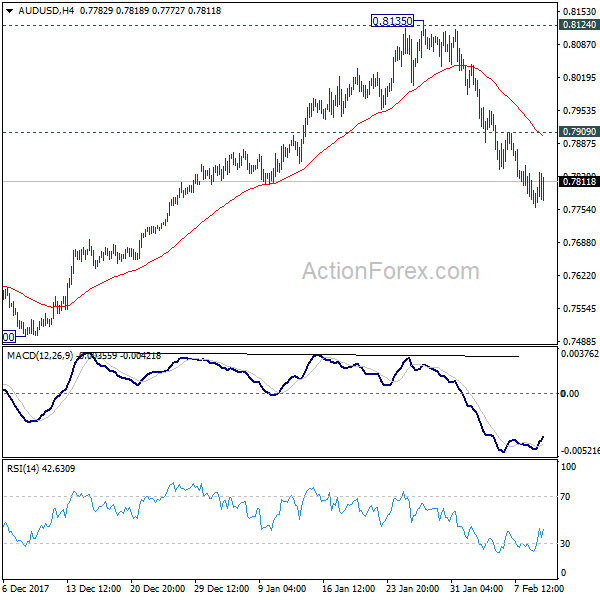

Daily Pivots: (S1) 0.7117; (P) 0.7138; (R1) 0.7158; More…

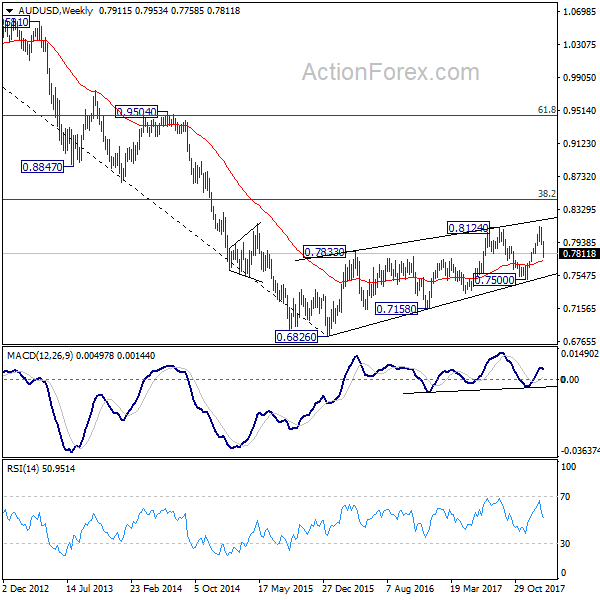

AUD/USD’s rise from 0.6966 is still in progress and intraday bias stays mildly on the upside for 0.7313 resistance. Decisive break there should confirm that 0.6991 key support was defended and turn near term outlook bullish. On the downside, below 0.7032 will bring retest of 0.6966. Sustained break of 0.6991 will resume the larger fall from 0.8006 and carry larger bearish implication.

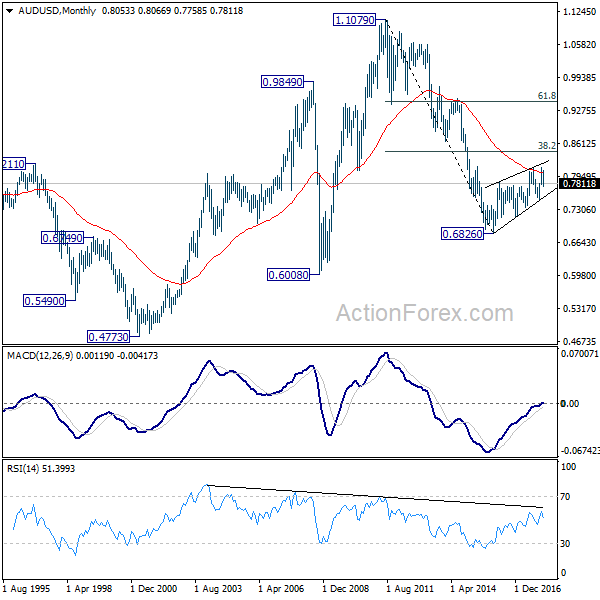

In the bigger picture, focus remains on 0.6991 key structural support. Sustained break there will argue that the whole up trend from 0.5506 might be finished at 0.8006, after rejection by 0.8135 long term resistance. Deeper decline would then be seen back to 61.8% retracement of 0.5506 to 0.8006 at 0.6461. Meanwhile, strong rebound from 0.6991 will retain medium term bullishness. That is, whole up trend from 0.5506 is still in progress.