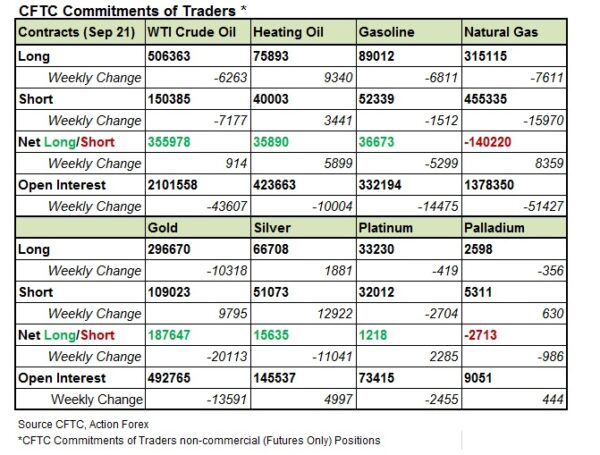

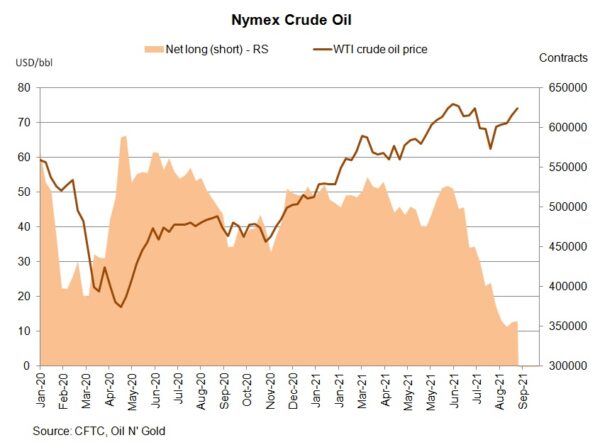

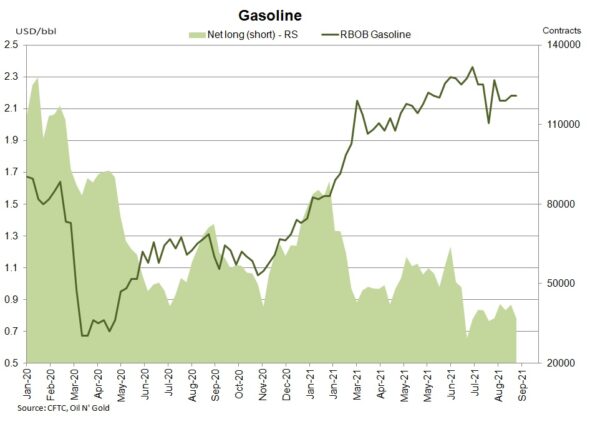

According to the CFTC Commitments of Traders report for the week ended September 21, NET LENGTH of crude oil futures added +914 contracts to 355 978. Bets on both sides fell with speculative longs and shorts down -6 263 contracts and -7 177 contracts, respectively. For refined oil products, NET LENGTH for heating oil rose +5 899 contracts to 35 890, while that for gasoline fell -5 299 contracts to 36 673. NET SHORT of natural gas futures plunged -8 359 contracts to 140 220 during the week. Bets were lowered on both sides but shorts declined sharply amidst a sharp rally in natural gas price. Demand for gas should increase as cold weather approaches, leading to a more optimistic outlook on gas prices and further decline in NET SHORT in coming months.

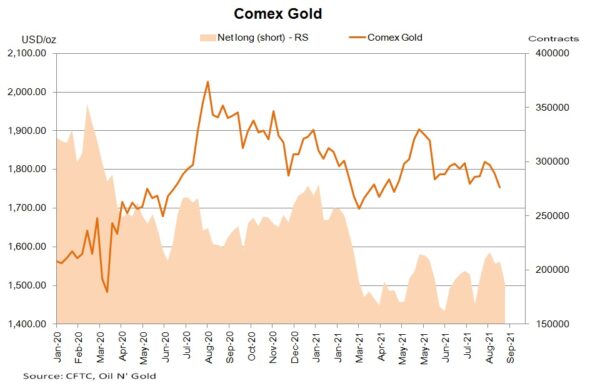

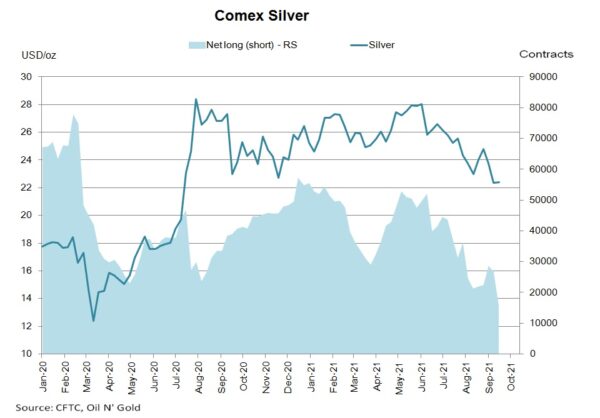

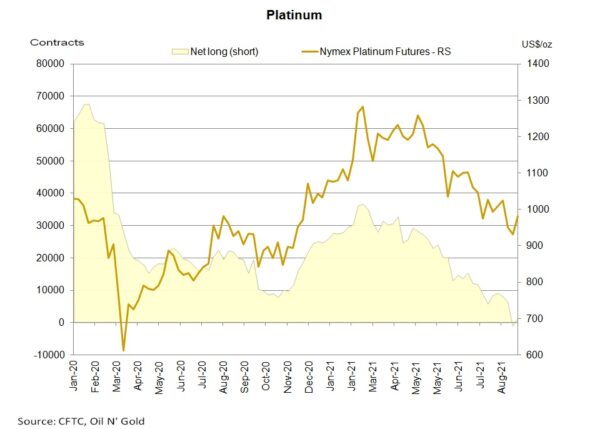

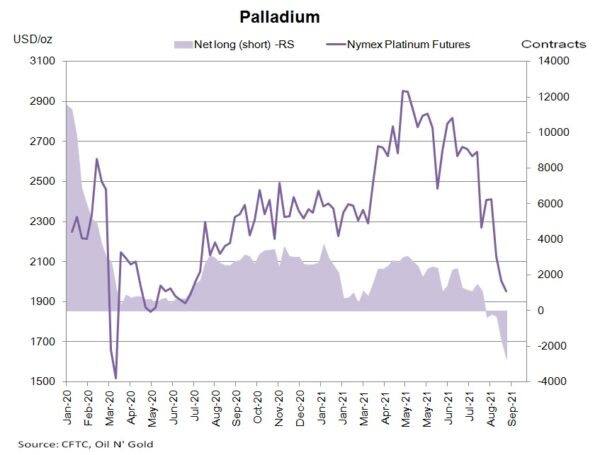

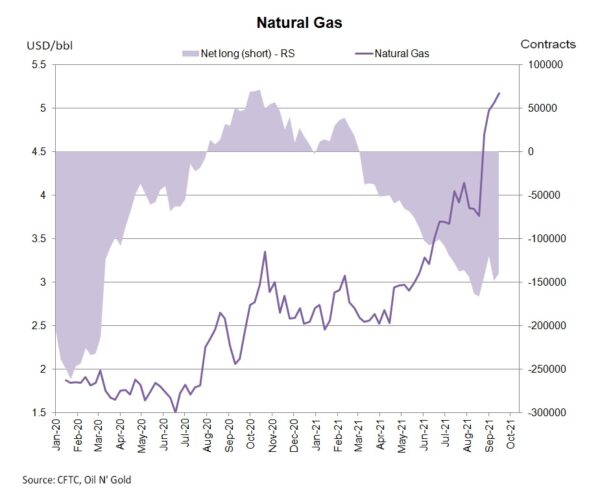

Gold futures’ NET LENGTH slumped -20 113 contracts to 187 647. Silver futures’ NET LENGTH plunged -11 041 contracts to 15 635. For PGMs, Nymex platinum futures returned to NET LENGTH of 1 218 contracts, while NET SHORT for palladium futures added +986 contracts to 2 713.

Gold futures’ NET LENGTH slumped -20 113 contracts to 187 647. Silver futures’ NET LENGTH plunged -11 041 contracts to 15 635. For PGMs, Nymex platinum futures returned to NET LENGTH of 1 218 contracts, while NET SHORT for palladium futures added +986 contracts to 2 713.