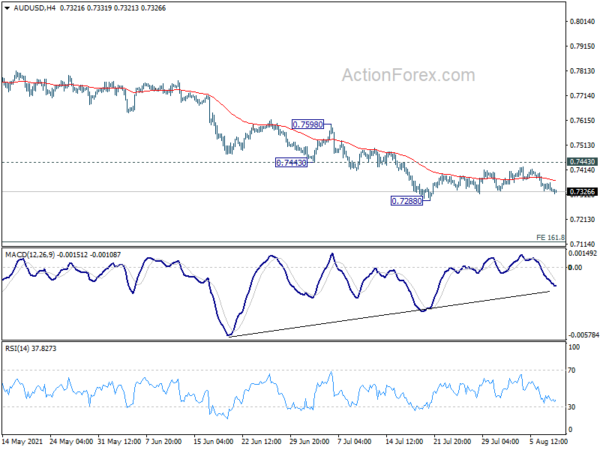

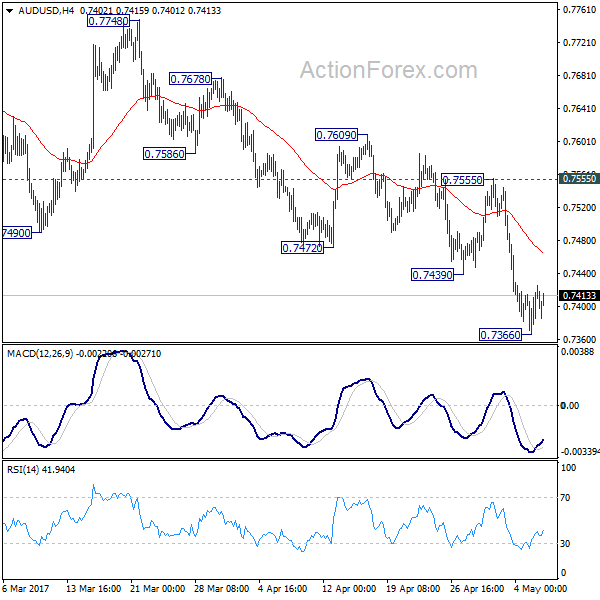

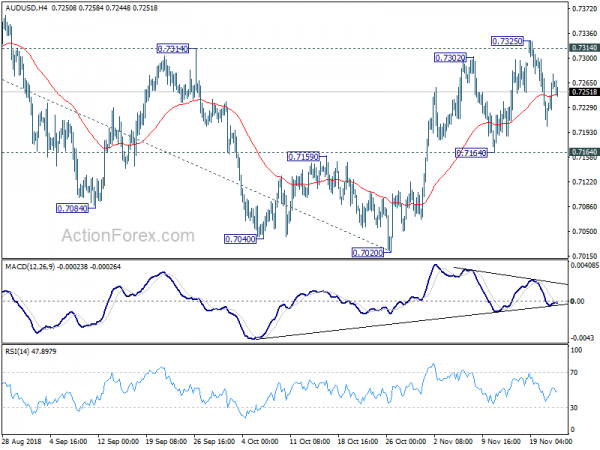

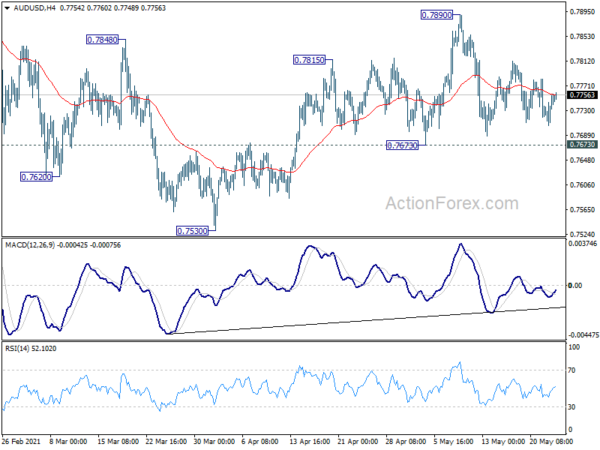

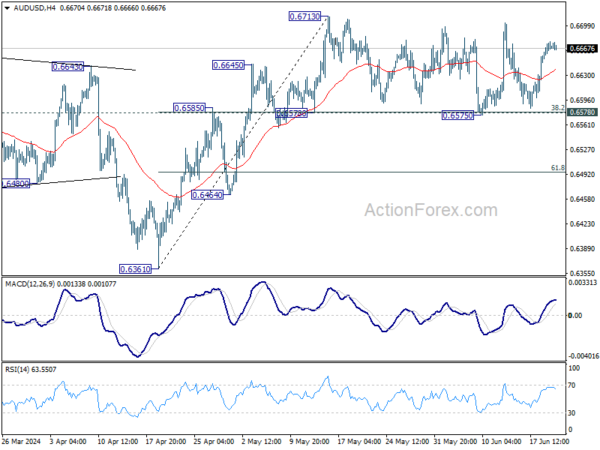

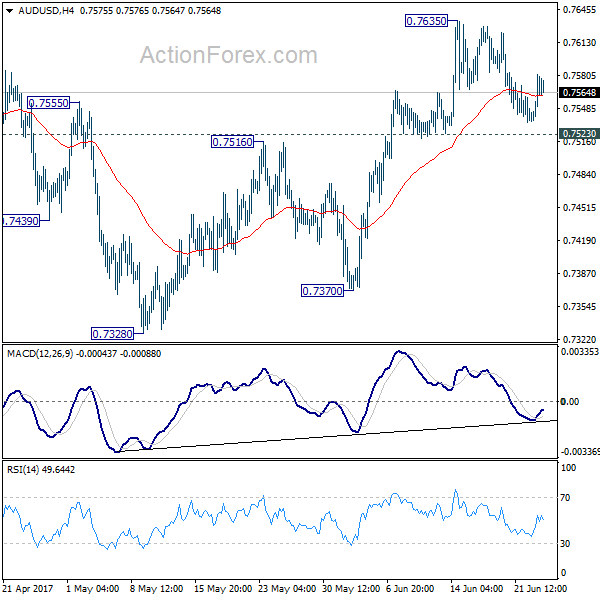

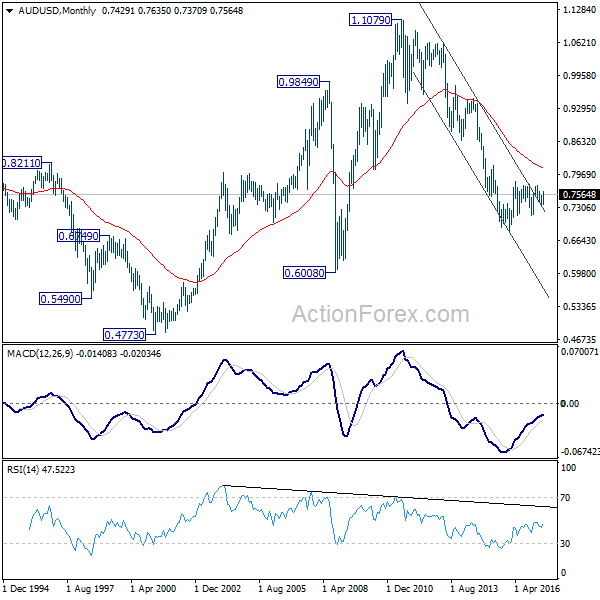

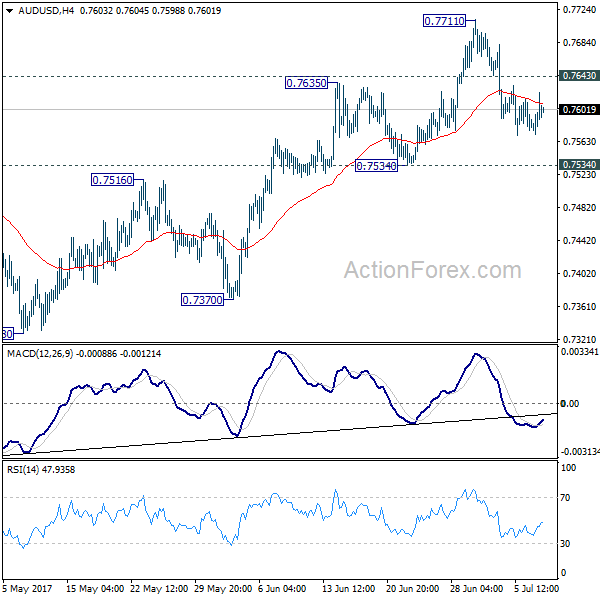

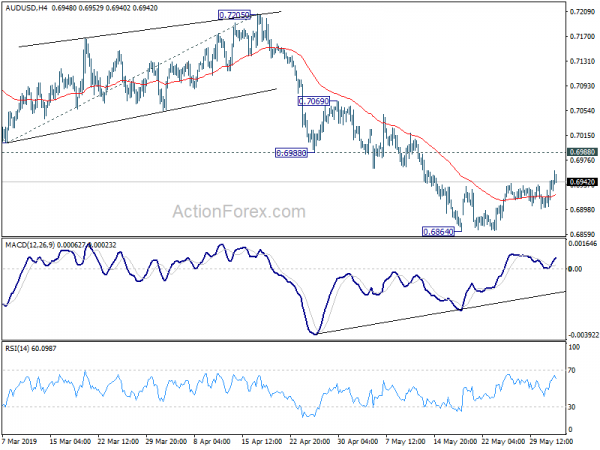

Daily Pivots: (S1) 0.7317; (P) 0.7340; (R1) 0.7353; More…

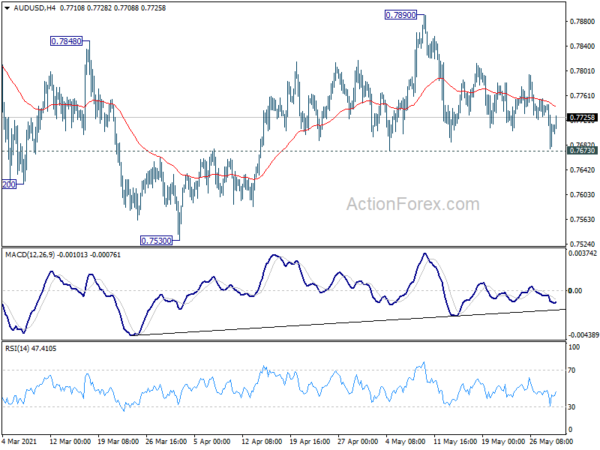

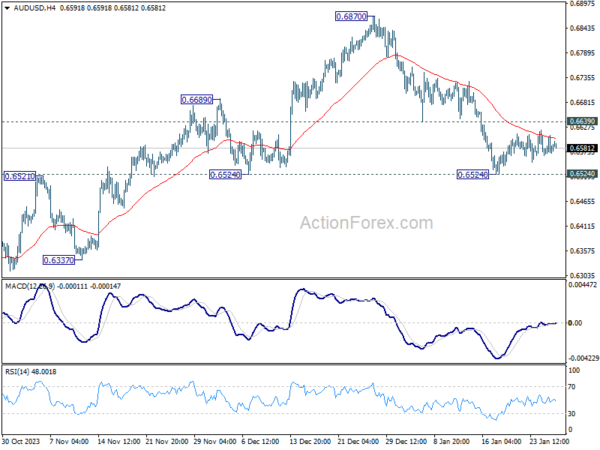

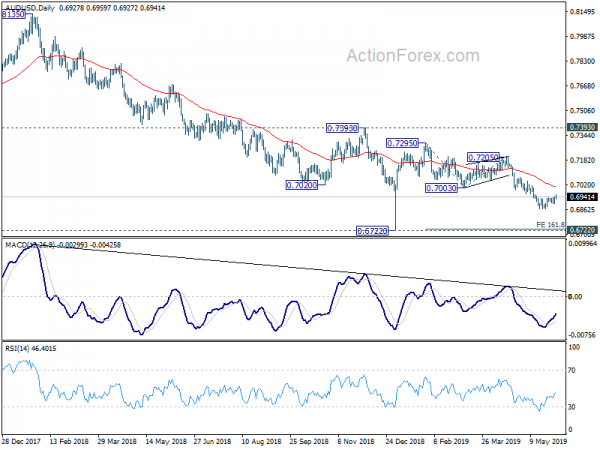

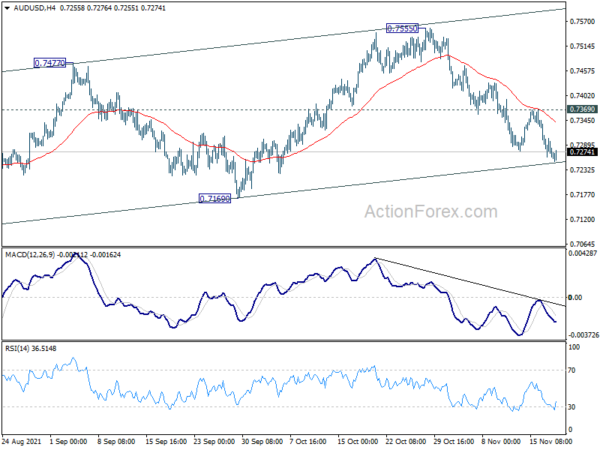

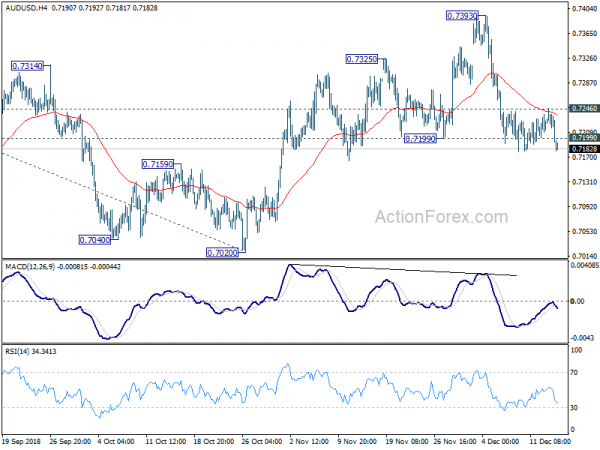

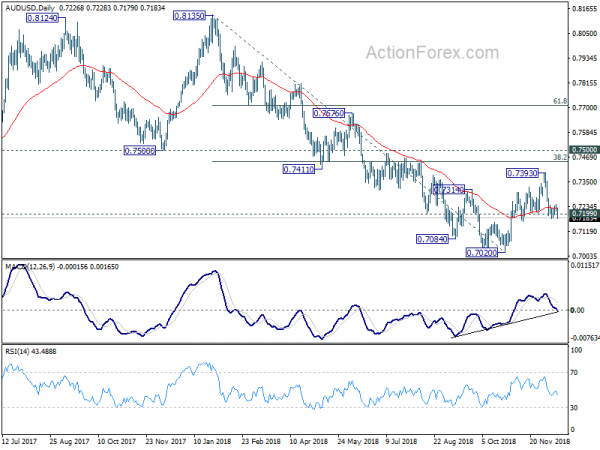

AUD/USD drops mildly but stays in consolidation from 0.7288. Intraday bias remains neutral for the moment. Outlook stays bearish as long as 0.7443 resistance holds. On the downside, break of 0.7288 will resume the fall from 0.8006 to 161.8% projection of 0.8006 to 0.7530 from 0.7890 at 0.7120 next. On the upside, break of 0.7443 will bring stronger rebound to 0.7530 support turned resistance instead.

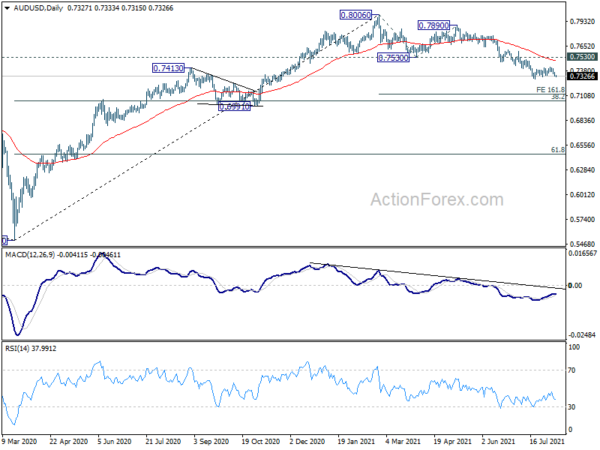

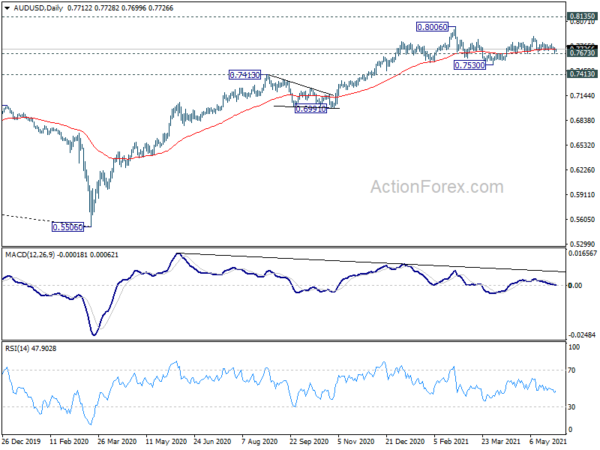

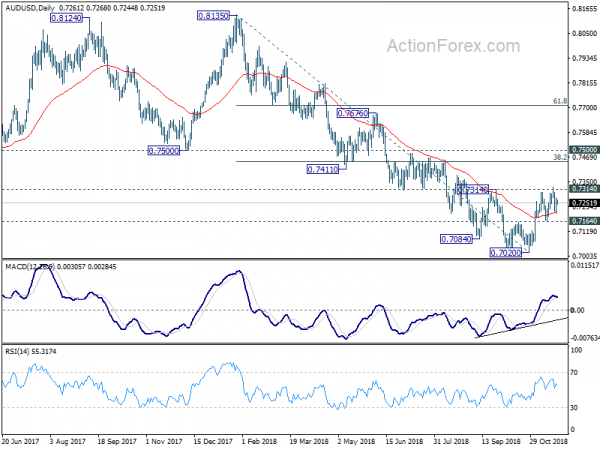

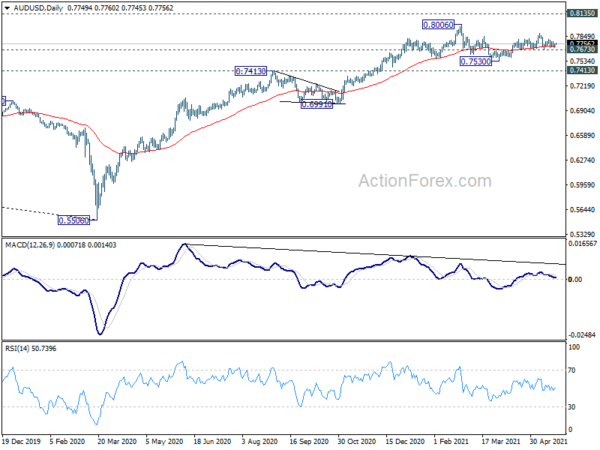

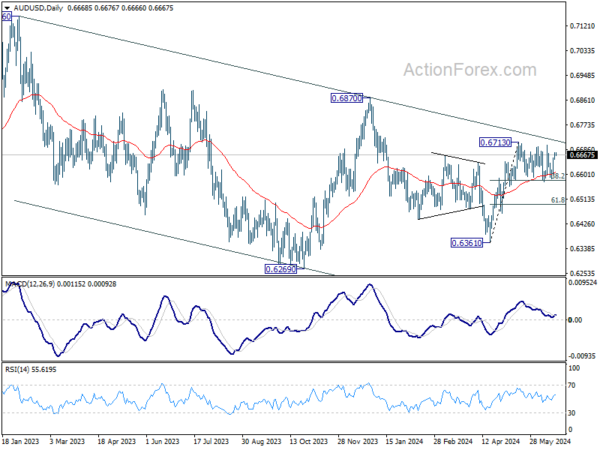

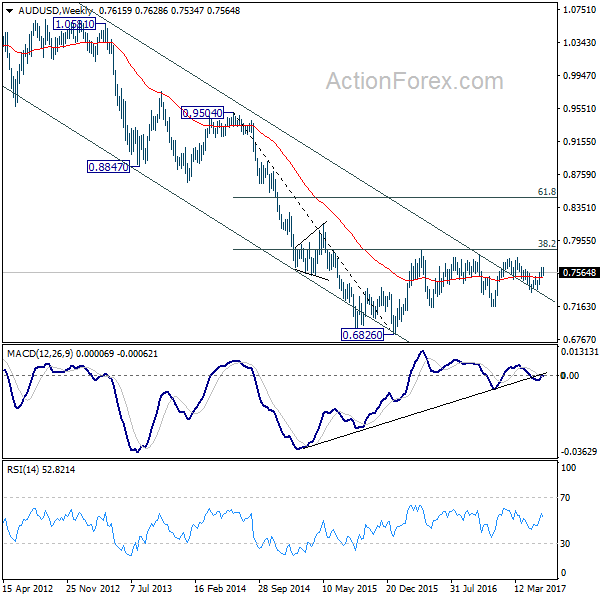

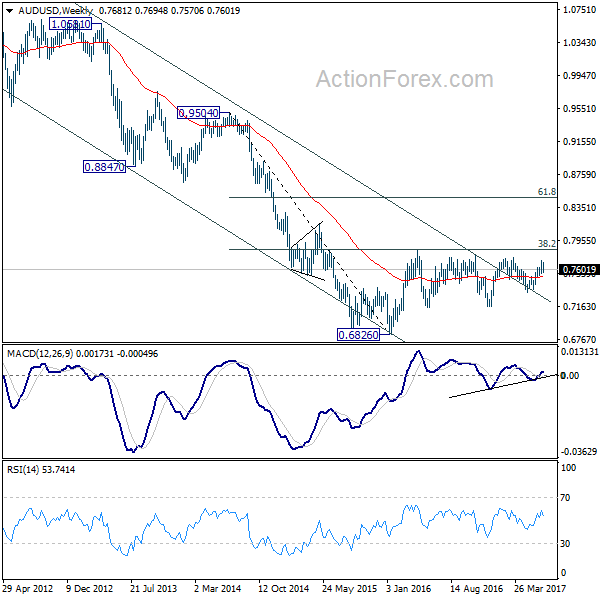

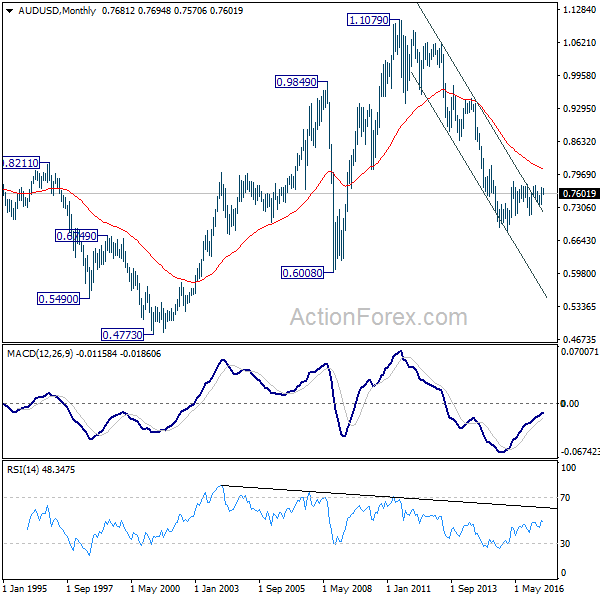

In the bigger picture, rise from 0.5506 medium term bottom could have completed at 0.8006, after failing 0.8135 key resistance. Correction from there could target 0.6991 cluster support (38.2% retracement of 0.5506 to 0.8006 at 0.7051). We’d look for strong support from there to bring rebound. However, sustained break of this level would argue that the whole medium term trend has indeed reversed.