While indicators certainly have a place, very little trumps good old fashioned market structure.

As you’ll see demonstrated in the following article, building trading ideas off basic market structure can be surprisingly easy, and more importantly, profitable!

Price movement

As much as we’d all love to see price trade linearly, particularly if one has a position in that direction, it’s just not how the market functions.

As the ocean rises and falls along a shoreline, price action ebbs and flows in a similar manner. This can be observed on any timeframe from as low as the 1 minute chart right up to the monthly scale.

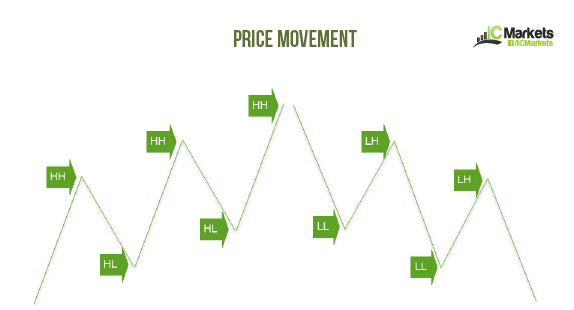

Below is a visual representation of basic market movement, comprised of four key swing points:

- HH – Higher high

- HL – Higher low

- LL – Lower low

- LH – Lower high

On a live chart, however, things are a little more complicated. Between the main swing points one also has to contend with minor-league swing points, which tend to cause confusion. For that reason, you may want to consider minimizing (zooming out from) the charts slightly. You’ll see this in action on the 1 minute chart of the EUR/USD posted below. Notice the clear alternating swings between lower lows and lower highs in motion.

While we may very well see a down trending market on the M1 timeframe, as per above, higher timeframes may (and very commonly do) trend in the opposite direction. This is the fractal nature of the market.

As demonstrated on the EUR/USD H4 chart below we had a brief period of LLs and LHs during September and October. The market, nevertheless, recovered in November and went on to chalk up multiple higher highs and higher lows. Using this structural approach one can identify trending markets.

Using basic structure can I forecast potential trend reversals?

There is NO methodology that can identify a trend reversal 100% of the time. This is impossible!

With that being said, using the basic principles shown above one can accurately determine where the buyers/sellers are gaining strength. This could lead to an eventual trend change.

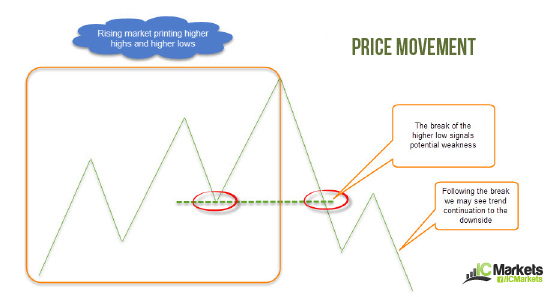

A market that’s pencilling in a series of higher highs and higher lows (referred to as an uptrend) will generally attract buyers looking to join this trending movement, and rightly so. But what happens when a higher low is unable to sustain its upside presence and drops lower, printing a lower low? This can be interpreted as a possible trend change to the downside (referred to as a downtrend). Here’s a pre-drawn image to show what we mean:

And here’s the same formation on a live chart of the H1 AUD/JPY:

How can I take advantage of this movement?

There are a myriad of ways one can use this knowledge to their advantage, but let’s remember that it all begins with basic market structure and builds from there. Here are a couple of methods one could potentially consider:

- In terms of a rising market, one will naturally expect price to pullback and eventually form a higher low. Knowing this, initiating long positions in-line with market structure at Fibonacci sweet spots could be an option. For those of you who do not know, Fib sweet spots, in our technical book, are the 61.8% and 38.2% values. Using the same chart posted above (AUD/JPY H1), notice how on the pullbacks both of these Fib values played key roles in supporting the market before probing higher:

- Using the same chart one could also look to combine Fib sweet spots with support/resistance zones. We touch on this concept here: Support and Resistance. On the chart below, we demonstrate the effectiveness of fusing support and resistance areas with basic market structure and Fibonacci points. In regard to the upper level, however, we were unable to pin point any form of support and resistance, only a Fib support. Despite this, as you can see, we have clearly identified three potential buy zones, built off basic market structure.

Is it worth focusing on basic structure?

It certainly is!

Mapping out your charts and basing trading ideas off of market structure is an incredibly organized approach to trading the markets.

Give it a try! You may be surprised how simple it really can be.