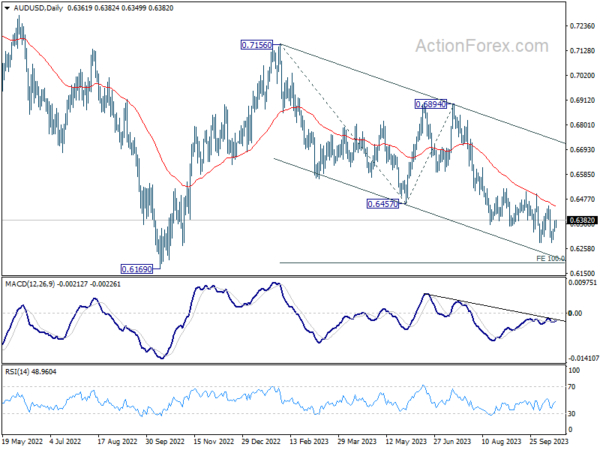

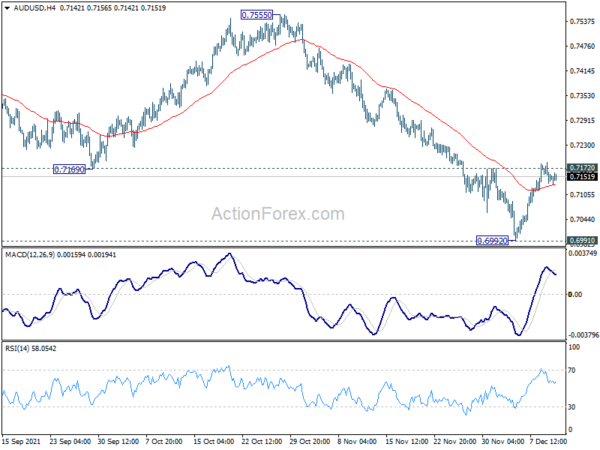

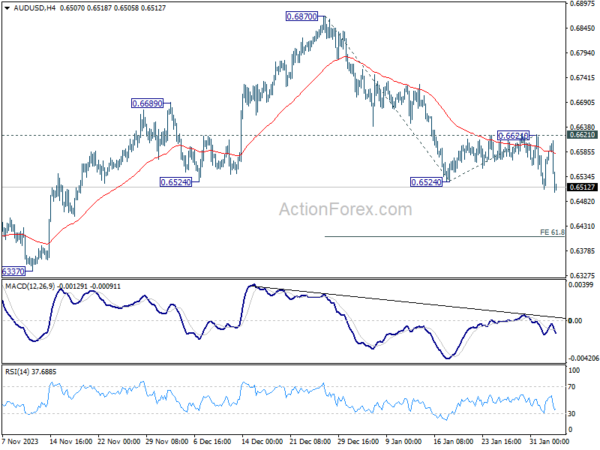

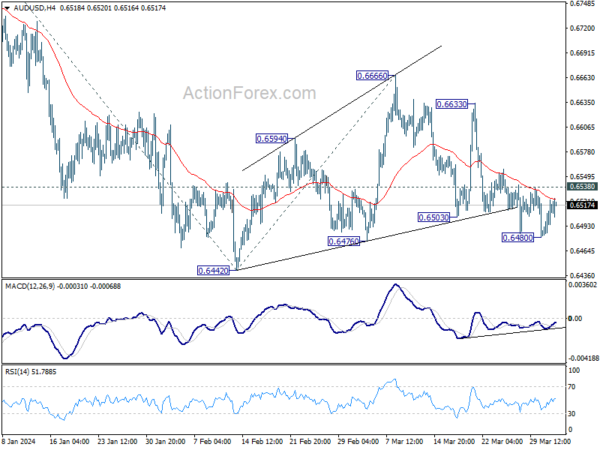

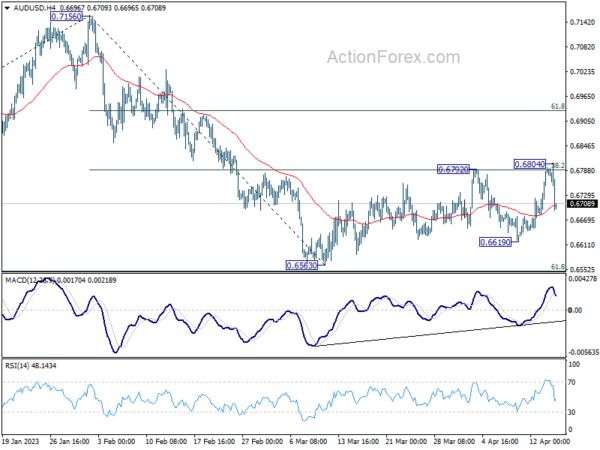

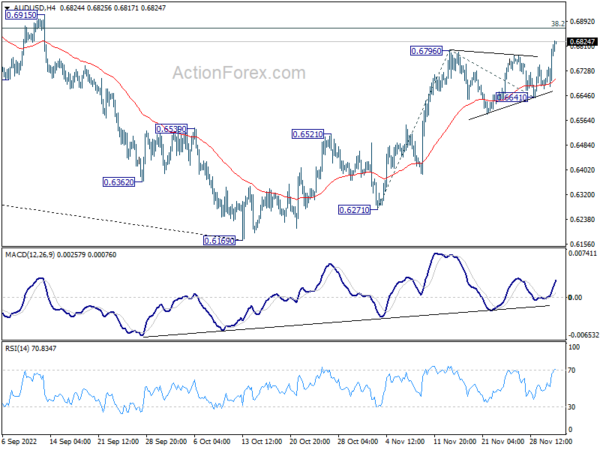

Daily Pivots: (S1) 0.6339; (P) 0.6360; (R1) 0.6386; More…

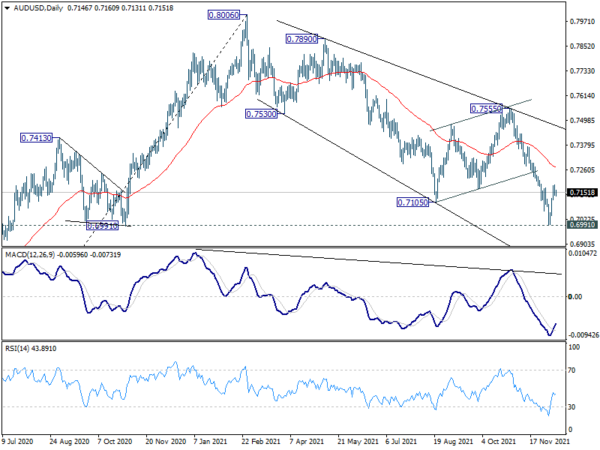

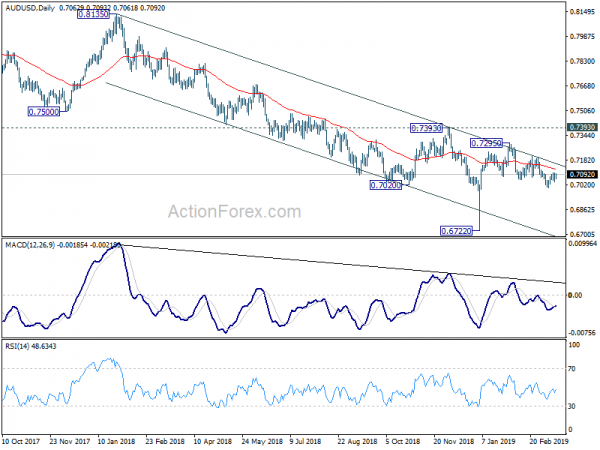

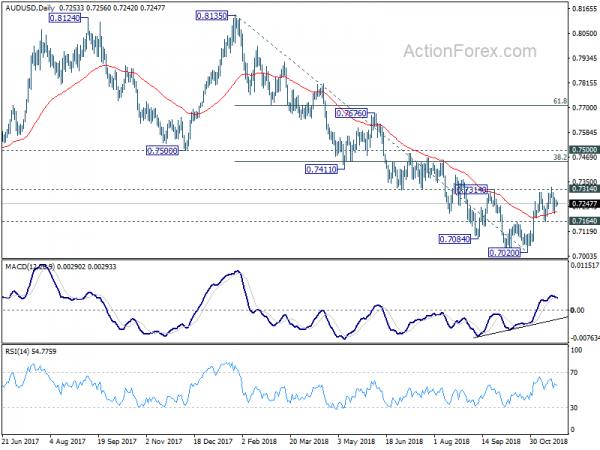

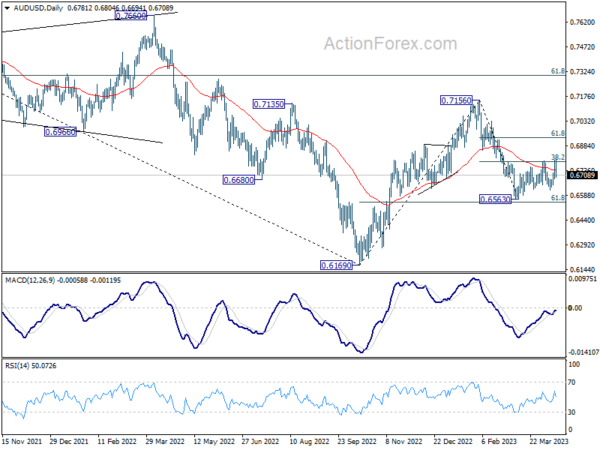

AUD/USD’s recovery continues today but stays below 0.6444 resistance. Intraday bias remains neutral and outlook stays bearish. On the downside, decisive break of 0.6284 will confirm resumption of whole decline from 0.7156. Next target is 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195, which is close to 0.6169 medium term support. Nevertheless, firm break of 0.6444 will confirm short term bottoming, and turn bias to the upside for stronger rebound.

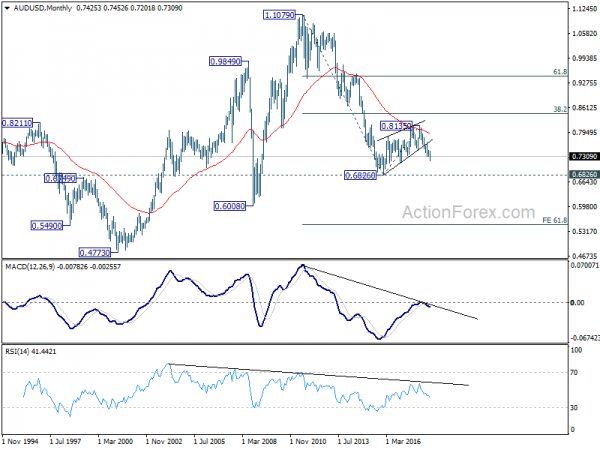

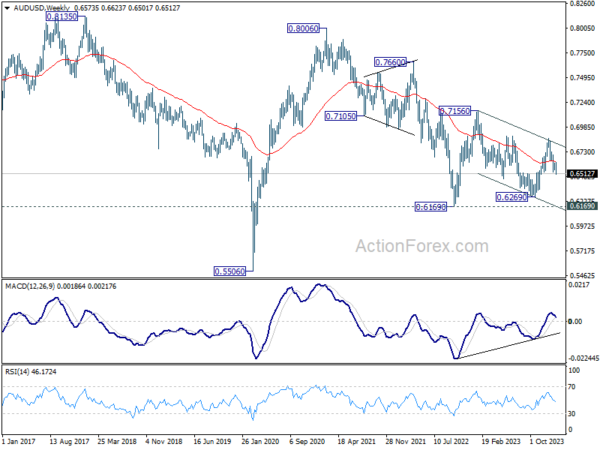

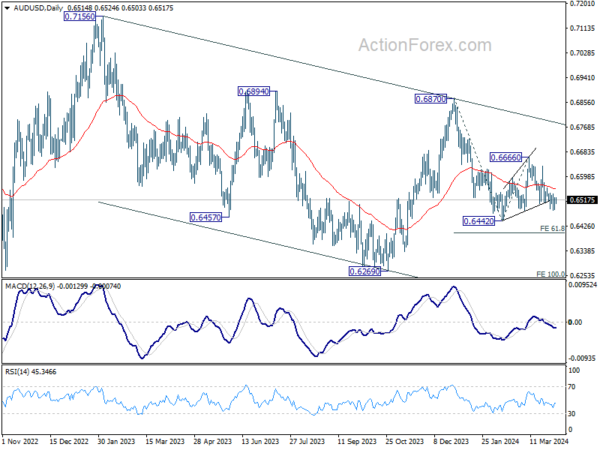

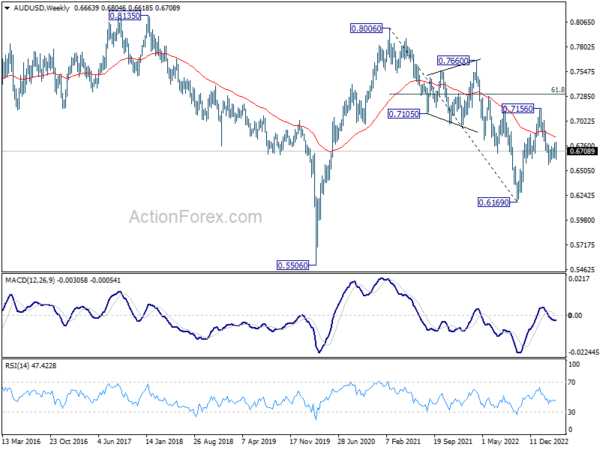

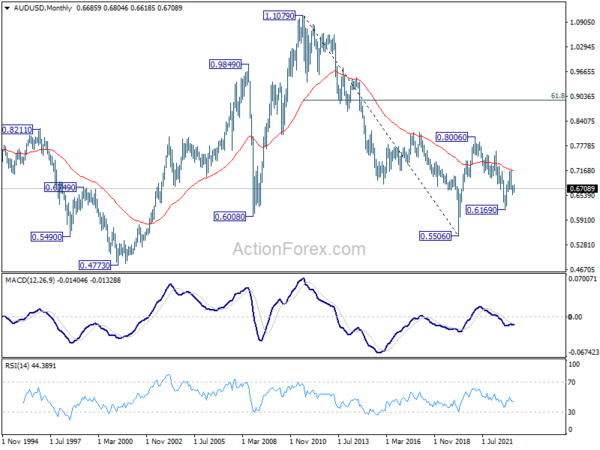

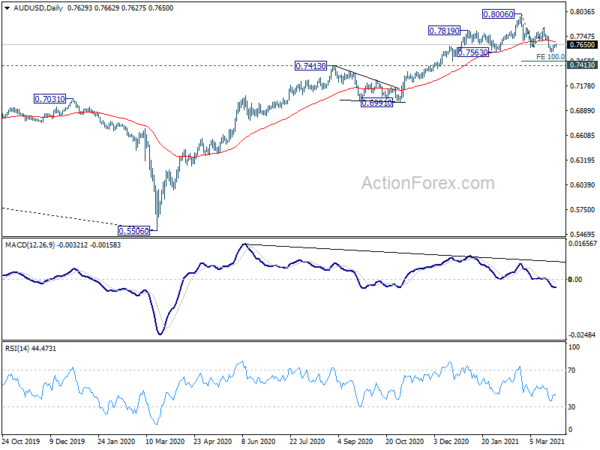

In the bigger picture, down trend from 0.8006 (2021 high) is possibly still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.