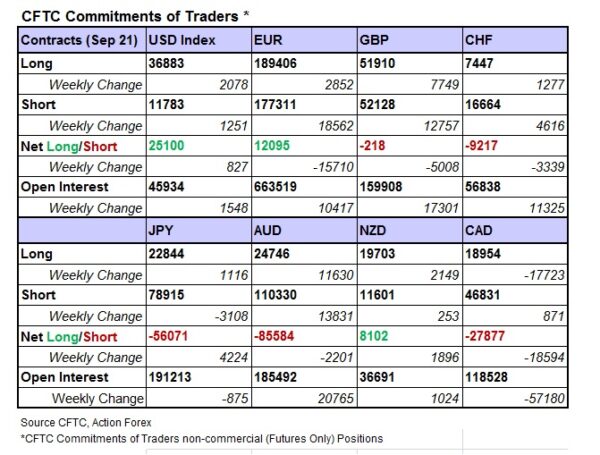

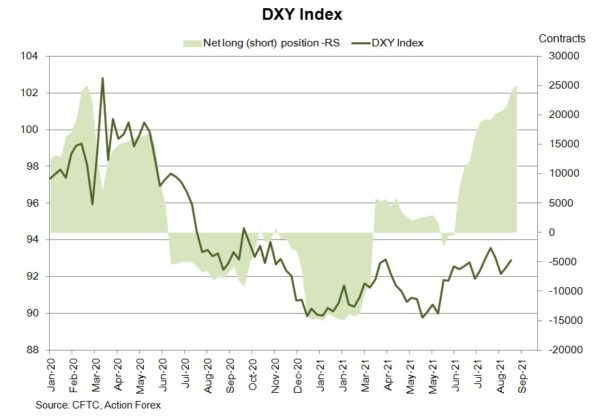

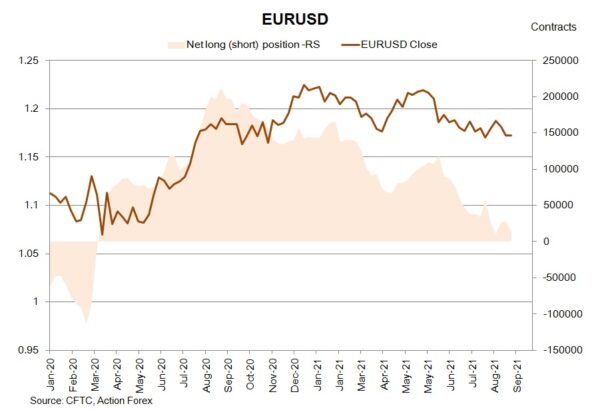

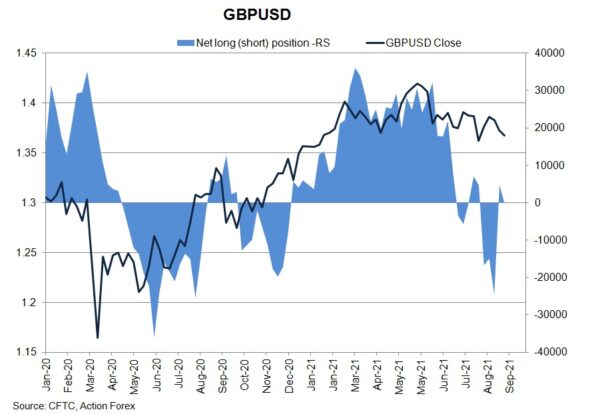

As suggested in the CFTC Commitments of Traders report in the week ended September 21, NET LENGTH of USD index futures ADDED +827 contracts to 25 100. The Fed signaled that QE tapering would coon “soon” while half of the committee members projected that rate hike would come as soon as next year. Concerning European currencies, NET LENGTH in EUR futures sank -15 710 contracts to 12 095. GBP futures drifted back to NET SHORT of -218 contracts. British pound got dumped until the BOE meeting delivered a slightly more hawkish bias.

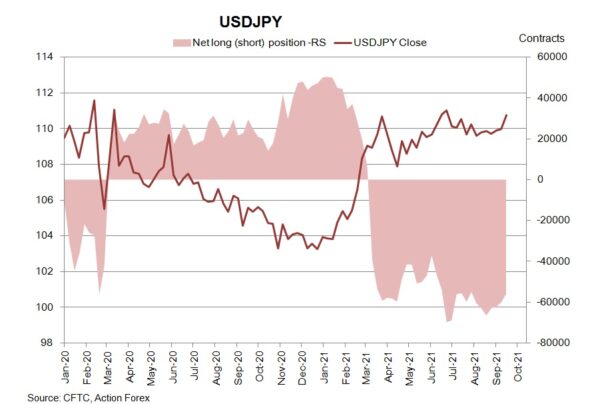

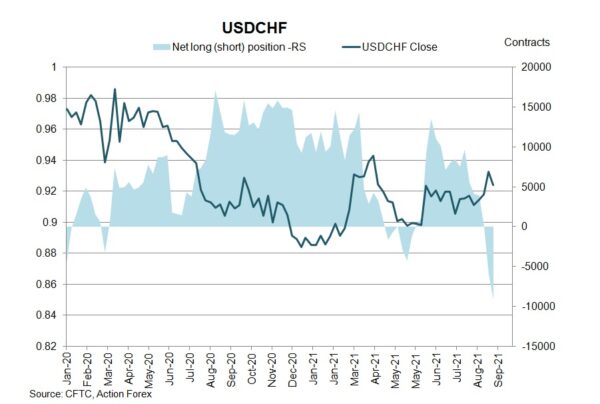

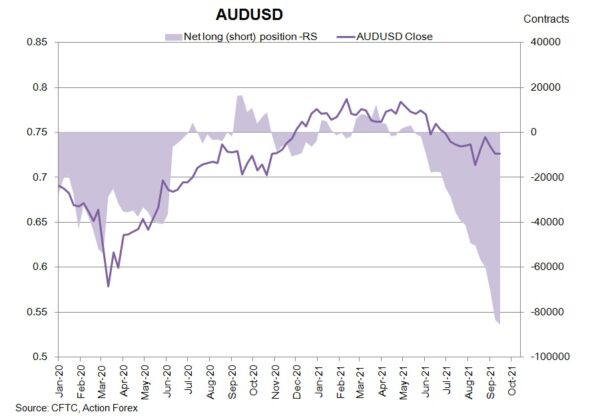

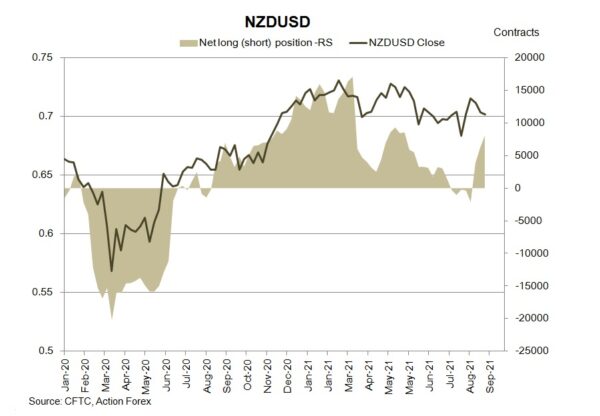

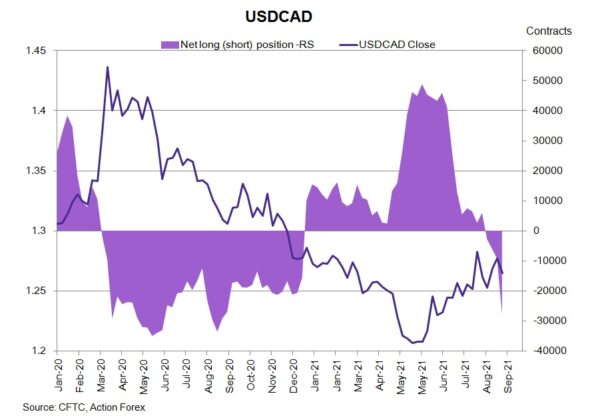

On safe-haven currencies, NET SHORT of CHF future soared +3 339 contracts to 9 217 while that of JPY futures declined -4 224 contracts to 56 071. Concerning commodity currencies, NET SHORT of AUD futures increased further (but at a slower pace), by +2 201 contracts to 85 584. NET LENGTH for NZD futures added +1 896 contracts to 8 102 during the week. CAD futures’ NET SHORT jumped +18 594 contracts to 27 8877.