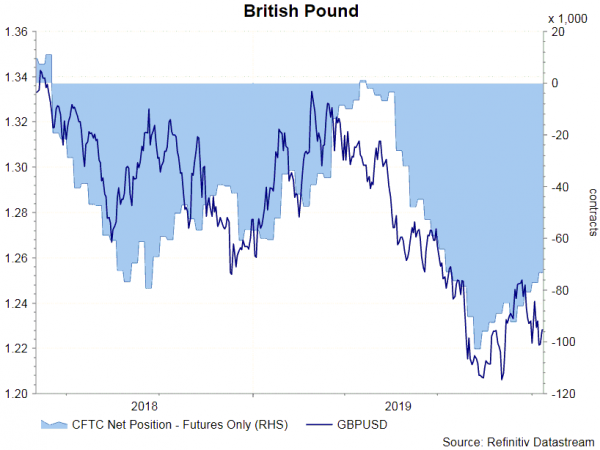

As suggested in the CFTC Commitments of Traders report in the week ended October 8, NET LENGTH in USD Index declined -3 169 contracts to 39 859. Speculative long positions fell -3 591 contracts and short positions slipped -422 contracts. Concerning European currencies, NET SHORT for EUR futures jumped +9 435 contracts to 75 413. NET SHORT for GBP futures fell -3 873 contracts to 73 219. Speculative long positions gained +1 566 contracts while speculative shorts dropped -2 307.

On safe-haven currencies, Net SHORT for CHF futures slipped -488 contracts to 11 047. NET LENGTH for JPY futures dropped -2 905 contracts to 11 012 during the week. Speculative long positions declined -5 090 contracts while shorts were down -2 185 contracts.

On safe-haven currencies, Net SHORT for CHF futures slipped -488 contracts to 11 047. NET LENGTH for JPY futures dropped -2 905 contracts to 11 012 during the week. Speculative long positions declined -5 090 contracts while shorts were down -2 185 contracts.

On commodity currencies, NET SHORT for AUD futures declined -5 358 contracts to 46 944. Speculative long positions dropped -3 581 contracts while shorts slumped -8 939 contracts. Separately, NET SHORT for NZD declined -4 257 contracts to 38 217 contracts last week. NET LENGTH for CAD futures dropped -1 014 contracts to 5 313.