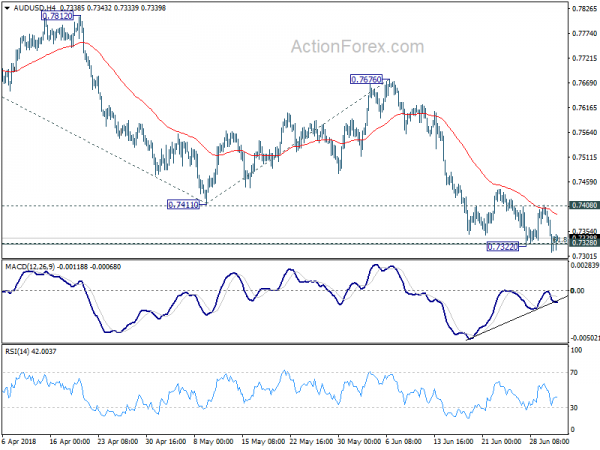

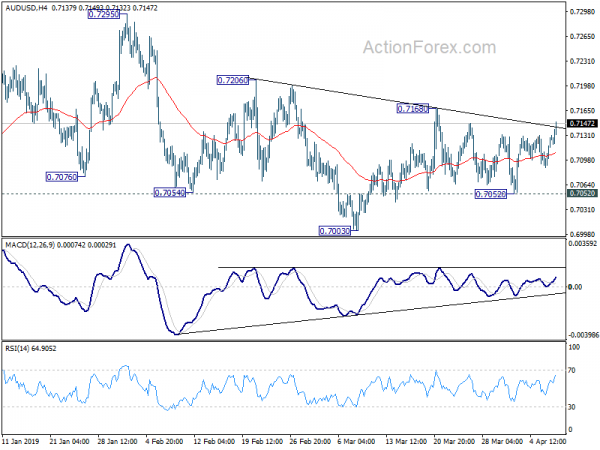

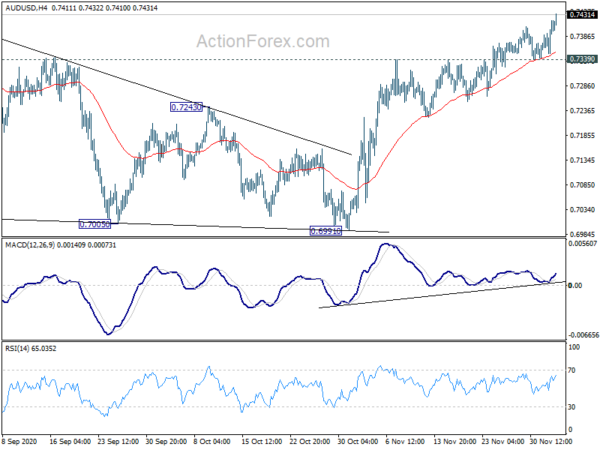

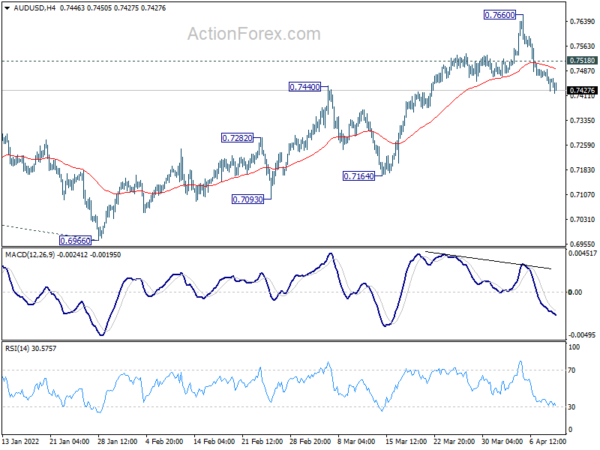

Daily Pivots: (S1) 0.7297; (P) 0.7353; (R1) 0.7397; More…

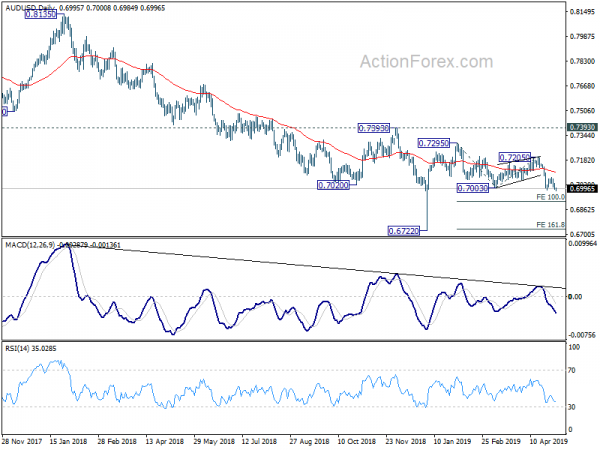

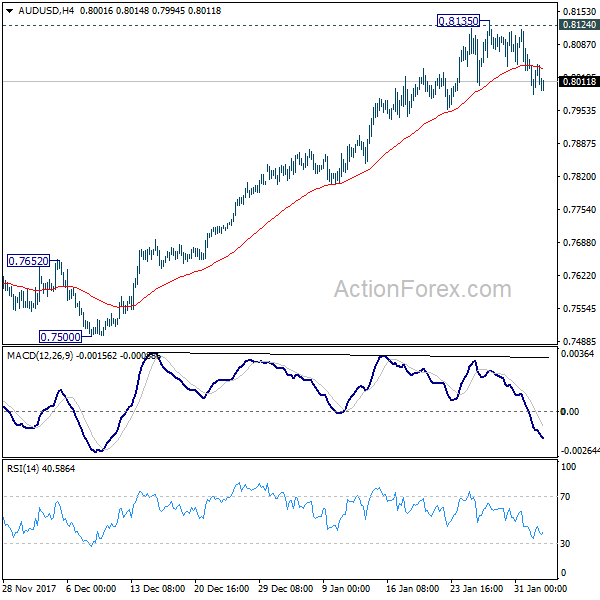

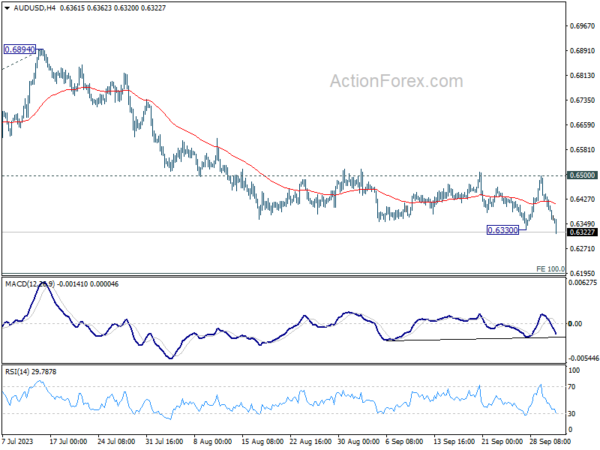

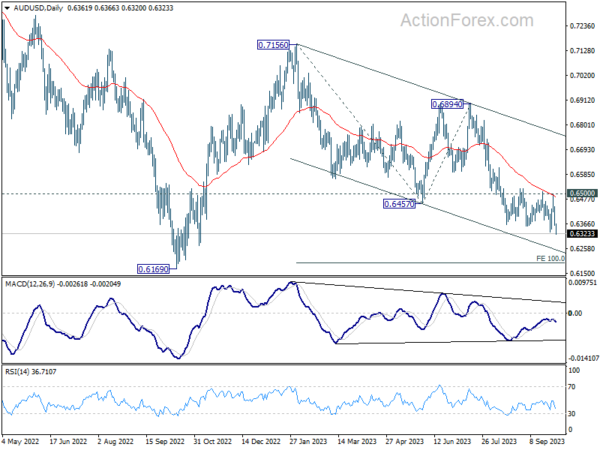

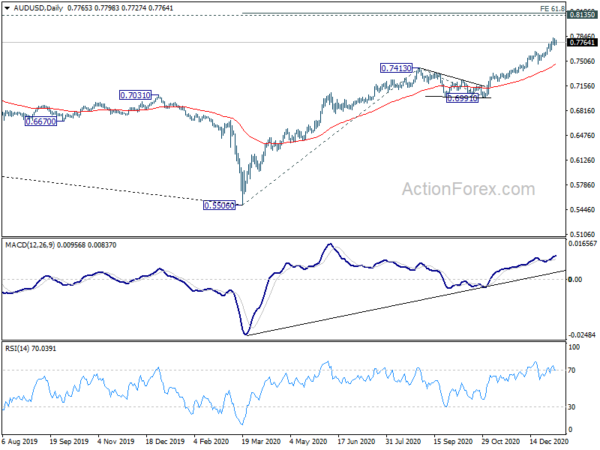

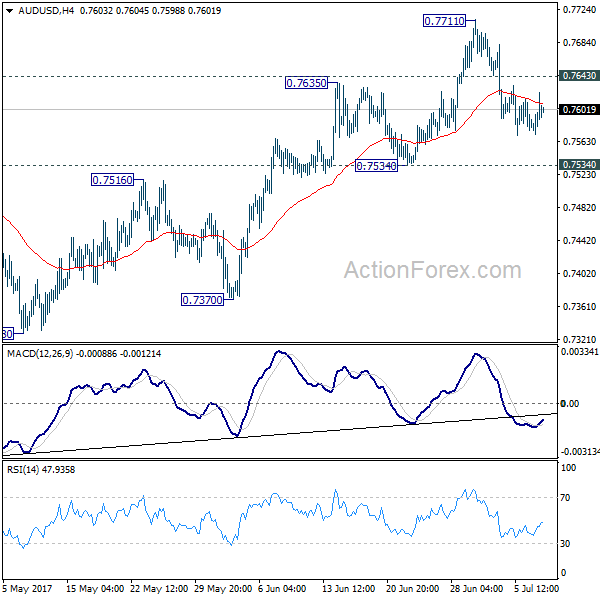

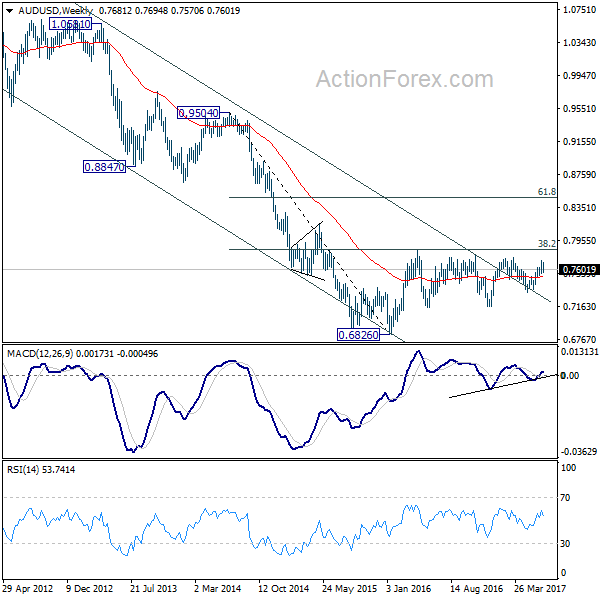

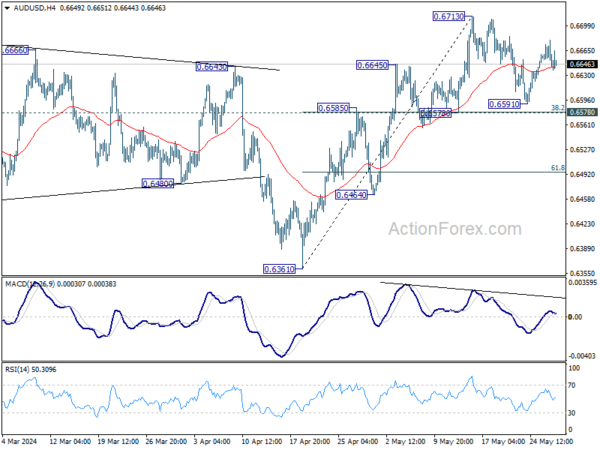

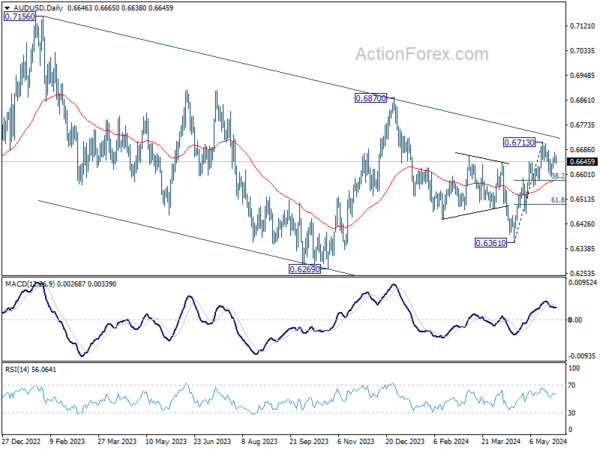

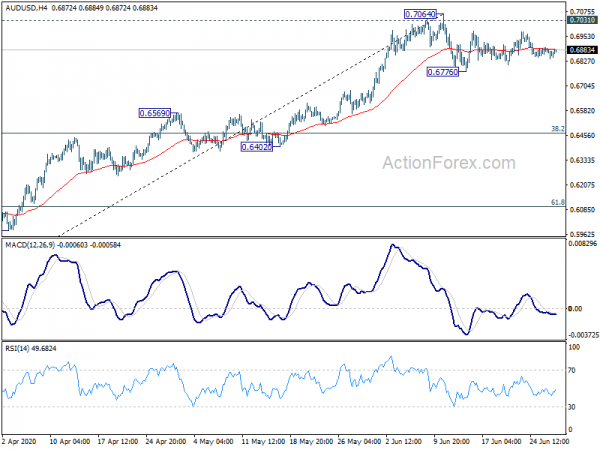

AUD/USD’s fall resumed after brief consolidation and edged lower to 0.7309. Intraday bias is back on the downside. Sustained break of f 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326) will target 61.8% projection of 0.8135 to 0.7411 from 0.7676 at 0.7229 next. On the upside, however, break of 0.7408 resistance will indicate short term bottoming and bring stronger rebound back towards 0.7676 resistance.

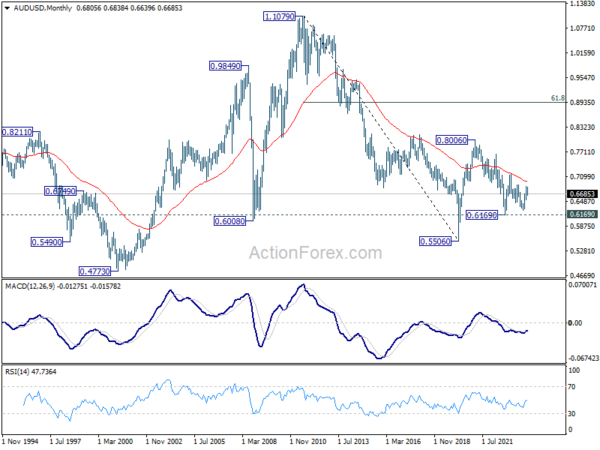

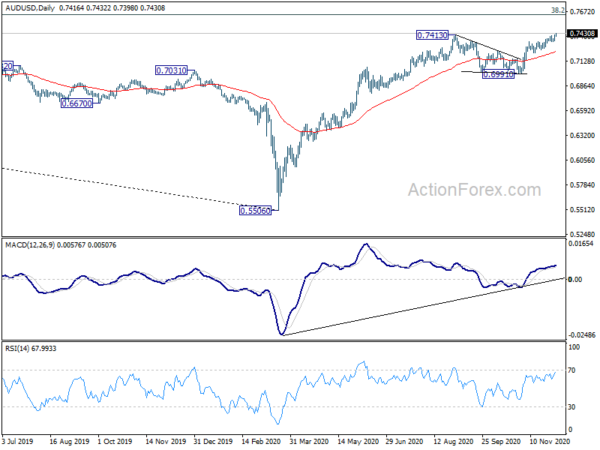

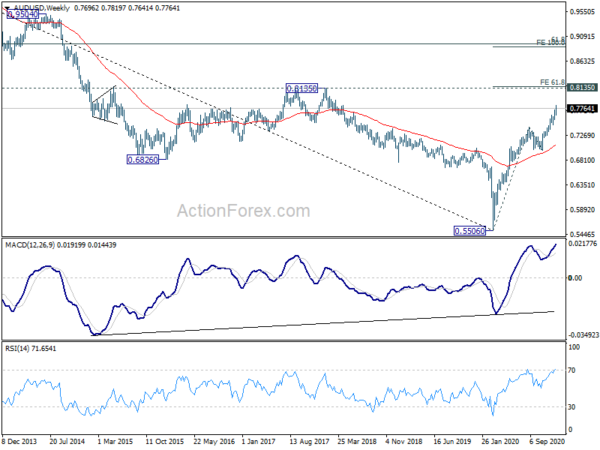

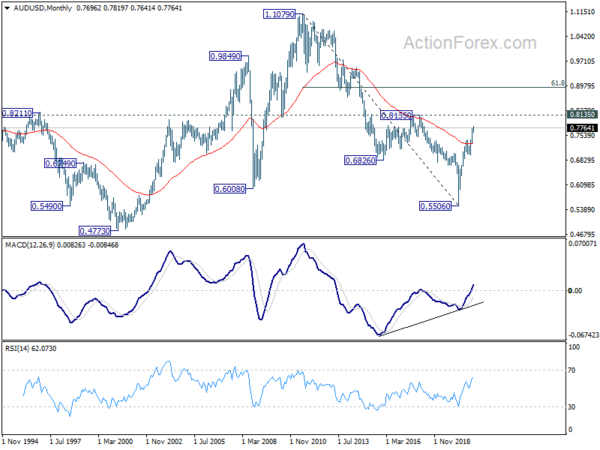

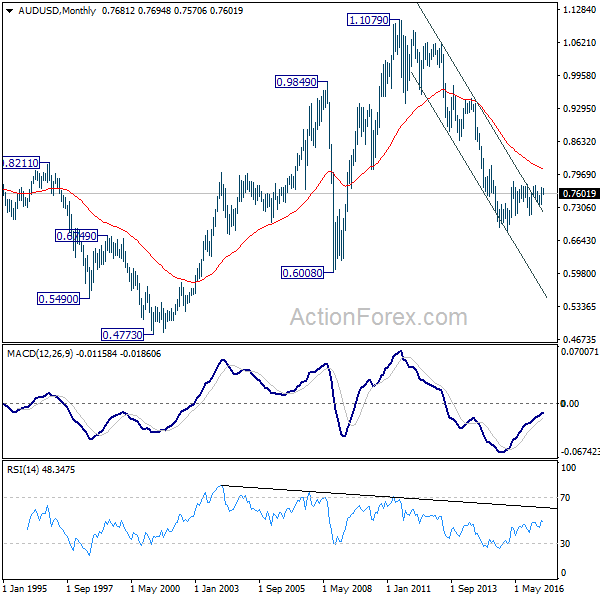

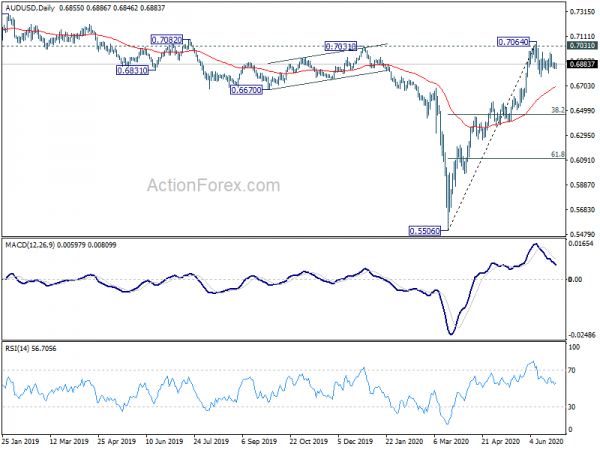

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move that should be completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. This will now remain the favored case as long as 0.7676 resistance holds.