Daily Pivots: (S1) 0.6600; (P) 0.6629; (R1) 0.6672; More…

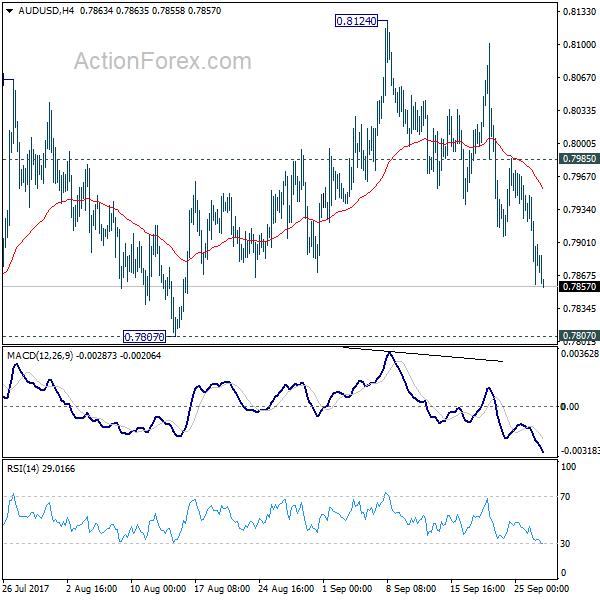

AUD/USD rebounds in early US session with break of 0.6657 resistance. We’re disregarding the spike low earlier today, due to extreme thin Asian market. Corrective rebound from 0.6433 is extending with intraday bias to the upside to 55 day EMA (now at 0.6720) and above. We’d expect strong resistance from 61.8% retracement of 0.7031 to 0.6433 at 0.6803 to limit upside.

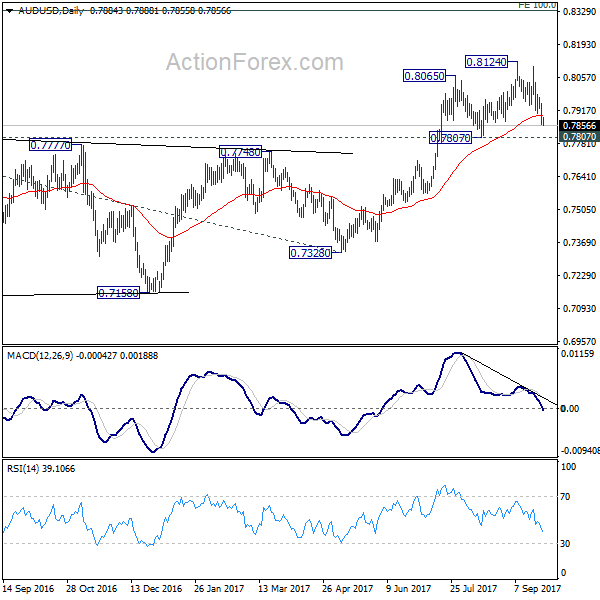

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Rejection by 55 week EMA affirms medium term bearishness. Next target is 0.6008 (2008 low). Outlook will stay bearish as long as 0.7031 resistance holds, even in case of strong rebound.