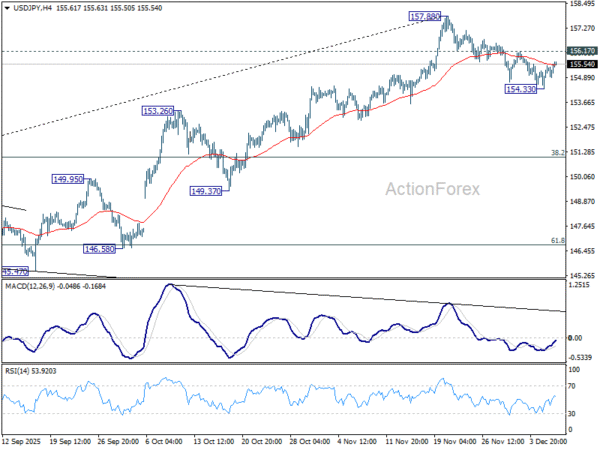

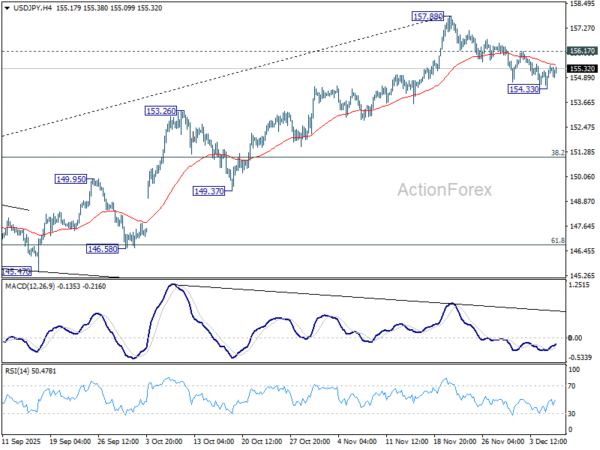

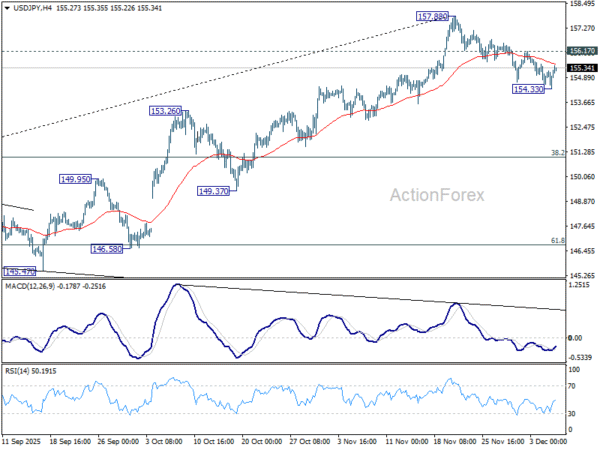

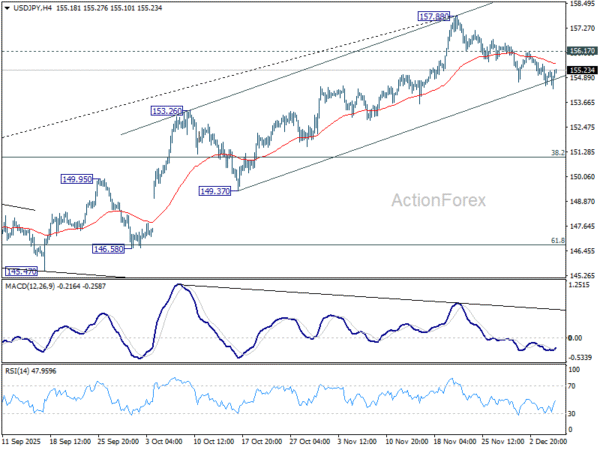

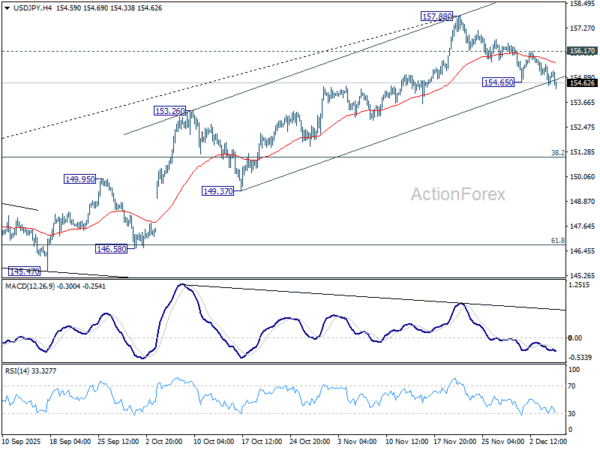

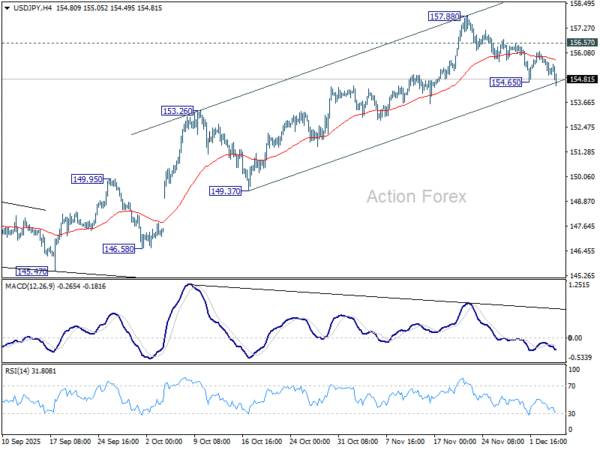

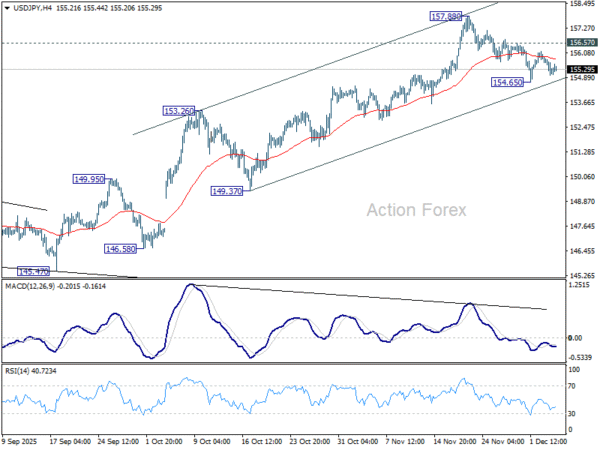

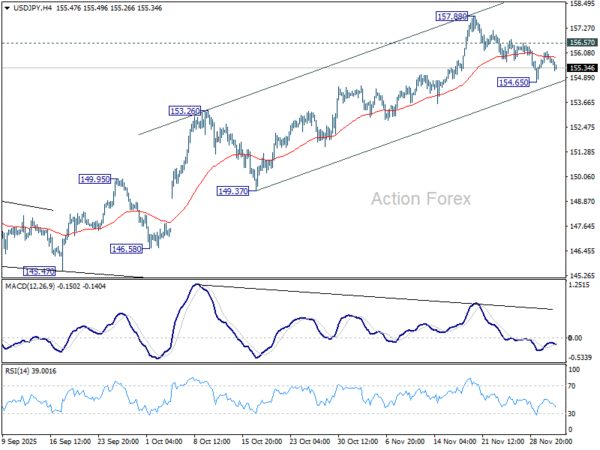

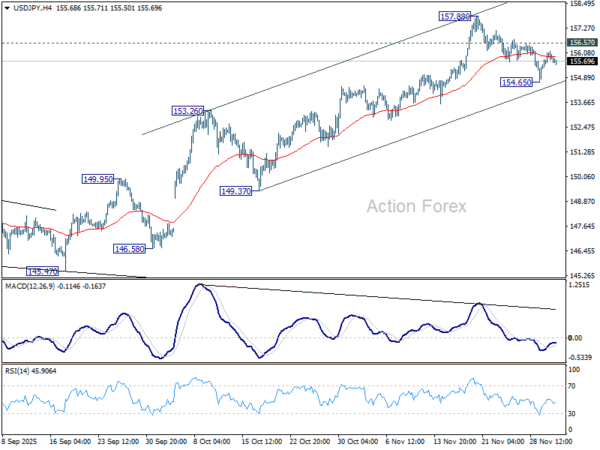

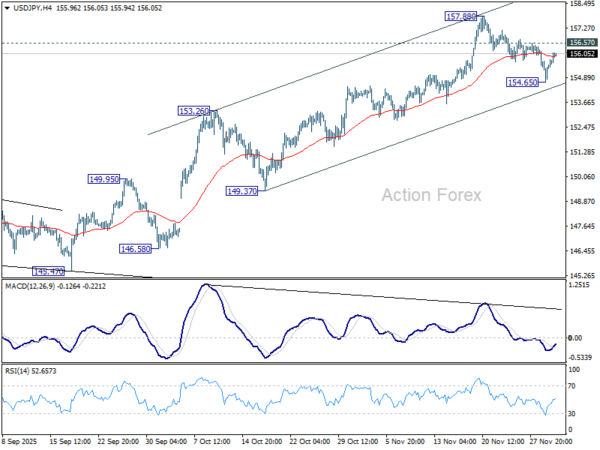

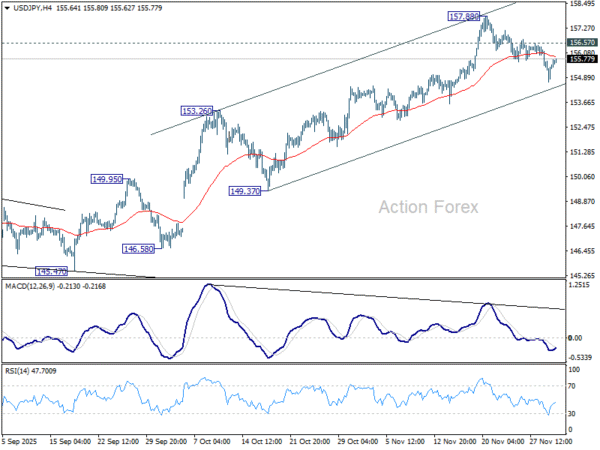

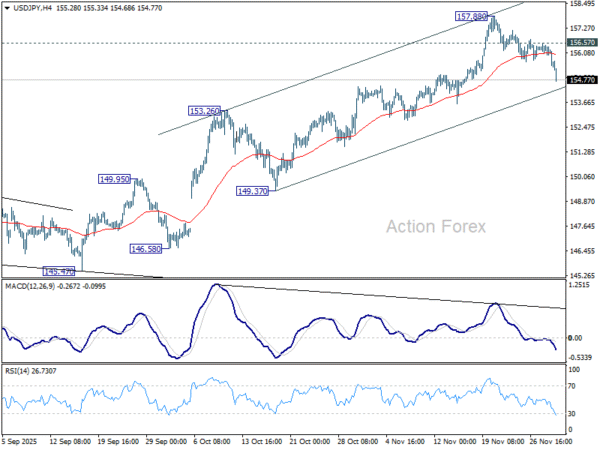

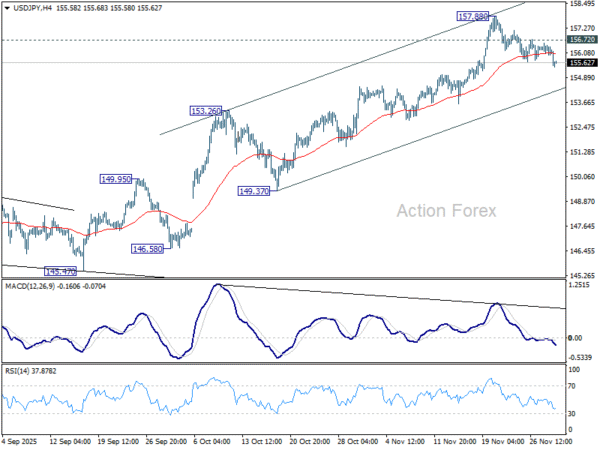

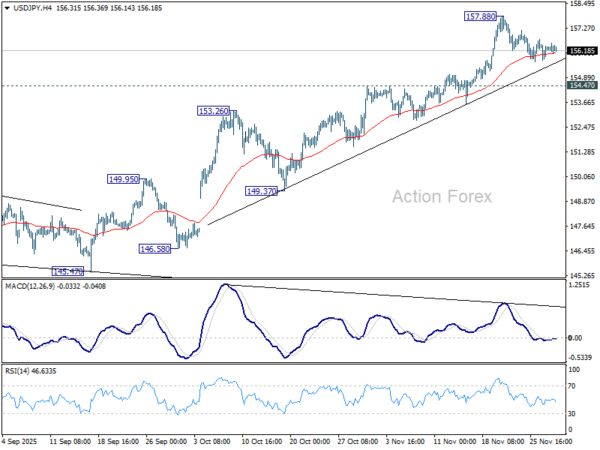

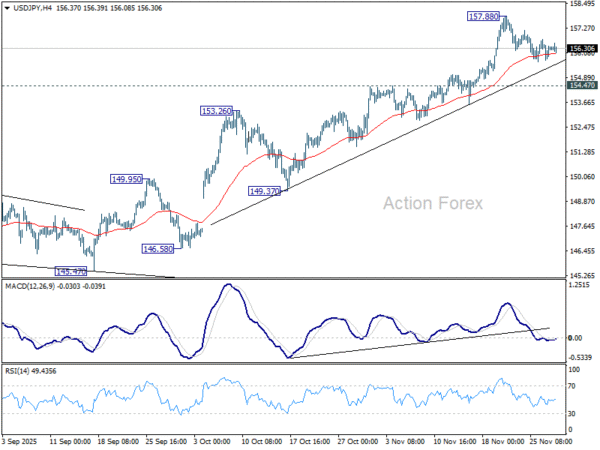

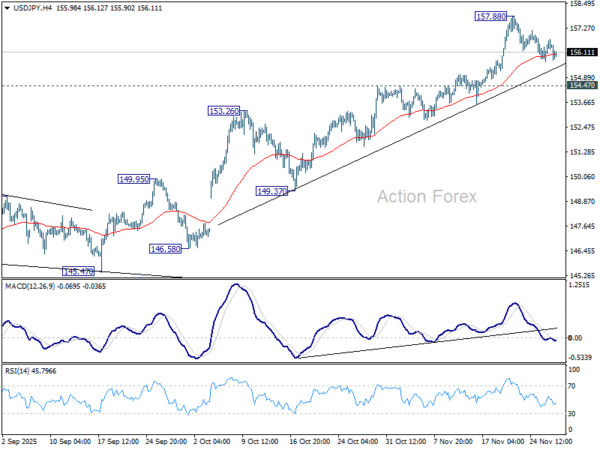

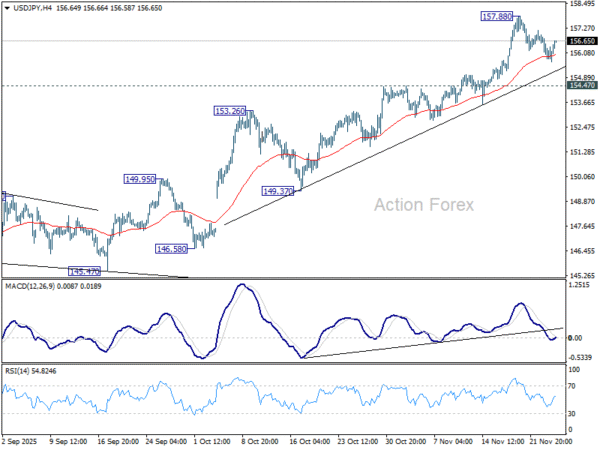

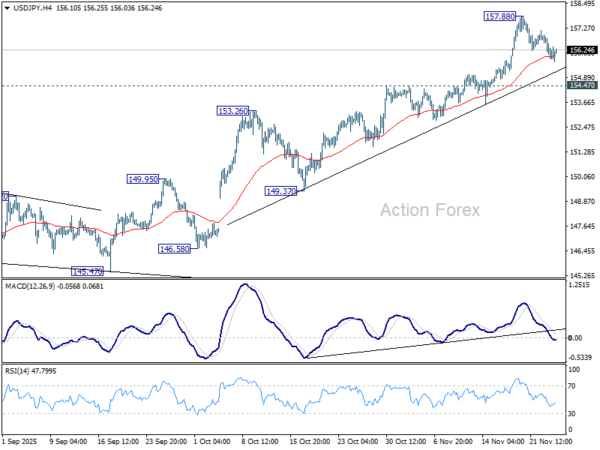

Daily Pivots: (S1) 154.66; (P) 155.07; (R1) 155.80; More…

No change in USD/JPY’s outlook and intraday bias stays neutral at this point. On the downside, below 154.33 will target 55 D EMA (now at 153.27). Firm break there will extend the fall from 157,88 short term top to 150.90 cluster (38.2% retracement of 139.87 to 157.88 at 151.00). On the upside, though, break of 156.17 resistance will indicate that the pullback has completed and bring retest of 157.88 high.

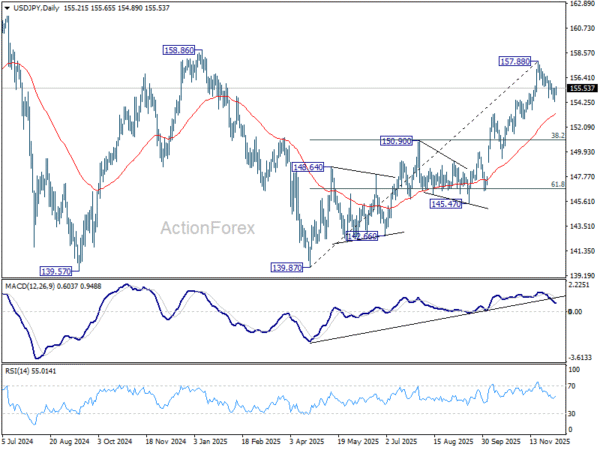

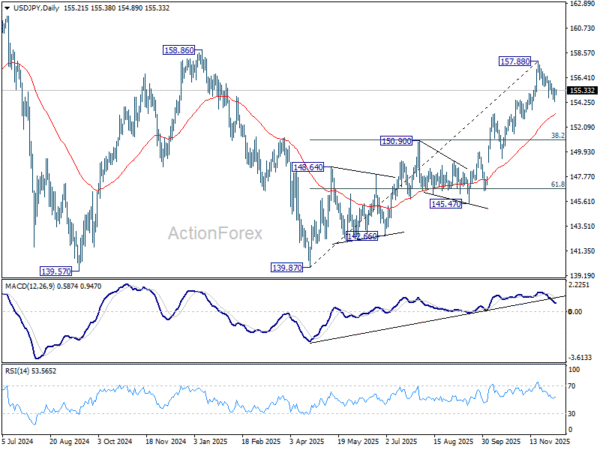

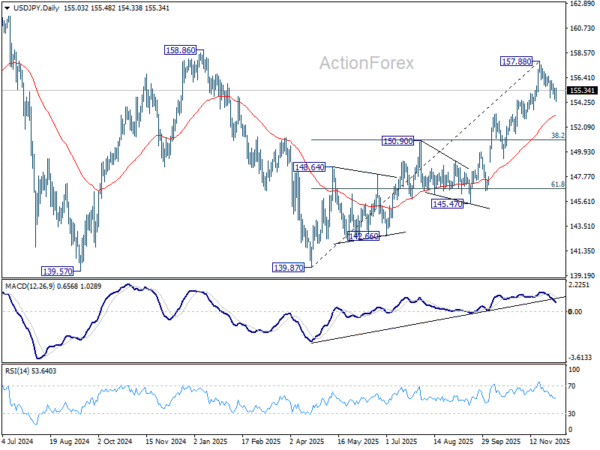

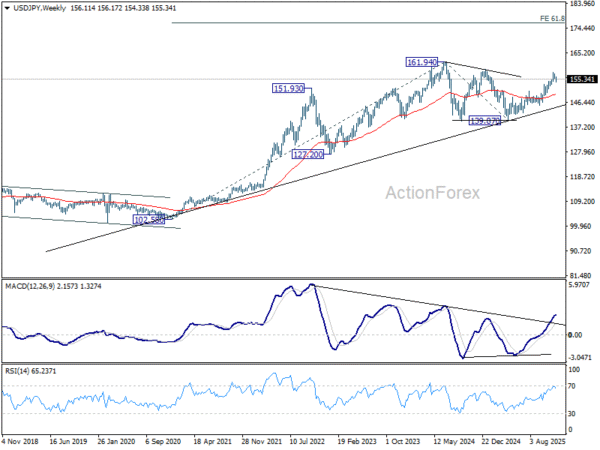

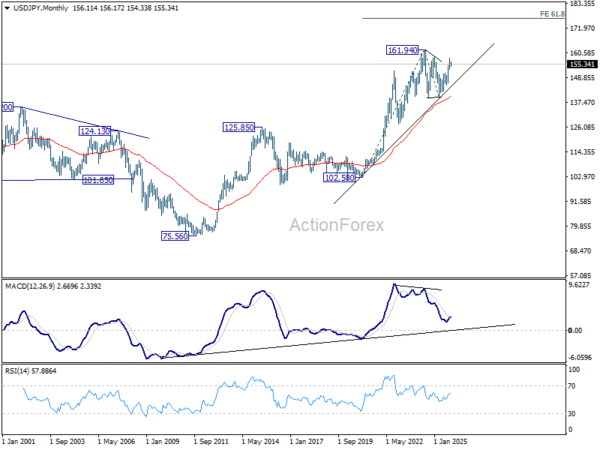

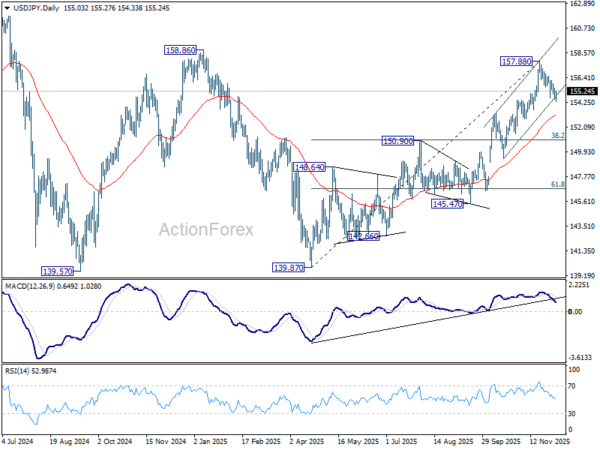

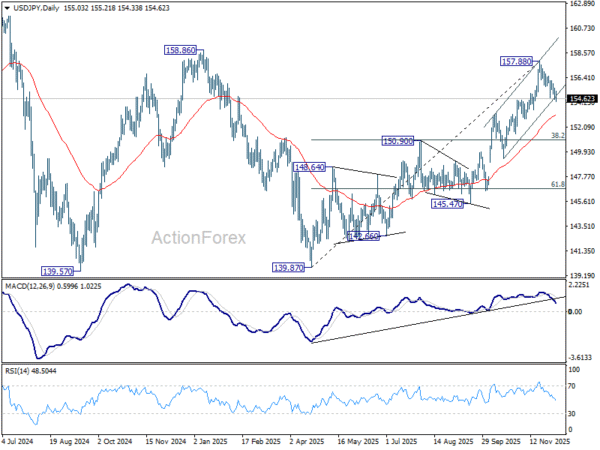

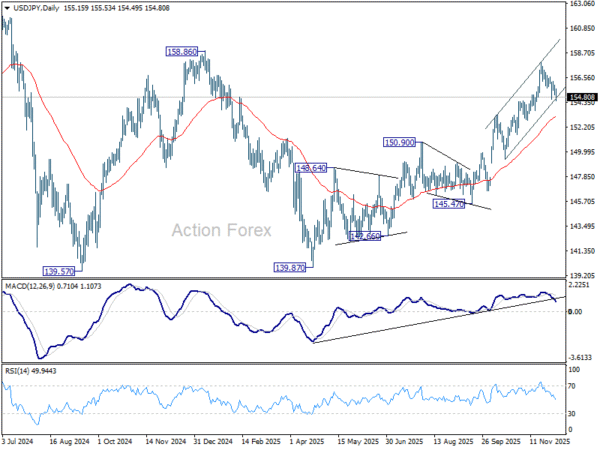

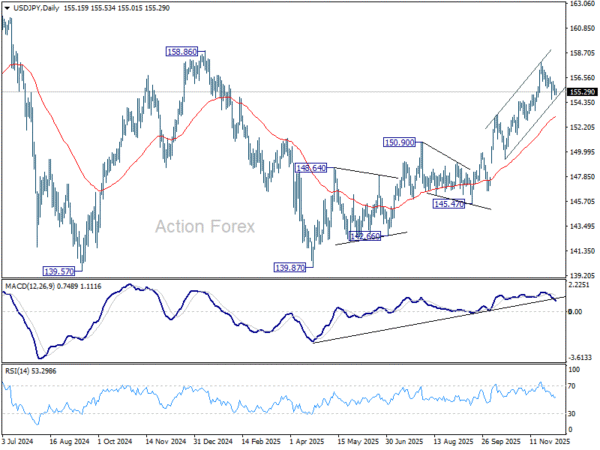

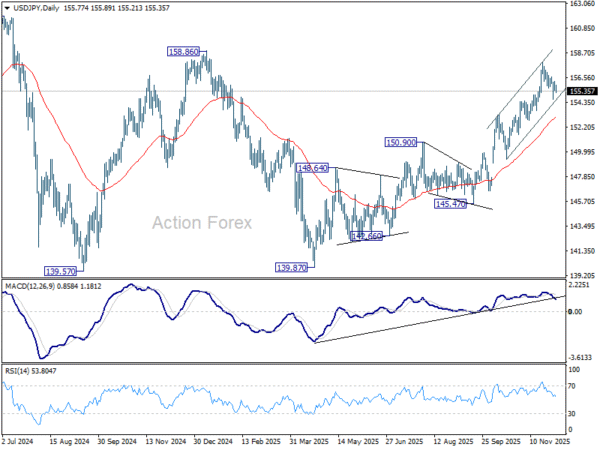

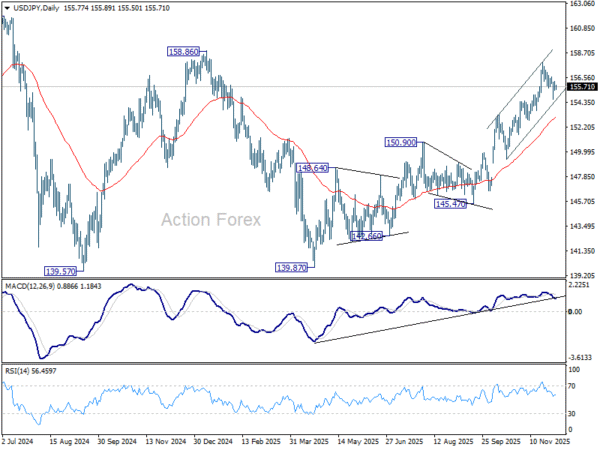

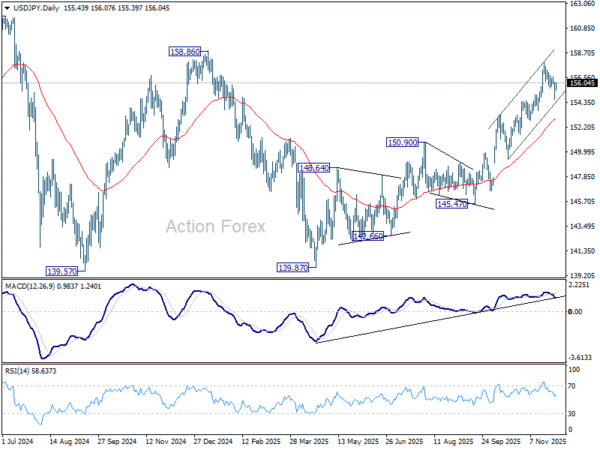

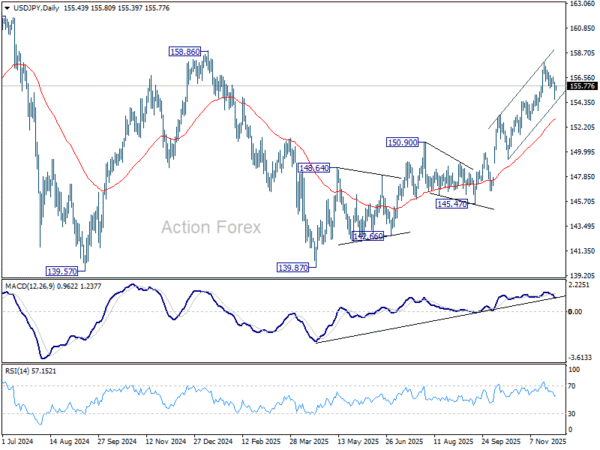

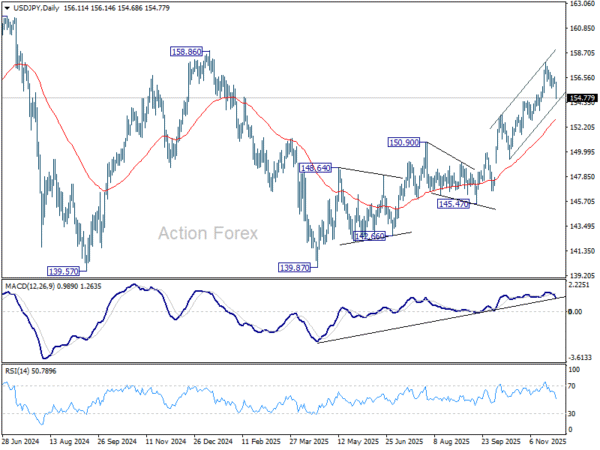

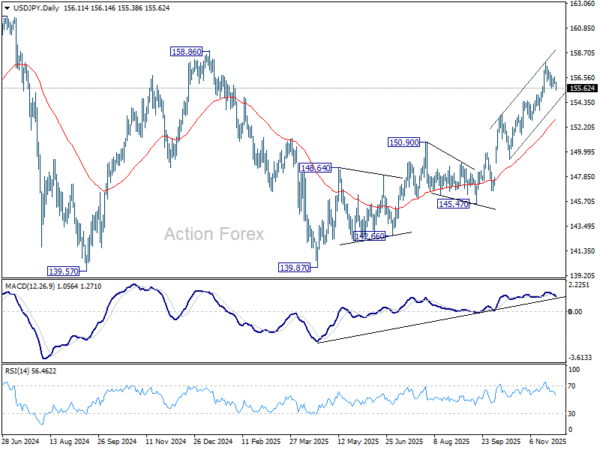

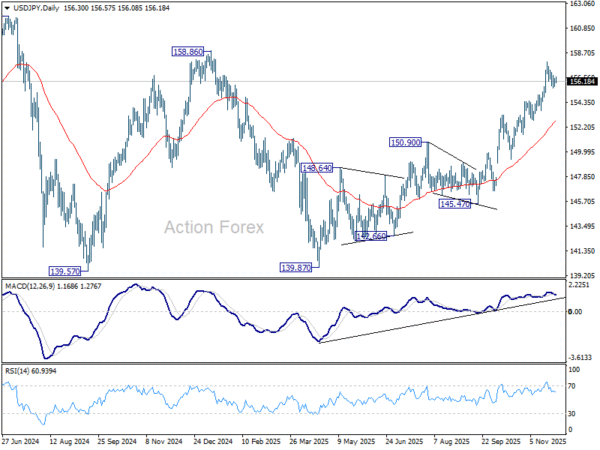

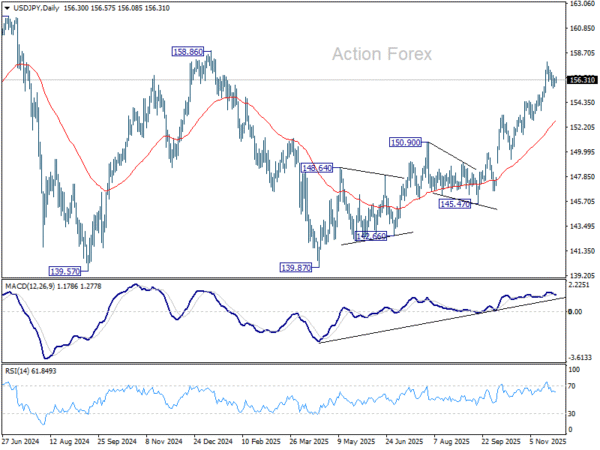

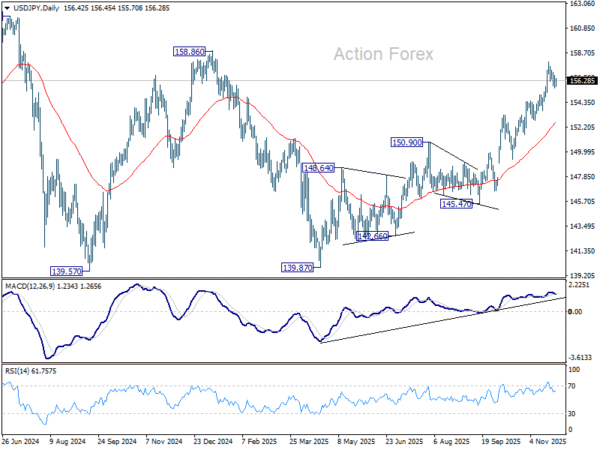

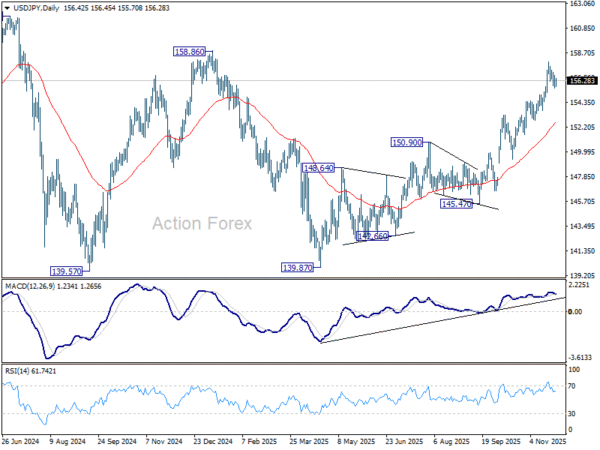

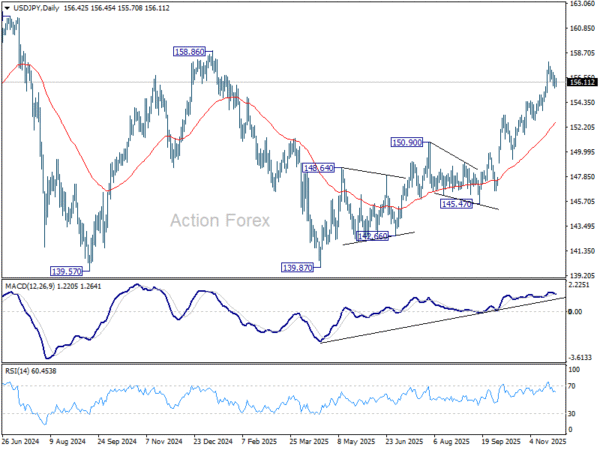

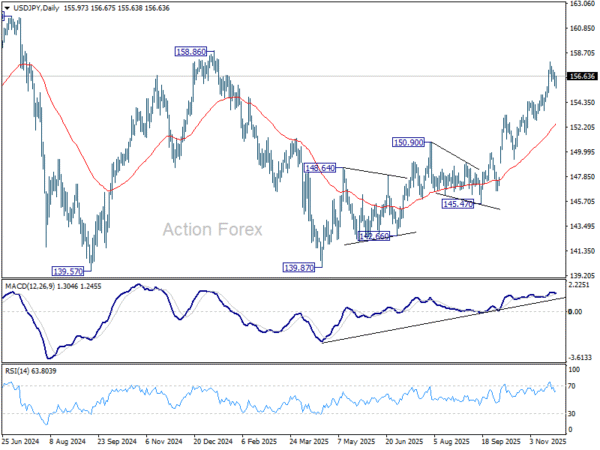

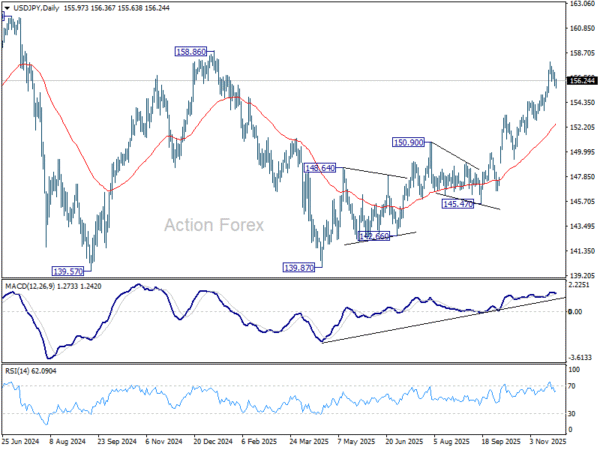

In the bigger picture, corrective pattern from 161.94 (2024 high) could have completed with three waves at 139.87. Larger up trend from 102.58 (2021 low) could be ready to resume through 161.94 high. Decisive break of 158.85 structural resistance will solidify this bullish case and target 161.94 for confirmation. On the downside, break of 150.90 resistance turned support will dampen this bullish view and extend the corrective range pattern with another falling leg.