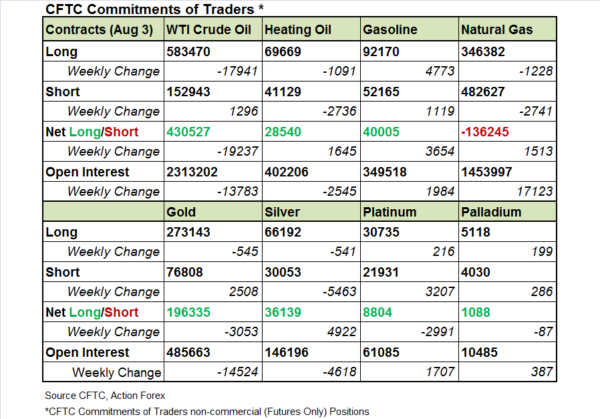

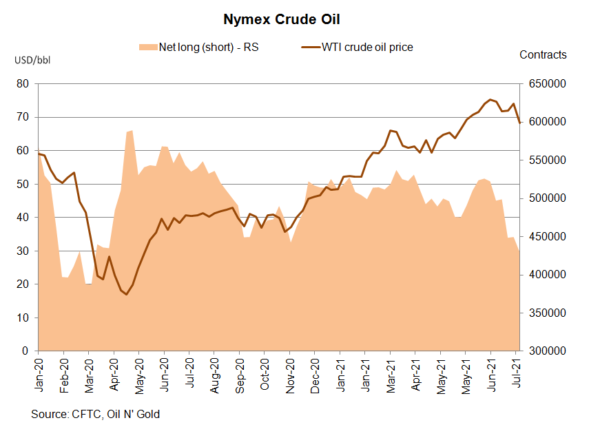

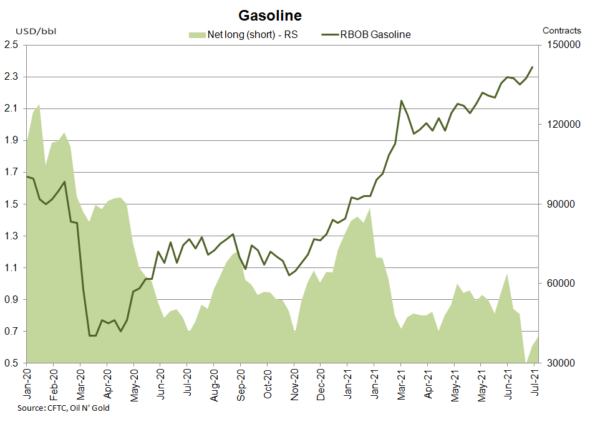

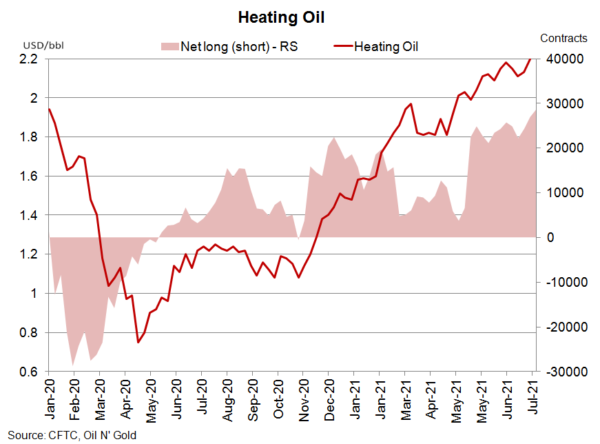

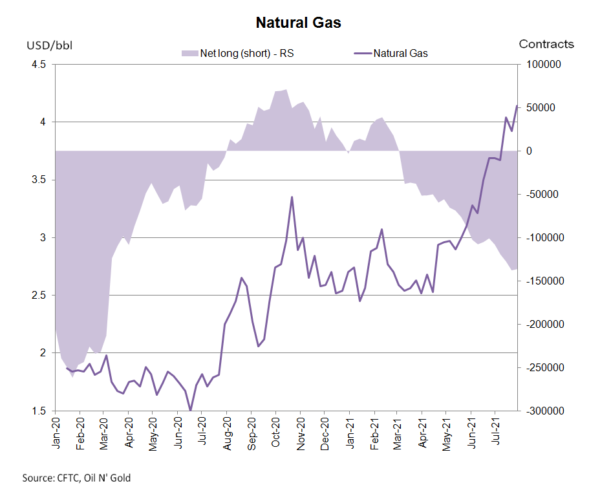

According to the CFTC Commitments of Traders report for the week ended August 3. NET LENGTH for crude oil futures sank -19 237 contracts to 430 527 for the week. Speculative long position declined -17 941 contracts, while shorts increased +1 296 contracts. Net length of WTI crude oil should fall further in the coming week. The benchmark contract plunged amidst concerns over resurgence of the pandemic in the US and China, the world’s two largest oil consumers. For refined oil products, NET LENGTH for heating oil gained +1 645 contracts to 28 540, while that for gasoline rose +3 654 contracts to 40 005. NET SHORT of natural gas futures dropped -1 513 contracts to 136 245 during the week.

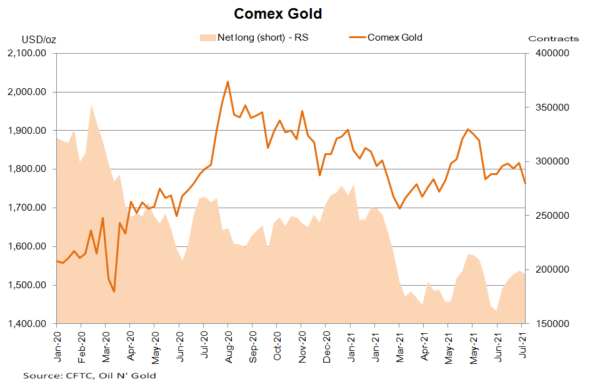

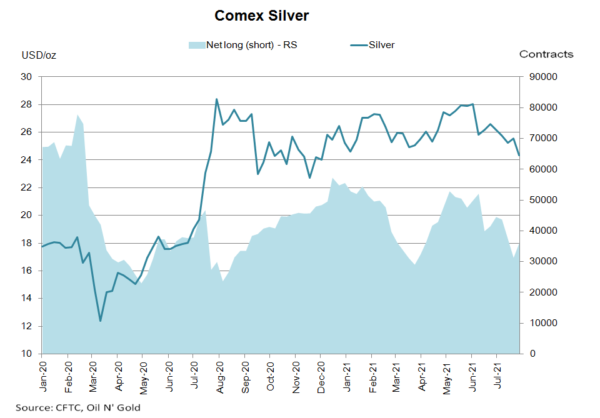

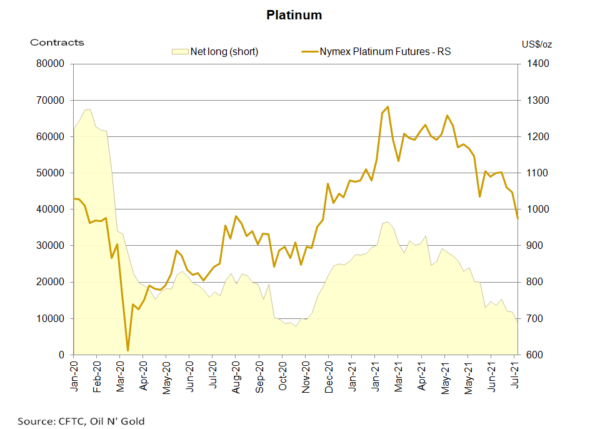

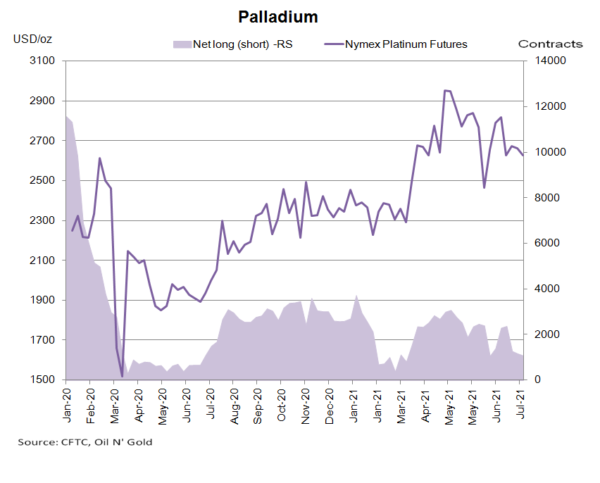

Gold futures’ NET LENGTH dropped -3 053 contracts to 196 335 while silver futures’ NET LENGTH gained +4 922 contracts to 36 139. For PGMs, NET LENGTH of Nymex platinum futures dropped -2 991 contracts to 8 804 while that for palladium slipped -87 contracts to 1 088.

Gold futures’ NET LENGTH dropped -3 053 contracts to 196 335 while silver futures’ NET LENGTH gained +4 922 contracts to 36 139. For PGMs, NET LENGTH of Nymex platinum futures dropped -2 991 contracts to 8 804 while that for palladium slipped -87 contracts to 1 088.