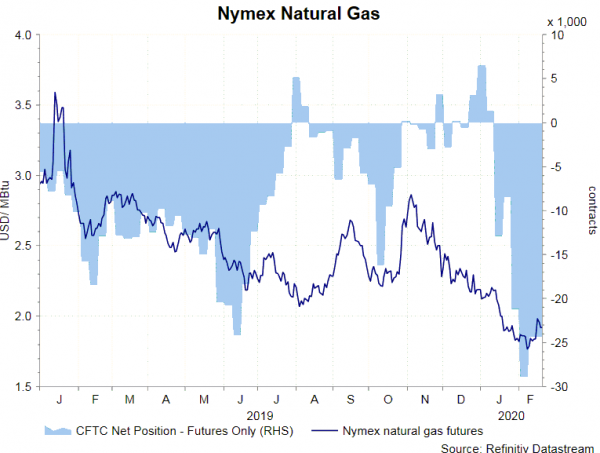

According to the CFTC Commitments of Traders report for the week ended February 18. NET LENGTH for crude oil futures gained +14 995 contracts to 411 764 for the week. Speculative long positions dropped -5 903 contracts while shorts declined -20 898 contracts. For refined oil products, NET LENGTH for gasoline added +3 320 contracts to 117 083, while heating oil‘s NET SHORT declined +3 273 contracts to 21 010. NET SHORT for natural gas futures fell -17 889 contracts to 225 586 contracts for the week.

NET LENGTH for gold futures soared +45 675 contracts to 353 649. Speculative long positions rose+51 814 contracts, while shorts increased +6 139 contracts. Silver futures’ NET LENGTH gained +10 240 contracts to 77 877. Speculative long positions rose +11 545 contracts while shorts added +1 305. For PGMs, NET LENGTH of Nymex platinum futures dropped -225 contracts to 61 615 while that for palladium dipped -170 contracts to 4 995.

NET LENGTH for gold futures soared +45 675 contracts to 353 649. Speculative long positions rose+51 814 contracts, while shorts increased +6 139 contracts. Silver futures’ NET LENGTH gained +10 240 contracts to 77 877. Speculative long positions rose +11 545 contracts while shorts added +1 305. For PGMs, NET LENGTH of Nymex platinum futures dropped -225 contracts to 61 615 while that for palladium dipped -170 contracts to 4 995.