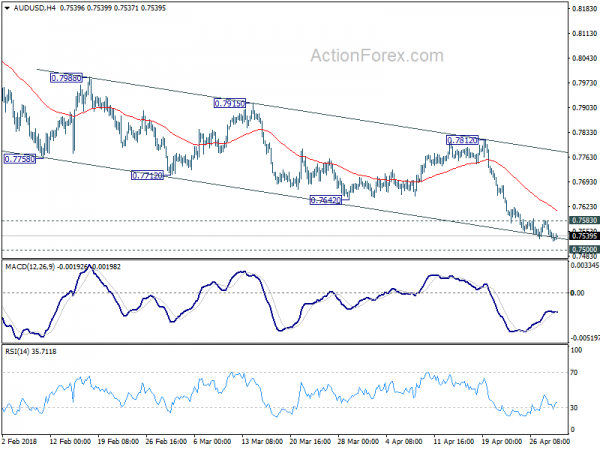

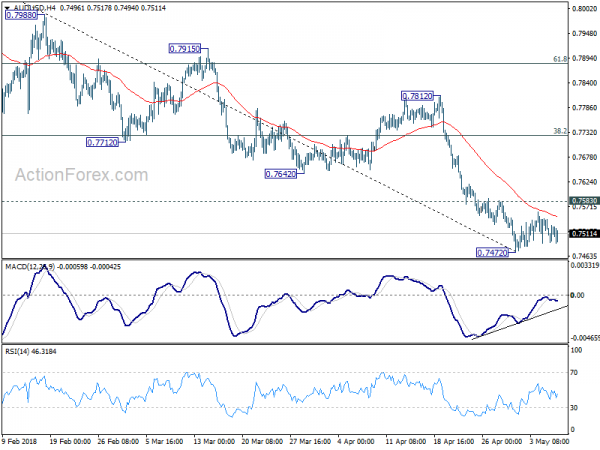

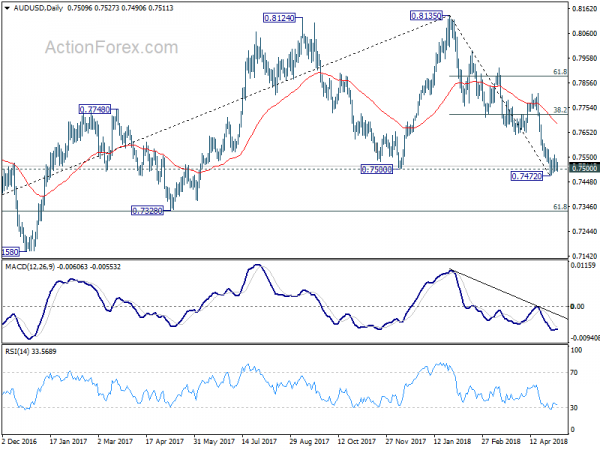

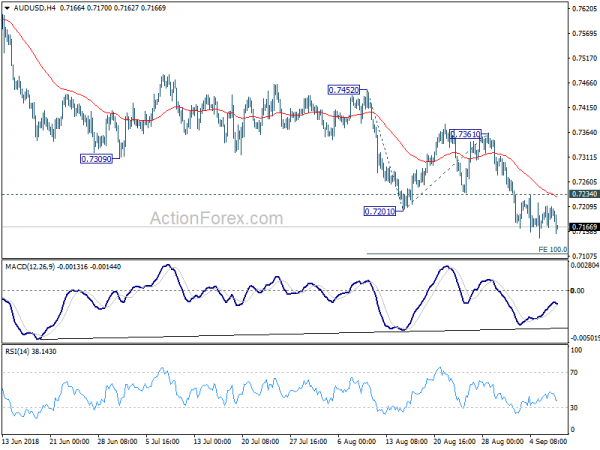

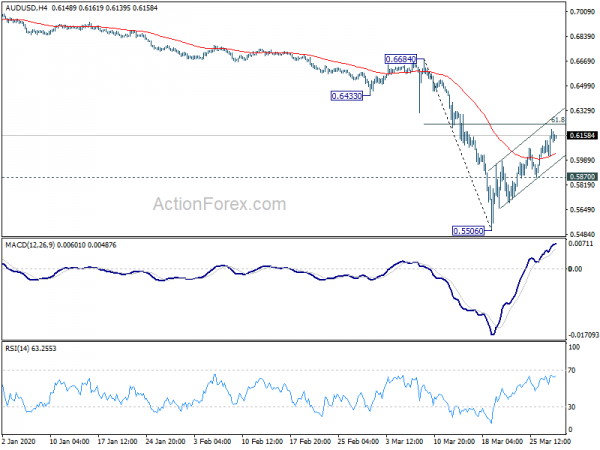

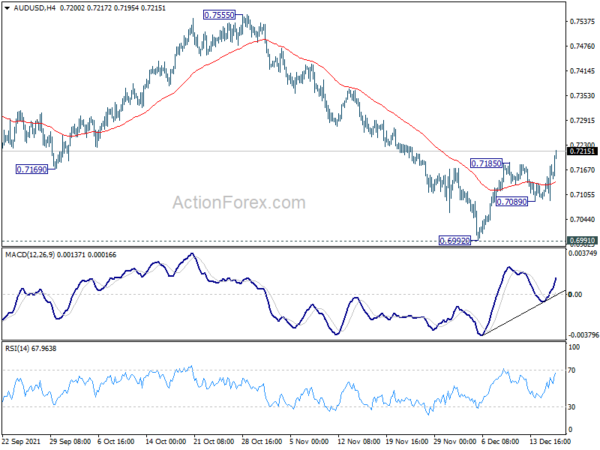

Daily Pivots: (S1) 0.7508; (P) 0.7545; (R1) 0.7566; More…

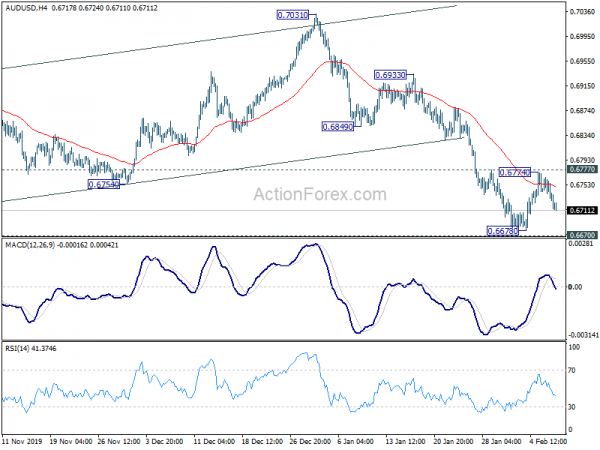

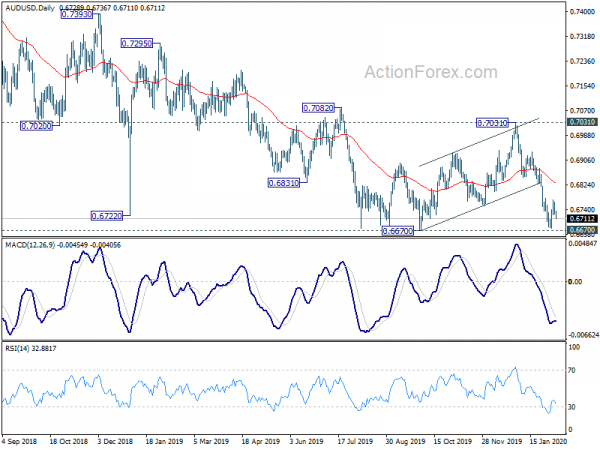

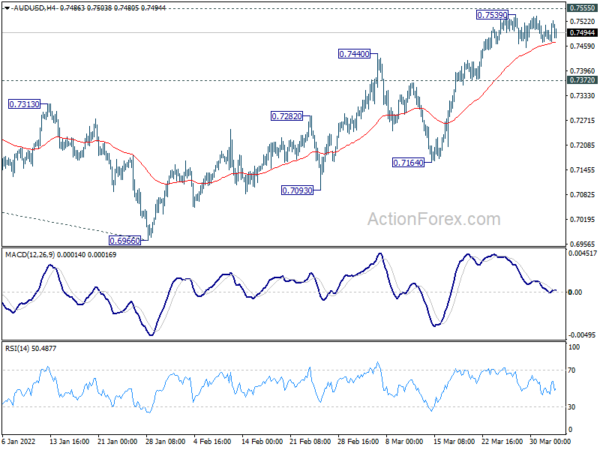

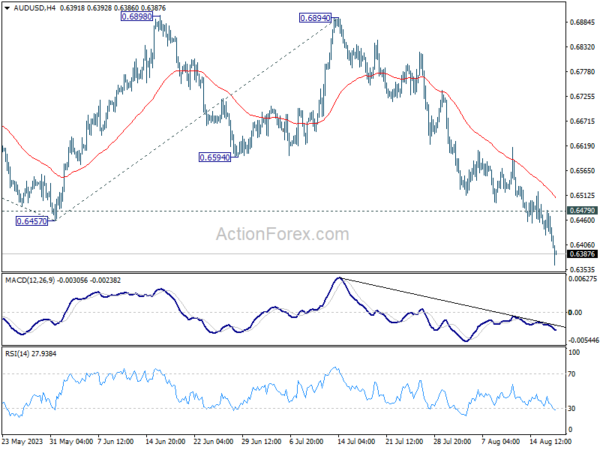

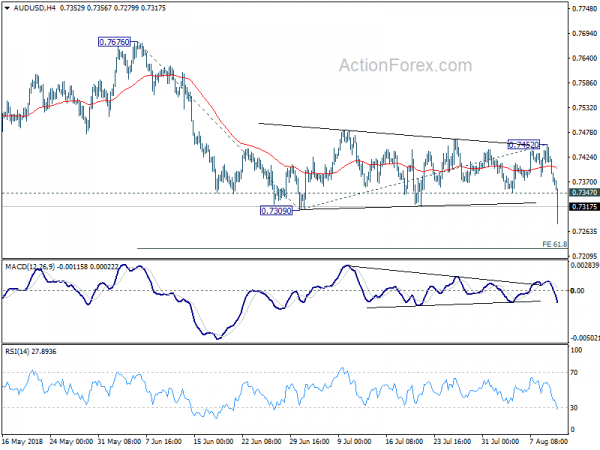

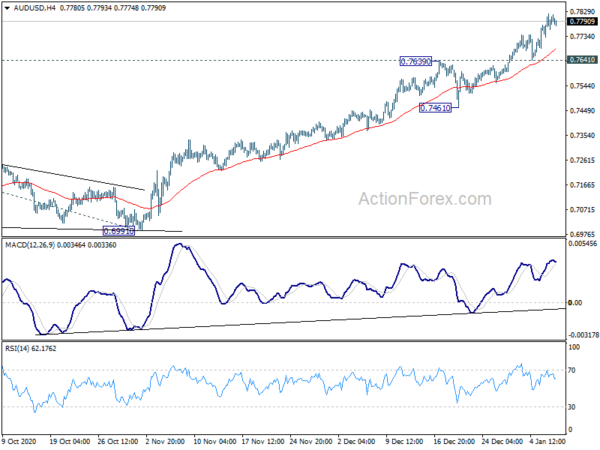

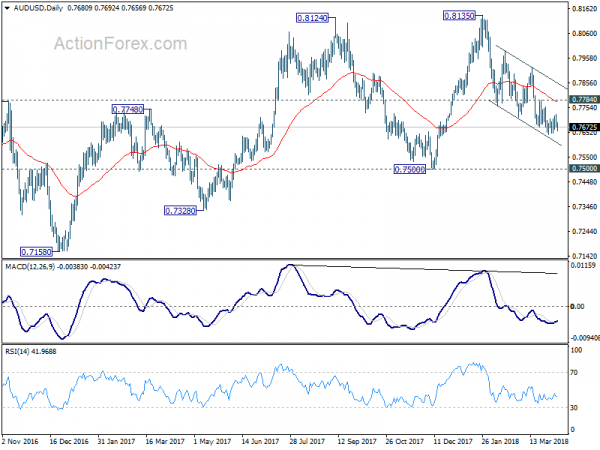

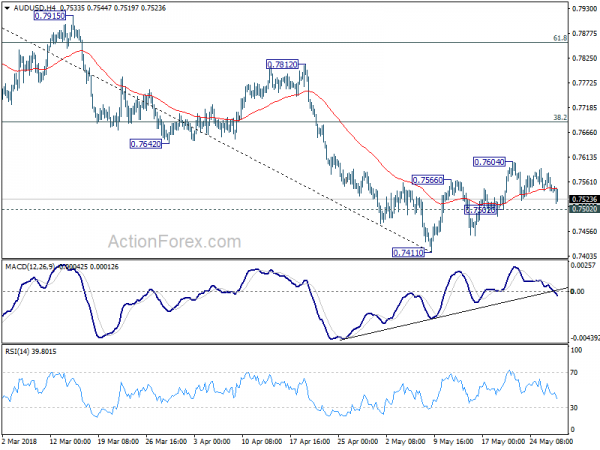

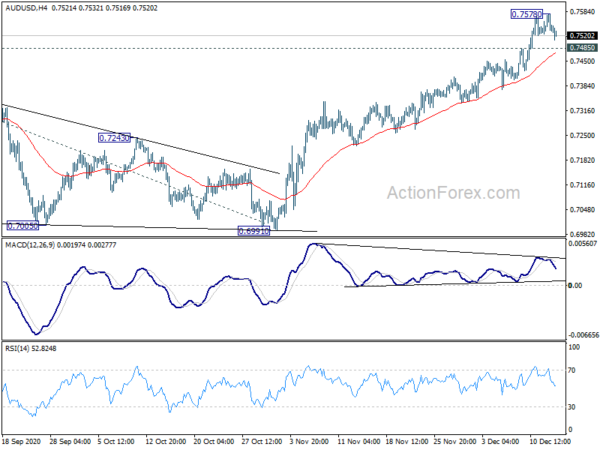

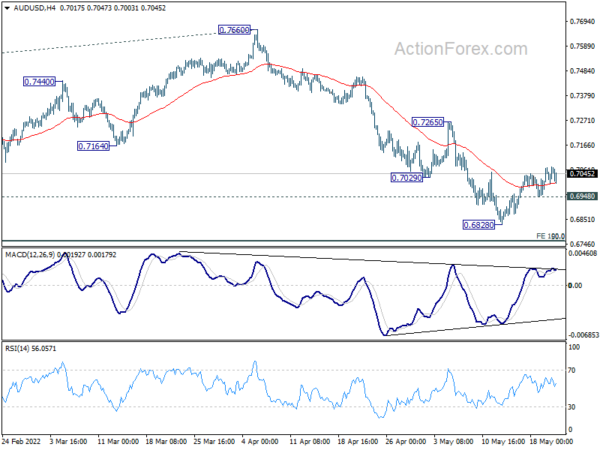

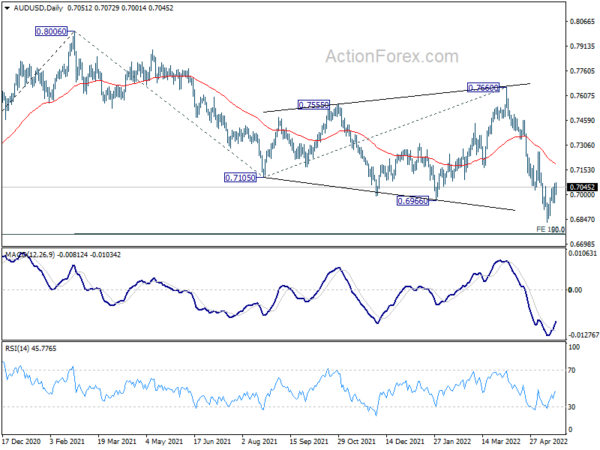

AUD/USD dips lower to 0.7524 as recent fall resumes. Intraday bias is back on the downside with focus on 0.7500 key support level. Decisive break there will indicate medium term reversal and target next support at 0.7328. On the upside, above 0.7583 minor resistance will suggest short term bottoming. In that case, stronger rebound would be seen back to 0.7642 support turned resistance.

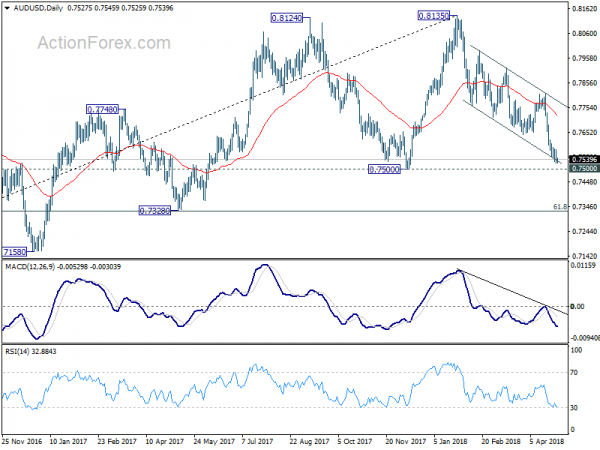

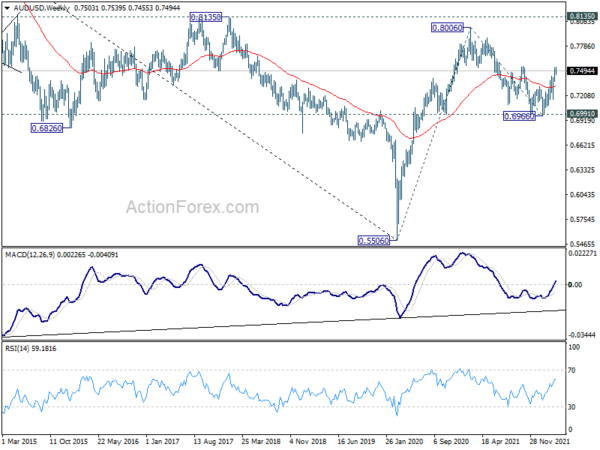

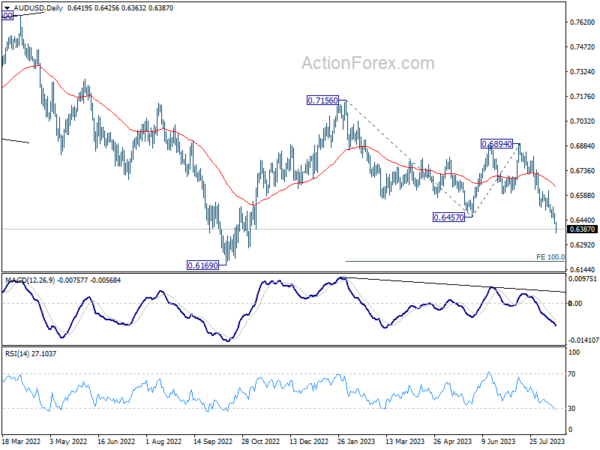

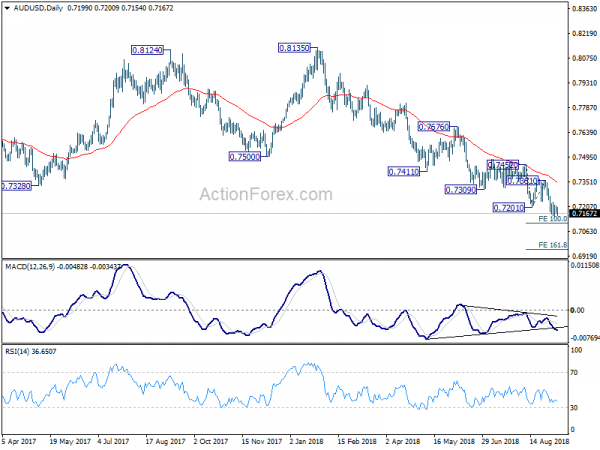

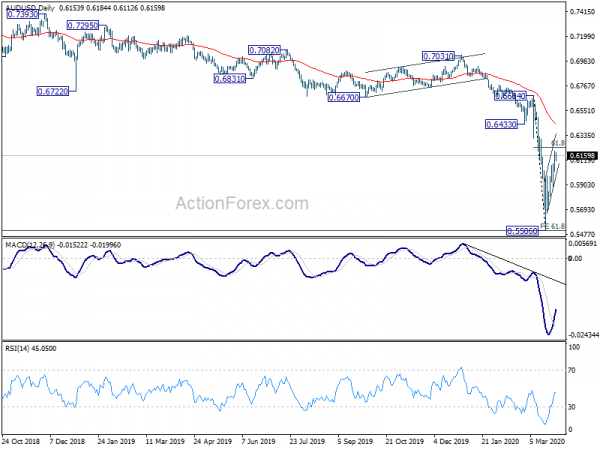

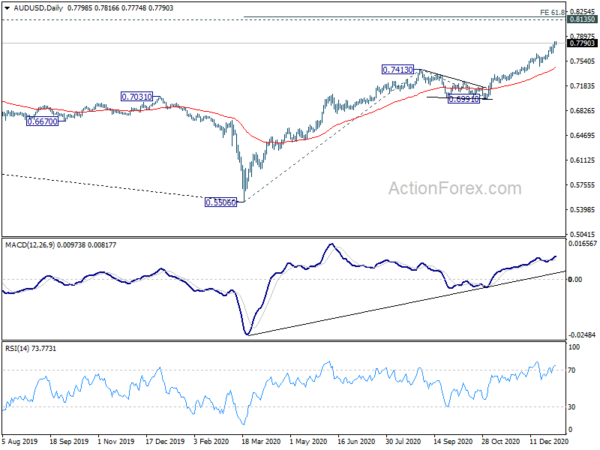

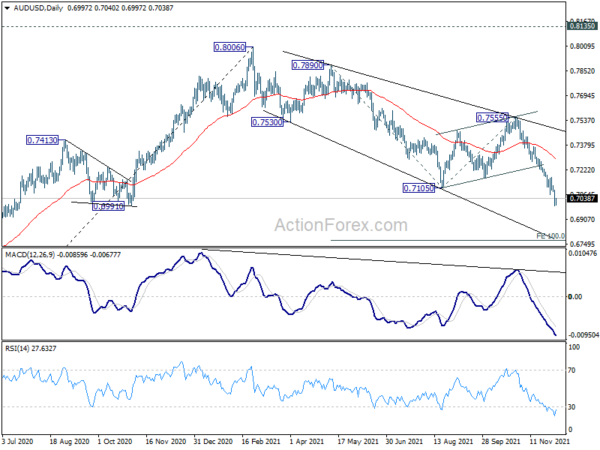

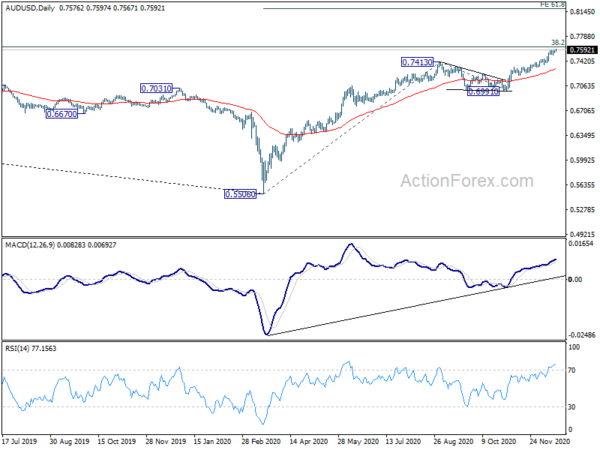

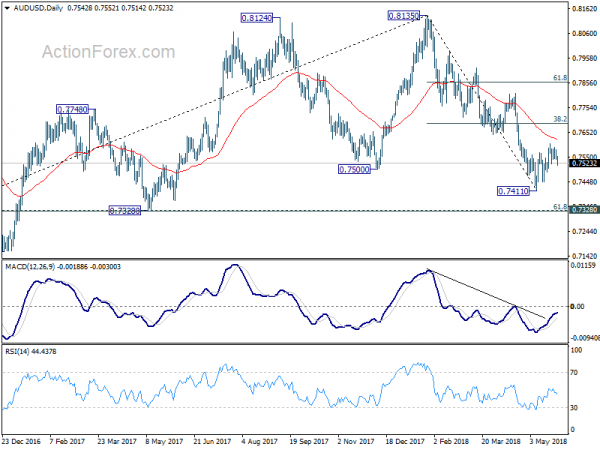

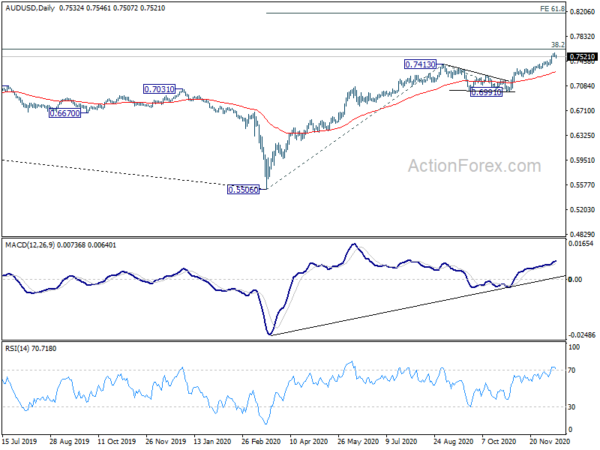

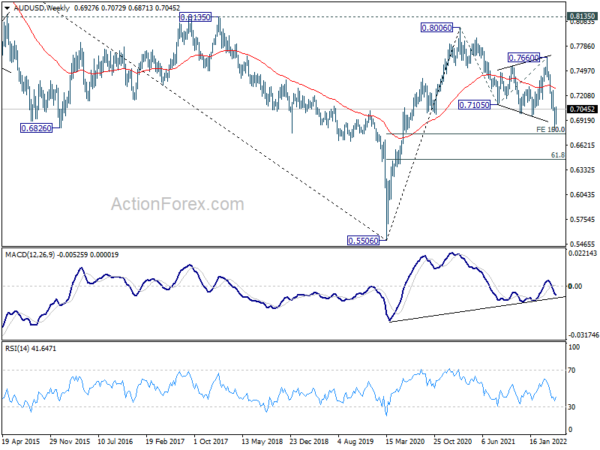

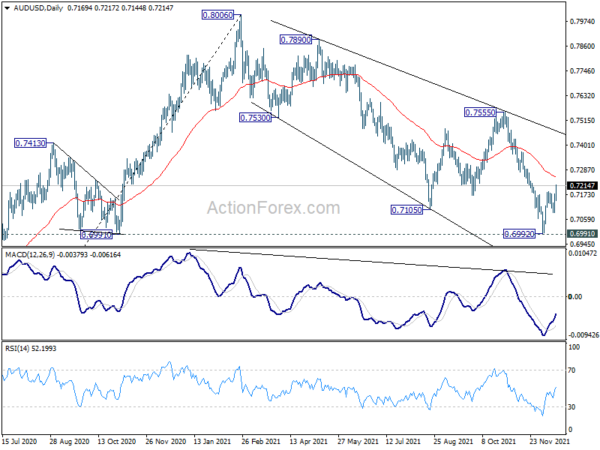

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Decisive break of 0.7500 key support will suggest that such correction is completed. In that case, deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.