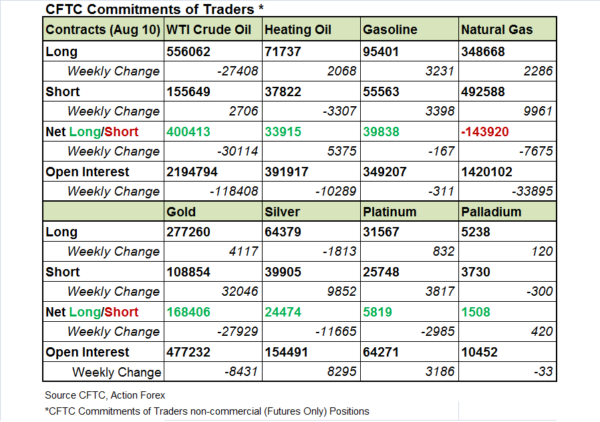

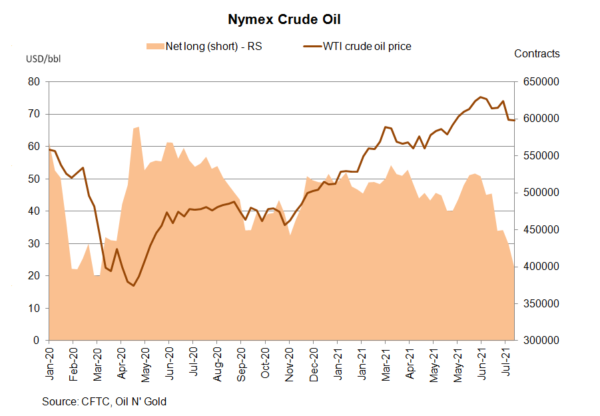

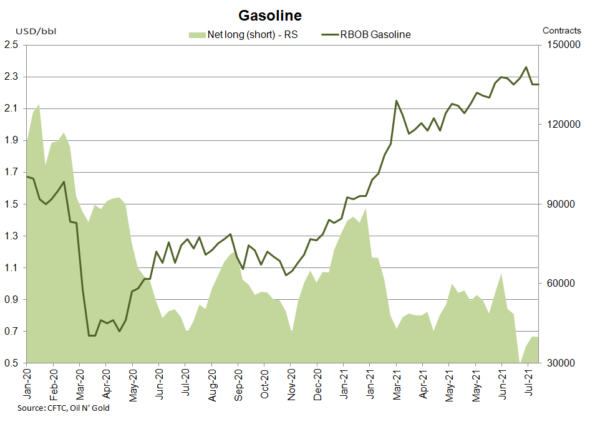

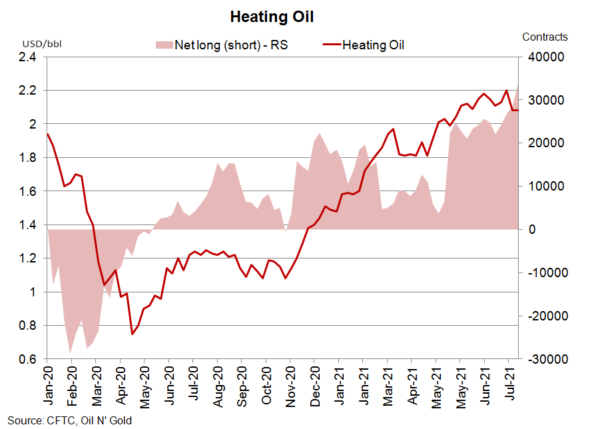

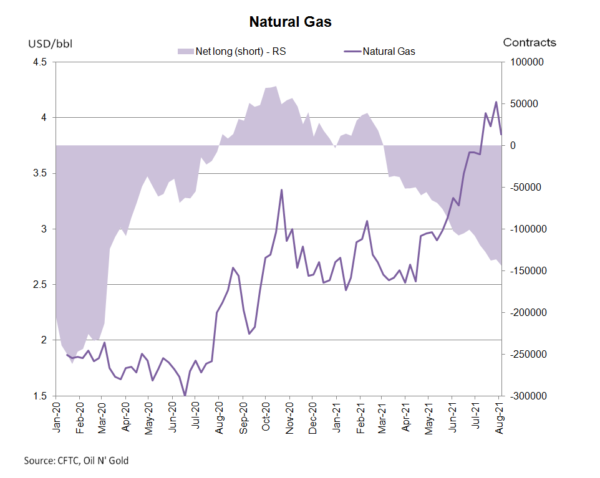

According to the CFTC Commitments of Traders report for the week ended August 10. NET LENGTH for crude oil futures slumped -30 114 contracts to 400 413 for the week. Speculative long position sank -27 408 contracts, while shorts increased +2 706 contracts. As we had anticipated, the sharp decline in net length was driven by concerns over China’s demand outlook. The resurgence of the pandemic has spread to many parts of the world’s largest oil consumer. For refined oil products, NET LENGTH for heating oil rose +5 375 contracts to 33 915, while that for gasoline dropped -167 contracts to 39 838. NET SHORT of natural gas futures soared +7 675 contracts to 143 920 during the week.

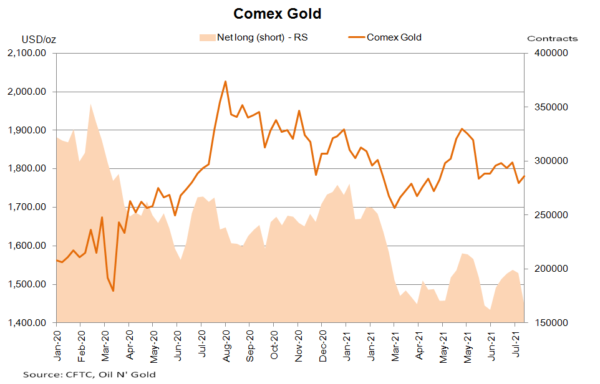

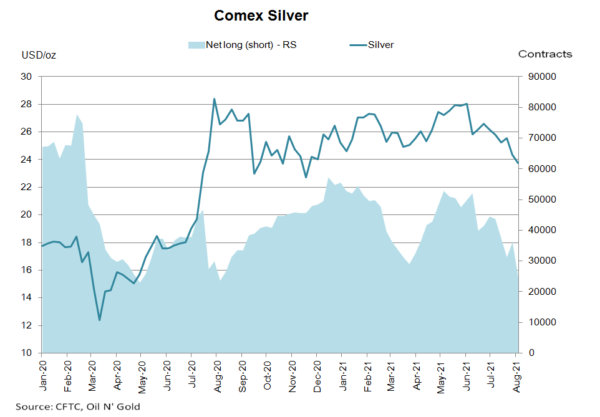

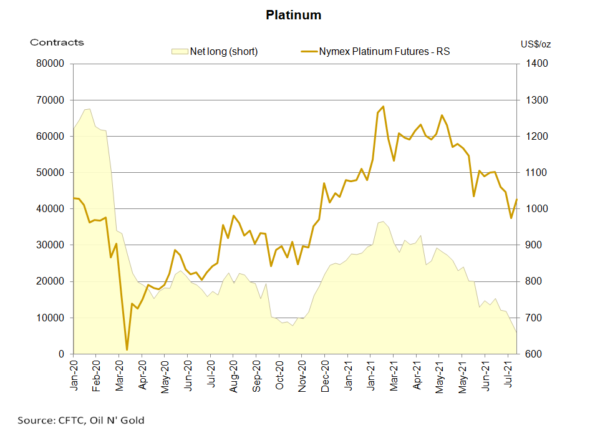

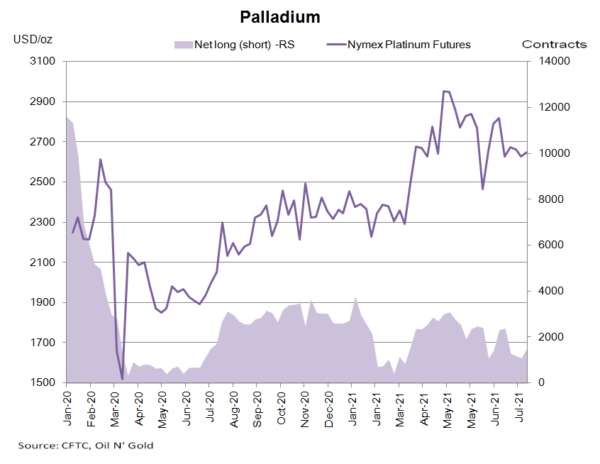

Gold futures’ NET LENGTH plunged -27 929 contracts to 168 406 while silver futures’ NET LENGTH fell -11 665 contracts to 24 474. Net lengths in both metals should likely rebound amidst price recovery. For PGMs, NET LENGTH of Nymex platinum futures dropped -2 985 contracts to 5 819 while that for palladium added +420 contracts to 1 508.

Gold futures’ NET LENGTH plunged -27 929 contracts to 168 406 while silver futures’ NET LENGTH fell -11 665 contracts to 24 474. Net lengths in both metals should likely rebound amidst price recovery. For PGMs, NET LENGTH of Nymex platinum futures dropped -2 985 contracts to 5 819 while that for palladium added +420 contracts to 1 508.