Daily Pivots: (S1) 0.6449; (P) 0.6484; (R1) 0.6547; More…

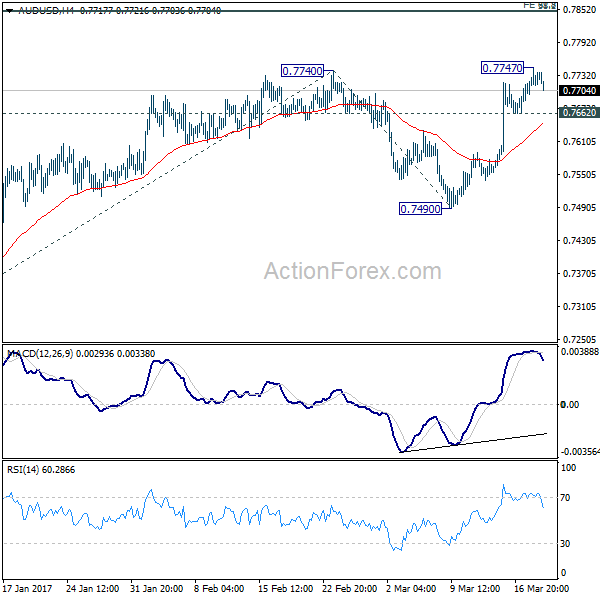

Intraday bias in AUD/USD is turned neutral first with today’s steep retreat. For now, another rise will remain mildly in favor as long as 0.6411 minor support holds. Sustained break of 0.6510 cluster resistance (38.2% retracement of 0.6894 to 0.6269 at 0.6508) will argue that whole decline from 0.7156 might be completed with three waves down to 0.6269. Stronger rally should then be seen to medium term trend line resistance (now at 0.6700). However, firm break of 0.6411 will indicate rejection by 0.6510, and turn bias back to the downside for retesting 0.6269 low.

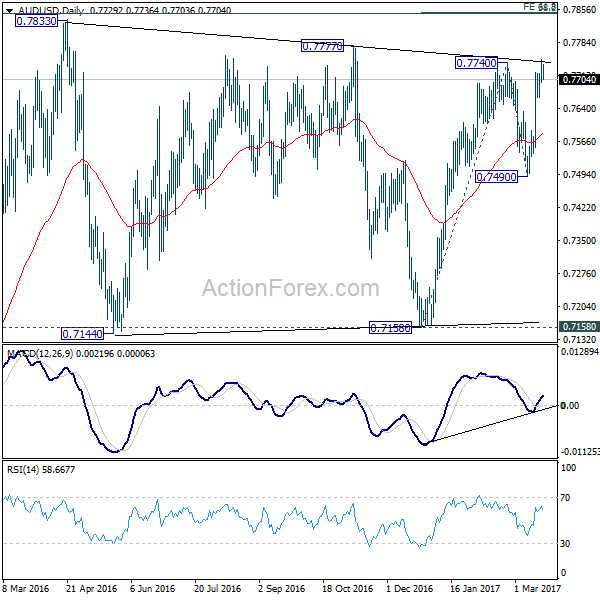

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. While current rebound from 0.6269 might extend higher, it could be the third leg of a corrective pattern from 0.6169 (2022 low) only. For now, medium term bearishness will remain as long as 0.6894 resistance holds.