Daily Pivots: (S1) 0.7041; (P) 0.7057; (R1) 0.7083; More…

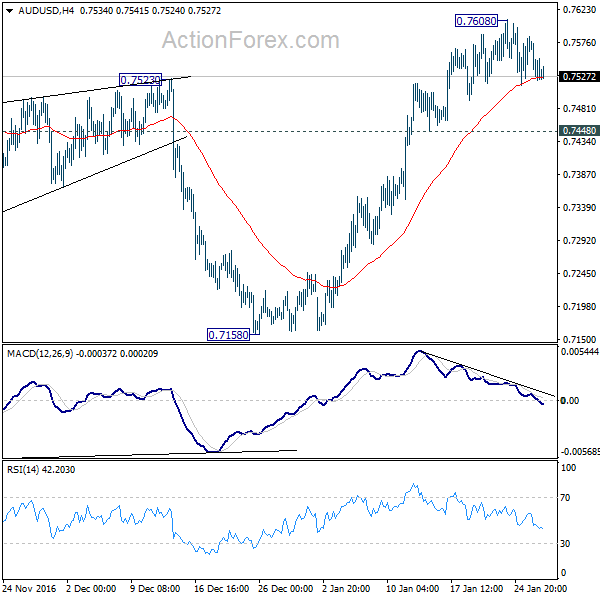

AUD/USD continues to lose downside momentum as seen in 4 hour MACD. But with 0.7148 resistance intact, further fall is still expected to 0.7020 support. Decisive break there will resume larger decline from 0.8135 for 0.6826 key support. However, firm break of 0.7148 will suggest that correction from 0.7020 is extending with another rise. Intraday bias will then be turned back to the upside for 0.7393 resistance.

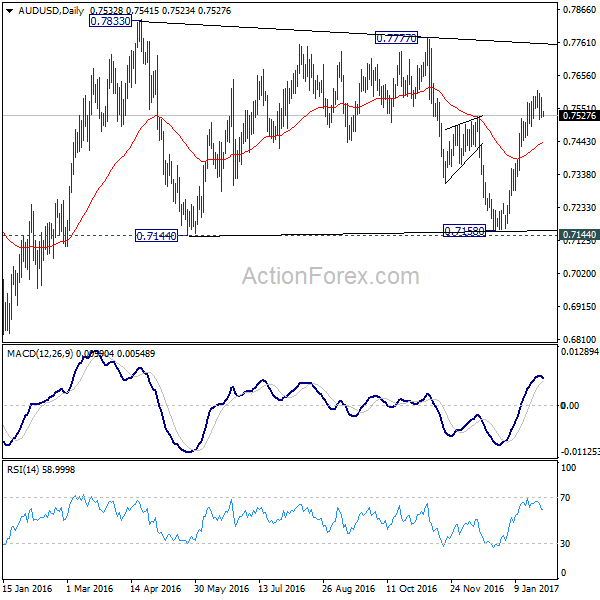

In the bigger picture, price actions from 0.7020 are corrective in nature. In case such corrective pattern extends, upside should be limited by 38.2% retracement of 0.8135 to 0.7020 at 0.7446 to bring down trend resumption. Firm break of 0.7020 will extend medium term decline from 0.8135 to retest 0.6826 (2016 low).