Canadian Dollar surged broadly last week following the rally in oil prices. Weaker than expected employment capped the Loonie’s gain, but it ended as the strongest still. Sterling survived BoE super Thursday and ended up against all but Canadian. That’s a clear indication that markets didn’t see BoE announcements that dovish. On the other hand, RBNZ was the real dovish one, sending New Zealand Dollar broadly and deeply lower against most. Yen followed as the second weakest as global treasury yields recovered. Meanwhile, Dollar has entered into a consolidation phase after core CPI miss and ended the week mixed.

Canadian Dollar in solid up trend on BoC outlook and oil price

The nature in the strength of Canadian Dollar and Sterling last week was very different. Technically, Canadian Dollar ended above prior week’s high against all but Yen and Aussie. For the month, it’s trading above April’s high against all but Dollar and Yen. Fundamentally, BoC is on course for another rate hike this year. The question is just on the timing. Outcome of NAFTA renegotiation and trade conflicts with the US is a factor. The pass through of prior rate hikes and the impact on businesses and households is another factor. For the latter, BoC policy makers and the markets will get more idea with CPI and retail sales to be released this week.

Additionally, the surge in oil price after Trump’s announcement to withdraw from the NAFTA deal gave Canadian Dollar a solid boost. WTI crude oil extended the medium term up trend to as high as 71.89 last week before closing at 70.70. As long as 66.66 near term support holds, we’d expect further rally in WTI to 61.8% retracement of 107.68 to 26.05 at 76.50. Over bought condition in weekly chart might limit upside around there. But we’ll see.

Sterling resilient as BoE was stayed hawkish, but fate depends on data

Sterling’s resilience was mainly due to the fact that a May rate hike was totally priced out well before the meeting. And the overall BoE announcements were, at least, better than the least hawkish scenario as we argued here. Currently, markets are only having full pricing of the next hike in February 2019. But we have to emphasize that in BoE’s condition path for Bank Rate, there could be a hike as early as in Q3. Depending on the strength of the rebound in Q2 and Q3, the chance of a November, or even an August hike is there. And that’s the main reason that Sterling didn’t break down. Though, it’s still vulnerable to data misses. And job and wage data on Tuesday will be a key event to watch.

With receding expectation of BoE hike, FTSE extended recent strong rally to as high as 7728.89 last week. The index is on course for 7792.56 high. Based on current momentum, the resistance will likely be taken out without much trouble. And the larger up trend would then be resuming for channel resistance at around 8165.

Australian Dollar rebound could be temporary

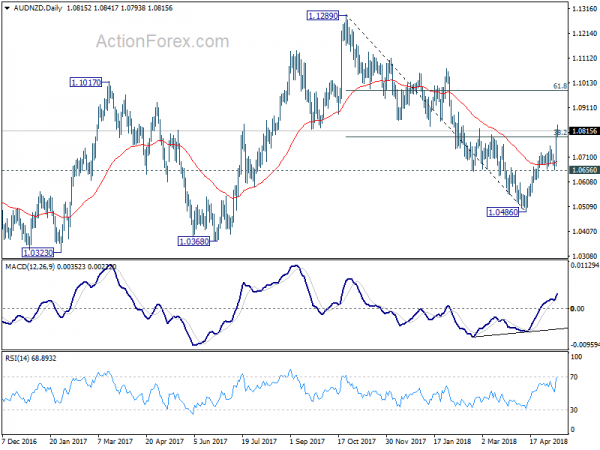

Australian Dollar ended as the third strongest one last week, partly thanks to the cross buying in AUD/NZD, and partly on rebound in China iron ore price. New Zealand dollar tumbled sharply as new RBNZ Governor Adrian Orr sound more dovish than most expected as he noted that the direction of next move “is equally balanced, up or down”. RBNZ also downgraded both inflation and growth forecast. AUD/NZD surged to as high as 1.0841 last week as a reaction. The development suggested that medium term fall from 1.1289 has completed at 1.0486 already. As long as 1.0656 support holds, further rise should be seen back to 61.8% retracement of 1.1289 to 1.0486 at 1.0982 and above.

But other than those, we’re not seeing more factor in support the Aussie. RBA May meeting minutes to be released this Tuesday will remind the markets that it’s in no rush to rate interest rate. And most expected RBA to stay on hold through this year. Australia will also release job data on Thursday. Risks are skew on the downside and we don’t expect an upside surprise to have lasting bullish impact on Aussie. But downside surprise could declare the completion of this week’s rebound. And bear in mind there is a head and shoulder top pattern (ls: 88.17; h: 90.29, rs: 89.09) in AUD/JPY. Australia data miss, coupled with falling fall global treasury yields, will push AUD/JPY through 80.48 low to 61.8% retracement of 72.39 to 90.29 at 79.22.

Dollar turned into consolidation phase as yield to gyrate lower

Dollar’s late pull back last week suggested that it has turned into consolidation phase, after long-stretched rally. Retail sales, housing, regional Fed surveys and industrial production will be released from the US this week. But we don’t expect them to be too market moving. Instead, Eurozone data like German ZEW could move the greenback more. Anyway, a short term top is formed at 93.41 in Dollar index, after hitting 55 week EMA. Deeper retreat is in favor in near term. But for now, we’d expect strong support from 38.2% retracement of 88.25 to 93.41 at 91.43 to contain downside to bring rise resumption.

We’re holding on to the view that medium term corrective fall from 103.82 has completed at 88.25, after drawing support from 88.25 long term fibonacci level. Rebound from there should at least have a test on 38.2% retracement of 103.82 to 88.25 at 94.19. And there is prospect of extending further to 61.8% retracement at 97.87.

The rebound in 10 year yield last last week proved to be temporary. TNX failed to hold above 3% handle and ended at 2.971. The consolidation from 3.035 is still in progress and TNX will likely gyrate lower to 55 day EMA (now at 2.866). As it’s close to medium term channel line, we’d expect strong support from there to contain downside and bring rise resumption. TNX should have another take of 3.036 key resistance at a latter stage. By then, we would ideally see Dollar index ended its own pull back too.

GBP/USD Weekly Outlook

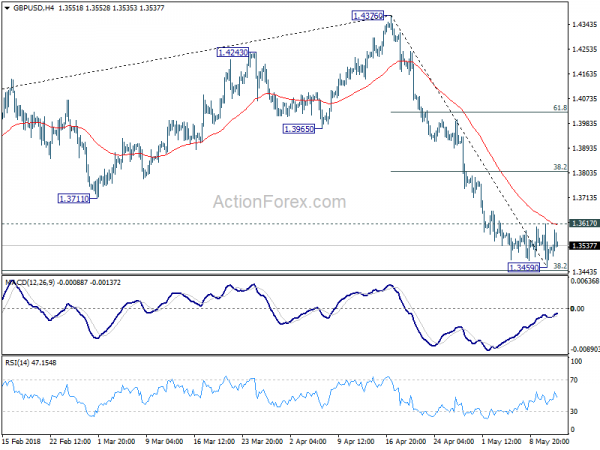

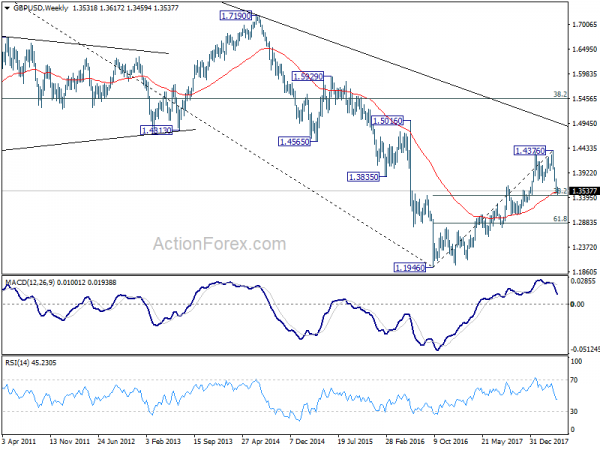

GBP/USD edged lower to 1.3459 last week but drew support from 55 week EMA and 1.3448 fibonacci level and recovered. A short term bottom is likely formed and initial bias is neutral this week first. On the upside, break of 1.3617 minor resistance will turn bias to the upside for stronger recovery. But upside should be limited by 38.2% retracement of 1.4376 to 1.3459 at 1.3809. On the downside, sustained break of 1.3448 fibonacci level will confirm resumption of whole fall from 1.4376 and target next fibonacci level at 1.2874.

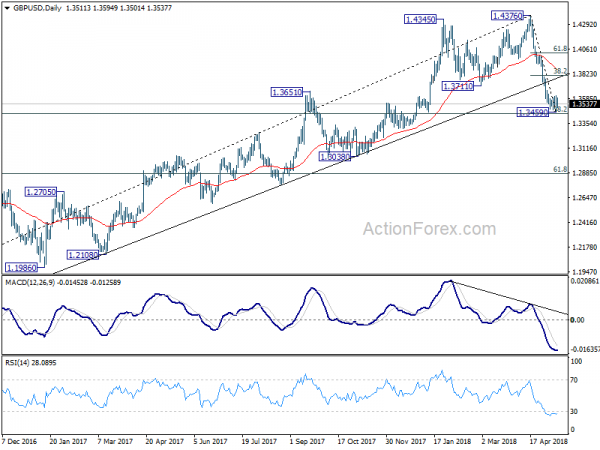

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4223). 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 was almost met. Break there will target 61.8% retracement at 1.2874 and below. Outlook will stay bearish as long as 55 day EMA (now at 1.3861) holds, even in case of strong rebound.

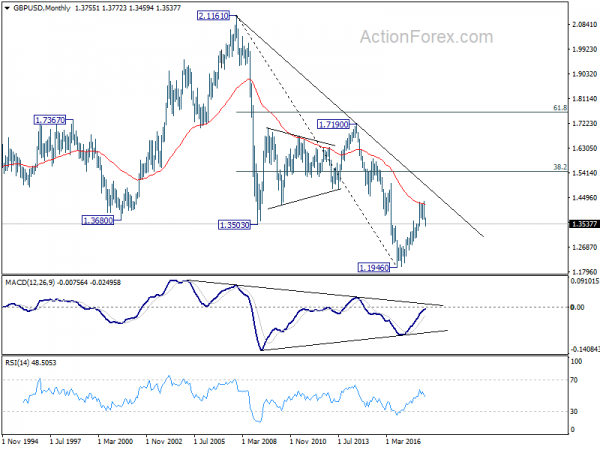

In the longer term picture, rise from 1.1946 (2016 low) is viewed as a corrective move, no change in this view. Rejection from 55 month EMA argues that it might be completed already. Larger down trend from 2.1161 (2007 high) could extend to a new low. This will now be the preferred case as long as 1.4376 resistance holds.