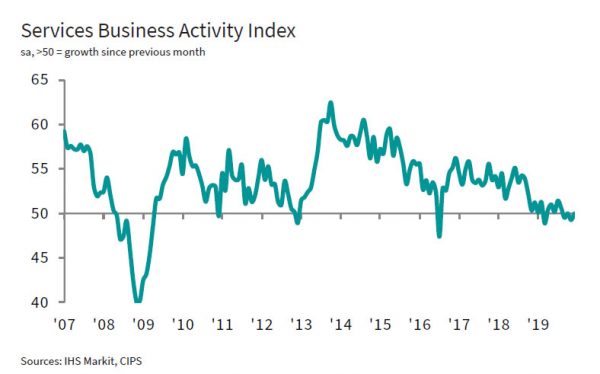

UK PMI Services was finalized at 50.0 in December, up from November’s 49.3. PMI Composite was unchanged at 49.3. Stabilization of the service sector was offset by a sharp and accelerated decline in manufacturing output (index at 45.6).

Tim Moore, Economics Associate Director at IHS Markit, which compiles the survey:

“Service companies widely commented on delayed spending decisions and a headwind to sales from domestic political uncertainty in the run-up to the general election. With manufacturing and construction output also subdued in December, the latest PMI surveys collectively signal an overall stagnation of the UK economy at the end of 2019. “However, the latest UK service sector figures are an improvement on those seen in November and strike a slightly more positive tone than the earlier ‘flash’ PMI for December. The final IHS Markit/CIPS UK Services data includes survey responses from after the election, unlike the earlier flash estimate.

“It is notable that the forward-looking business expectations index is now the highest since September 2018 and comfortably above its ‘flash’ reading for December. The modest rebound in new work provides another signal that business conditions should begin to improve in the coming months, helped by a boost to business sentiment from greater Brexit clarity and a more predictable political landscape.”

Swiss CPI slows to 1.3% yoy in Jun, vs exp 1.4% yoy

Swiss CPI rose 0.0% mom in June, below expectation of 0.1% mom. Core CPI (excluding fresh and seasonal products, energy and fuel) fell -0.1% mom. Domestic product prices rose 0.2% mom while imported products prices fell -0.5% mom.

For the 12-month period, CPI rose 1.3% yoy, slowed from prior month’s 1.4% yoy, below expectation of 1.4% yoy. Core CPI slowed from 1.2% yoy to 1.2% yoy. Domestic products prices growth was unchanged at 2.0% yoy. Imported products prices fell -0.8% yoy, down from May’s -0.6% yoy.

Full Swiss CPI release here.