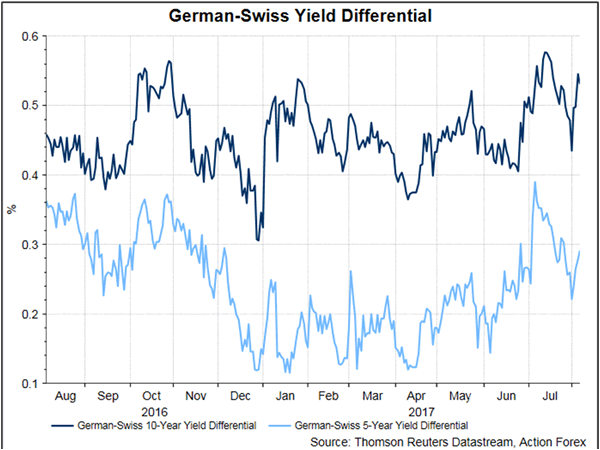

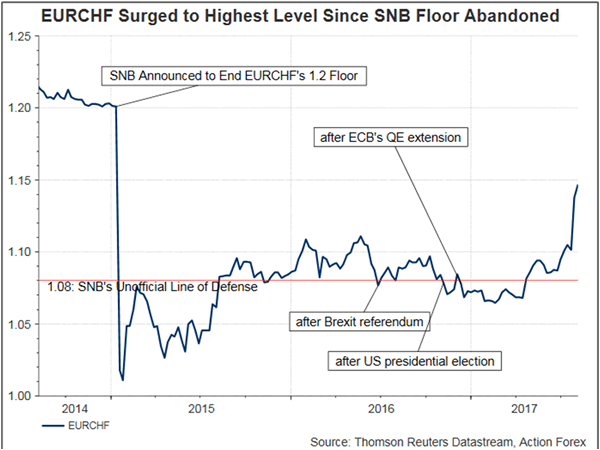

The broad-based selloff of Swiss franc of late has raised speculations of renewed SNB intervention. Yet, the latest release of FX reserve and sight deposit data suggest that it was unlikely the cause. We believe franc’s depreciation, especially against the euro was mainly driven by yield differential as the ECB is approaching tapering of its asset purchase program while the SNB maintained the pledge to fight against deflation. EURUSD soared over +4% over the past two weeks while USDCHF gained about +3% during the period. The recent risk-on mode in the financial market has also raised franc’s appeal as funding currency, thereby exacerbating its decline.

FX Reserves

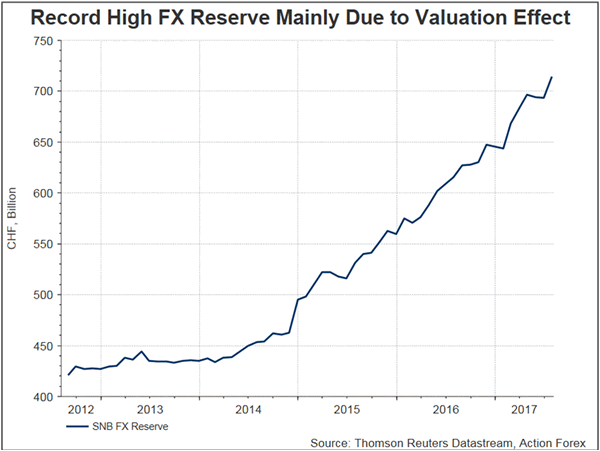

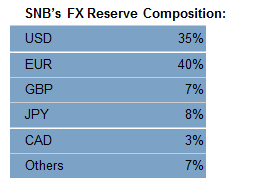

SNB’s FX reserves rose to 714.3B franc in July, from 693.7B franc in the prior month. Yet, our estimate suggests that most of the +3% increase was due to valuation effect. Concerning the central bank’s allocation of FX reserve, about 40% was in euro while 35% in US dollar. The rest was allocated to British pound (7%), Japanese pound (8%) and Canadian dollar (3%) and others (7%). In July, the euro and US dollar rose +4.15% and +0.75%, respectively, against franc, while pound, yen and Canadian gained against the franc, by +2.25% , +2.79% and +4.63%, respectively. Altogether, valuation effect raised the FX reserve by +2.5% in July, while the remaining +0.5% increase was driven by possible intervention.

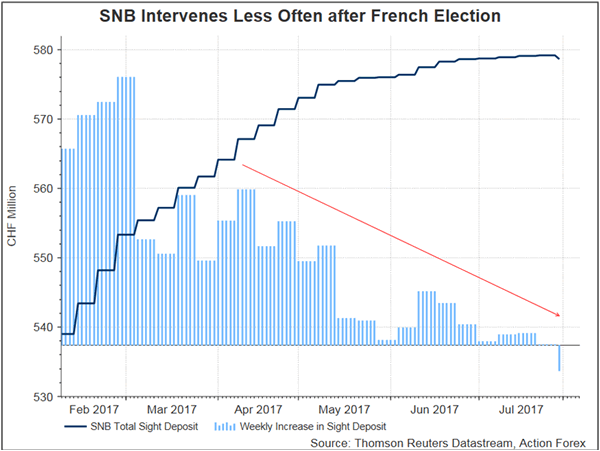

Sight Deposits

Indeed, the latest sight deposit data also signaled that SNB had not intervened aggressively in July. The SNB can expand the deposit through FX swaps and repurchases of its own debt. It is a usual way that the SNB intervene to depreciate its currency. Sight deposit stayed largely unchanged at 578.6M franc in July

Policy divergence

Although the ECB has maintained its policy rates at record lows and the asset purchase program unchanged at a monthly rate of 60B euro since April. Some moves over the past two months have showed that the central bank has turned more hawkish. Policymakers removed the reference at the June meeting statement that interest rates might be lower from the current levels. President Mario Draghi’s speech in Sintra, Portugal in late June indicated that Eurozone’s recovery has strengthened and broadened. He also noted that“deflationary forces have been replaced by reflationary ones”. Meanwhile, the June meeting minutes unveiled that policymakers had discussed about adjusting the QE reference stressing the central bank’s readiness to increase the pave and /or duration of the asset purchases if necessary, but eventually decided to retain it. Although Draghi attempted the downplay expectations of QE adjustment at the July meeting, his comment that policymakers might begin the discussion in the fall lifted the EURUSD to the highest level in 2 years.

Meanwhile, SNB reiterated the pledge to intervene the exchange rate in June. Chairman Thomas Jordan stressed that the central bank followed “exactly the situation in the foreign exchange market, we look at the pressure, and then we decide what to do in foreign exchange interventions’. At an interview two weeks ago, Jordan insisted that Swiss franc remained “significantly overvalued”. Inflation developments suggest SNB would have to maintain the current stance. SNB downgraded in June its inflation forecast to +0.3% for 2018 (from +0.4%) and to 1% for 2019 (from +1.1%). The outlook for 2017 stayed unchanged at +0.3%. The latest data showed that headline CPI improved modestly to +0.3% y/y in July, from +0.2% a month ago. Yet, from a month ago, inflation contracted -0.3%, worsening from -0.1% in June. Soft inflation suggests that the number one task for the central bank remains the fight against deflation

If the economic developments continue the current trend, we expect the policy divergence between ECB and SNB would remain, thus widening yield differential and prolonging franc’s weakness.