Live Comments

BoE’s Pill urges to look past April inflation dip

BoE Chief Economist Huw Pill cautioned against drawing "too much comfort" from the near-term dip in inflation expected later this year. Speaking at an event today, Pill said the downside in short-term inflation dynamics was partly created by "fiscal measures" announced last November and risks obscuring the more persistent forces shaping longer-term price pressures.

Drawing a parallel with 2025, Pill said the Bank of England had previously looked through a temporary inflation spike caused by regulatory changes, and should apply the same logic to the projected drop to 2% in April when lower regulated energy prices take effect.

He stressed that monetary policy must remain focused on addressing persistence in inflationary pressures beyond these temporary effects. Pill was among the narrow 5–4 majority on the MPC who voted to keep Bank Rate unchanged at 3.75% this week.

BoE survey sees gradual rate cuts, higher gilt yields ahead

According to the BoE’s latest Market Participants Survey, investors expect a steady easing cycle over the next year. Respondents see Bank Rate gradually reduced from the current 3.75% to around 3.0% by the March 2027 meeting, pointing to confidence that disinflation will allow policy to ease without urgency.

Despite expectations for lower rates, views on quantitative tightening were unchanged. The median forecast for gilt sales over the 12 months from October remained at GBP 50 billion.

At the same time, participants revised up their outlook for long-term yields. The median expectation for 10-year gilt yields at end-2026 rose to 4.25%, from 4.0% previously, indicating that while policy rates are expected to fall, investors see structural or fiscal factors keeping longer-dated yields elevated.

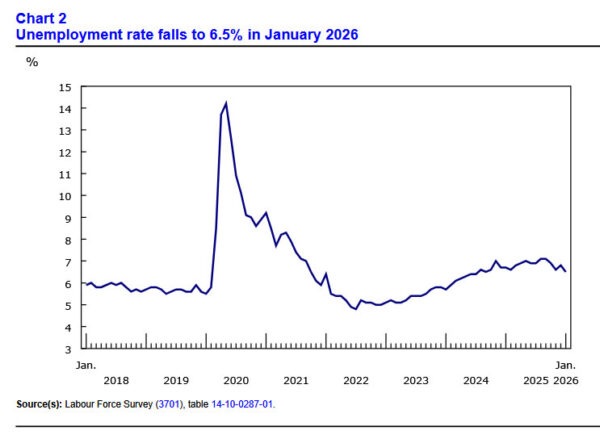

Canada employment falls -25k, participation drop drives unemployment rate down to 6.5%

Employment in Canada fell by -25k in January, a sharp miss versus expectations for a modest 7k gain and a clear sign of near-term labor market softness. The decline was driven by a steep drop in part-time jobs (-70k), which more than offset gains in full-time employment (45k).

Meanwhile, Headline unemployment fell sharply from 6.8% to 6.5%, beating expectations of 6.8%, and marking its lowest level since September 2024. However, the improvement was driven by a sizeable drop in labor force participation rather than stronger hiring, with the participation rate falling 0.4ppt to 65.0%. Employment rate slipped from 60.9%. to 60.8%, its first decline since August.

Wage pressures continued to ease at the margin. Average hourly wages rose 3.3% yoy, down slightly from December's 3.4% yoy.