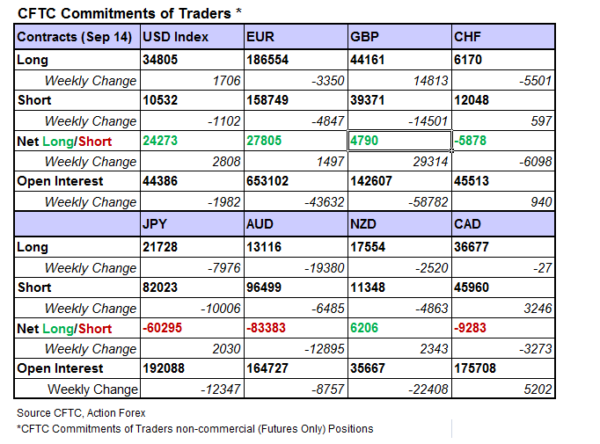

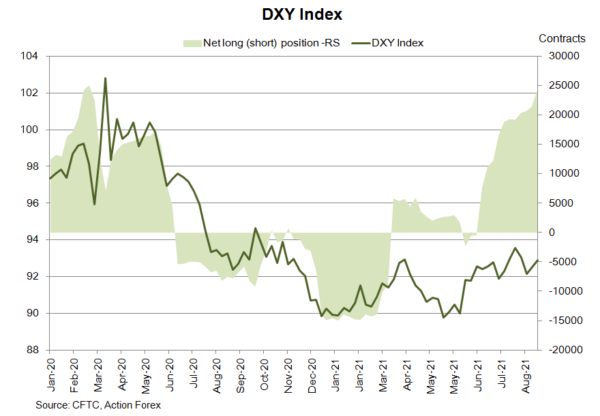

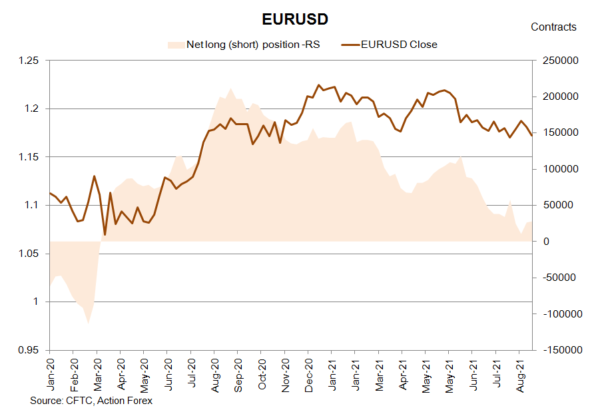

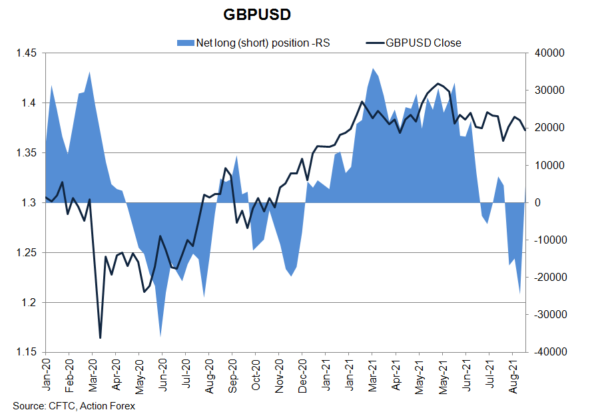

As suggested in the CFTC Commitments of Traders report in the week ended September 14, NET SHORT of USD index futures gained +2 808 contracts to 24 273. In light of hopes that the Fed would announce plans to taper QE at next week’s meeting, traders increased speculative longs but trimmed shorts. Concerning European currencies, NET LENGTH in EUR futures added +1 497 contracts to 27 805. GBP futures returned to NET LENGTH of 29 314 contracts. UK’s inflation rallied to a record high of +3.2% in the 12 months to August, compared with +2.1% in the 12 months to July. Stronger-than-expected inflation might accelerate the pace of BOE’s first rate hike. Yet, slow GDP growth as complicated the picture.

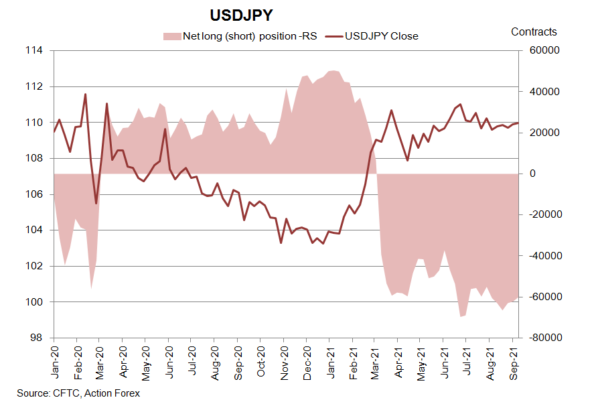

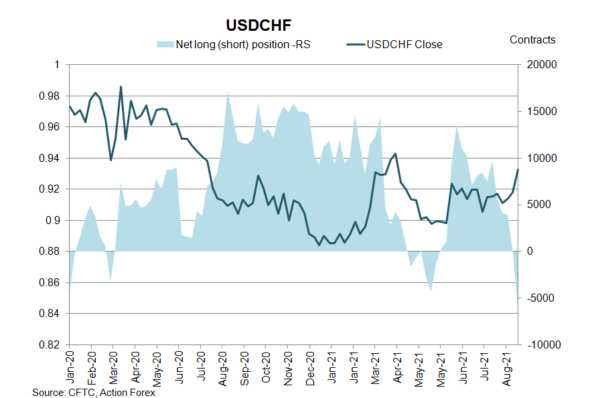

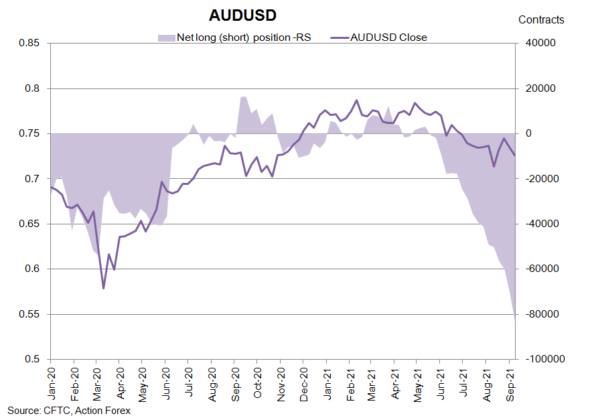

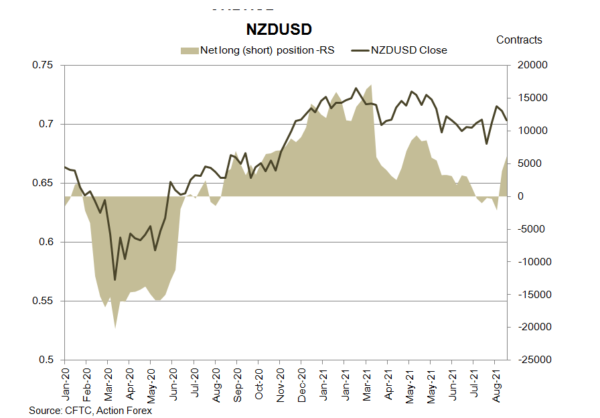

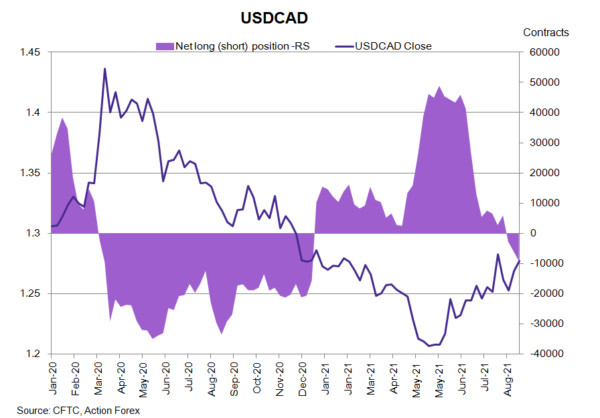

On safe-haven currencies, CHF future drifted NET SHORT of 5 878 contracts while NET SHORT of JPY futures dropped -2 030 contracts to 60 295. Concerning commodity currencies, NET SHORT of AUD futures increased further, by +12 895 contracts to 83 383. NET LENGTH for NZD futures added +2 343 contracts to 6 206 during the week. CAD futures’ NET SHORT rose +3 273 contracts to 9 283.

On safe-haven currencies, CHF future drifted NET SHORT of 5 878 contracts while NET SHORT of JPY futures dropped -2 030 contracts to 60 295. Concerning commodity currencies, NET SHORT of AUD futures increased further, by +12 895 contracts to 83 383. NET LENGTH for NZD futures added +2 343 contracts to 6 206 during the week. CAD futures’ NET SHORT rose +3 273 contracts to 9 283.