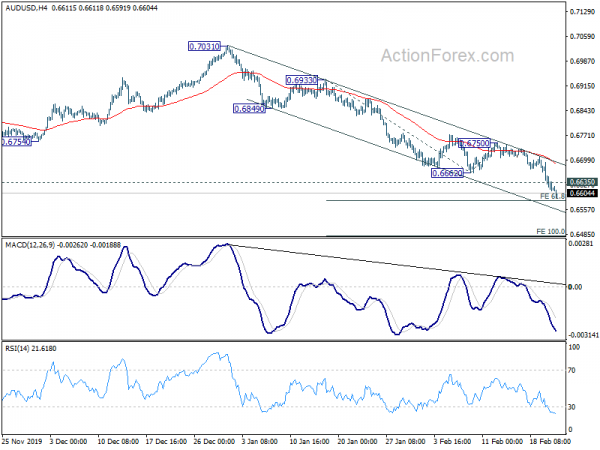

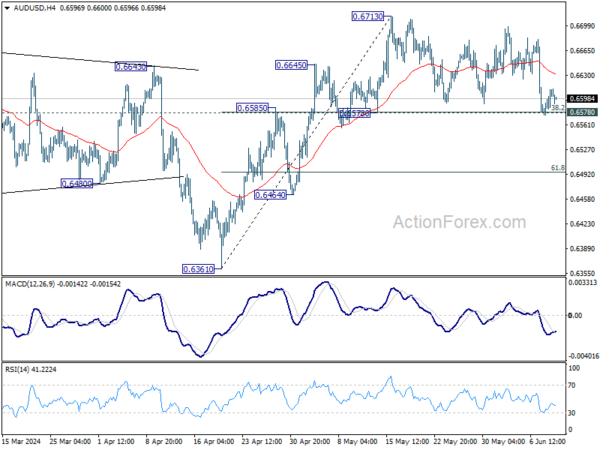

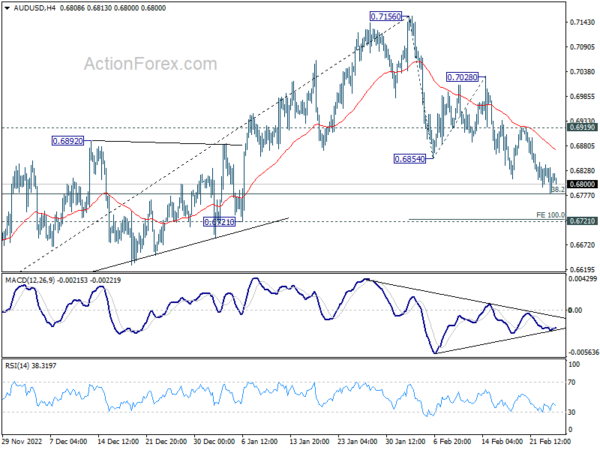

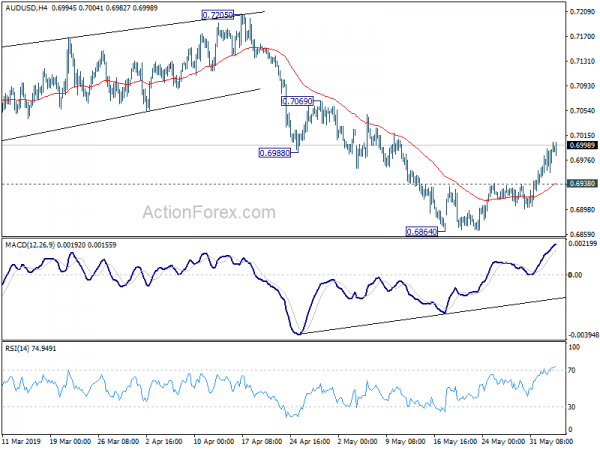

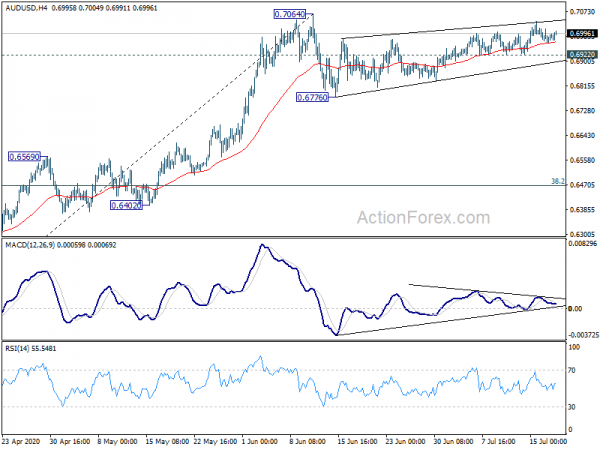

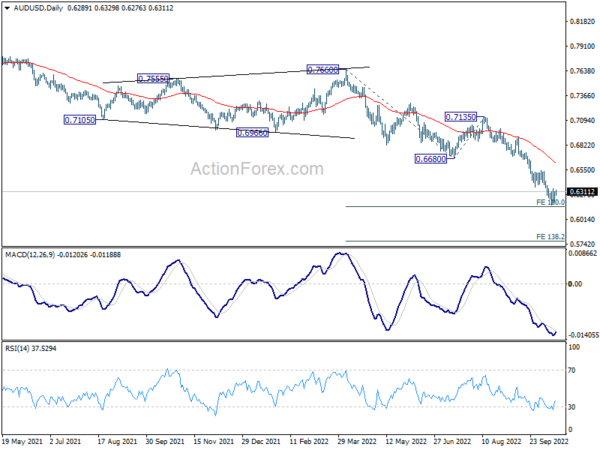

Daily Pivots: (S1) 0.6584; (P) 0.6639; (R1) 0.6669; More….

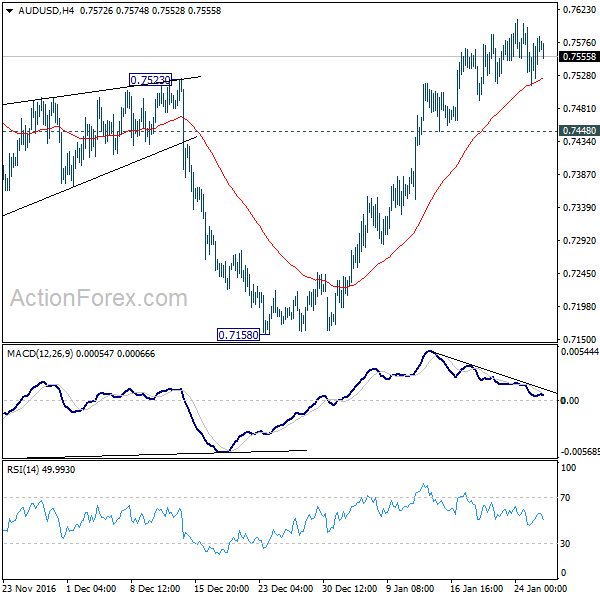

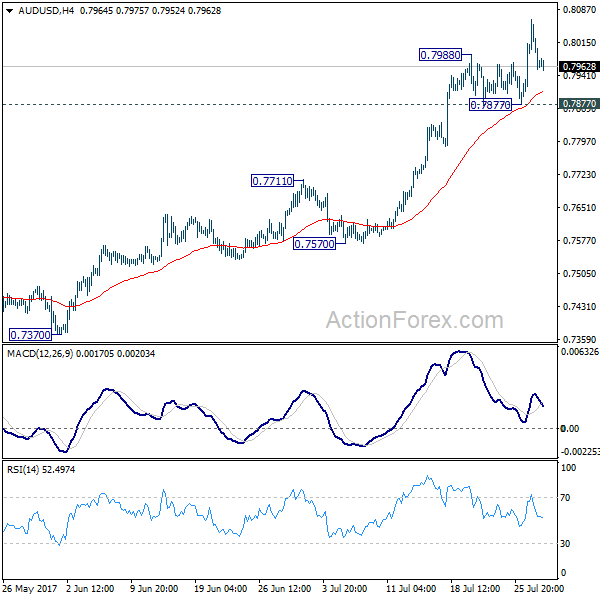

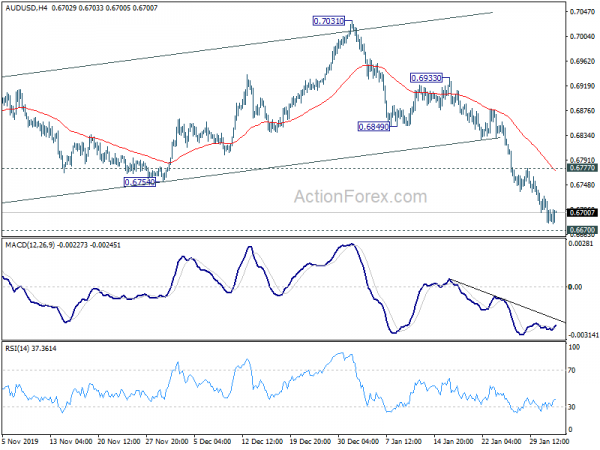

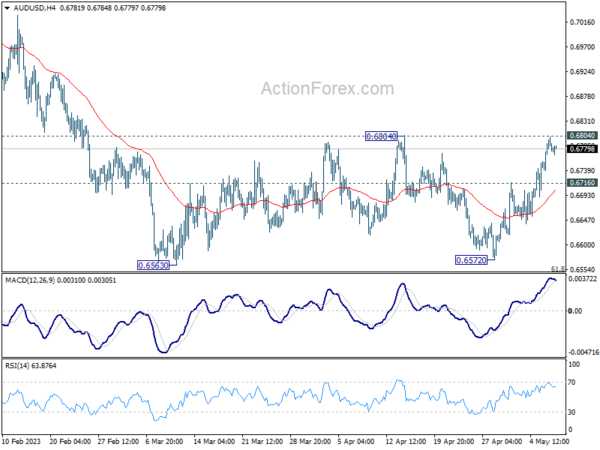

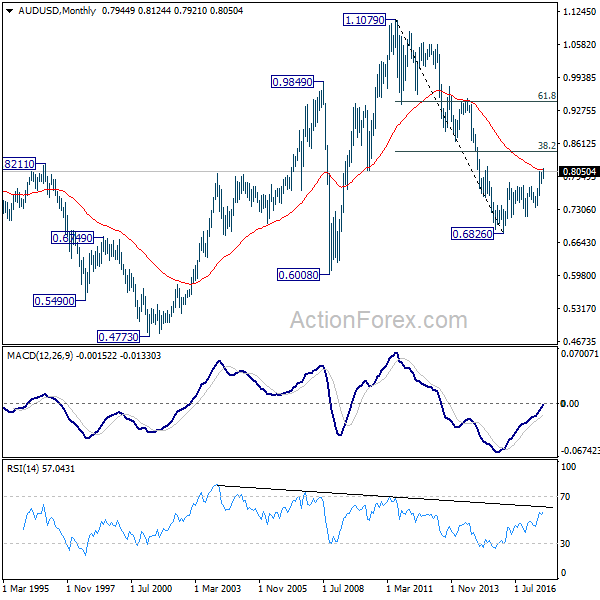

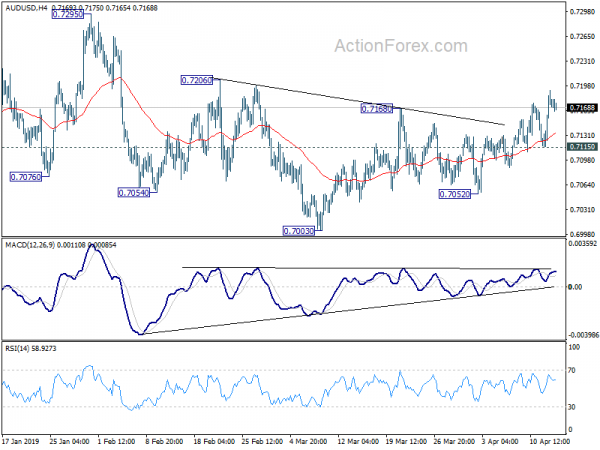

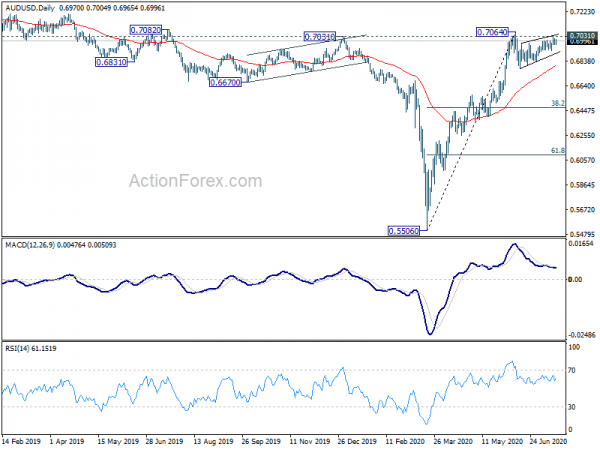

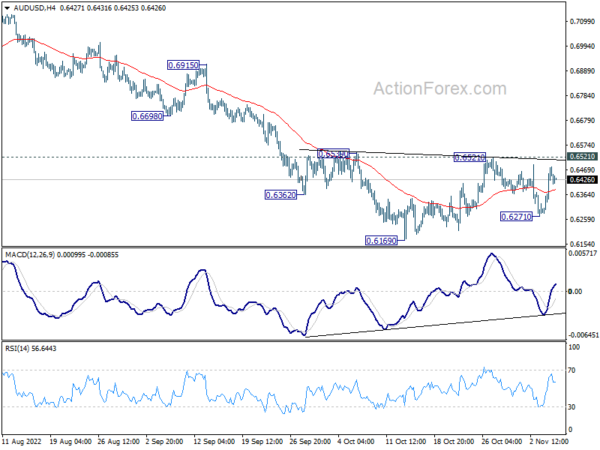

AUD/USD’s decline continues today and reaches as low as 0.6591 so far. Intraday bias remains on the downside for deeper decline. Break of 61.8% projection of 0.6933 to 0.6662 from 0.6750 at 0.6583 will pave the way to 100% projection at 0.6479. On the upside, above 0.6635 minor resistance will turn intraday bias neutral first. But recovery should be limited below 0.6750 resistance to bring fall resumption.

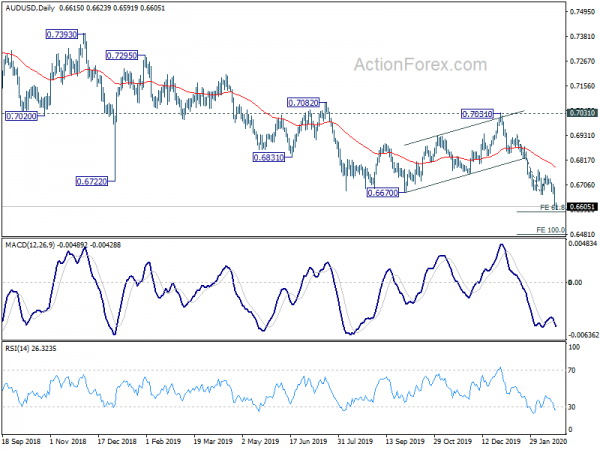

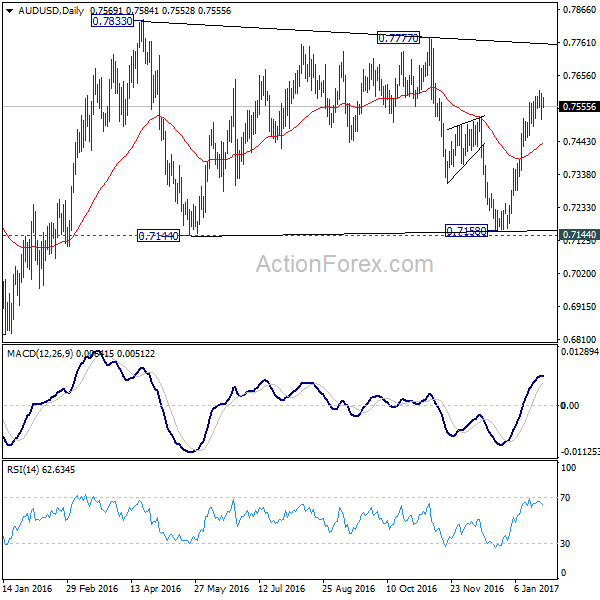

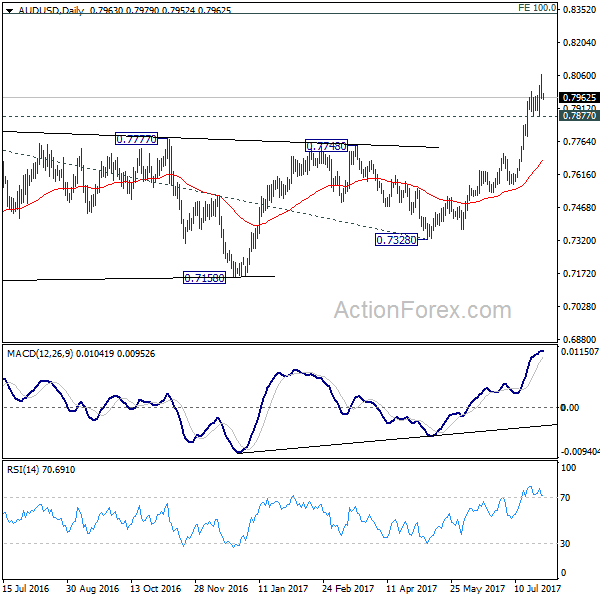

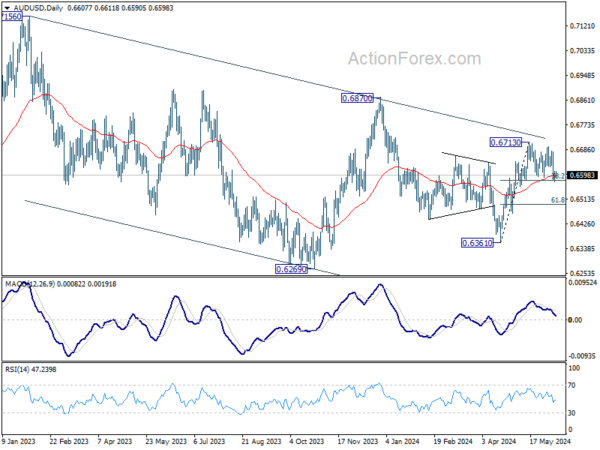

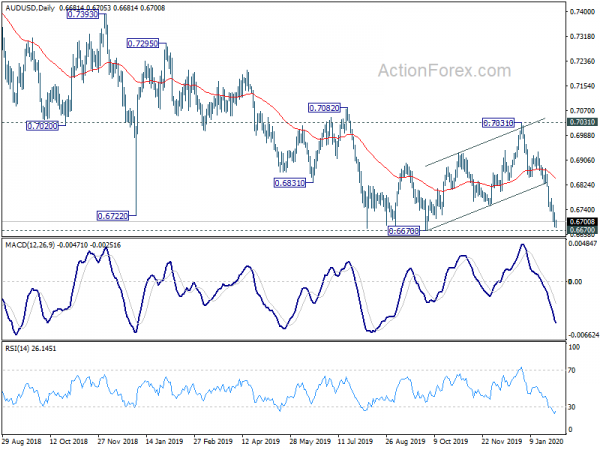

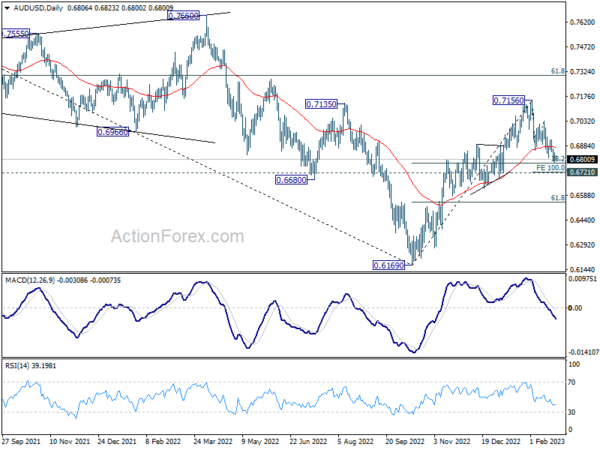

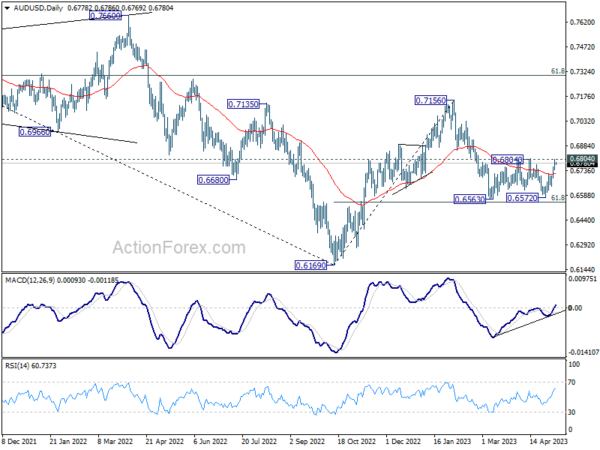

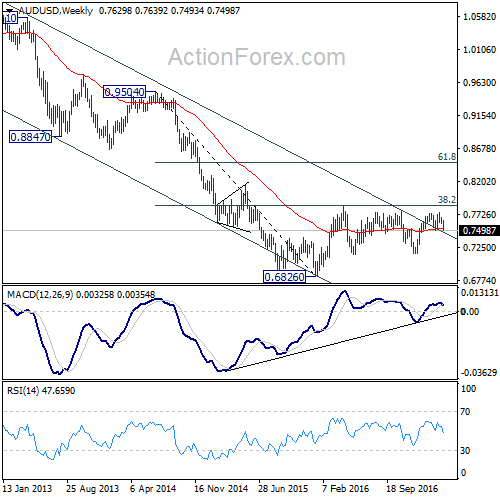

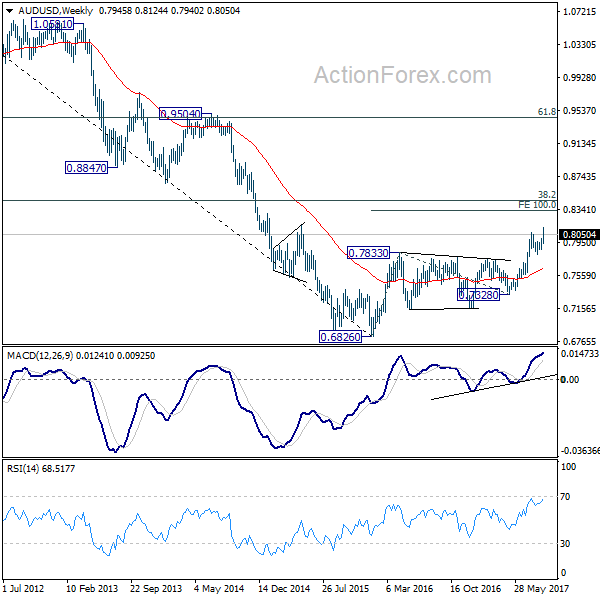

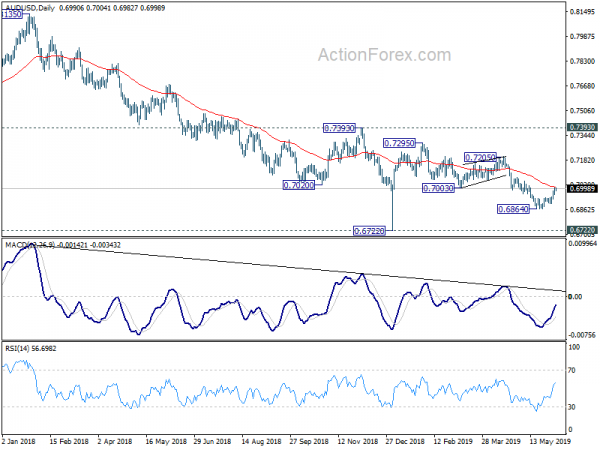

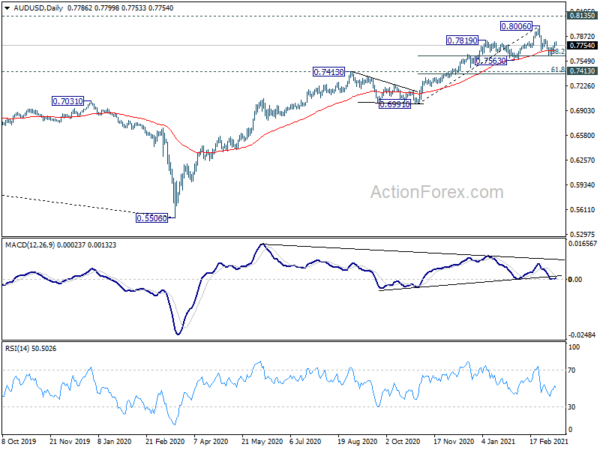

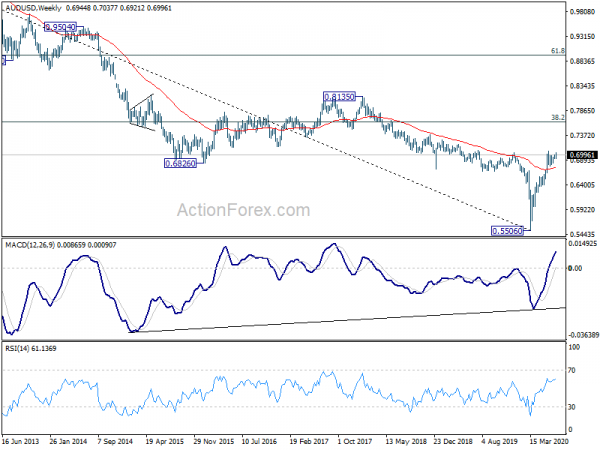

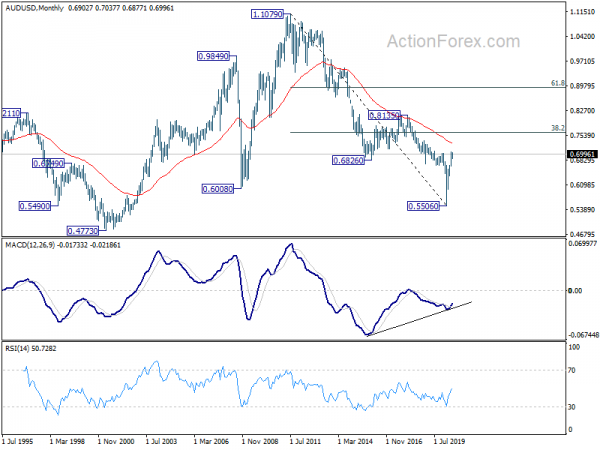

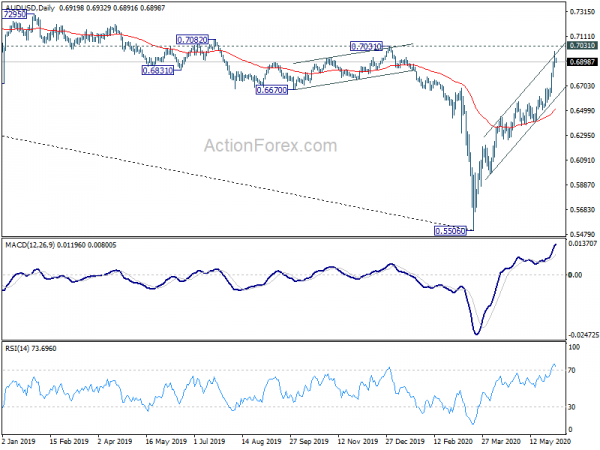

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Rejection by 55 week EMA affirms medium term bearishness. Next target is 0.6008 (2008 low). Outlook will stay bearish as long as 0.7031 resistance holds, even in case of strong rebound.