As suggested in the CFTC Commitments of Traders report in the week ended August 20, NET LENGTH in USD Index slipped -343 contracts to 29 499. Speculative long positions gained +1 189 contracts while short positions rose +1 532 contracts during the week. we expect greenback’s outlook to remain directionless. It is uncertain how the Fed could react as US- China trade war escalates. Concerning European currencies, NET SHORT for EUR futures declined -8 672 contracts to 37 977. NET SHORT for GBP futures was reduced, by -6 402 contracts, to 92 418. Speculative long positions were unchanged contracts while speculative shorts fell -3 402 contracts for the week. Traders simply avoided British pound amid rising risks on no- deal Brexit.

On safe-haven currencies, Net SHORT for CHF futures declined -1 835 contracts to 11 117. NET LENGTH for JPY futures rose +6 412 contracts to 31 154 during the week. Speculative long positions dropped -1 780 contracts while shorts plunged -8 192 contracts.

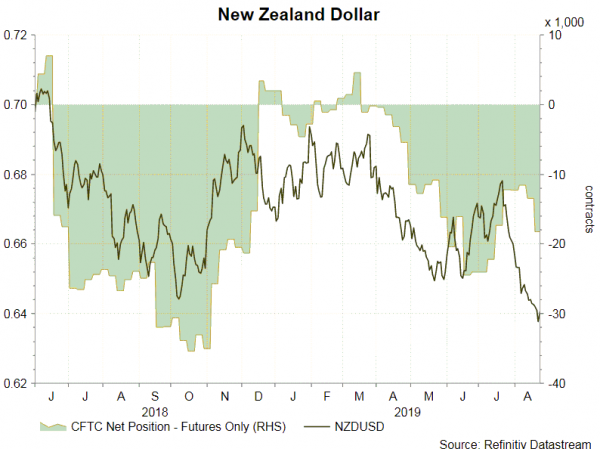

On commodity currencies, NET SHORT for AUD futures dropped -131 contracts to 62 781. Speculative long positions decreased -3 946 contracts while shorts fell -4 077 contracts. Separately, NET SHORT for NZD gained +4 813 contracts to 18 260 contracts last week. NET LENGTH for CAD futures dropped -1 163 contracts to 13 037.

On commodity currencies, NET SHORT for AUD futures dropped -131 contracts to 62 781. Speculative long positions decreased -3 946 contracts while shorts fell -4 077 contracts. Separately, NET SHORT for NZD gained +4 813 contracts to 18 260 contracts last week. NET LENGTH for CAD futures dropped -1 163 contracts to 13 037.