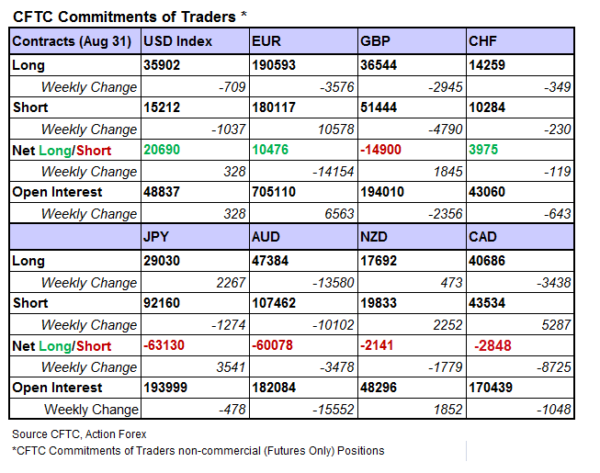

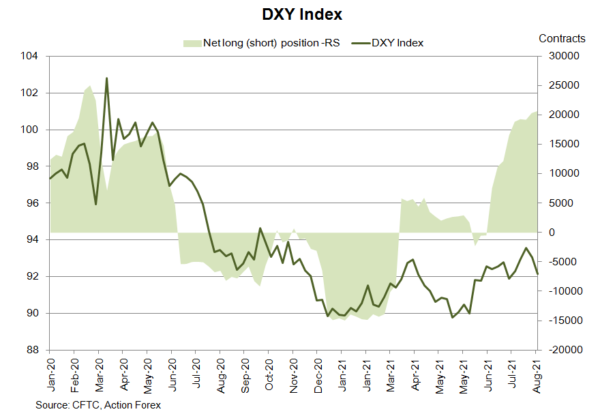

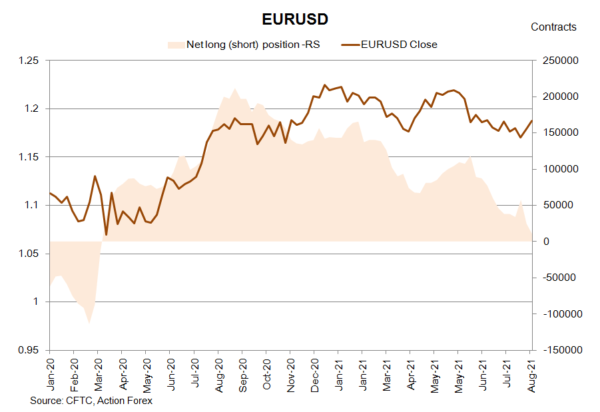

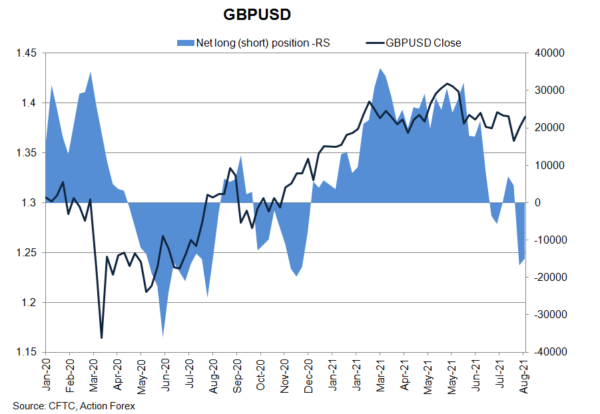

In the last week of August, bets on USD index futures fell on both sides as traders pondered Fed Chair Powell’s Jackson Hole speech and awaited the August employment report. As speculations of Fed’s tapering tamed after both events, it is likely that the euro, as well as commodity currencies, would see increase(decrease) in net longs (shorts) in the coming week. As suggested in the CFTC Commitments of Traders report in the week ended August 31, NET SHORT of USD index futures gained +328 contracts to 20 690. Speculative long positions slipped -709 contracts while speculative shorts dropped -1 037. NET LENGTH in EUR futures more than halved to 10 476 contracts. GBP futures’ NET SHORT fell -1 845 contracts.

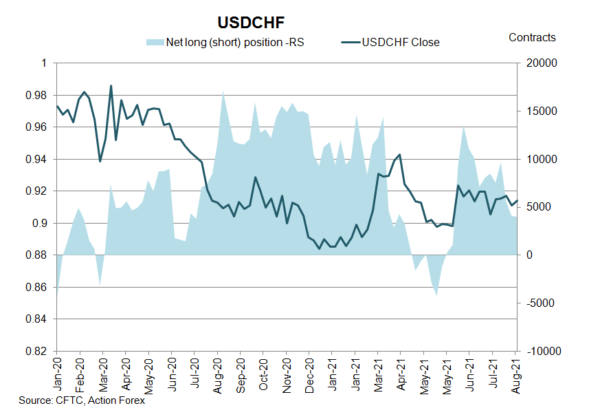

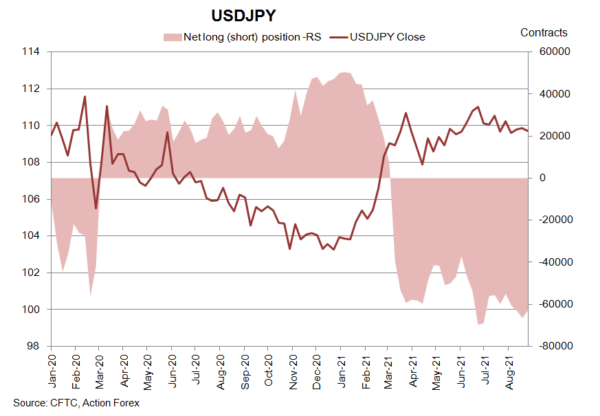

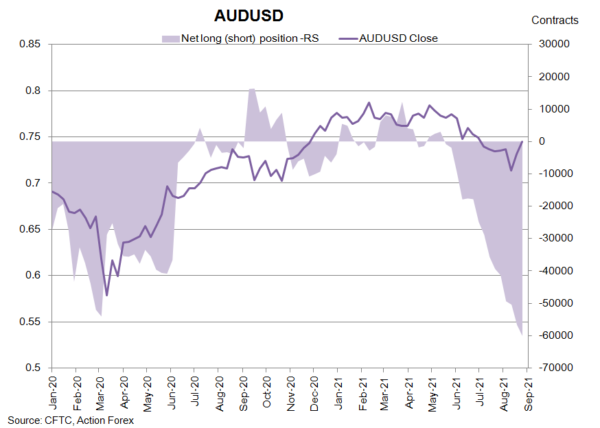

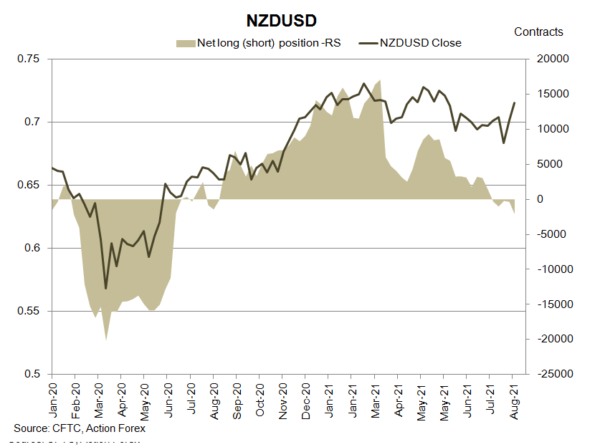

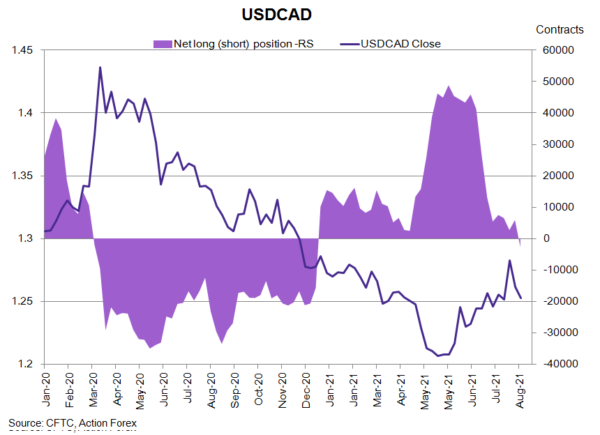

On safe-haven currencies, NET LENGTH of CHF future dropped -119 contracts to 3 975 while while NET SHORT of JPY futures declined -3 541 contracts to 63 130. Concerning commodity currencies, NET SHORT of AUD futures rose 3 478 contracts to 60 078 while that of NZD futures tgained +1 779 contracts to 2 141 during the week. CAD futures drifted to NET SHORT of 2 848 contracts.