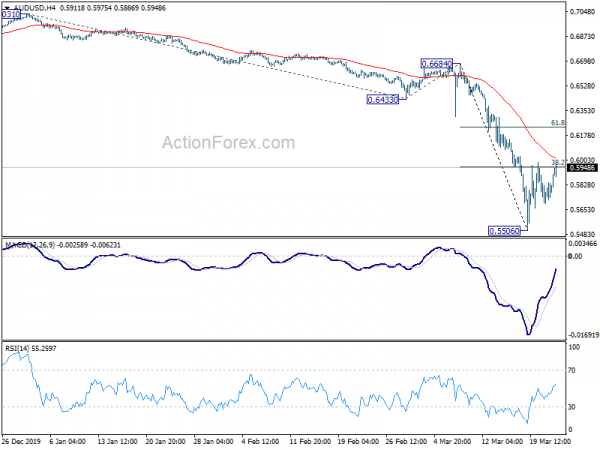

Daily Pivots: (S1) 0.5732; (P) 0.5788; (R1) 0.5877; More…

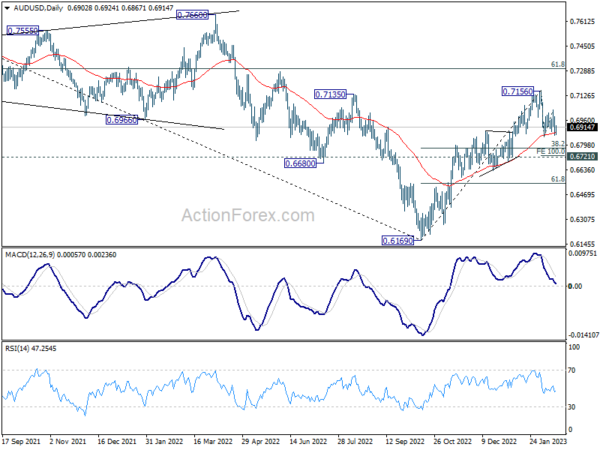

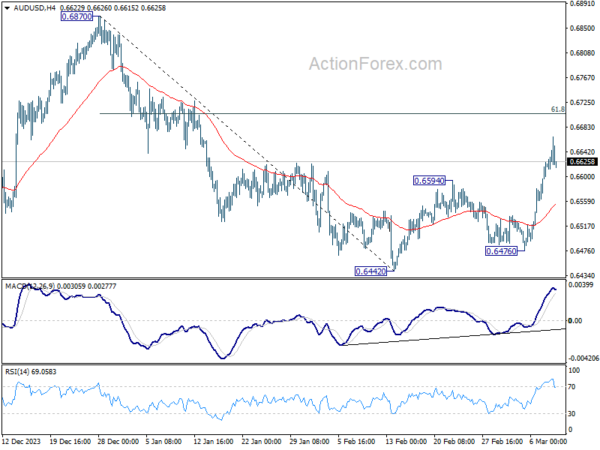

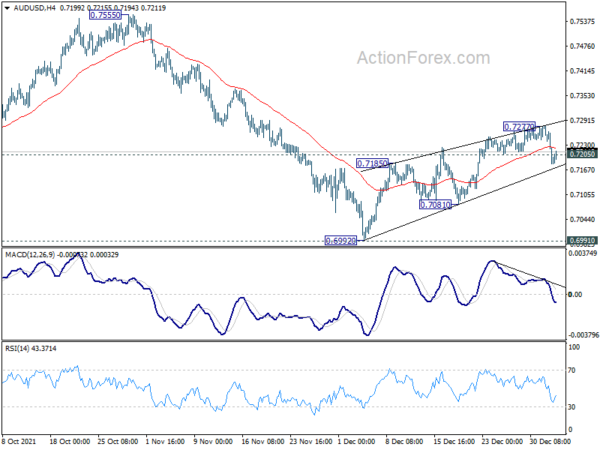

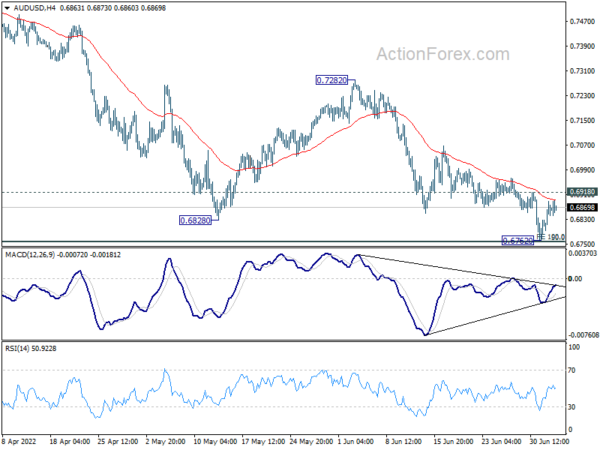

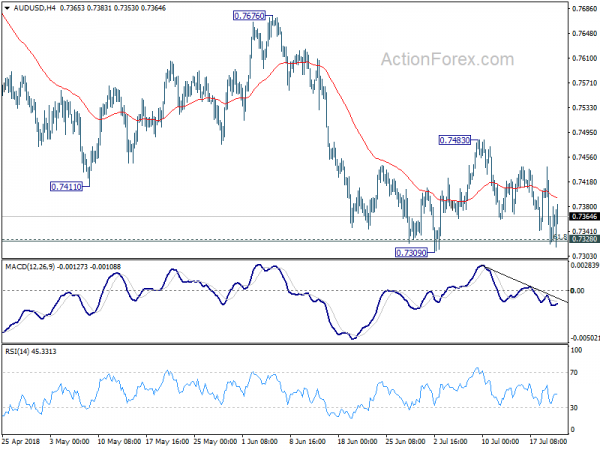

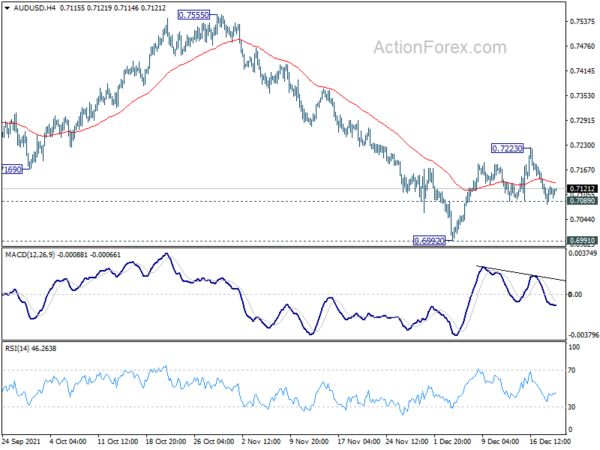

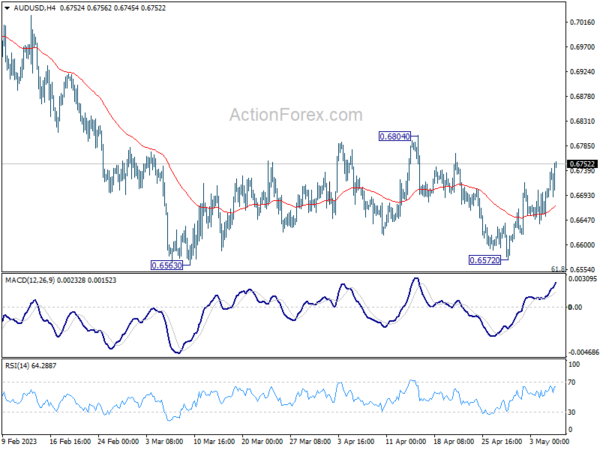

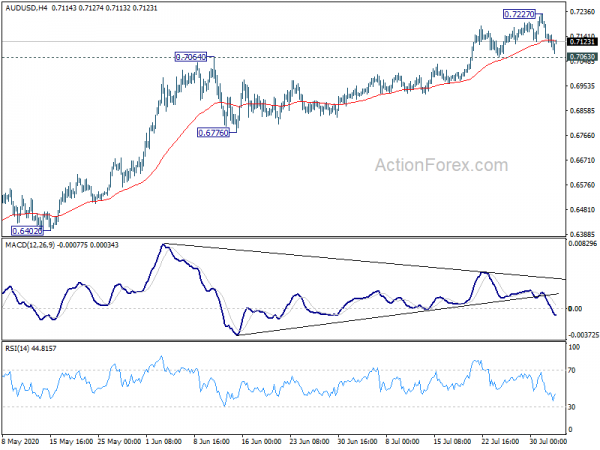

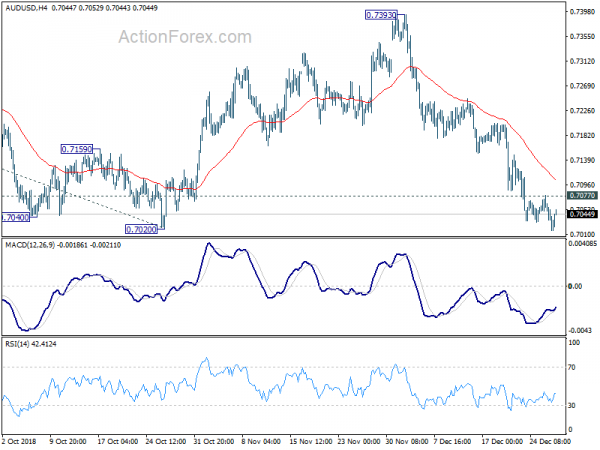

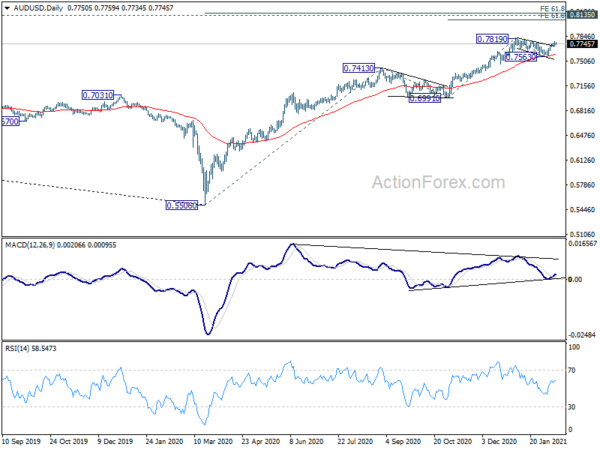

ADU?USD is staying in consolidation from 0.5506 and intraday bias remains neutral. Stronger recovery cannot be ruled out, to 4 hour 55 EMA (now at 0.6020). But upside should be limited by 61.8% retracement of 0.6684 to 0.5506 at 0.6234 to bring fall resumption. On the downside, break of 0.5506 will target 261.8% projection of 0.7031 to 0.6433 from 0.6684 at 0.5118.

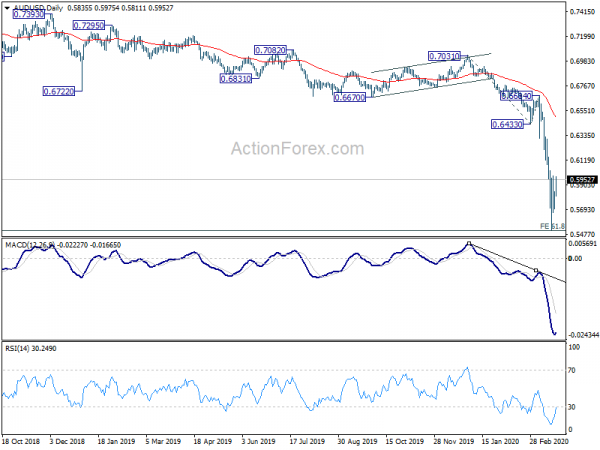

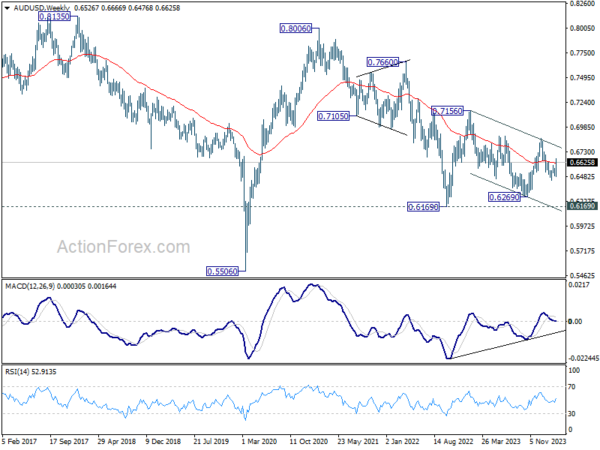

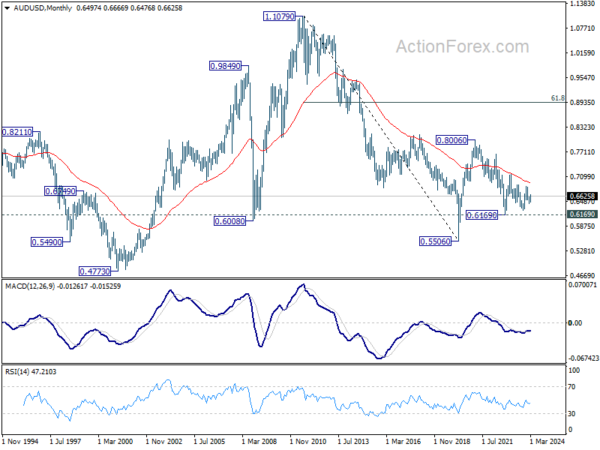

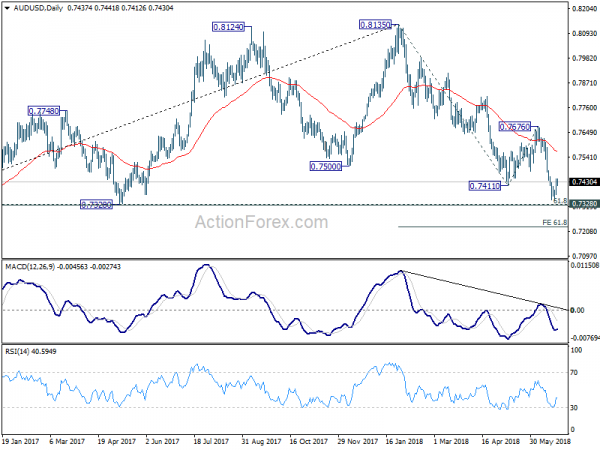

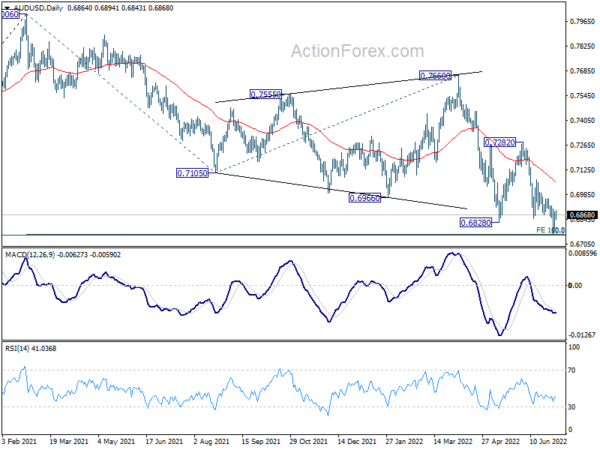

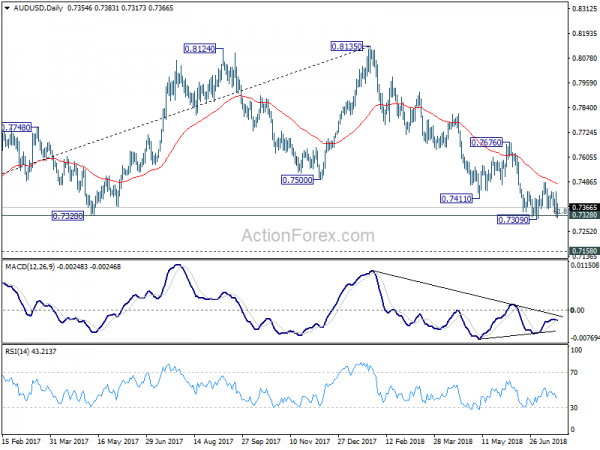

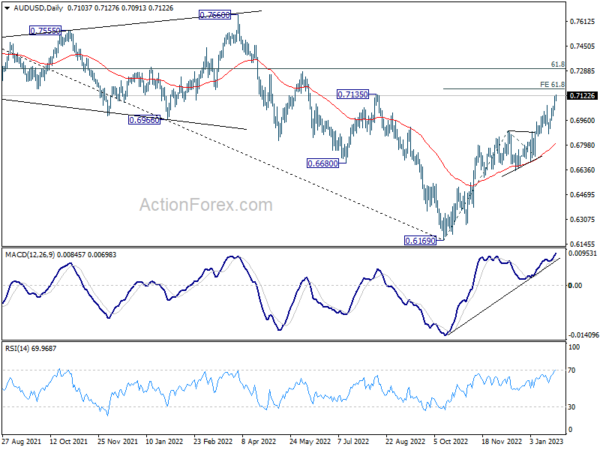

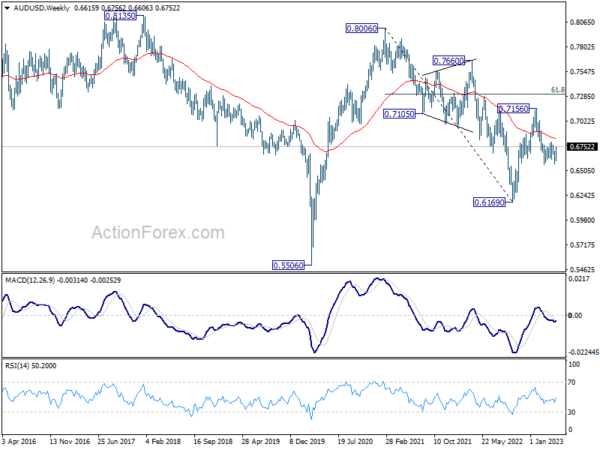

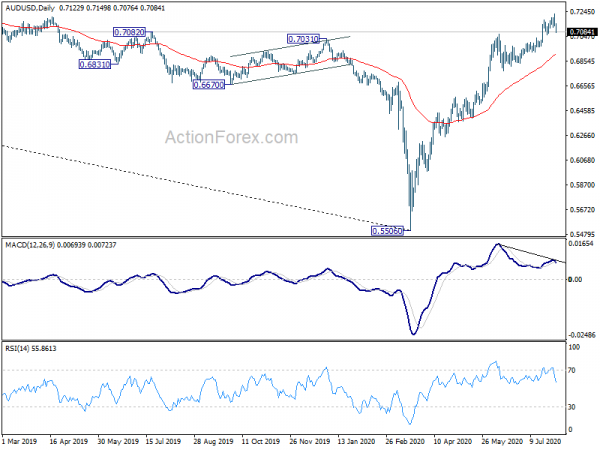

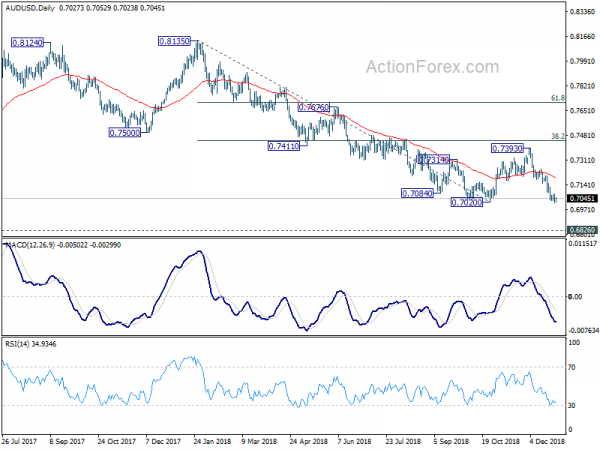

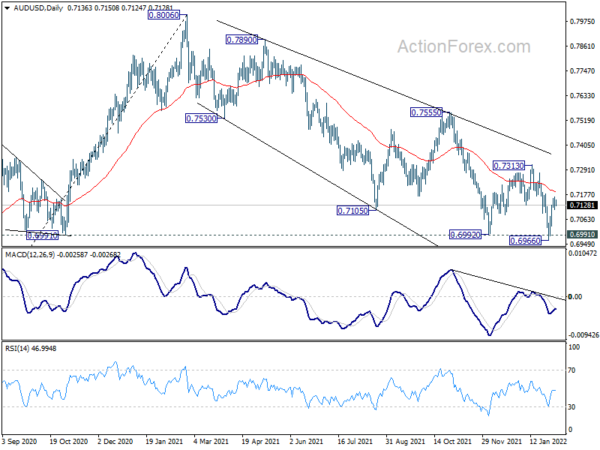

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507 is already met. Sustained break there will pave the way to 0.4773 (2001 low). On the upside, break of 0.6670 resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.