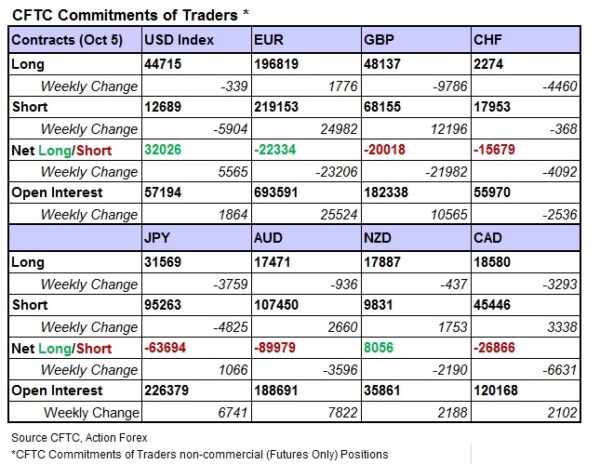

As suggested in the CFTC Commitments of Traders report in the week ended October 5, NET LENGTH of USD index futures rose +5 565 contracts to 32 026. Bets were trimmed on both sides. Concerning European currencies, EUR futures drifted to NET SHORT of 22 334. Speculative shorts rallied 24 982 contracts as the bloc is struggling with power shortage and protests were seen against higher electricity prices. GBP futures drifted back to NET SHORT of 20 018 contracts. High energy prices and supply chain disruption are expected to worsen in coming months, heightening the risks of stagflation.

On safe-haven currencies, NET SHORT of CHF future rose +4 092 contracts to 15 679 while that of JPY futures dropped -1 066 contracts to 63 694. Concerning commodity currencies, NET SHORT of AUD futures increased +3 596 contracts to 89 979. NET LENGTH for NZD futures dropped -2 190 contracts to 8 056 during the week. CAD futures’ NET SHORT jumped +6 631 contracts to 26 866.