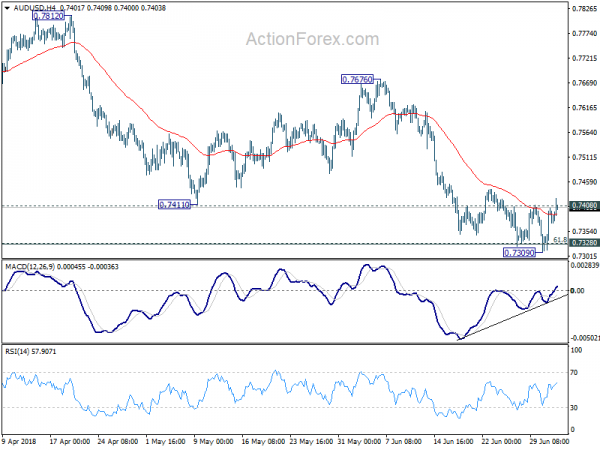

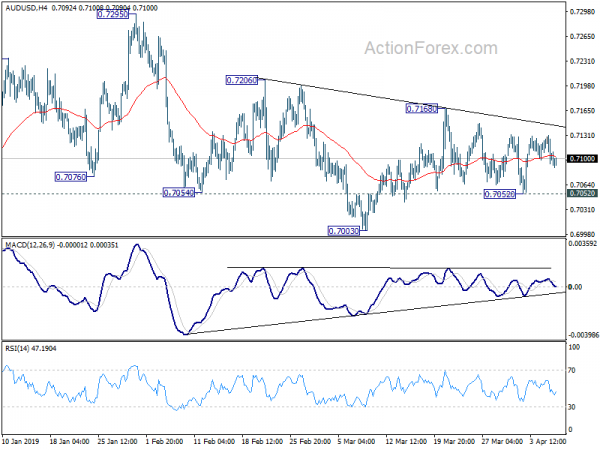

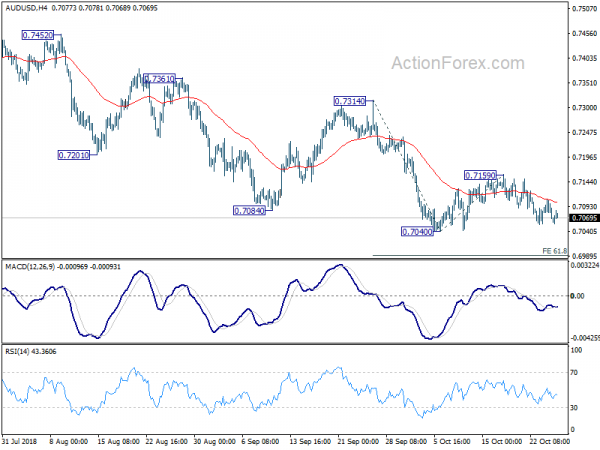

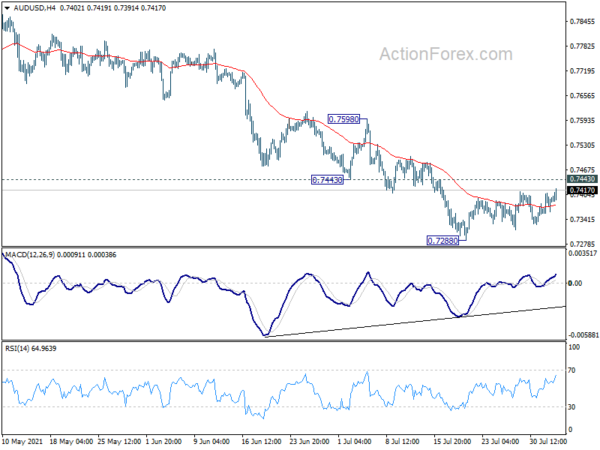

AUD/USD’s rebound from 0.74900 continues today and further rise could be seen. But such rise is seen as a correction at this point. And intraday bias remains neutral. We’d expect upside to be limited by 0.7631 resistance and bring fall resumption. As noted before, rise from 0.7150 has completed at 0.7740 already. Below 0.7490 will turn bias back to the downside and target 0.7144/7158 support zone. However, break of 0.7631 resistance will dampen our bearish view and turn bias back to the upside for 0.7740 instead.

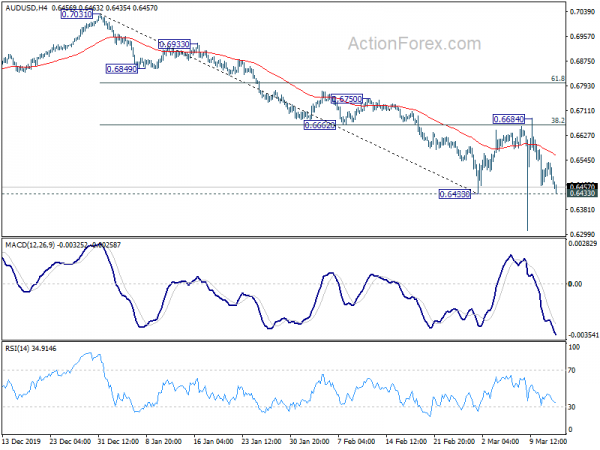

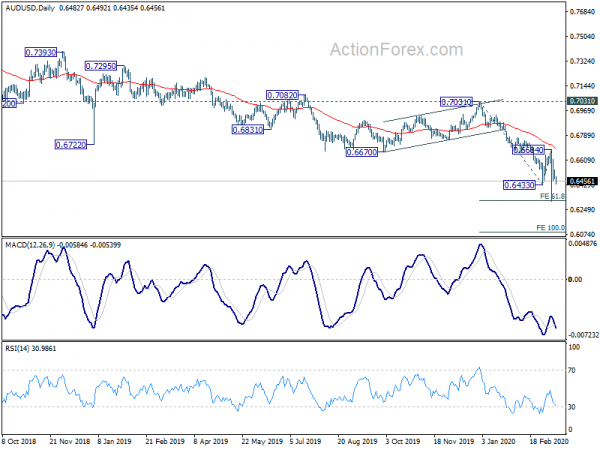

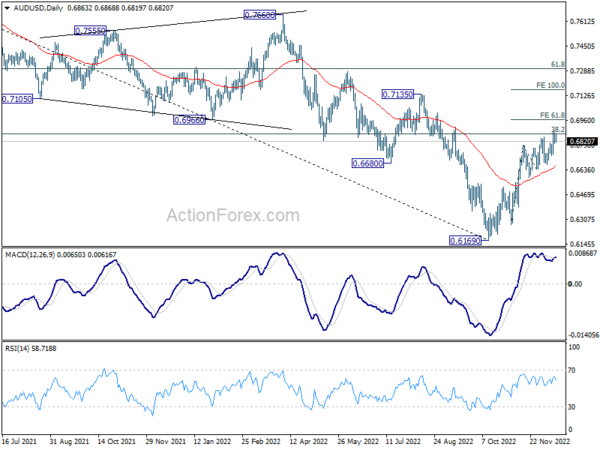

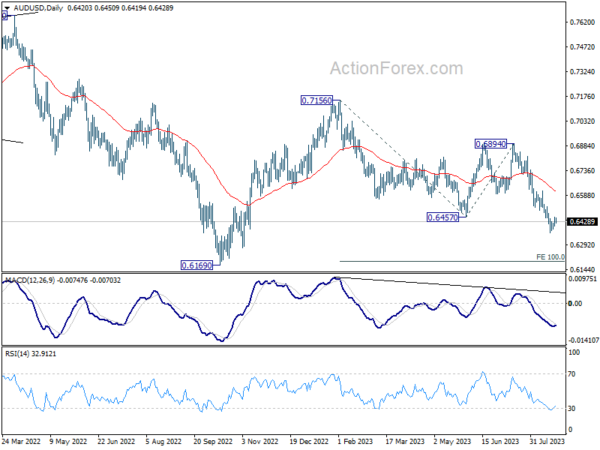

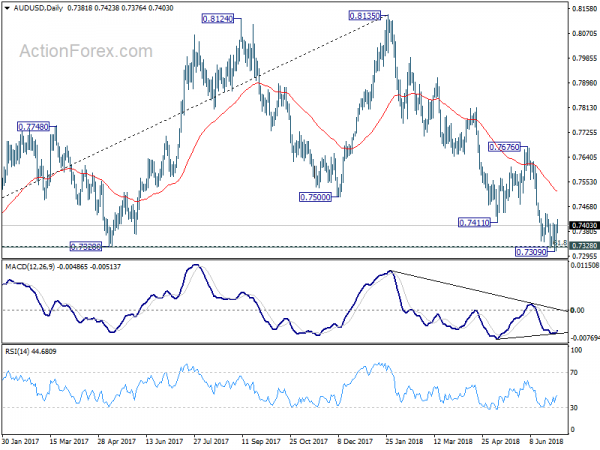

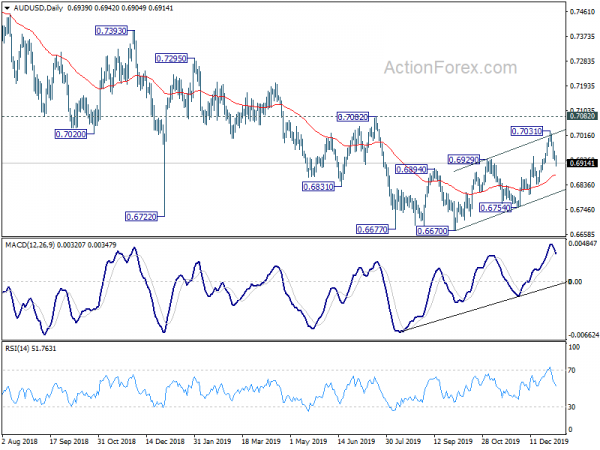

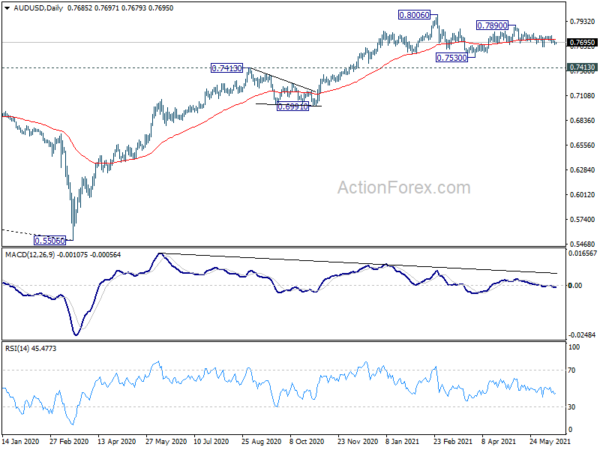

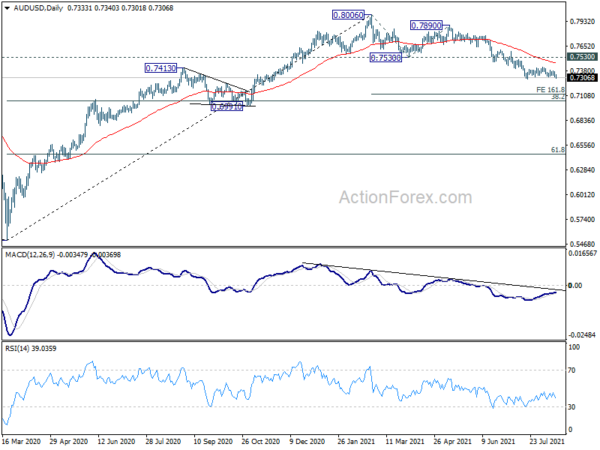

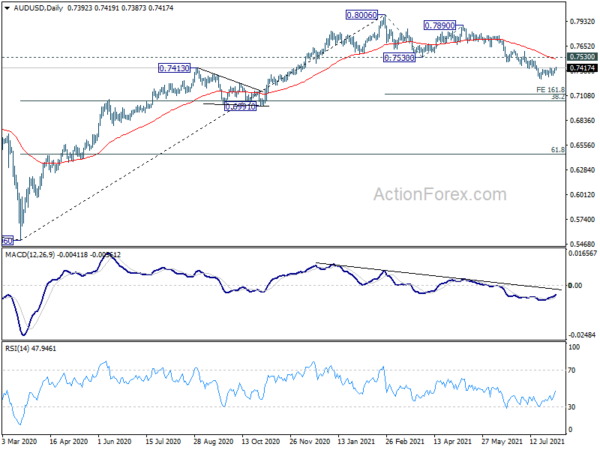

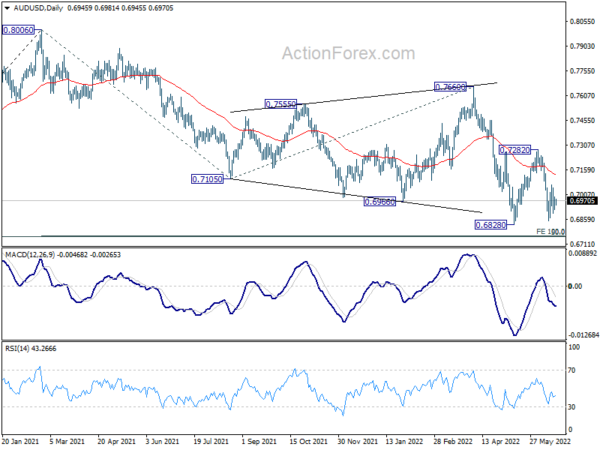

In the bigger picture, we’re still treating price actions from 0.6826 low as a correction. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seek to 55 month EMA (now at 0.8185) and above.