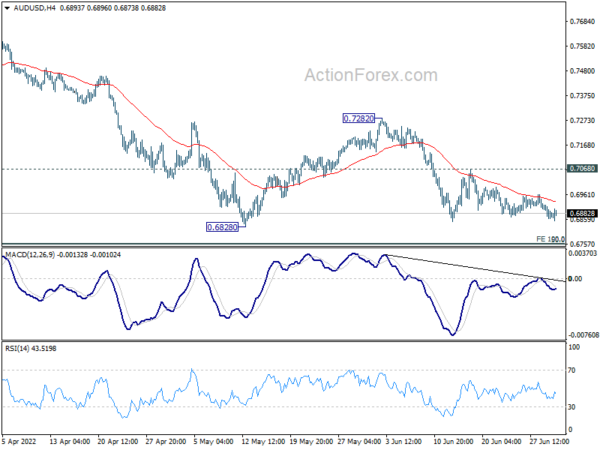

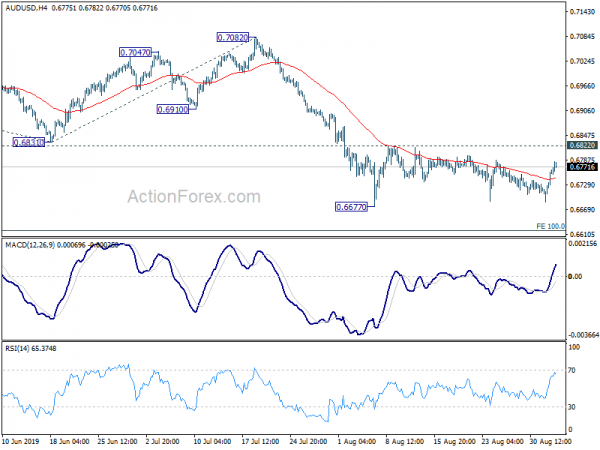

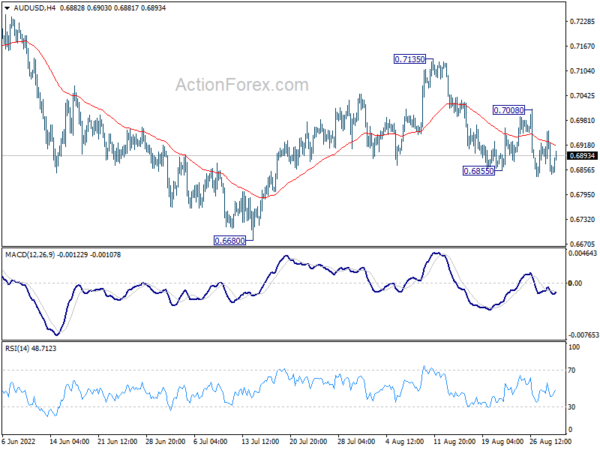

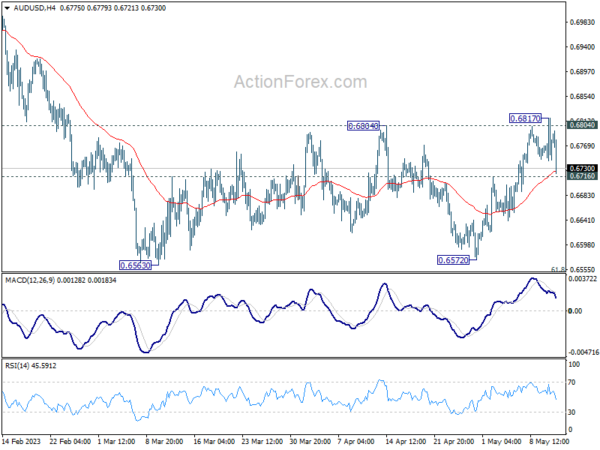

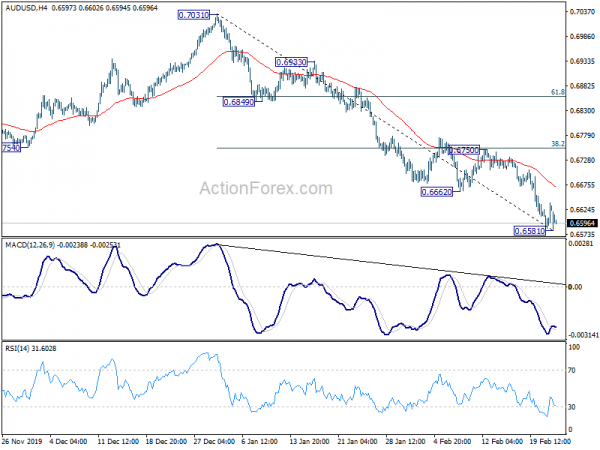

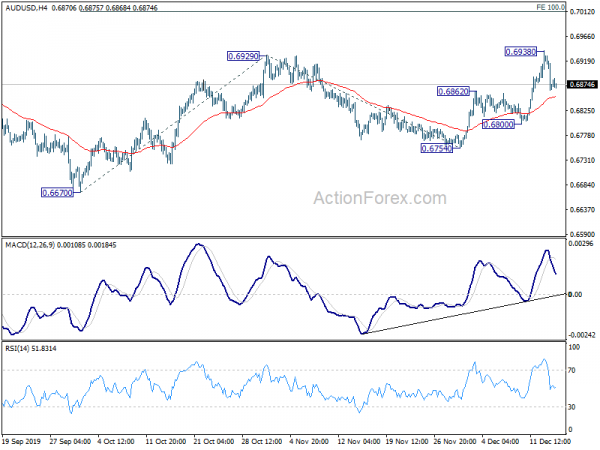

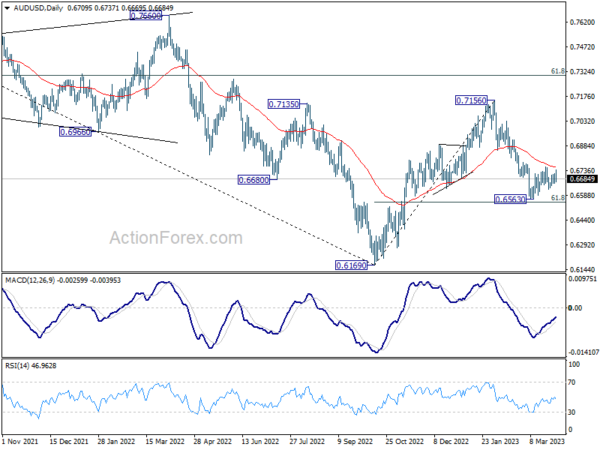

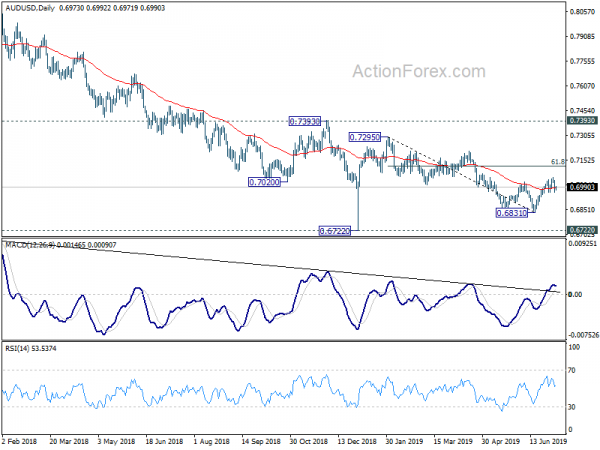

Daily Pivots: (S1) 0.6854; (P) 0.6887; (R1) 0.6912; More…

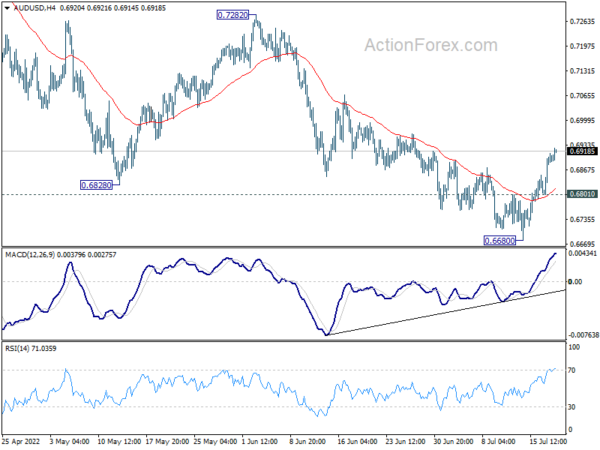

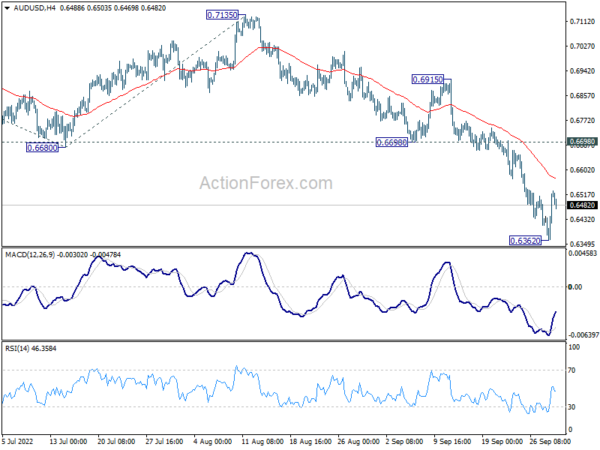

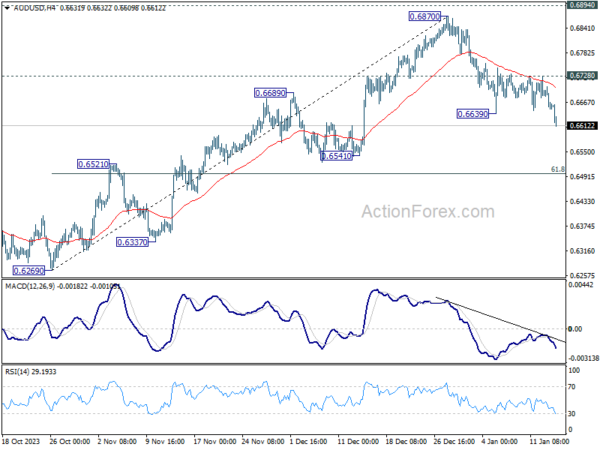

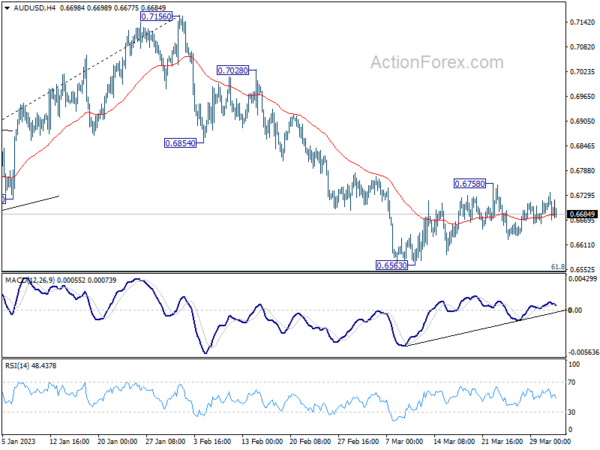

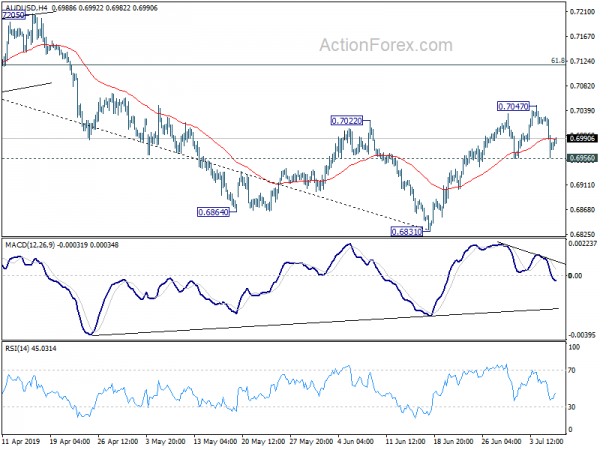

Intraday bias in AUD/USD remains neutral for the moment. On the downside, firm break of 0.6828 support will resume larger fall from 0.8006. Next target is 0.6756/60 cluster support. On the upside, above 0.7068 minor resistance will bring stronger rebound to 0.7282 resistance first. Firm break there will be a sign of bullish reversal and bring stronger rebound to 0.7666 resistance.

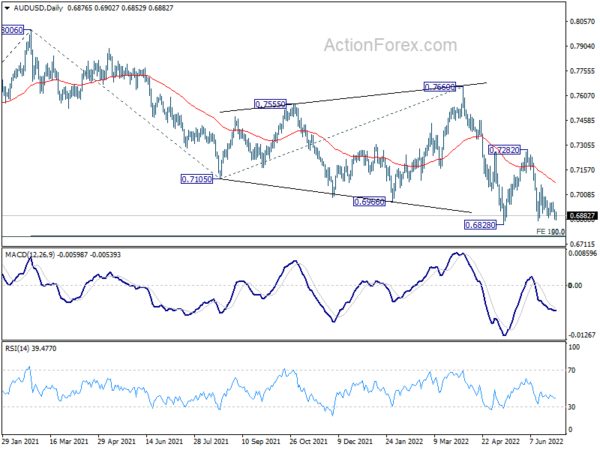

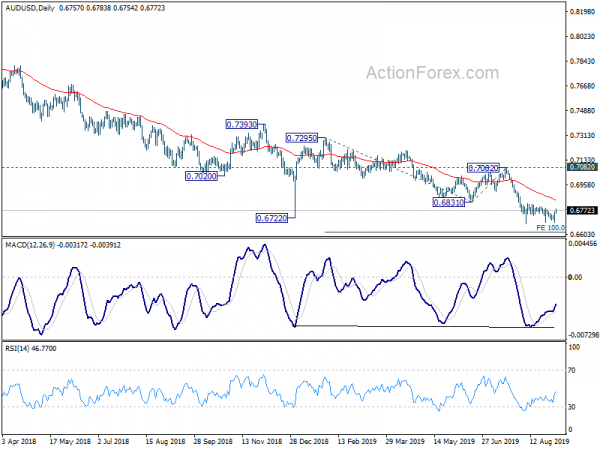

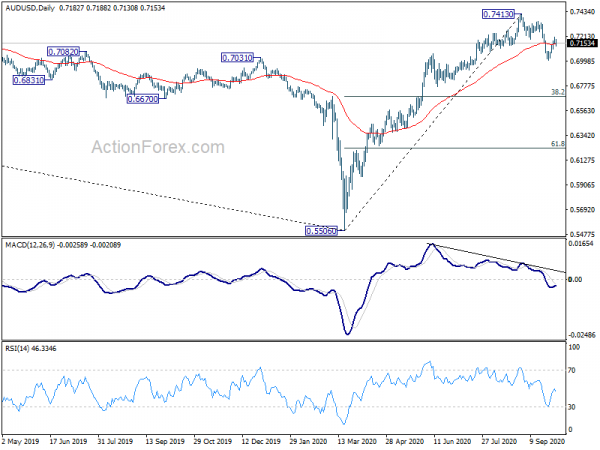

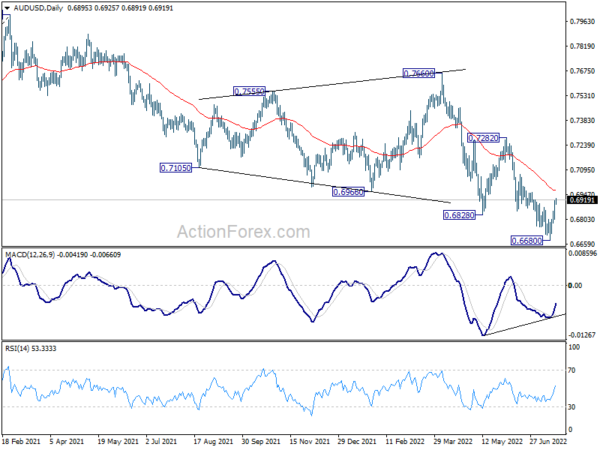

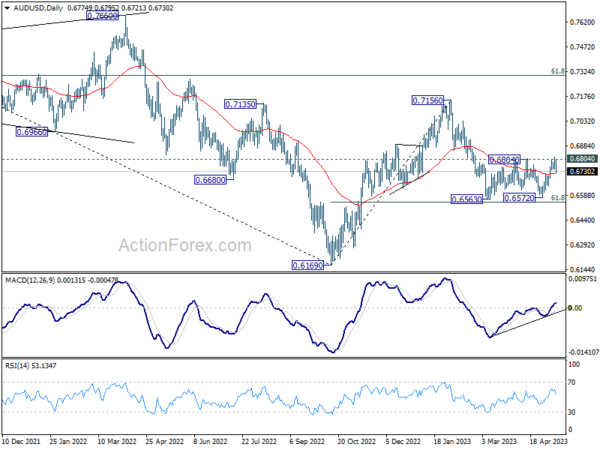

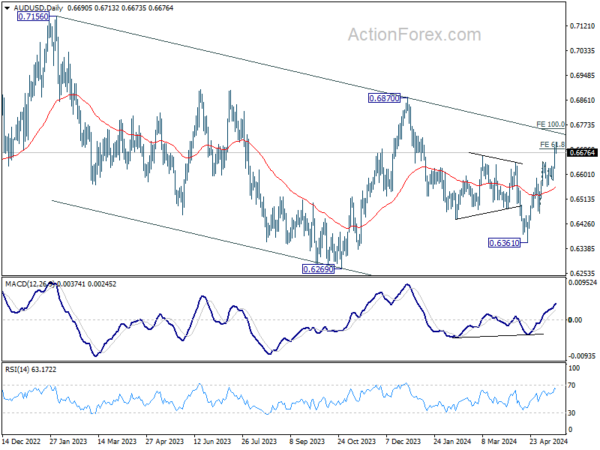

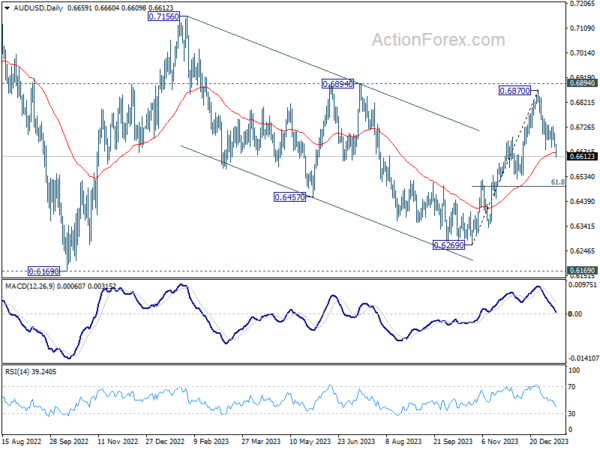

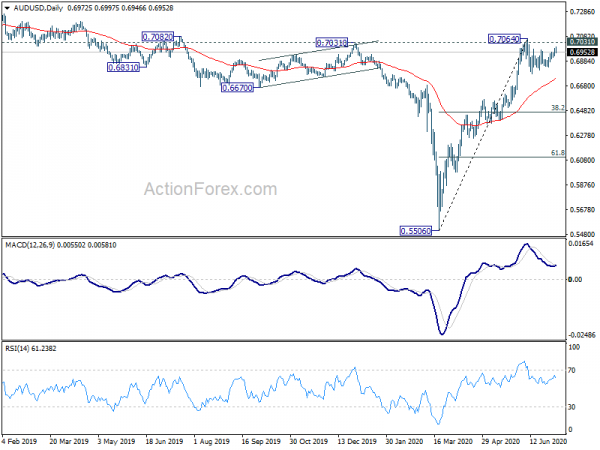

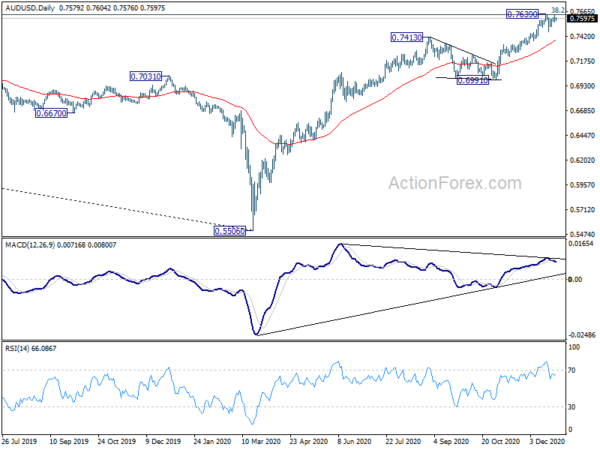

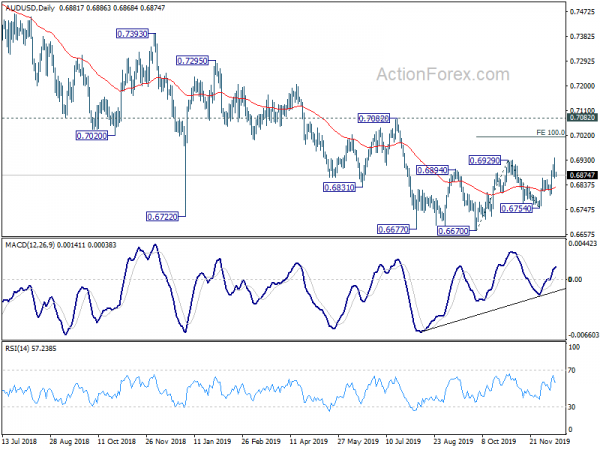

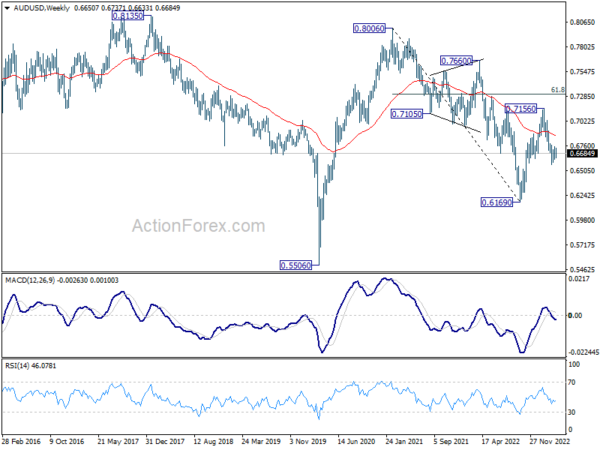

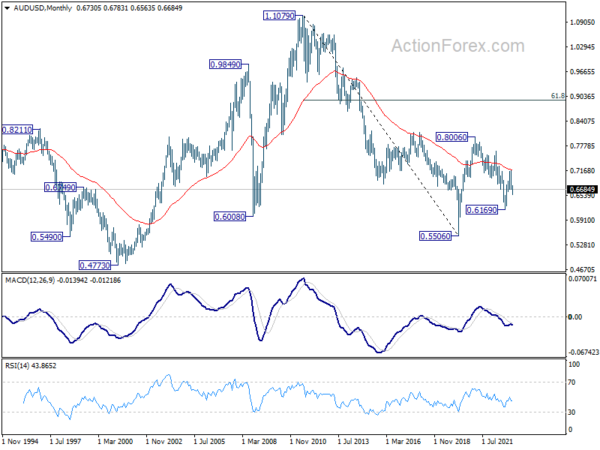

In the bigger picture, price actions from 0.8006 are seen as a corrective pattern to rise from 0.5506 (2020 low). Deeper fall could still be seen to 50% retracement of 0.5506 to 0.8006 at 0.6756. This coincides with 100% projection of 0.8006 to 0.7105 from 0.7660 at 0.6760. Strong support is expected from 0.6756/60 cluster to contain downside to complete the correction. Meanwhile, firm break of 0.7660 resistance will confirm that such corrective pattern has completed, and larger up trend is ready to resume.