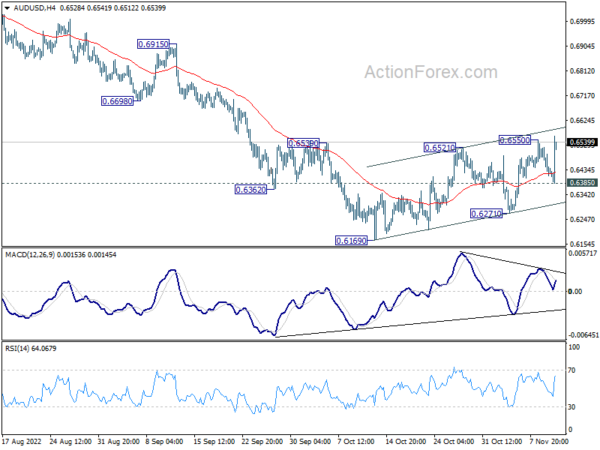

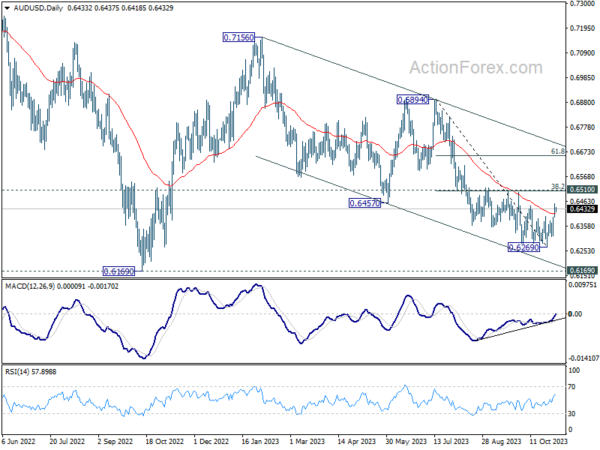

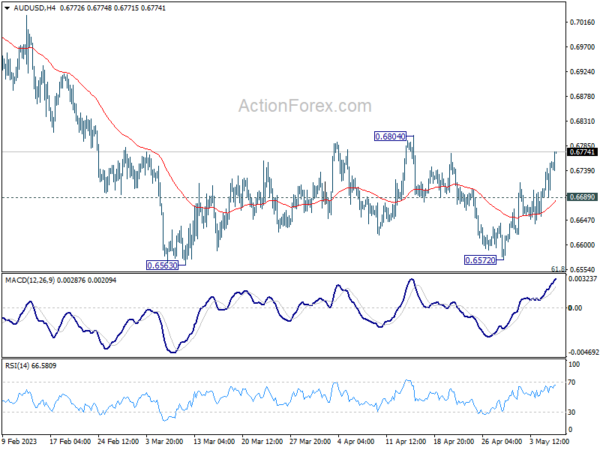

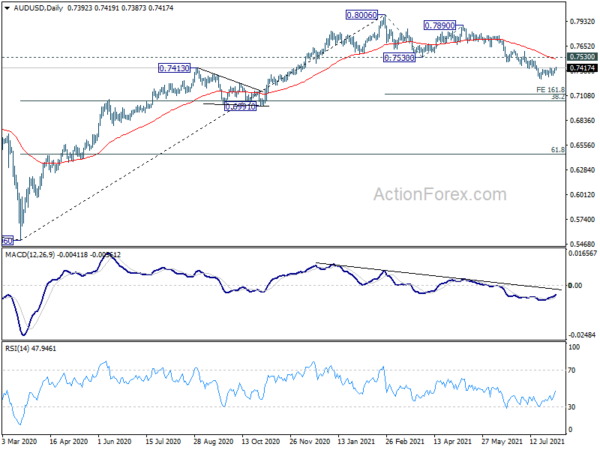

Daily Pivots: (S1) 0.6390; (P) 0.6456; (R1) 0.6497; More…

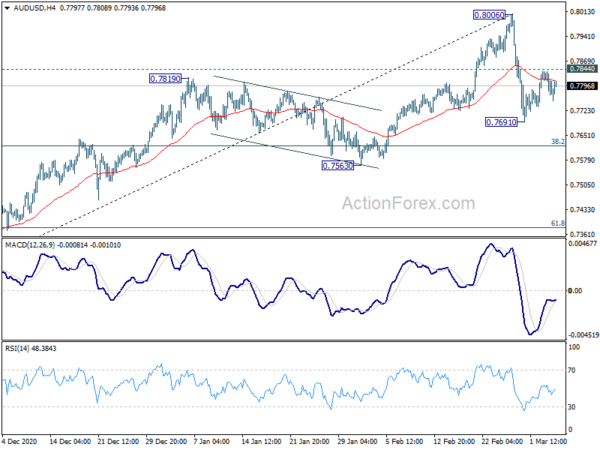

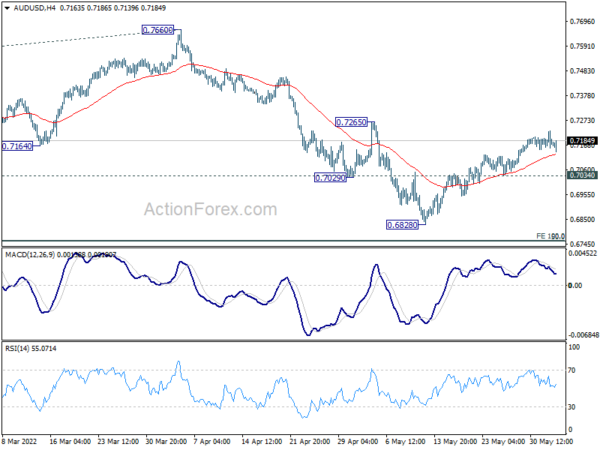

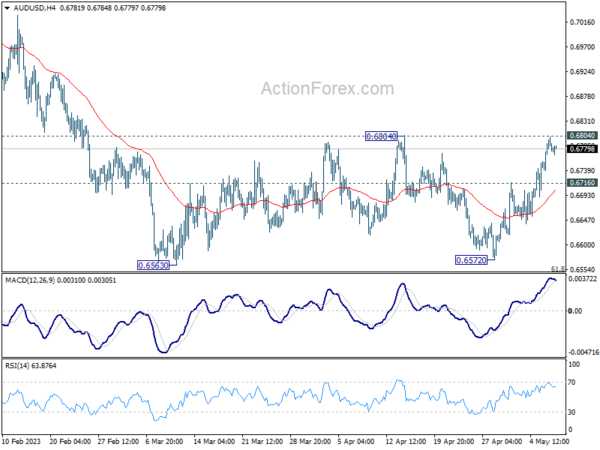

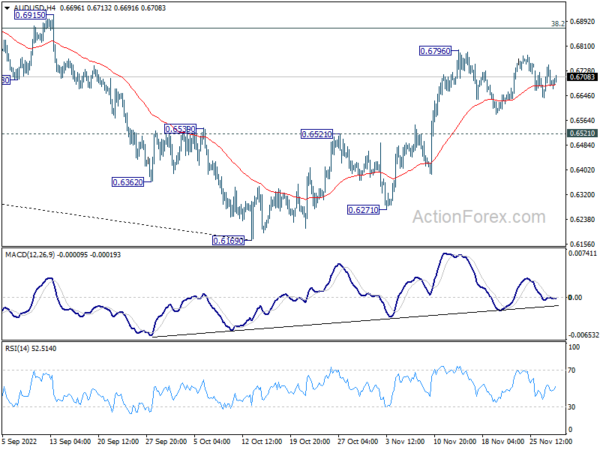

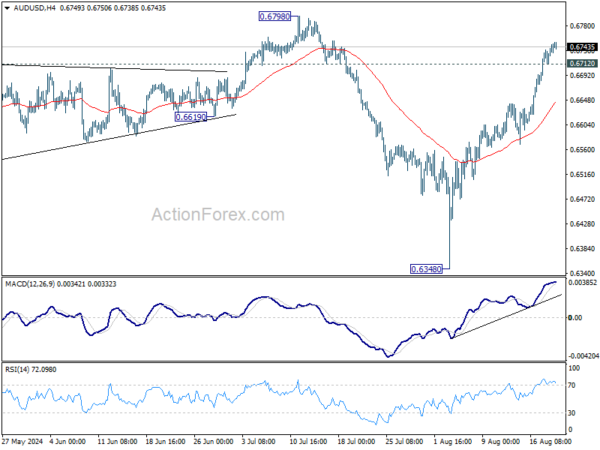

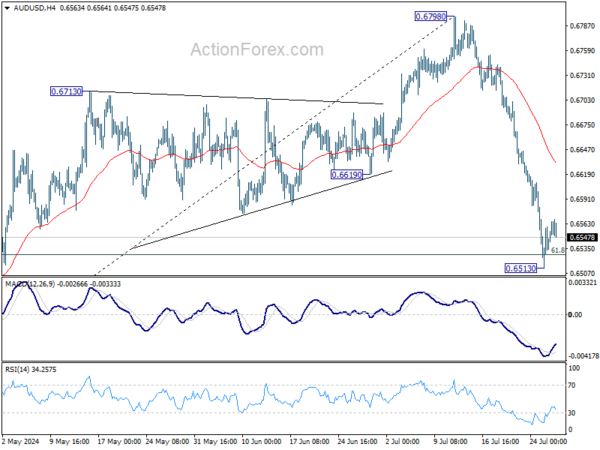

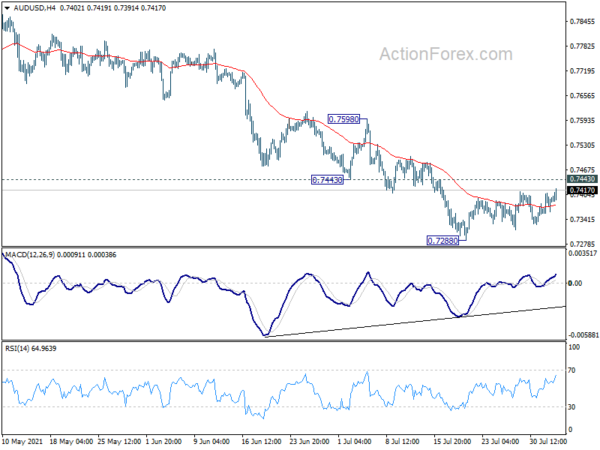

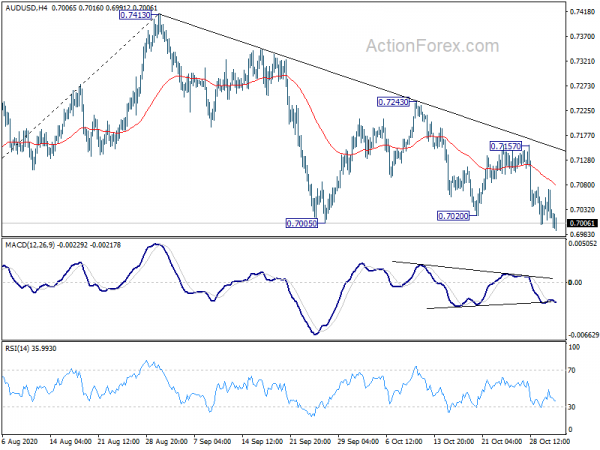

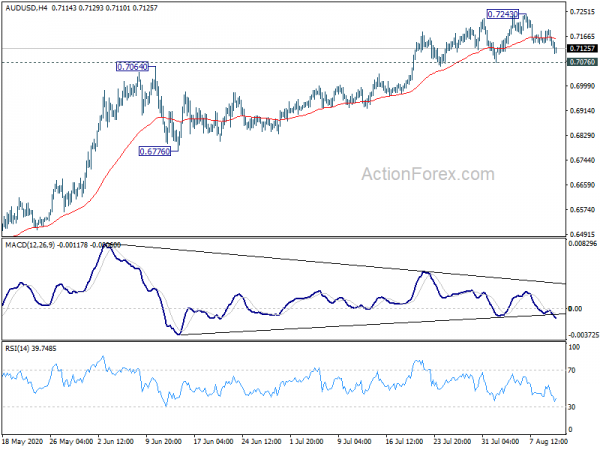

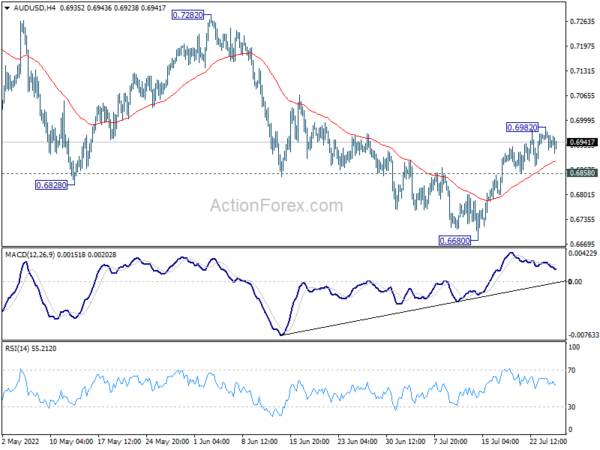

Break of 0.6550 resistance indicate resumption of rise from 0.6169. Intraday bias is back on the upside. Sustained trading above 55 day EMA will be a bullish sign and target 0.6680 support turned resistance. On the downside, break of 0.6385 minor support will turn intraday bias neutral first.

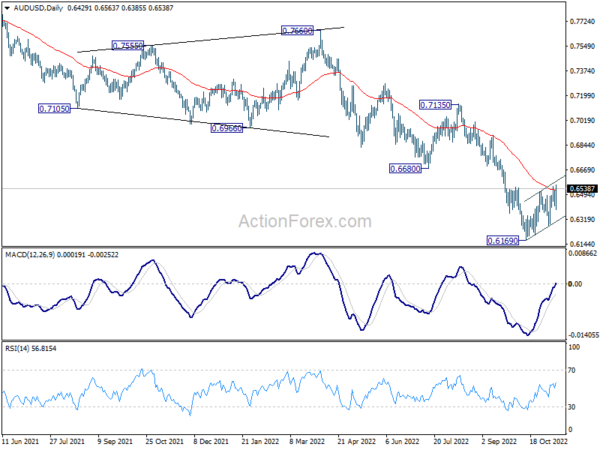

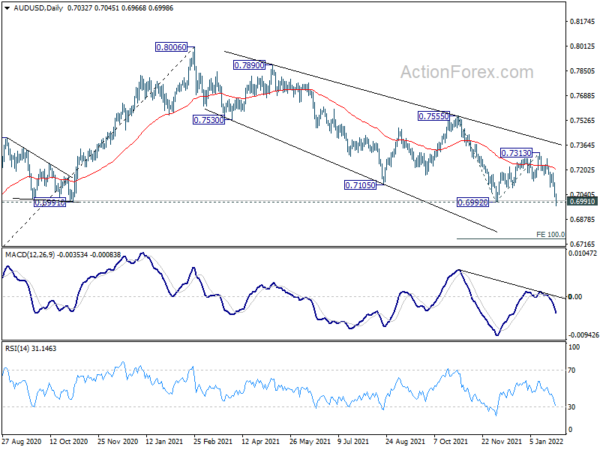

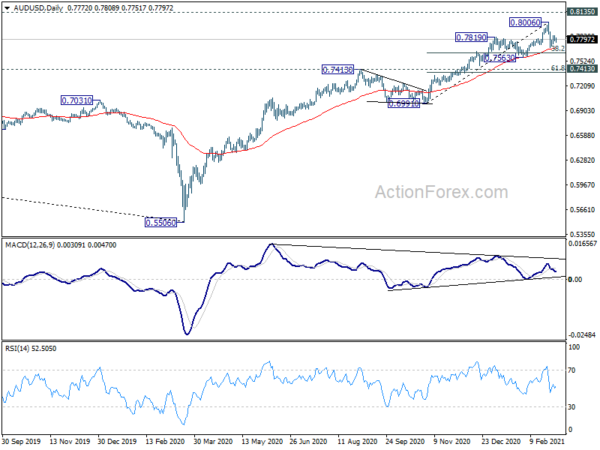

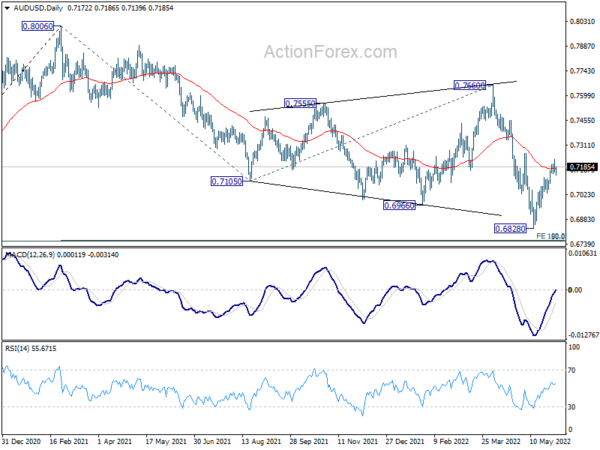

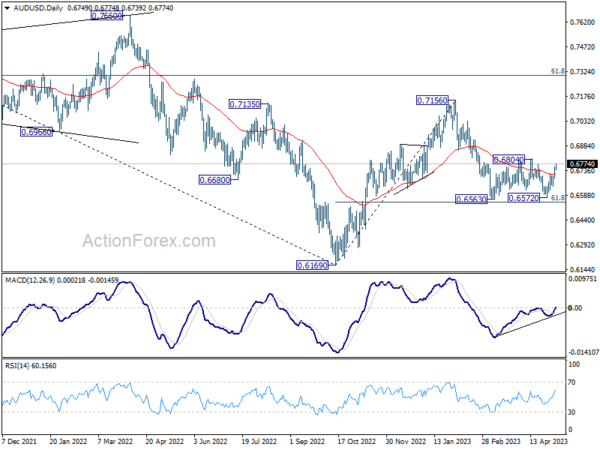

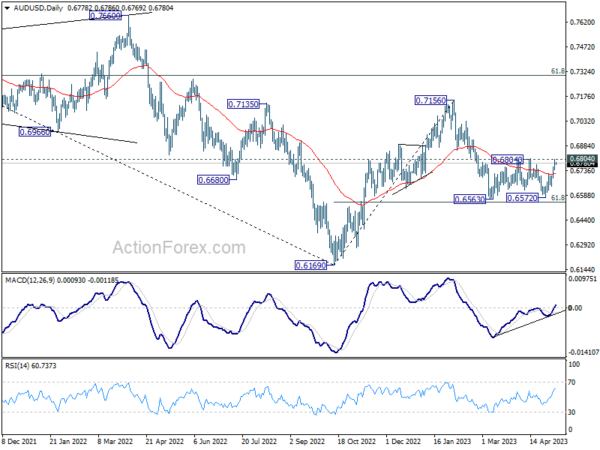

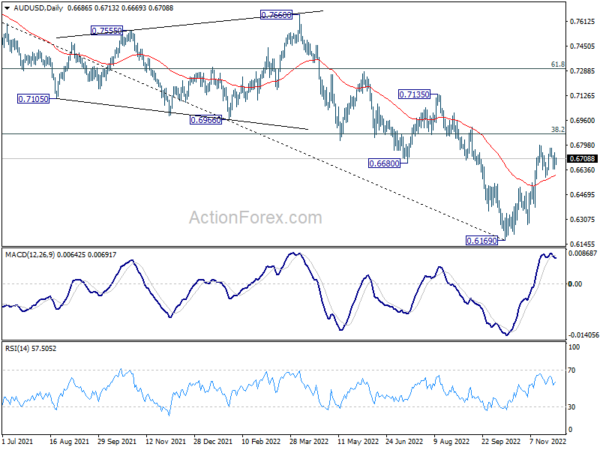

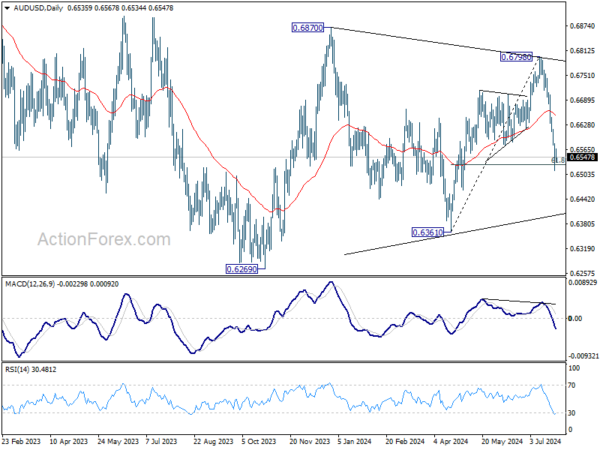

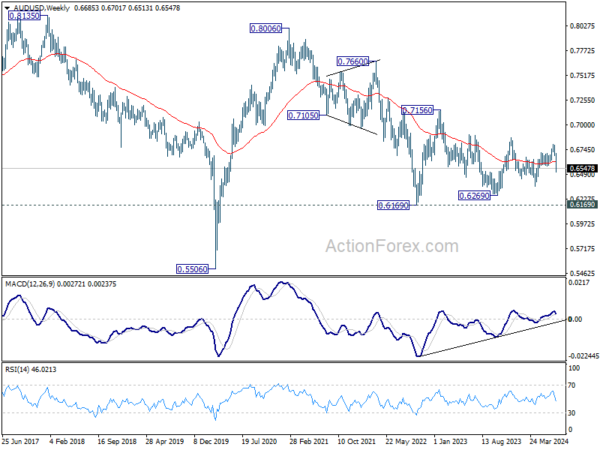

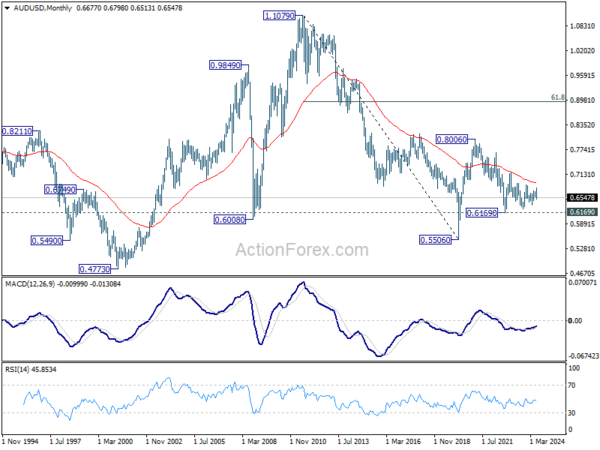

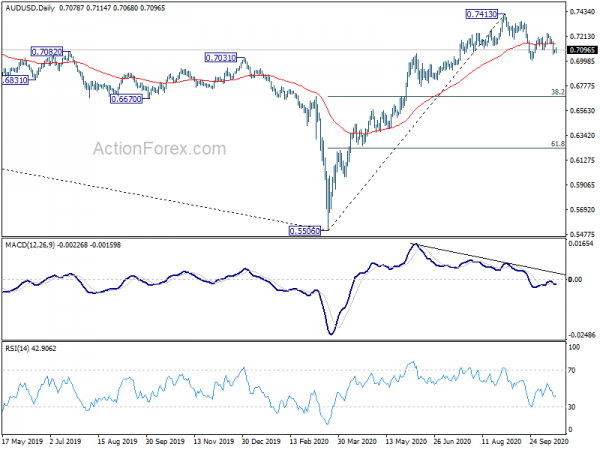

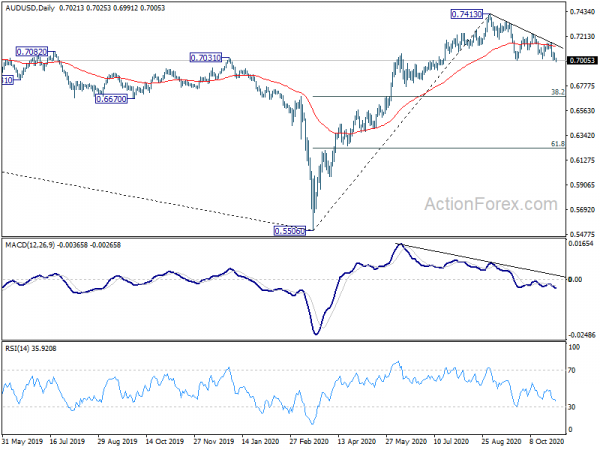

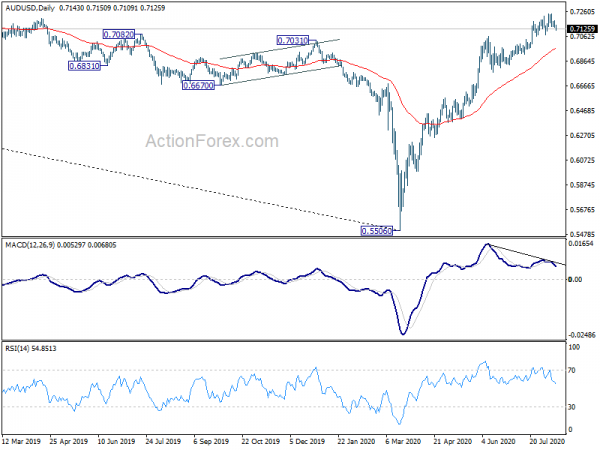

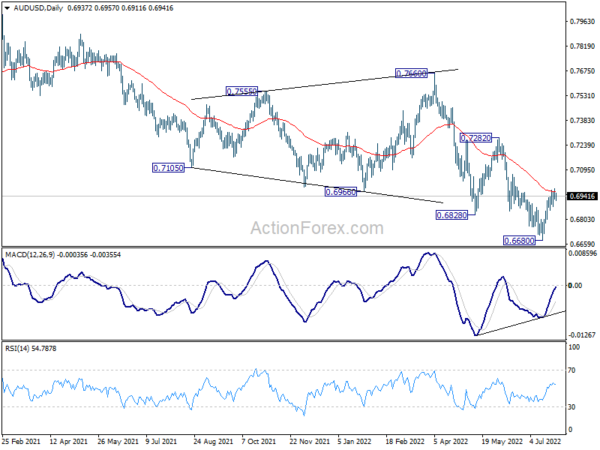

In the bigger picture, down trend from 0.8006 (2021 high) is expected to continue as long as 0.6680 support turned resistance holds. Medium term momentum remains strong and retest of 0.5506 (2020 low) cannot be ruled out. But firm break of 0.6680 will be the first sign of reversal, and bring stronger rebound back to 0.7135 resistance.