Among technical analysts, moving averages (MA) are one of the more commonly used indicators. In the right hands, these tools can be exceedingly powerful!

The two most popular moving averages are the simple moving average (SMA) and the exponential moving average (EMA), and therefore, will be the central focus of today’s piece.

So, what are moving averages?

Moving averages are a way of smoothing out price data over time.

As the indicator uses historic price points in its calculation, there is going to be a lag. A lagging indicator is a tool that changes only after the underlying instrument has begun to move. Think of it as a line that trails price action.

The simple moving average is calculated by adding the closing prices of an instrument over a number of time periods, and then dividing this total by the number of time periods.

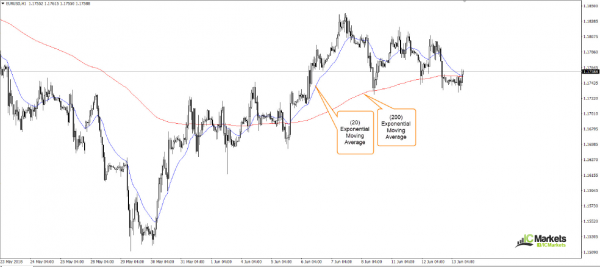

Below is a visual representation of two simple moving averages, one with a 200-period setting and the other with a 20-period value. Note that the longer the moving average settings, the more the lag. A 20-period moving average, for example, will spend its time hugging price action closely, rotating shortly after price turns. The 200-period moving average, on the other hand, will turn at a slower speed.

Think of the (20) moving average as a jet ski and a (200) moving average as a cruise ship.

The exponential moving average, although similar to the simple moving average, houses a subtle difference: more weight is given to the latest data in the calculation. Accounting for this, exponential moving averages tend to react faster to price movement. Below we’ve plotted two exponential moving averages on the same chart as above using the same values. Notice the difference?

Many uses

Trend identification. Some traders, particularly those new to the business, favour using moving averages as a way of identifying a trending market, or one that may be on the verge of reversing.

Put simply, when price action crosses above/below your chosen moving average, this suggests a possible trend change may be on the horizon. As shown on the EUR/USD H1 chart below using a (200) exponential moving average, the indicator displays a potential trend change in play as price recently crossed above the moving average. Also worth noting is the fake signal seen around the 1.1965 region, which tend to be common viewing amid high-impacting news.

Entry confirmation

Alongside trend identification, moving averages can be used as a means of entry confirmation. Having two moving averages crossover can provide reliable buy and sell signals.

Long-term traders tend to opt for a 200/50 period setting, while intraday (shorter-term traders) target lower settings in the range of 50/20. When the shorter-term moving average crosses above/below its longer-term counterpart; a signal to engage is presented.

On the EUR/USD m15 timeframe displayed below, we have attached a (50) exponential moving average (red) along with a (20) exponential moving average (blue). The green arrows denote potential entry signals where the (20) moving average crosses its longer-term equivalent. However, like all things technical in the trading domain, nothing is guaranteed to work 100% of the time. Note the fake signal to sell short, circled in red. It can get particularly frustrating when multiple back-to-back false signals are generated. Another aspect to bear in mind is the spread between your chosen moving averages: the further apart they are, the stronger the trend is likely to be.

Like all moving averages, though, they often provide healthier signals in trending environments, offering potentially lucrative risk/reward opportunities.

Dynamic support and resistance

When one talks of support and resistance, they’re usually referring to horizontal lines. Dynamic support and resistance, however, can be found where a moving average intersects with price action.

Although dynamic support and resistance does work, using it in isolation is unreliable. In line with additional tools, on the other hand, the indicator can serve as a strong confirming point.

Still on the EUR/USD chart, only this time on the H4 timeframe, we’ve attached a (50) exponential moving average. As you can see, the moving average offered support and resistance to the market on multiple occasions, hence when one combines this tool with other price action concepts it can be a powerful aid.

Trailing technique

One of the simplest uses a moving average offers is determining where to place stop-loss orders when trailing a position. As the trade progresses and the moving average alters course, you can adjust your stop position behind the moving average as price moves in favour. This can provide one with fantastic return on risk.

Using the same H4 chart on the EUR/USD, we can see that if one would have managed to pin down a short sell at around the 1.2330 mark and trailed the position using the (50) exponential moving average, you would have been taken out at 1.1963. That’s nearly a 400-pip move.

Final words

We firmly believe moving averages have a place in one’s toolbox. However, we also believe they should be considered secondary indicators. For example, trades should never be initiated on the back of only a moving average. Instead they should be used as additional confirming tools to chart-based structure such as, supply and demand, round numbers etc.

This leaves only one question: what are the most reliable moving averages to select?

The answer, we’re afraid, is subjective and heavily debated among technical analysts. The best answer we can offer is research. Explore which moving averages best fits your personality and trading methodology and work from there.