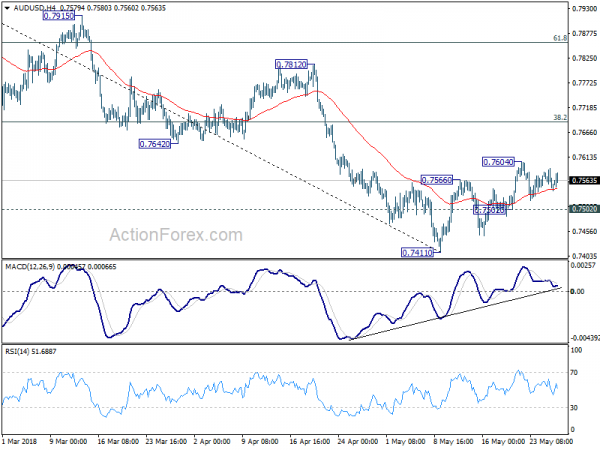

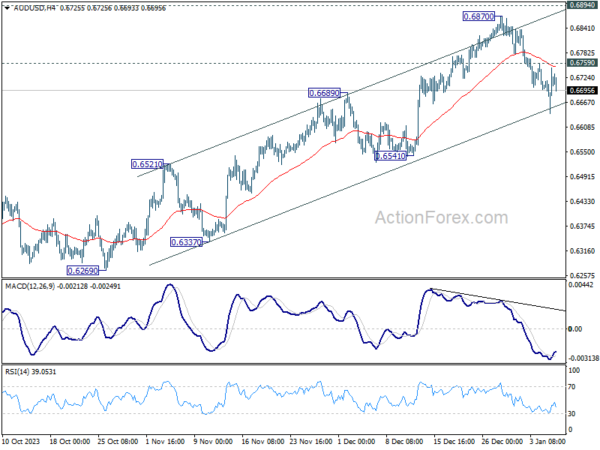

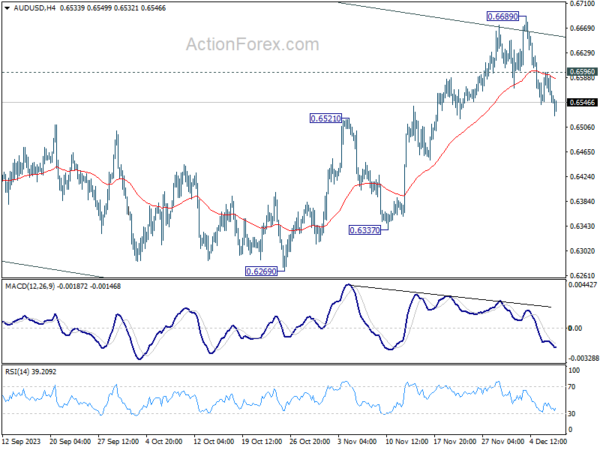

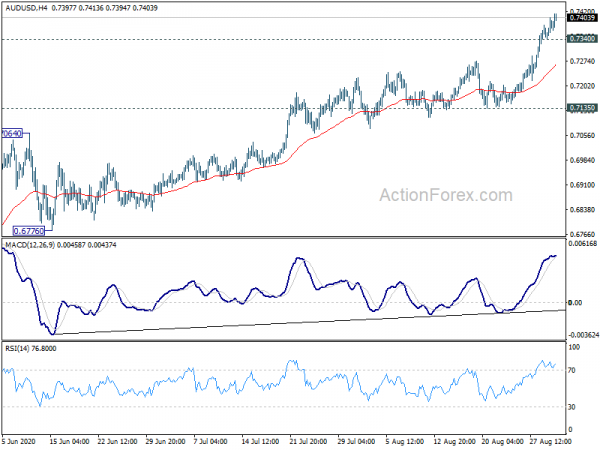

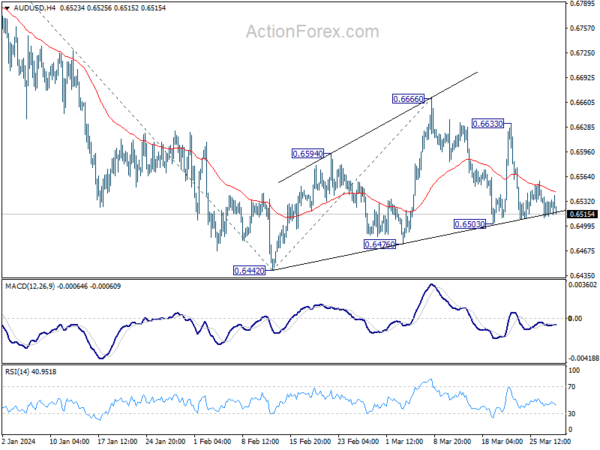

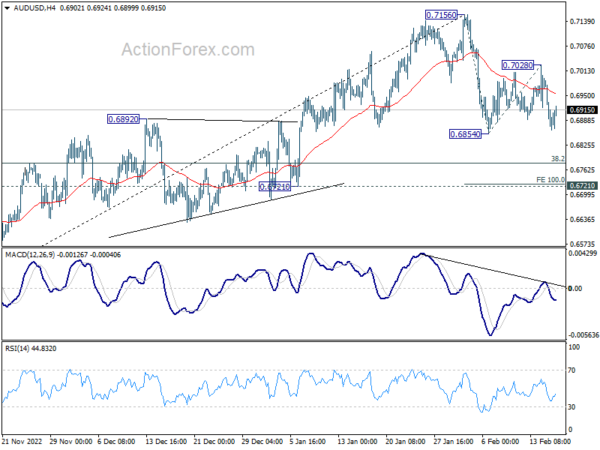

Daily Pivots: (S1) 0.7437; (P) 0.7477; (R1) 0.7525; More…

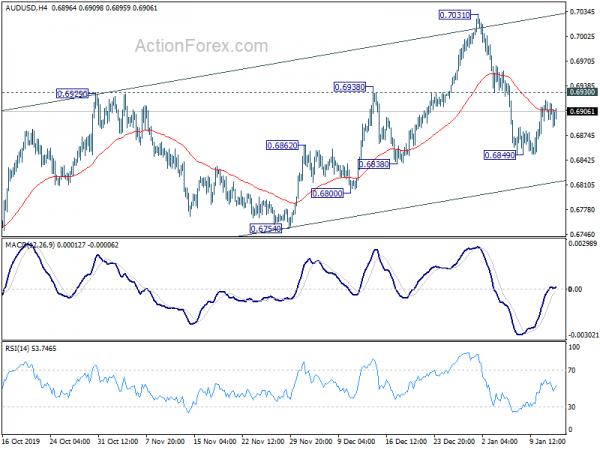

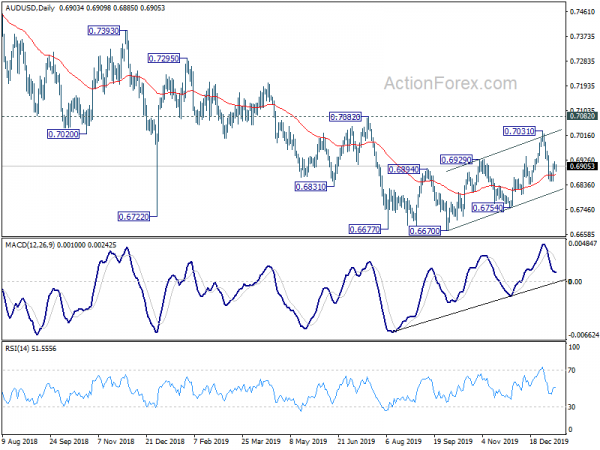

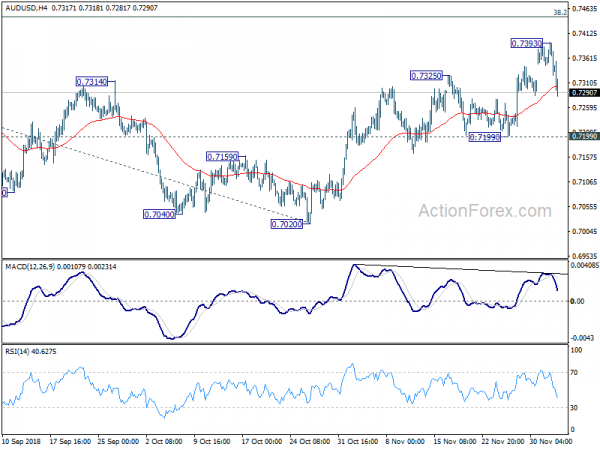

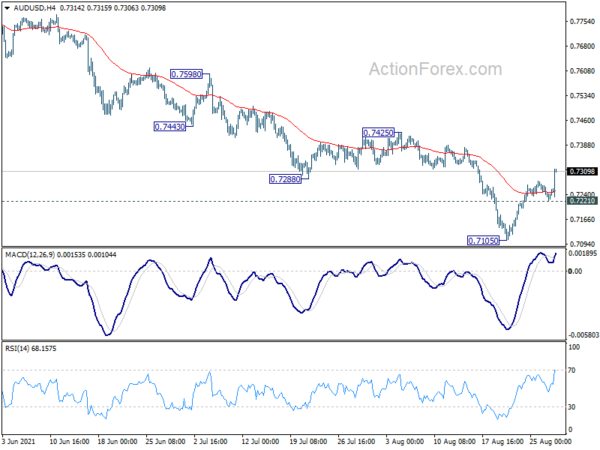

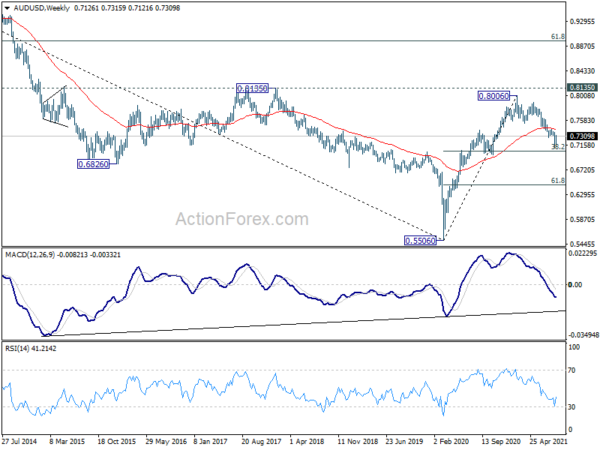

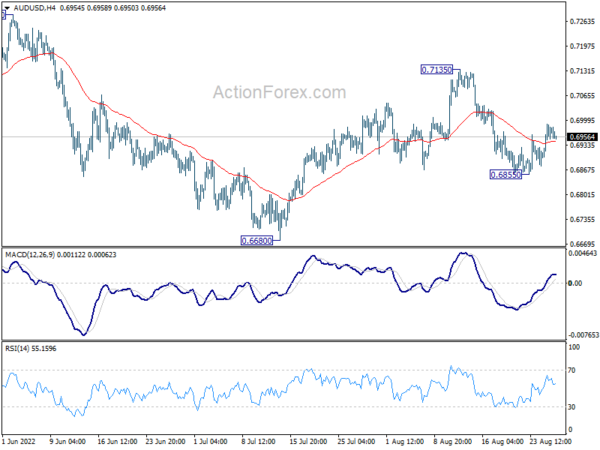

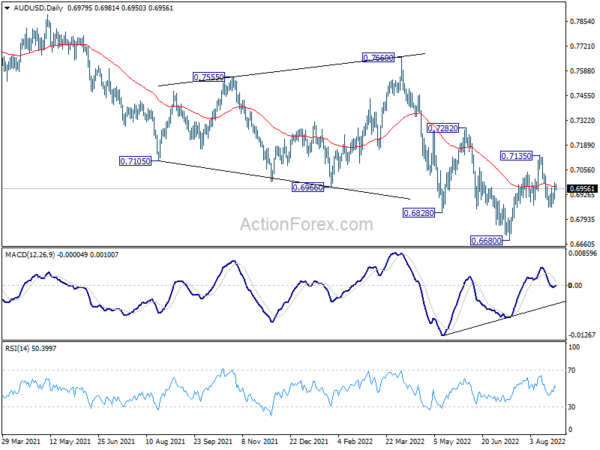

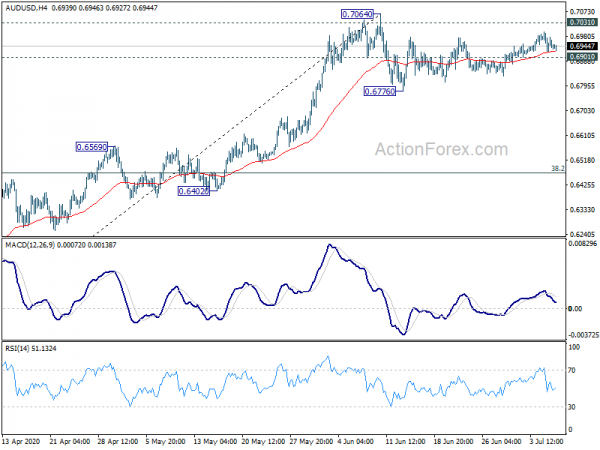

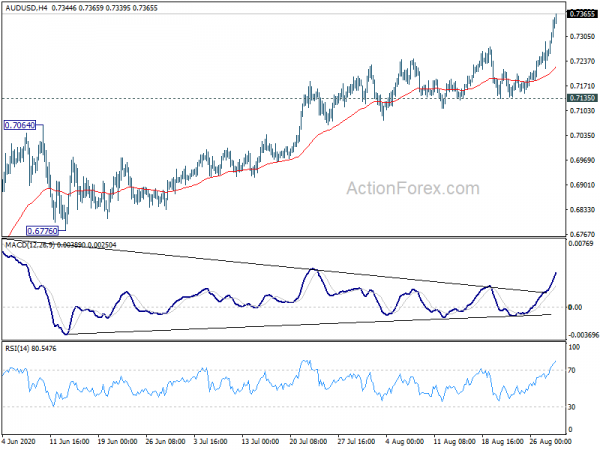

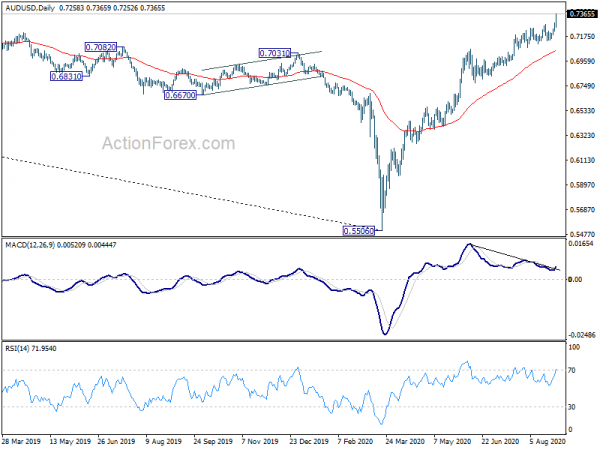

Intraday bias in AUD/USD remains on the upside as the rebound from 0.7158 extends. Further rise would be seen through 61.8% retracement of 0.7777 to 0.7518 at 0.7541. At this point, we’d expect strong resistance from 0.7777/7833 to limit upside. On the downside, below 0.7351 minor support will turn bias back to the downside for 0.7144 key support level.

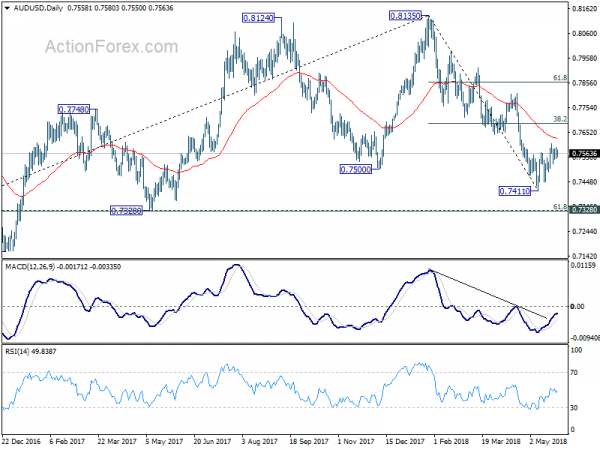

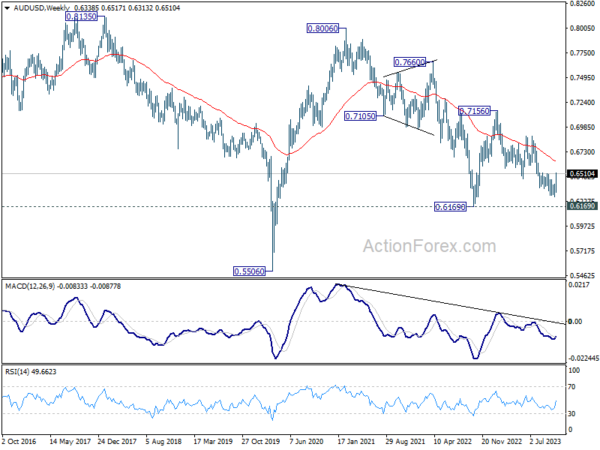

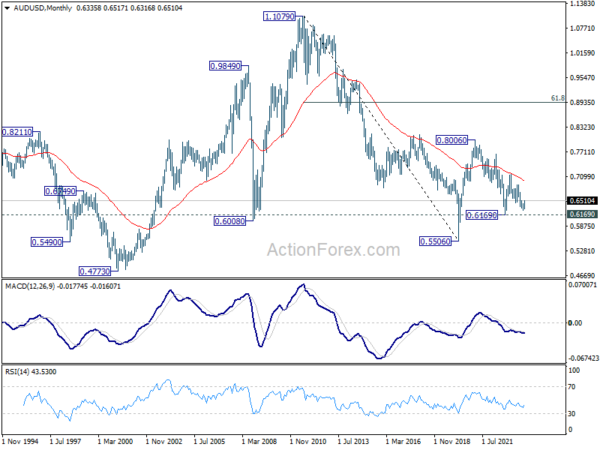

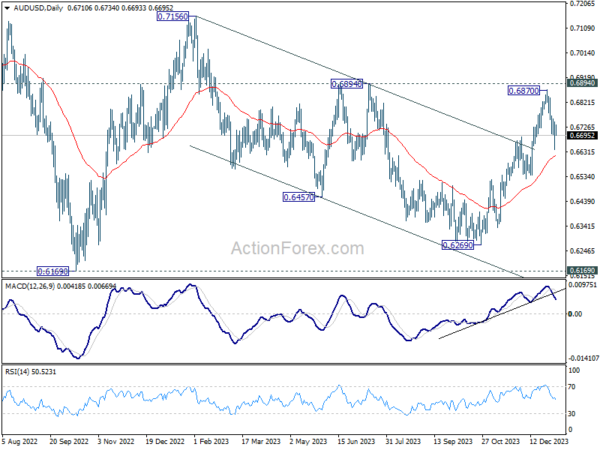

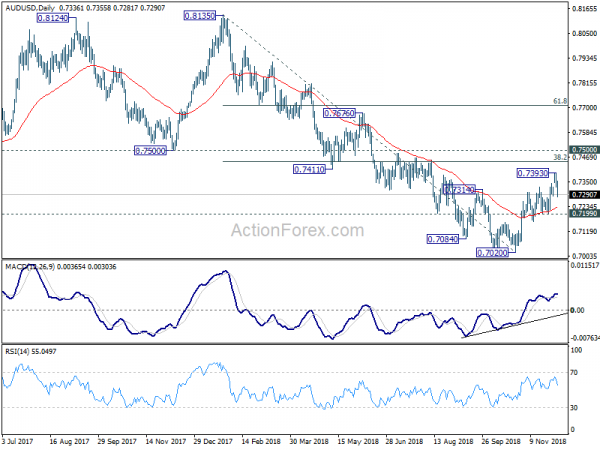

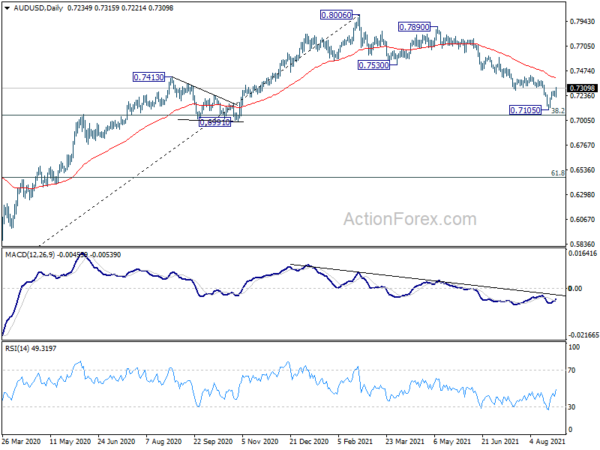

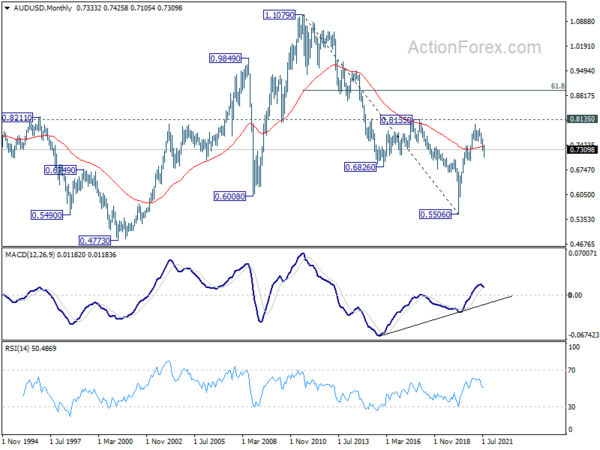

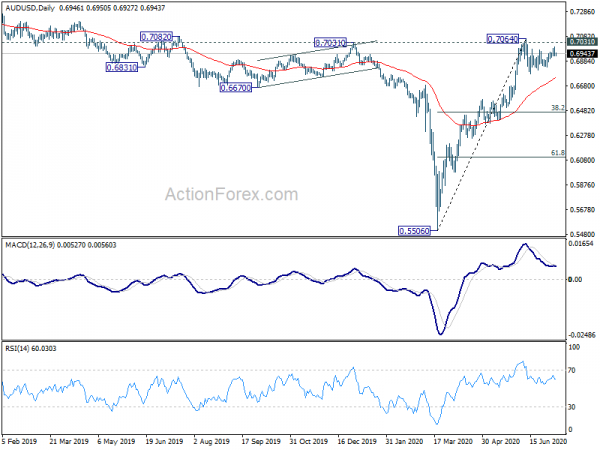

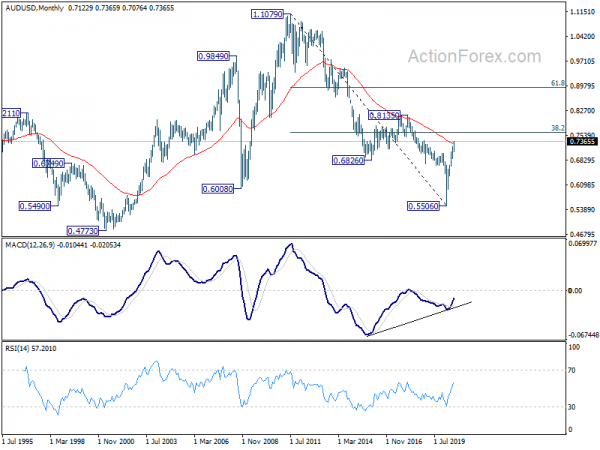

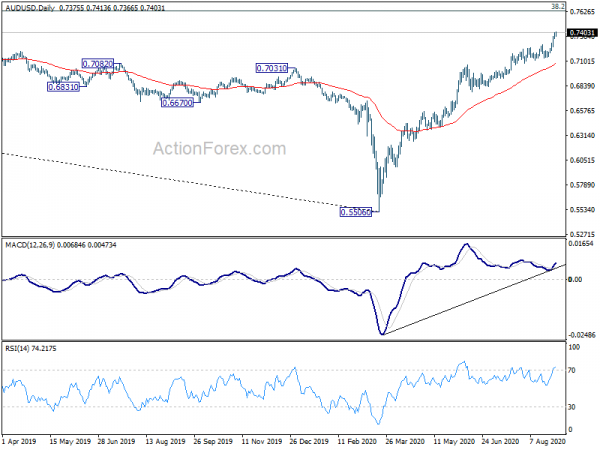

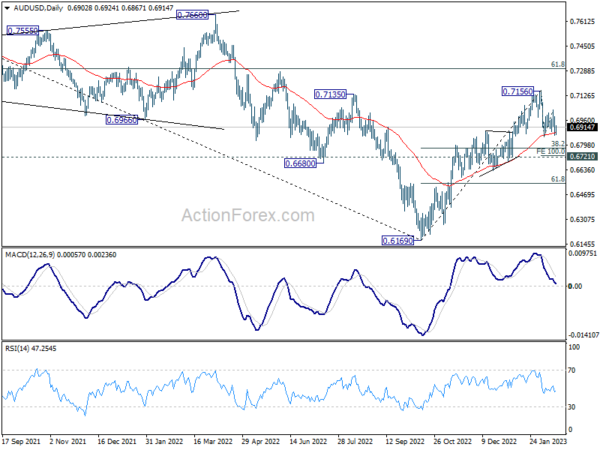

In the bigger picture, AUD/USD is staying inside long term falling channel and it’s likely that the down trend from 1.1079 is still in progress. Break of 0.6826 low will confirm this bearish case and target 61.8% projection of 0.9504 to 0.6826 from 0.7777 at 0.6122 next. We’ll be looking for bottoming sign again as it approaches 0.6008 key support level. Meanwhile, sustained break of 0.7833 resistance will be a strong sign of medium term reversal.

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box