Live Comments

US retail sales stall in December, consumption ends 2025 on softer note

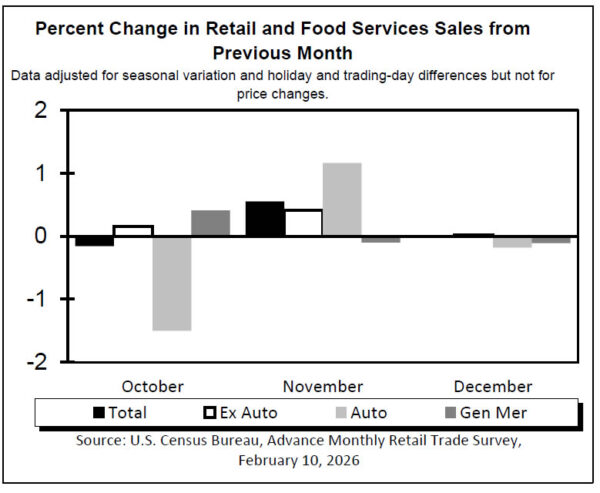

US retail sales stalled in December, adding to signs that consumer momentum cooled into year-end. Headline sales were flat month-on-month at USD 735B, undershooting expectations for a 0.4% rise and marking a clear slowdown after earlier resilience.

The softness was broad-based. Retail sales excluding autos were also unchanged at USD 596B, missing forecasts for a 0.4% increase. Ex-gasoline sales were flat at USD 682B.

That said, the broader trend remains less alarming. Total retail sales for the October–December 2025 period were up 3.0% year-on-year, pointing to moderation rather than contraction.

ECB research sees tariffs as disinflationary shock

ECB research published in a blog post argued that tariffs are more likely to drag on inflation than fuel it, as the hit to demand outweighs any inflationary impact from disrupted supply chains. ECB economists found that weaker export demand exerts a net disinflationary effect on the Eurozone economy.

According to the study, a tariff-related shock that reduces Eurozone exports to the US by 1% ultimately lowers the consumer price level by around 0.1%, with the effect peaking roughly one and a half years after the shock. The analysis comes as trade data already show material deterioration. In the latest three months for which figures are available, Eurozone exports to the U.S. were down around 6.5% compared with a year earlier.

For policy, the ECB noted that sectors hit hardest by tariffs — including machinery, autos and chemicals — are also among the most sensitive to interest rate changes. Output in these industries may fall sharply after trade shocks, but responds strongly to lower borrowing costs.

"We find that this pattern holds for about 60% of the sectors we study – representing roughly 50% of total average euro zone industrial output and of total goods exports to the United States," the economists said.

ECB’s de Guindos plays down CPI undershoot, shrugs off Euro strength

ECB Vice President Luis de Guindos downplayed concerns over January’s softer inflation print. In an interview with Econostream Media, he said that headline inflation dipping below 2% in early 2026 had been clearly signalled well in advance. He cautioned against overreacting to individual releases, arguing that markets tend to fixate on small deviations. However, "the overall trend is in line with what we had projected," he emphasized

Energy prices came in lower than expected, but de Guindos highlighted elevated volatility in that component. Services inflation continues to move in the “right direction.” Minor downside surprises in services, he said, are not policy-relevant.

On the currency side, de Guindos reiterated that the ECB does not target EUR/USD, but acknowledged its importance for an open economy. Euro’s pullback toward the long-standing 1.16–1.18 range was described as unsurprising and fully embedded in the ECB’s projections.

Even with recent euro gains largely reflecting US dollar weakness, de Guindos played down the implications. The move, he said, “deserves attention” but is far from "dramatic", signalling that exchange-rate developments are unlikely to disrupt the ECB’s wait-and-see stance unless they become materially more persistent or disorderly.