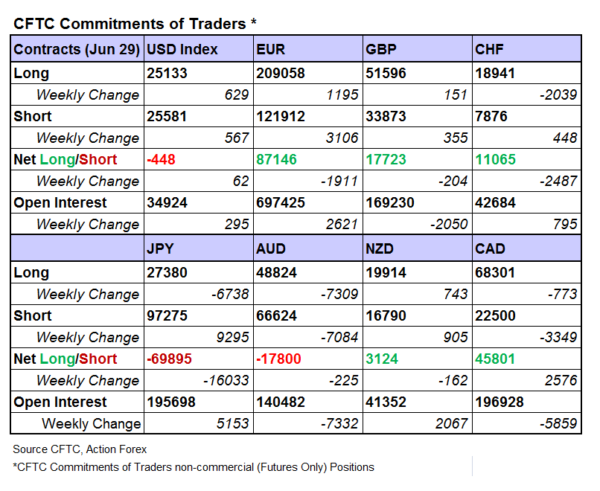

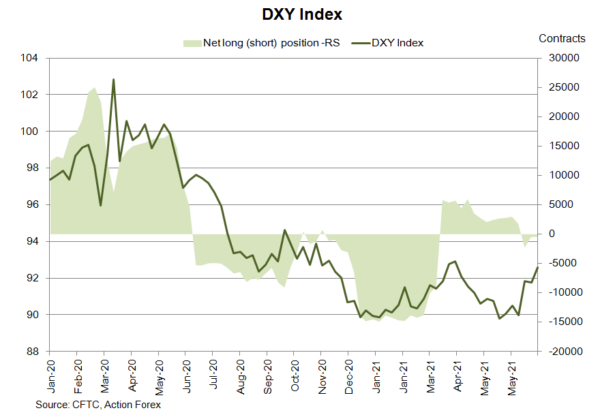

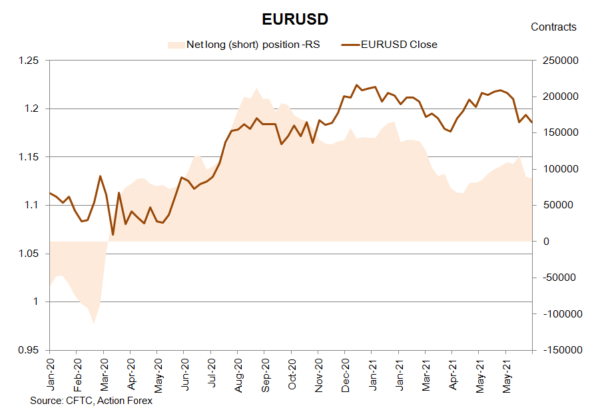

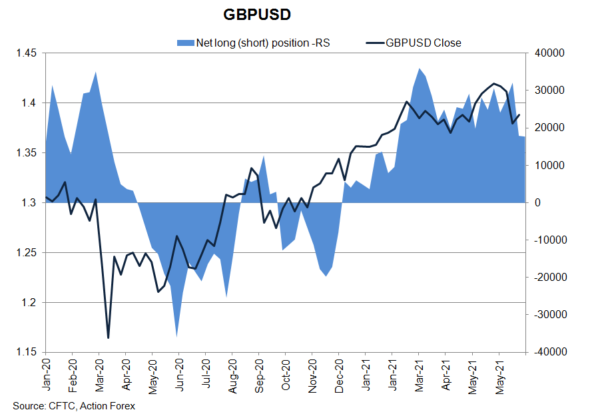

As suggested in the CFTC Commitments of Traders report in the week ended June 29, NET SHORT of USD index futures slipped -62 contracts. Speculative long positions added +629 contracts while shorts increased +567 contracts. Concerning European currencies, NET LENGTH in EUR futures dropped -1 911 contracts to 87 149. NET LENGTH of GBP futures slipped -204 contracts to 17 723.

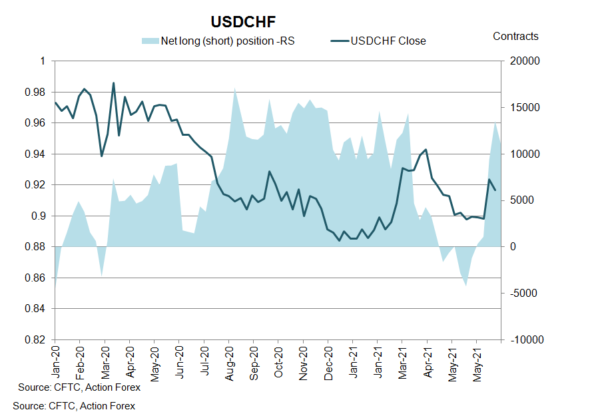

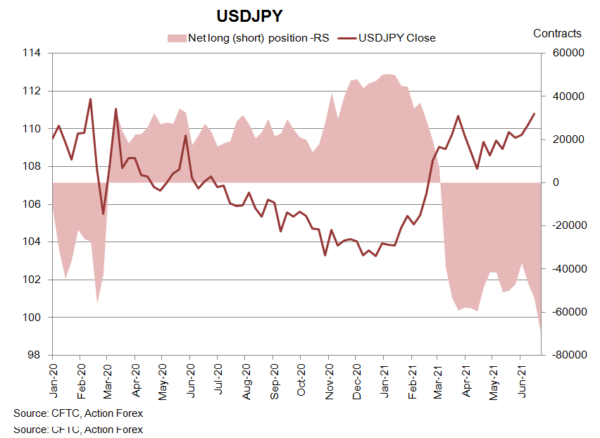

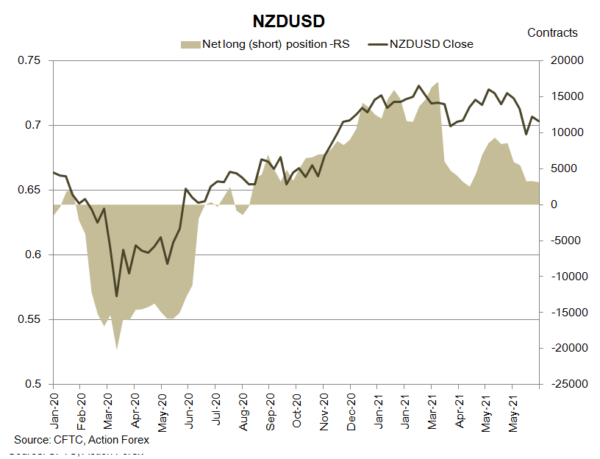

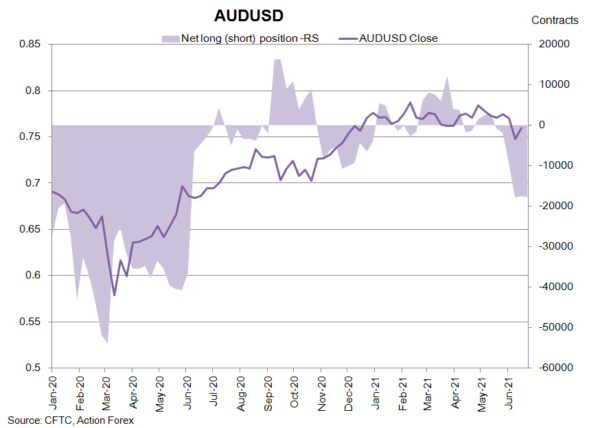

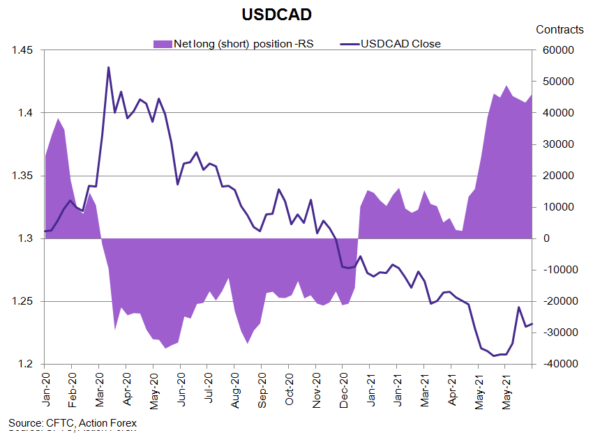

On safe-haven currencies, NET LENGTH of CHF futures declined -2 487 contracts to 11 065 while NET SHORT of JPY futures jumped -16 033 contracts to 69 895. Concerning commodity currencies, NET SHORT of AUD futures increased +225 contracts to 17 800. Separately, NZD futures’ NET LENGTH slipped -162 contracts to 3 124. NET LENGTH of CAD futures rose +2 576 contracts to 45 801 during the week.

On safe-haven currencies, NET LENGTH of CHF futures declined -2 487 contracts to 11 065 while NET SHORT of JPY futures jumped -16 033 contracts to 69 895. Concerning commodity currencies, NET SHORT of AUD futures increased +225 contracts to 17 800. Separately, NZD futures’ NET LENGTH slipped -162 contracts to 3 124. NET LENGTH of CAD futures rose +2 576 contracts to 45 801 during the week.