In a session with the Treasury Select Committee today, BoE Governor Andrew Bailey acknowledged that It’s “not unreasonable” for the market to think about reductions in interest rates this year

However, he was quick to qualify this by stating that MPC “do not endorse the market curve” forecasting such cuts, adding that “we are not making a prediction of when or by how much” BoE cuts interest rates.

Bailey pointed to “encouraging signs” in key economic indicators, but stressed the importance of “sustained progress” in tackling inflation.

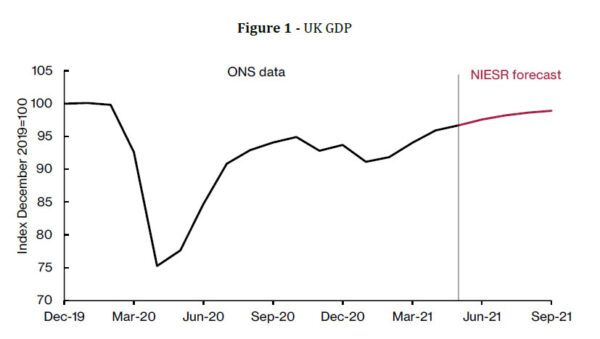

Addressing recent data indicating the UK’s entry into a technical recession in the latter half of the previous year, Bailey downplayed its impact, describing the downturn as “very weak” and pointing to “distinct signs of an upturn.”

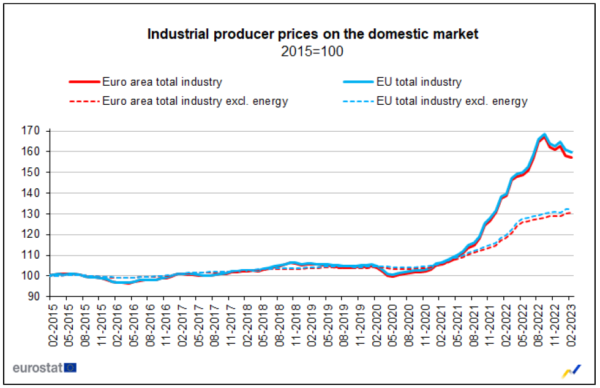

ECB Rehn: Weakening outlook justifies significant and impactful stimulus in Sep

ECB Governing Council member Olli Rehn said, “there is a certain weakening of the economic outlook for Europe in the last couple of months”. And, the backdrop “justifies taking further action in monetary policy, as we intend to do in September.”

He added, “it’s important that we come up with a significant and impactful policy package in September” monetary policy meeting. He added, “when you’re working with financial markets, it’s often better to overshoot than undershoot, and better to have a very strong package of policy measures than to tinker.”.

On the composition of the stimulus, Rehn said A package of several measures “has a stronger impact than sequencing various measures over time,” due to synergies between different policy tools. Currently, markets are expected a -10bps cut to the key interest rate from current -0.4%. Also, ECB could restart asset purchase program with fresh EUR 50B per month buying.