Trump suddenly announced on late Friday evening that the US has reached agreement with Mexico on migration issue. Hence, the proposed tariffs will be “indefinitely suspended”. He hailed that Mexico has has agreed to take strong measures to stem the tide of Migration through Mexico, and to our Southern Border. This is being done to greatly reduce, or eliminate, Illegal Immigration coming from Mexico and into the United States.”

The news should be welcomed by the markets. But at the same time, it might raise a big question. That is, is an “insurance cut” by Fed still needed?

US and Mexico also released a joint statement on the agreement. Full text below:

U.S.-Mexico Joint Declaration

The United States and Mexico met this week to address the shared challenges of irregular migration, to include the entry of migrants into the United States in violation of U.S. law. Given the dramatic increase in migrants moving from Central America through Mexico to the United States, both countries recognize the vital importance of rapidly resolving the humanitarian emergency and security situation. The Governments of the United States and Mexico will work together to immediately implement a durable solution.

As a result of these discussions, the United States and Mexico commit to:

Mexican Enforcement Surge

Mexico will take unprecedented steps to increase enforcement to curb irregular migration, to include the deployment of its National Guard throughout Mexico, giving priority to its southern border. Mexico is also taking decisive action to dismantle human smuggling and trafficking organizations as well as their illicit financial and transportation networks. Additionally, the United States and Mexico commit to strengthen bilateral cooperation, including information sharing and coordinated actions to better protect and secure our common border.

Migrant Protection Protocols

The United States will immediately expand the implementation of the existing Migrant Protection Protocols across its entire Southern Border. This means that those crossing the U.S. Southern Border to seek asylum will be rapidly returned to Mexico where they may await the adjudication of their asylum claims.

In response, Mexico will authorize the entrance of all of those individuals for humanitarian reasons, in compliance with its international obligations, while they await the adjudication of their asylum claims. Mexico will also offer jobs, healthcare and education according to its principles.

The United States commits to work to accelerate the adjudication of asylum claims and to conclude removal proceedings as expeditiously as possible.

Further Actions

Both parties also agree that, in the event the measures adopted do not have the expected results, they will take further actions. Therefore, the United States and Mexico will continue their discussions on the terms of additional understandings to address irregular migrant flows and asylum issues, to be completed and announced within 90 days, if necessary.

Ongoing Regional Strategy

The United States and Mexico reiterate their previous statement of December 18, 2018, that both countries recognize the strong links between promoting development and economic growth in southern Mexico and the success of promoting prosperity, good governance and security in Central America. The United States and Mexico welcome the Comprehensive Development Plan launched by the Government of Mexico in concert with the Governments of El Salvador, Guatemala and Honduras to promote these goals. The United States and Mexico will lead in working with regional and international partners to build a more prosperous and secure Central America to address the underlying causes of migration, so that citizens of the region can build better lives for themselves and their families at home.

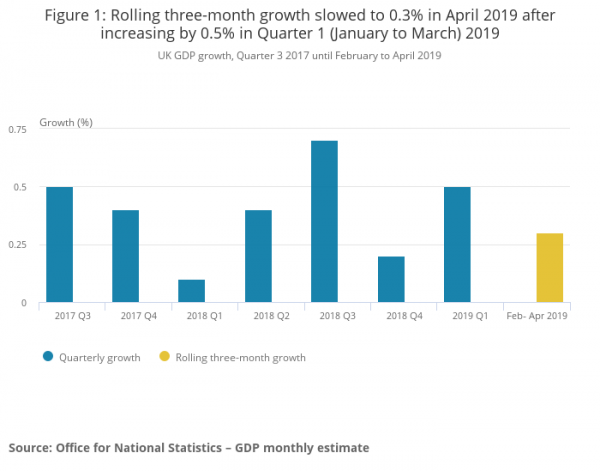

NIESR: UK GDP to contract -0.2% in Q2 on production and construction

NIESR said the UK economy is course to contract by -0.2% in Q2, “mainly driven by the production and construction sectors”. That would be a “marked slowdown” from Q1 when growth was boosted by pre-Brexit “stockbuilding”. It added that recent surveys suggests “there has not been a material recovery in output in May”.

Garry Young, Head of Macroeconomic Modelling and Forecasting, said “The latest GDP data were weaker than expected, partly reflecting shifts in production around the original Brexit departure date, including a 24 per cent fall in car manufacturing. The underlying picture is also quite weak, with Brexit-related uncertainty at home and trade tensions abroad dragging on investment spending and economic growth”.

Full release here.